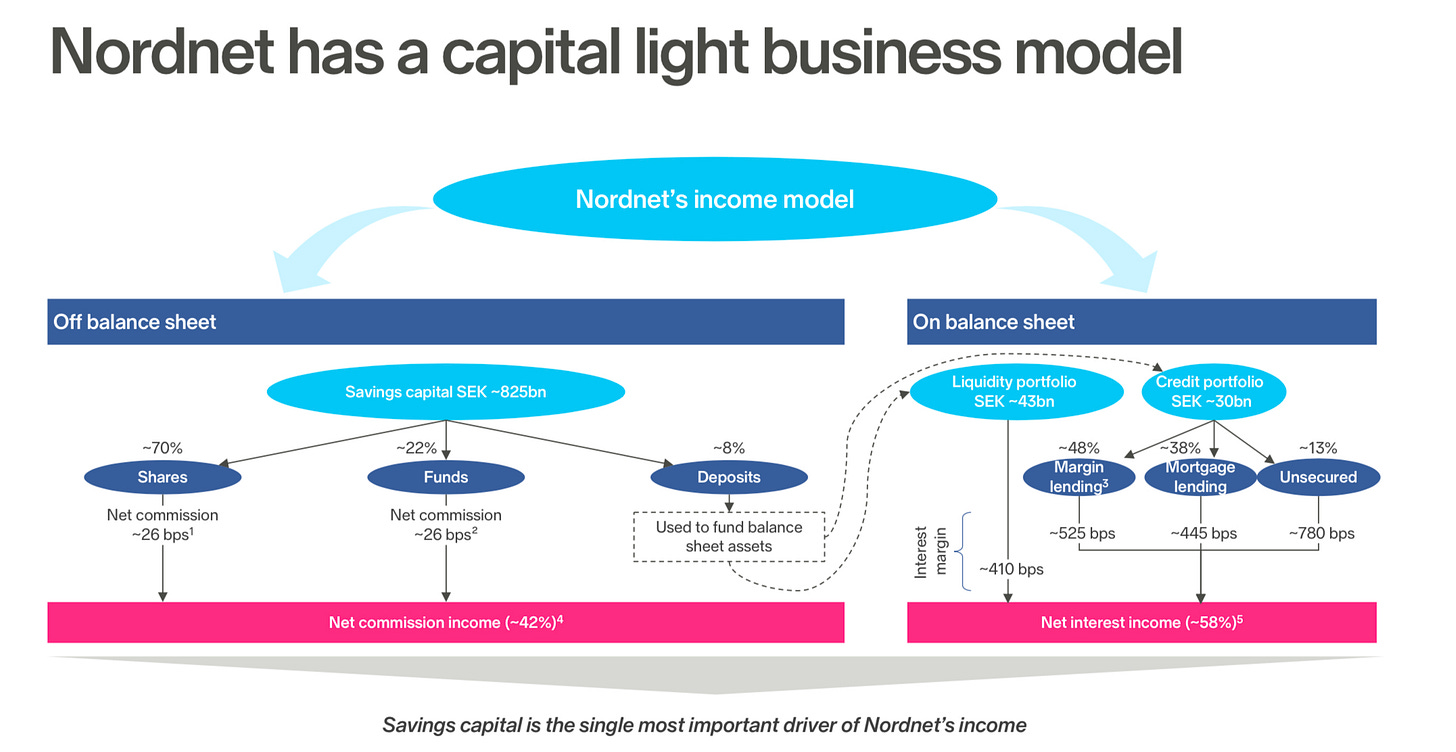

If you're outside the Nordics, you might not know Nordnet. It's a digital brokerage with a simple yet effective model: You can invest your savings capital there by paying small fees for every transaction & they will use your deposits to fund their liquidity & credit portfolio - brining in interest income. Though it may not sound glamorous, a closer look at their financials tells a different tale:

Net profit margin: 57% in 2023, average last 4y: 51%

Net profit per employee: 3.4M SEK or ~ $340k

Growth CAGR from 2020: Revenue +19% & EPS +26%

Insider ownership: 35% of shares outstanding

Price / Earnings multiple: 15x, with ~5% dividend yield

Expected market growth: 6-8% over next 5 years

A company priced at 15x profits, is not expected to grow much, despite the expected market growth rates. With a business model (partly) benefiting from high interest rates, the market may assume earnings are superficially high this year. Time will tell, whether this is a declining business or an asymmetric stalwart1 opportunity. SEB stated their opinion on this in their latest research note on Nordnet´s stock price:

“Skyscraper growth at basement valuation” (SEB, 2024)

Disrupting the nordic investment industry

“The overarching purpose of Nordnet’s operations is to democratize savings and investments. By that, we mean giving private savers access to the same information and tools as professional investors. This purpose has driven us since we started in 1996 and remains our direction to this day” (Nordnet IR, 2024).

“Our customers loved it, traditional banks hated it”

Buying & selling stocks or funds is nothing new - the first being the founding of the Amsterdam stock exchange - back in 1602. Some 394 years later, Nordnet came to the pitch. Then, with the rise of the internet, customers wanted to trade stocks online, via their computers, and soon, mobile phones. A transition removing a lot of physical overhead costs by being a brokerage. To exemplify the impressive economies of scale, “only” 735 employees work at Nordnet - a company doing ~$0.25B in net profits or ~$340k per employee, while serving 4 unique language-speaking countries.

The dual edged sword

Interest rates is especially important for this industry, at least in the medium term. In particular, higher interest rates have resulted in:

Higher interest income from liquidity & lending portfolio

Lower commission income, due to customers trading less, probably due to less capital available after household expenses (mortgage, inflation etc.)

Changing market sentiment, with interest rates working as gravity towards stocks, especially growth stocks (higher rates puts more weight on profits today)

While the above graph, shows how one part of the company (commission income) struggles during higher interest rates, another flourishes (interest income). However, here is why I think this is mostly noise for the long-term investor. First, you, I, or anybody else for that matter, can´t predict future interest rates, or the economy for that matter. Also, since commission & interest income work as a “dual-edged sword” (illustration below), the financials are quite robust & antifragile. The intelligent investor, will understand that what really matters in the long run, is fundamentals: Savings capital growth, revenue take-rate & cost discipline.

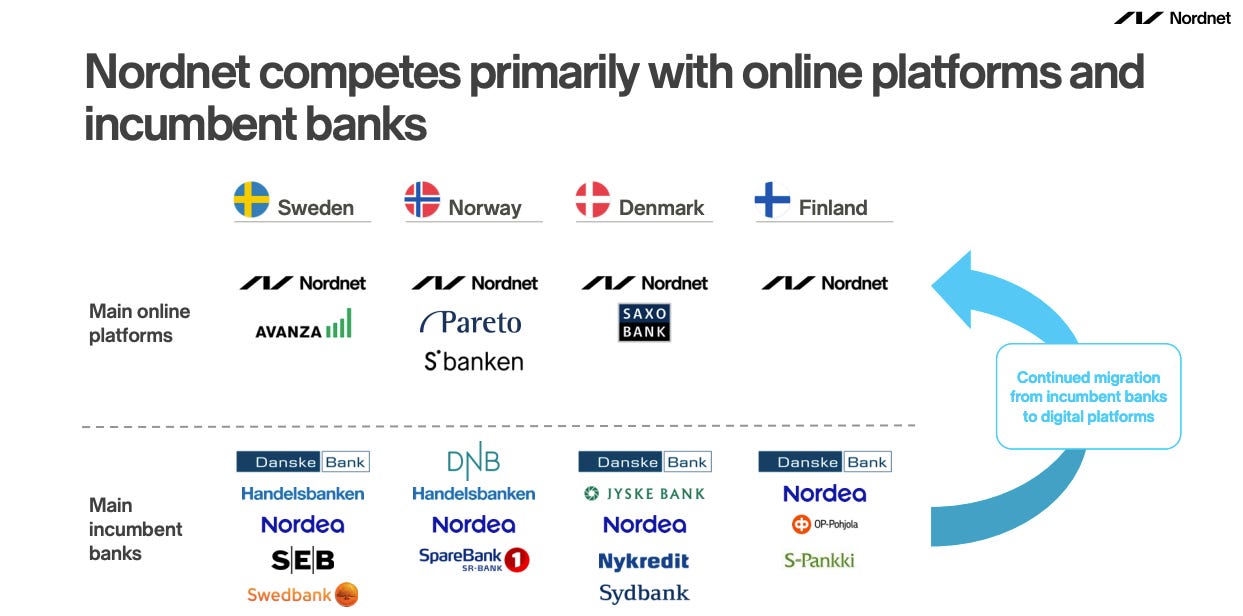

A crowded field

In a competitive landscape, Nordnet emerged as a disruptor, perfectly timed to adapt to changing consumer habits. However, as is often the case, attractive industries draw multiple competitors, raising the stakes for innovation. Without a sustainable competitive advantage, businesses risk succumbing to price wars that erode both top-line revenue and margins, as seen in the aviation industry. More specifically, Robinhood (with a fitting name) did exactly this with their disrupting payment for orderflow business model in the US2. However, this business practise, where the customer is the product, is constrained by the EU according to Art.27 of Mifid23.

Nevertheless, if competition should be getting more intense, how come Nordnet is still taking market share?

Pace of Innovation

If you are a Nordnet customer, you know they ship (iterate their app) fast. But not the type of changes where you are annoyed as a customer. More those subtle small additions of features, or features you didn’t knew you wanted. While the 2 examples below shipped to 1,8m customers last week are quite small, they highlight something important - Pace of innovation.

Write personal notes on investment instruments, such as notes on a stock chart

Search for Shareville (“Nordnet´s investor social media”) users in global search

Innovative companies that prioritise continuous improvement can build strong defenses against competitors, echoing Amazons' emphasis on customer obsession at Amazon. As companies grow larger, they often become slower, but Nordnet stands out as an agile and well-managed innovation machine, still evolving.

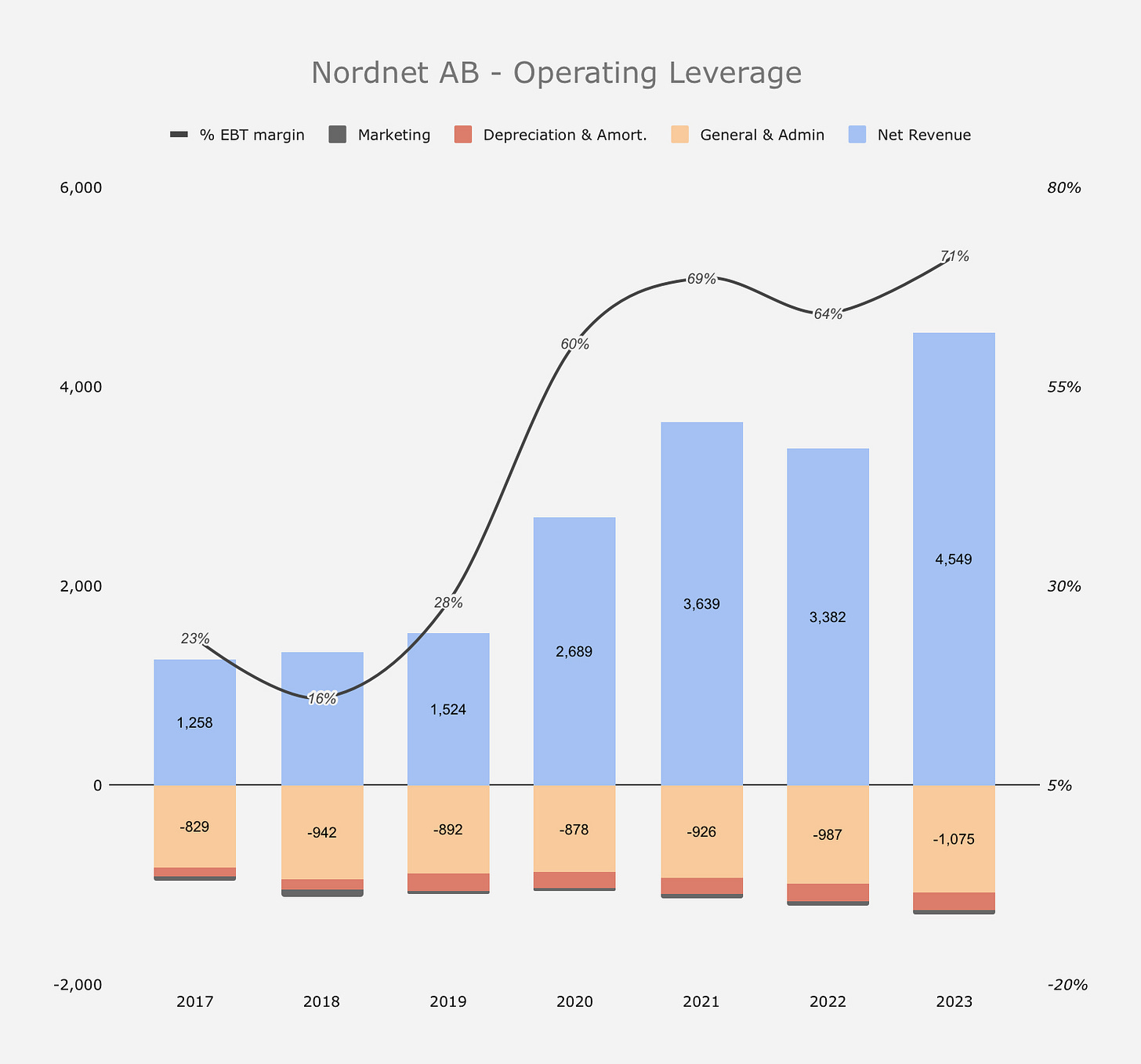

Cost discipline → Operating Leverage

The operating leverage of Nordnet resembles more a payment network business, like V 0.00%↑ or MA 0.00%↑, than a bank. 10% in revenue growth, have historically led to 15 or 20% in profit growth. The key behind this, is economies of scale & cost discipline. As the below graph shows, Nordnet have maintained cost discipline, which have resulted in enormous operating leverage - given their fast growth in revenues.

Another interesting datapoint from the historic financials above, is their low marketing spend (black bars). CEO, Lars-Ake Norling commented during the Q4 23 earnings call, that they will be ramping up (3x) marketing spend in the coming years:

Last year, we spent around 10m SEK on marketing per country, which is a low level. We plan to increase that to ~30m SEK per country - to increase customer growth, from the 9% where we are to the upper part of 10 to 15%.

Valuation

At the beginning of this post I described Nordnet as a potential asymmetric stalwart opportunity. With that I mean a well-proven business, which now have claimed a leading position - but still can deliver outsized shareholder returns. How so?

(+) Dividend. For a company not in need of much cash (they actually have more than required, leading to potentially buying back shares), 70% of profits can be returned. This equals roughly 4,5% yield at today´s price.

(+) Taking market share. The nordic savings market is expected to grow 6-8% per year. In addition, Nordnet plans to ramp up marketing efforts to reaccelerate growth → a 10-15% growth rate is not out of the question for some more years.

(+) Operating Leverage. With proven cost discipline & economies of scale, one could expect profits to grow at least similar or faster than revenue.

(-) Declining interest rates. If interest rates where to fall, interest income will come down. Then it will be up to the “dual-edged sword” to see if higher trading revenues will weigh up for this. There is certainly a chance of the next 2 years profits being relatively flat from today, which is what the market prices in.

(-) Takerates. I pay between 5-10$ per trade at Nordnet. A big improvement for the costs a decade ago. Although, this being a small % of your investment, is this a sustainable level, or will there be pricing pressure from competitors & especially from consumers on this? A conservative investor would not rely on this going up at least.

Time will tell whether SEB´s analysis of Nordnet as “skyskraper growth at basement price” will be correct. A company looking to continue growing savings capital at 10-15% for quite some time, with operating leverage and almost 5% dividend yield - sounds very reasonable. Risks are certainly there, and more of them also within their lending business. Below I´ll show my simple valuation model of different outcomes. As always, the stock price can go way higher or way lower.

Disclaimer: None of this is financial advice, so due your own due diligence. The writer of this post may own shares in Nordnet.

Stalwart: A large, well-established business still offering long-term growth opportunity. A term made popular by legendary investor, Peter Lynch.

Payment for order flow (PFOF) is when a brokerage, like Robinhood, gets paid by market makers for routing customer orders to them. Instead of executing trades on an exchange, the brokerage sends orders to market makers who execute them, and in return, the market makers pay the brokerage for the order flow.

Mifid2 Source obtained 30.01.2024 from: https://www.esma.europa.eu/publications-and-data/interactive-single-rulebook/mifid-ii.

Other sources include Nordnet Investor Relations & company filings / presentations.