Before diving into this analysis, I want to thank Michael Gielkens for inspiring this idea. While European industrials may not be the most glamorous sector right now, this could explain the significant discount on MBB’s portfolio. As the price gap between 'tech' and 'industry' widens, I would argue the potential for higher future returns from the 'less popular' sectors increases.

As frequent readers know, I’m a fan of holding companies, especially family-run ones with a strong track record of capital allocation. Many legs to stand on, a focused and flexible capital allocator at the helm and often substantial discounts to the asset values, are some reasons behind this. Gert-Maria Freimuth and Dr Christof Nesemeier are still involved in the company they founded in 1995, serving as vice chairman and executive chairman of the board. Insiders own close to 70% of this holding company.

MBB SE seems promising at first glance: family-run, 20-year CAGR of 11%, 14 consecutive years of dividend increases, and a diversified portfolio of 3 public and 3 private businesses. However, there are concerns.

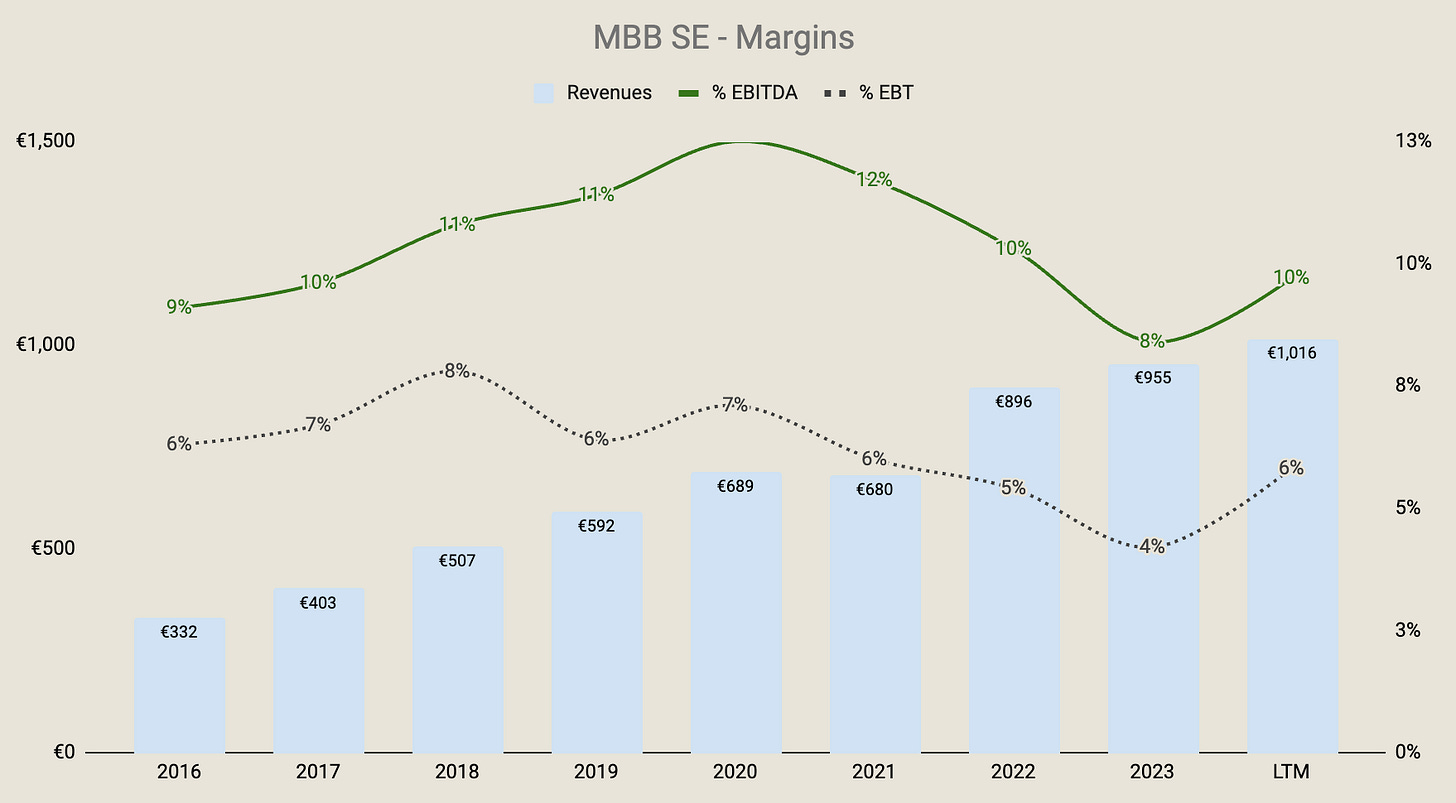

Margins have been weak since 2021, and the share price have stagnated from 2017. Yet, an intelligent investor would note that both operating earnings (EBIT/share) and the net cash position have roughly doubled since 2017. With the market valuing MBB at 5x LTM EV/EBIT, could MBB be a compelling opportunity for long-term investors, or is this a holding company in steady decline? Looking at the operating earnings per share (red line), market values tend to follow earnings over the long run.

Business Model

MBB owns 6 companies, which is divided into three segments: Service & Infrastructure, Technological Applications & Consumer Goods. CEO, Dr. Constantin Mang, explains the company´s purpose like this.

MBB offers long-term succession solutions to sustainable Mittelstand companies. First of all, we are a family business ourselves. That means we share the same DNA with the businesses that we want to acquire. Secondly, we are fans of the capital market (3 listed companies). Thirdly, we have a long-term focus that means when we buy a new company, we really don´t have any intention to sell it, but to develop and grow it for the long term.

During it´s two decades of existence, MBB have ended up with this portfolio of today.

Service & Infrastructure (50% of revenues)

Technological Applications (40% of revenues)

Consumer Goods (10% of revenues)

Overall, the portfolio consists mainly of industrial companies selling physical products or services. While many operate in cyclical industries, with the exception of Hanke Tissue and DTS, these cycles are unlikely to overlap significantly. For example, Vorwerk depends on investments in Germany’s energy infrastructure, Aumann on automotive manufacturers increasing EV production, and Delignit on the demand for sustainably sourced materials in sectors like rail, caravans, and commercial vehicles. Owning the entire portfolio should offer better diversification and stability than holding these companies individually, especially given the support of a financially robust, long-term-focused owner. Nonetheless, holding companies often trade at a discount to the value of their individual subsidiaries.

Holding Company - Reinvestment Engine

A holding company’s long-term growth in earnings power is driven by a dual reinvestment engine: the underlying companies reinvesting in themselves and the cash flows distributed to the holding company, which can be reinvested strategically. For instance, Exor's industrial cash flows enable the holding company to transition its portfolio across sectors. Investor AB, another conglomerate, reinvest some of the dividends from listed companies into their wholly-owned company portfolio Patricia Industries. While other cash sources exist for holding companies—such as IPOs, issuing debt or asset sales—a steady stream of cash flow is invaluable.

MBB - Reinvestment Engine & Cash Position

Regarding MBB SE’s capital allocation, there is a big elephant in the room: it´s substantial cash position. Following the successful IPOs of Aumann in 2017 and Vorwerk in 2021, MBB amassed significant cash reserves. Whether the lack of reinvestment of these sums reflects poor capital allocation, few opportunities or strategic patience, is up for debate. It is worth noting that MBB have found better opportunity reinvesting in itself recently, by reinvesting €45M in share buybacks, €37M to increase stake of Vorwerk and €23M into Aumann shares, since early 2023.

To illustrate MBB’s historical developments, I’ve created a chart showing the growth in cash position alongside these IPOs and the declining, though relatively strong, ROCE.

While €82M of the €358M cash position today belongs to it´s subsidiaries (primarily within Aumann), I do believe a big chunk of this cash position is likely to be invested in the coming year. MBB is trying to build something for the long term, and listening to themself, they find private market valuations particularly attractive now.

Recent Problems

As already mentioned, margins have been declining since 2021. However, there are 2 main reasons for this drop, both of which seemingly in the rearview mirror by now.

Friedrich Vorwerk, MBB´s largest holding, has recently finished some orders placed in 2020. The problem? Prices on these were not index-regulated, prior to a period of record inflation and cost increases. In addition, after the Nordstream sabotage in 2022, deadlines from the government in developing new pipelines were tight. Vorwerk needed to hire third-party contractors to meet these targets, increasing costs further. To make things worse, they were also impacted by a cyberattack late 2022. While I have little insights here, it is not hard imagining them being a strategical target, given the importance of critical energy infrastructure during European war and restrictions for trade.

Hanke Tissue, producer of toilet paper and tissues, agreed on fixed energy prices at the midst of an energy crisis in Europe. Management said this after Q1: “This was mainly driven by the high energy price commitments from the previous year that expired for Hanke at the beginning of the financial year, meaning that the company will return to its usual high level of profitability in 2024”

Cyclicality. While companies like Delignit, Aumann and Vorwerk have sustainability as a tailwind, they are still cyclical. Right now, the caravan market for example is especially weak for Delignit. Nonetheless, this is where the strength of the holding company come in, with them rarely seeing all their underlying companies struggling at the same time.

While it’s unclear if MBB could have navigated recent challenges more effectively, these issues now seem largely resolved. Margins improved significantly in the first half of 2024, as management anticipated. Despite Friedrich Vorwerk's recent struggles, it boasts an impressive €1.2B order backlog. Additionally, a Q4 2023 call question from M. Gielkens suggests management might be compensated for issues beyond their control. Although the market appears to penalize MBB for these problems, I trust their long track record and family-run ownership to steer the company back on course, continuing the positive momentum seen in 2024.

Fundamentals vs. Market Value

Interestingly, it looks like the market does not price in much growth from MBB´s portfolio going forward, despite being positioned in industries with sustainability as a major tailwind (energy infrastructure, battery-driven vehicles, wood-based raw materials, IT security). Further, with an EV/EBITDA of ~5x, the market also gives minimal value to the reinvestment engine which have delivered an average ROCE of 19% for the last decade and grown revenue at a 20% CAGR since 2011.

Over the past year, MBB surpassed €1B in revenue and returned to its typical EBITDA margins of 10-12% in the first half of 2024. Although cash flows are cyclical, they generate substantial free cash flow, fueling portfolio growth alongside reinvestment of IPO proceeds. More specifically, they have converted ~65% of EBITDA to Free Cashflows in the last 5 years. With it´s industrial holdings requiring substantial capex ~45M over the last year, an estimate of roughly 50% cash-conversion may be more conservative in calculating cash generation.

If the holding company do generate >100M EBITDA this year, this means the holding company could generate €50-60M in free cashflow (dependent on change in working capital) in 2024. Of these, they do pay a dividend of ~6M (1% yield) and have bought back €43M in shares so far in 2024. This is a higher pace than they did in 2019, when they bought back €60M shares during the full year. Seing management avoided buying back shares when the company traded more expensively, may hint to some wise capital allocators behind the helm.

These buybacks help increase the earnings power, the key driver behind long-term share appreciation. Adding these buybacks to the increased ownership stake in Vorwerk and Aumann since 2023, management have reinvested €105 million back into MBB. Further supporting management’s view that their own company is more attractive than outside opportunities.

Interestingly, they have given clear hints in the Q&A in both Q1 & Q2, that new companies will enter the portfolio soon, either in the form of new names or indirectly by one of their subsidiaries. With MBB’s cash position and the heightened interest rates, the ability to finance deals with equity, gives them an advantage compared to most others.

All in all, I see several opportunities for MBB shares to work well from here:

Long-term track record of value creation > poor margins in recent years

Acquiring another company, using their net cash position & achieving their historic ROCE of >15% over time → Increasing earnings per share

Coming back closer to their historic ROCE of ~19% from 12% as of today.

Continue buying back shares at 5x EV/EBIT → reducing shares outstanding

Market Rerating of publicly listed companies Aumann & Friedrich Vorwerk

Currently priced at 3x & 7x EV/EBITDA

Market rerating of MBB itself, as EBITDA may go up by ~50% this year compared to 2023. An EV/EBITDA expansion from 5→8x over 5 years, could add 10% return per year. A succesful acquisition may also be well received by the market, to place more value in the acquisition machine of the holding company itself.

Conversely, what could be possible reasons for MBB shares to work poorly?

With only 6 subsidiares, there could be significant competition risk or other risks I am not aware of in the individual companies.

Recession. As with most industrial companies, demand falling 10% can cut earnings much more with substantial fixed costs. However, the net cash position and minimal debt, should serve as a great buffer, if things get really tough.

Acquisitions at low ROIC. Either overpaying or by buying troubled companies could give the market even less belief in the holding company´s purpose. Seeing the return on capital fall further, would not be a great look.

As always, none of this is financial advise. The writer do own shares of MBB stock.

Hi Ole, Not sure how you arrive to the 20 year compounding of 11%. The company has been pubic since 2006. I arrive to an IRR of 18.4% since then.

Thanks and keep up the great work!

Great Idea and review. Congrats :))

I have this company in my portfolio and I believe in an appreciation of between 11-16%/Year in the long term. While they don't add/buy more companies, they are focusing on buying back shares that in their opinion (as in mine) are clearly undervalued. They are comfortable buying up to a price of €120, which clearly demonstrates the margin of safety that exists here. I hope to have patience and keep it up for many years.