MBB - 2024 Update

Follow-up on a German company up 50% YTD, having now multiplied sales by 28x since it's public listing in 2006, with less and less shares outstanding.

If you're new to MBB, you can access the initial writeup via the link below.

MBB SE

Before diving into this analysis, I want to thank Michael Gielkens for inspiring this idea. While European industrials may not be the most glamorous sector right now, this could explain the significa…

The original thesis was straightforward: a German holding company with a proven, successful track record, trading at a deeply undervalued price. It offered multiple avenues for double-digit profit growth, including margin normalization, organic growth in sectors with durable tailwinds, and, most critically, strategic capital allocation of its substantial net cash position, including significant buybacks.

8 months later, many things have gone right for MBB, including positive news especially around Friedrich Vorwerk, having sent the stock up 50% YTD.

Annual Report

When analyzing MBB's financial performance, it's important to remember that they consolidate 100% of a subsidiares revenue, when they own the majority share of it.

The Ownership Structure is shown below (30/09/2024).

To clarify, consider if DTS makes €100 in revenues, MBB would then consolidate €100m into their figures, but then deduct the remaining 20% of DTS net profits within minority interest, all the way down after the earnings after tax line.

Therefore, to accurately evaluate MBB's business, you should either consider the net profit after deducting non-controlling interest (€40.7m) or multiply figures above the non-controlling interest section by their share of the total pie.

MBB shareholders stake of fully consolidated net earnings increased to 58% in the current year, compared to 53% in 2023. This increase came mostly from MBB acquiring more Friedrich Vorwerk shares and share repurchases within Aumann.

Let’s take a look at key numbers, presented below:

Revenues increased by 12% in 2024, EBITDA by 86% and net profits surged by 170%—or 186% on a per-share basis. The drastic difference between sales growth and net profits, comes primarily from 2 places: gross margin up from 40 → 46% (lower materials cost) and lower depreciation & amortization expense relative to sales.

Average number of shares also declined 5,3%, as management found their own stock an attractive use of capital. There is no doubt management knows a thing or two about capital allocation, exemplified with a quote from the Annual Report.

Over the last two years, purchases of shares in Group companies totalled €105 million. The market value of these repurchased shares had more than doubled by the end of March 2025. It would probably not have been possible to achieve a similar return within the time frame of two years by acquiring a new company.

The net cash of €553 million, which is an increase from €475 million last year, show strong operating cash flow this year of €194 million. This was achieved despite significant capital expenditures (€48 million), investments in intangible assets (€8 million), share repurchases (€40 million), increased ownership stake in Vorwerk (€12 million), buybacks within Aumann (€6 million), and €9 million in combined dividend distributions (of which €5 million went to shareholders).

Despite the industrial image of MBB, which often implies that much cash is tied up, cash flow is strong and reinvestments in 2024 happened primarily within the group.

Capital Allocation → Balance Sheet

Before we dive into the individual holdings, it’s useful to think about how MBB reinvest their earnings and capital allocation in general. In the first writeup, I may have underestimated what MBB management did with it’s cash.

Our aim is to realise a return on the Group's free liquidity. To this extent, some of these funds are invested in securities until they are needed to finance new acquisitions.

The cash from investing line shows how they approach this. MBB has over the last 2 years invested a net of €39m into financial assets & securities. But, these assets are not only invested into bonds.

So, what are these long-term financial assets and securities?

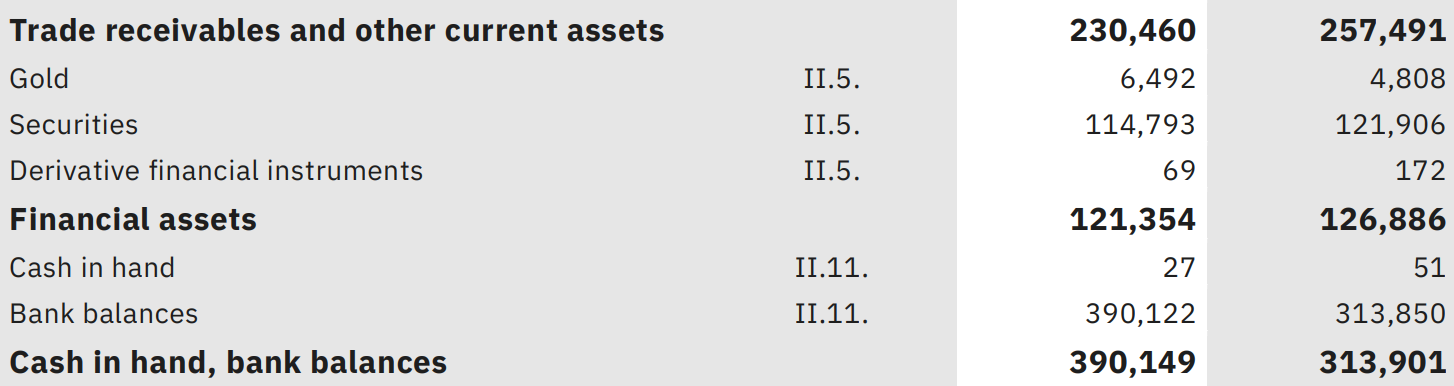

A) Ownership in Stocks (€114m)

The non-current assets on the balance sheet include €9 million in joint ventures and €104.7 million in long-term securities. These securities are invested in established companies, such as Alphabet and Microsoft. The €15 million increase in securities is due to €12 million in gains and €3 million in contributions. Unfortunately, the cumulated gains on these investment are not shared by management.

B) Ownership in Bonds & Gold (€121m)

The family company's current assets include €115m in listed bond investments and €6m in gold reserves.

C) Cash in hand, bank balances (€390m) - Debt

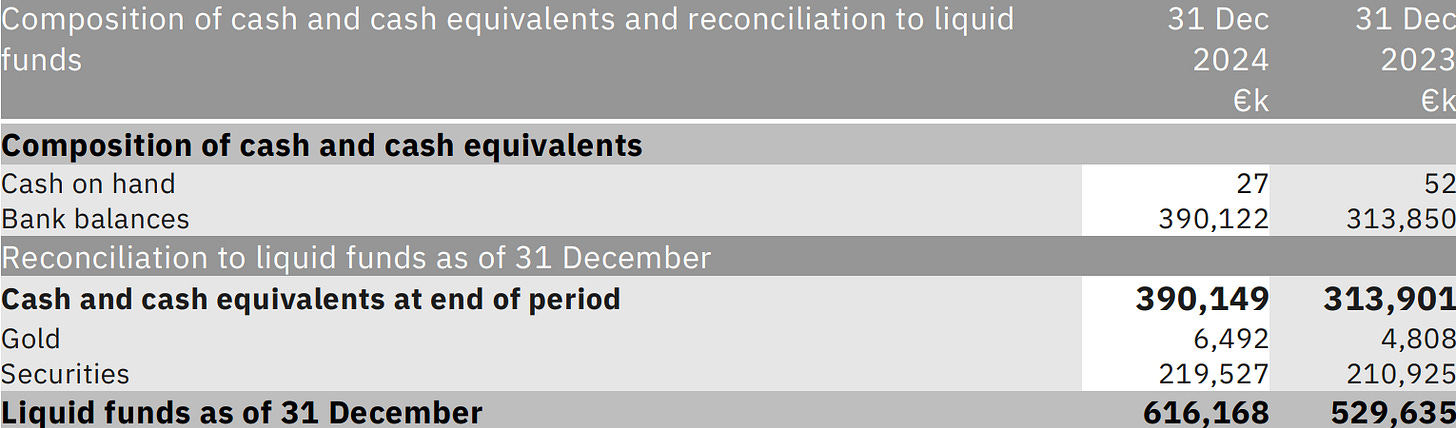

Lastly, we have cash of €390m, with some of this within the individual subsidiaries. For the consolidated entity, this equals €616m in liquid funds (not including €9m in joint ventures).

Including €62.3 million in bank and lease liabilities, the company holds €553 million in net cash—assets that could become especially valuable if market conditions or valuations deteriorate further. This strong cash position also leaves room for selective tuck-in acquisitions at the subsidiary level. For example, Aumann, with its significant cash reserves, is looking to expand beyond its core automotive equipment segment, so don’t rule out the possibility of a tuck-in acquisition from them as well.

As noted, the family owners continued this year to reinvest capital into their existing portfolio rather than pursuing new acquisitions. Notably, these incremental investments in Vorwerk, Aumann, and buybacks of MBB’s own shares have already generated exceptional returns.

Once you find capable capital allocators who sticks around for a long time, such as family owners, time can be your friend, illustrated with MBB’s history below.

Counter-Cyclical Management

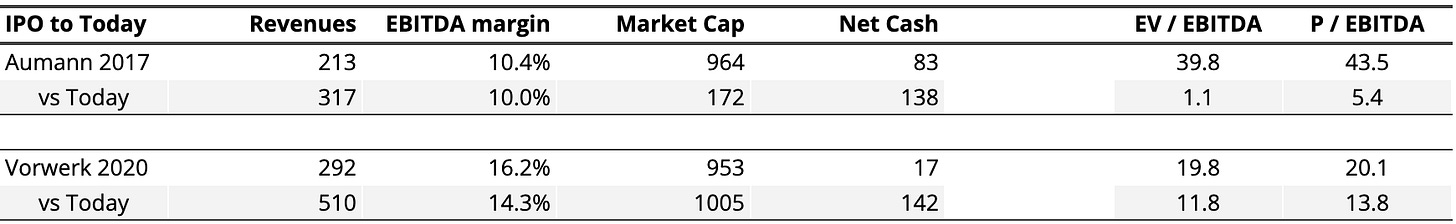

A question I received after the first writeup of MBB, was the poor performance following the stock-listings of Aumann (in particular) and Vorwerk. The table below is to illustrate key figures for these two subsidiaries from their IPO to 2024.

Revenues up, net cash up, margins slightly down and multiples drastically down. But, remember that following the public listing of these two businesses, MBB got their capital back (and more) by selling parts of their holdings. And, they have been a net buyer in the last 2 years, at much lower valuations. Buy low, sell (IPO) high.

The doubters should ask whether they would prefer the opposite. Management selling their businesses to cheap and buying them back more expensive. As MBB cannot control the markets mood, this is a nothing burger in my opinion. Especially when the two things they can control, their purchase price and impact from the board room etc., looks to be just fine.

Let’s take a look at what management expect for this year.

Management Expectations for 2025

MBB SE expects consolidated revenue between €1.0 billion and €1.1 billion for the 2025 financial year (2024: €1.07 billion) with an adjusted EBITDA margin of between 11% and 14% (2024: 14%). MBB also sees good opportunities for further company acquisitions in 2025.

In an environment characterized by economic uncertainty, protectionist trends, and tariff concerns, the diversified structure of a holding company like MBB can offer resilience.

Friedrich Vorwerk, specializing in infrastructure for energy transport (gas, electricity, hydrogen), primarily serves network operators and utilities in Germany. With ongoing infrastructure investments in the country, its positioning appears favorable, proved with their massive order book of €1.2B, close to 2.5x this years record revenue! EBITDA margin 16%, finally recovered from the issues discussed in last years writeup.

DTS, focused on IT security, reported a slight decline in both revenue and EBITDA due to delayed public sector orders—expected to recover in 2025. A positive trend is the growing share of proprietary software sales, which could support higher margins. Current EBITDA margin: 13%.

Aumann, a provider of automation solutions for automotive manufacturing lines in particular, achieved record results in 2024, but faces a declining order backlog—raising questions about near-term momentum. Current EBITDA margin 11%.

The three smaller companies also looks to do just fine.

Delignit, supplying wood-based components for light commercial vehicles, remains a lower-margin, lower-quality business with single-digit EBITDA margins. Notably, both Aumann and Delignit are exploring diversification into sectors such as defense, though execution on this remains to be seen.

The smaller, yet resilient subsidiaries Hanke Tissue and CT Formpolster (toilet paper, mattresses, etc.) delivered solid results. The standout was Hanke Tissue, which achieved a double-digit EBITDA margin. While a business like CT Formpolster may appear a commodity business—selling mattresses through e-commerce—its integrated model offers a clear competitive edge. By vacuum-packing and roll-compressing products, it significantly reduces transport volume, enabling low-cost parcel shipping. Coupled with local production and direct-to-consumer logistics, this structure supports efficient distribution and strong regional positioning—making CT Formpolster a local champion in an otherwise cost-sensitive market.

In Summary: The Growing Weight of Friedrich Vorwerk

Friedrich Vorwerk’s significance within MBB has grown meaningfully. With a current market cap of €1.05 billion, MBB’s 49.5% stake is worth approximately €520 million. In addition, MBB holds publicly listed stakes in Aumann (€91 million) and Delignit (€15 million), bringing the total value of its holdings in listed companies to €626 million.

Compare this to MBB’s own market cap of €768 million, this implies the market is valuing the rest of the MBB group—including unlisted, cash-generative subsidiaries like Hanke Tissue, CT Formpolster, DTS, and their cash position—at just €142 million.

The €142 Million "Leftovers"

What are investors actually getting for the remaining €142 million?

First, I’m not a strict proponent of sum-of-the-parts valuation. Buying a euro for fifty cents sounds nice—but far more compelling is owning a business that compounds value over time. If you can get both, yeah, that should make investors excited.

The unlisted subsidiaries—DTS, Hanke Tissue, and CT Formpolster—generated a combined €23 million in EBITDA on €193 million in revenue, implying a healthy 12% EBITDA margin.

In addition, MBB holds €554 million in net cash, of which €281 million is attributable to the holding company itself.

Finally, and perhaps most importantly, the value of proven capital allocation should not be ignored. While markets often apply a discount to holding structures, MBB has consistently demonstrated disciplined and value-accretive reinvestment. In contrast to empire-builders, MBB’s role as a capital allocator is its core value proposition.

MBB management believes the same, and continue to buy back their own shares, even after the stock has rallied this year. Hopefully, we will see other use of capital in the future to, especially if the market weights the company more fairly.

That said, not all recent news has been positive.

Management Change

In early January, MBB announced that both CEO Constantin Mang and COO Jakob Ammer will not be renewing their contracts, which expire on June 30, 2025.

From July 2025, Christof Nesemeier, MBB’s founding shareholder and current Chairman, will return in an executive capacity, taking on responsibility for strategy, M&A, and operations. Alongside him, Torben Teichler will step in as CFO, overseeing capital allocation, finance, and investor relations.

While it's difficult to assess the full implications of this transition, one detail stands out: despite publicly emphasizing the undervaluation of MBB, Mang repeatedly sold shares in the open market during his tenure. While this may reflect personal circumstances, it contrasts with what long-term shareholders typically value—alignment between words and actions.

From the Outsiders Corner perspective, the return of a founder with deep strategic insight and a strong ownership mindset is a welcome development. Few things signal long-term alignment better than a founder stepping back into the driver’s seat—especially with a focus on operations and capital deployment. Whether this marks a meaningful shift in direction remains to be seen, but unlocking value from MBB’s substantial cash position should be at the top of the new leadership's agenda.

To wrap things up, we need to cover the elephant in the room.

Friedrich Vorwerk (+260% 1Y)

In last year’s write-up, MBB was presented as a compelling opportunity. In hindsight, most of the gains can be traced back to Friedrich Vorwerk’s stellar performance—a reminder that, sometimes, you can be right for the wrong reasons. But that’s the beauty of a holding company: value creation can stem from multiple sources—be it thoughtful capital allocation, operational excellence, or portfolio surprises. Ideally, all three.

Back then, we argued that Vorwerk’s margins were likely to normalize once legacy projects rolled off. Project risk is part of the business model—present in both good and bad times. The real issue is perception: when a few projects go sideways, markets often treat it as a structural flaw, forgetting the company’s 60-year track record of consistently executing complex infrastructure projects.

That sentiment has clearly shifted.

Structural Tailwinds Reinforce the Outlook

In late 2024, Germany’s Federal Network Agency approved the 9,040 km Hydrogen Core Network, with operations starting in 2025 and full buildout targeted by 2032. Around 40% of the network will be newly constructed—an area where Friedrich Vorwerk’s engineering and pipeline capabilities are directly relevant.

At the same time, the new Merz-led coalition announced a €500 billion infrastructure plan aimed at modernizing Germany’s energy systems. This includes ramping up gas-fired power capacity and accelerating hydrogen infrastructure—two areas squarely within Vorwerk’s core competencies.

This is precisely the rationale behind MBB’s emphasis on businesses with structural tailwinds. When the wind is at your back, positive surprises tend to show up.

Execution Meets Opportunity: Three Major Wins

EWA Pipeline: In partnership with HABAU, Vorwerk is building a 24 km section of a new pipeline connecting LNG imports to the German gas grid. The project, worth a high double-digit million euro amount, is already underway—and built with future hydrogen transport in mind.

WAD Pipeline: The joint venture also secured the next 36 km stretch of the same pipeline system, valued in the low triple-digit millions. This ensures full utilization into 2026 and further entrenches Vorwerk in Germany’s energy infrastructure buildout.

Statkraft Hydrogen Plant: Vorwerk will construct a 10 MW green hydrogen electrolysis plant in Emden. The project not only strengthens its credentials in hydrogen tech but also positions the company to capture growth as demand for clean industrial hydrogen scales up.

Looking ahead, the runway is long. Whether in water, gas, electricity, or hydrogen, Friedrich Vorwerk is increasingly positioned as a cornerstone of Germany’s energy transition. For MBB shareholders, that’s exactly the kind of embedded optionality you want to see play out.

Conclusion

Stepping back, MBB offers a portfolio of both public and private businesses across uncorrelated industries. While Aumann and Delignit continue to navigate the cyclical downturn in automotive, both are actively exploring opportunities to diversify beyond that sector. In the middle stand the more resilient businesses—DTS, Hanke Tissue, and CT Formpolster. And out in front is Friedrich Vorwerk, firing on all cylinders and doing the heavy lifting on value creation.

Will next year’s upside come from another part of the portfolio? Possibly. Or a new acquisition? That’s the strength of a well-run holding company—you don’t need to pinpoint where the value will come from, just trust that they’ll find it.

I enjoyed that commentary!

Nice write up. (I did recently sell too early in hindsight, judges from today).

You wrote "...but unlocking value from MBB’s substantial cash position should be at the top of the new leadership's agenda."

Do you mean (1) 'should' as you wish for it, or (2) 'should' like you think the probability for it being so is deemed to be high?

Because, it might be that mang etc were not allowed to put that cash to use, ie bc ab wanted to wait for even more compelling opportunities (which may never present themselves)...