Medistim

Norwegian Medical Equipment Leader currently growing 25%, EBIT margins of 30% and ROIC of 35%

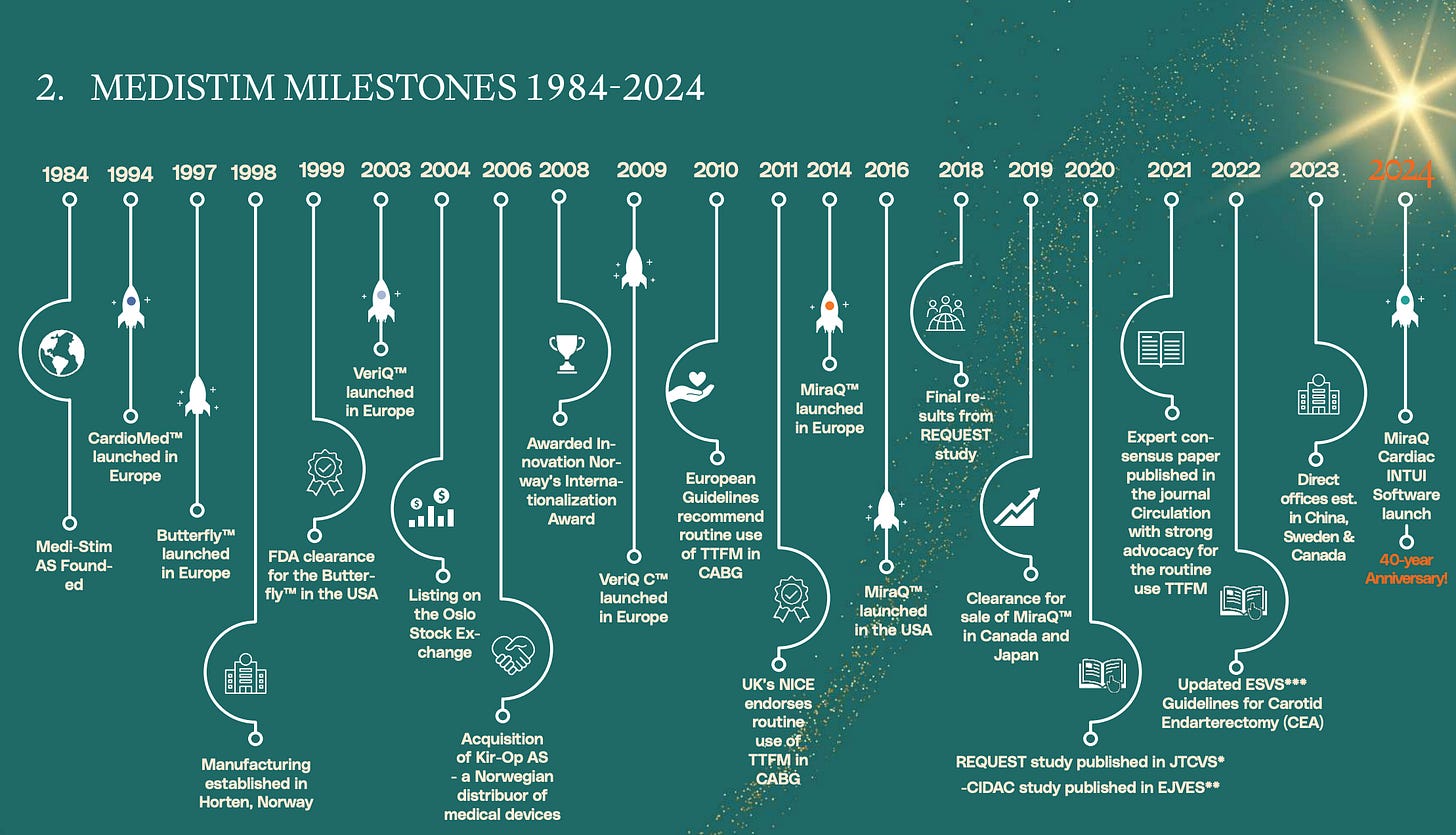

Medistim has spent more than four decades refining technologies that give surgeons real-time guidance in the operating room. This writeup aims to cover the runway for this Medical Equipment leader to continue redeploying capital at their excellent historic returns and what direction their competetive advantage is heading.

When we first initiated our position in Medistim at the end of last year (shared here), we thought we got a far-above average company for (finally) a price around the market-average. Our research was not that comprehensive back then.

9 months later, the stock is up 75% including dividends received, and we had to ask ourselves, what to do know? We went for trying to understand the reinvestment runway, as we have sold high quality businesses way to soon before.

I — Introduction

At first glance, it doesn’t take long to notice that Medistim is special. Since 2004, the company has delivered a total-return CAGR of 20% (>4,500%), with >80% gross margins, nearly 30% EBIT margins, and a mid-30% return on invested capital.

Our attempt at explaining how they could sustain such figures, goes like this:

Medistim solves problems few can and consistently drives the industry forward, where every innovation improves patient outcomes and increases Medistim’s competetive advantage.

With their Installed Base business model, where roughly two-thirds of sales are recurring, the company has the stability to continually reinvest in research and development, fund clinical studies, and expand into new markets. And since intraoperative quality assurance within primarily cardiac surgery is a highly specialized niche, it offers limited scale or synergies for larger medtech players — making it unlikely they would enter and compete heads-on.

The problem for potential competitors looks to be that they would first need an up-to-date flow- and imagining system (which Medistim is still the only to have), but also receive approvals and conduct multi-year studies on patient outcomes etc. And without an installed base revenue base to sell to, the unit economics would be poor initially, and you would also have to convince Hospitals globally to replace current infrastructure (likely Medistim) and retrain their surgeons. With little incentive to switch, but also better things to spent their time on, we’d call that no easy task.

While Medistim have paved the way for others to replicate their offering, meaning time-to-market may be faster for those replicating their steps, we believe their recent software innovations further separates them from the pack, and increases the barriers to entry.

Some of the best surgeons in the world participated in developing and fine-tuning the recently launched INTUI software for their MiraQ devices. Like Medistim said themselves: It’s not just engineers sitting in a room.

In short, Medistim enjoys a powerful competitive position, yet operates in a relatively niche part of the Surgery Market that remains unattractive to larger players. With such a strong competetive position, we think our time is better served figuring out where the market’s heading, or like our header image below could suggest, where Medistim takes their markets next.

It’s important to note that the 80% market share example above applies only to CABG surgeries within the Cardiac Segment, which accounts for 65% of sales. Medistim also serves Vascular and Transplant surgeries (19% of sales, reported under the Vascular segment). The third segment called Third-Party Products segment (16% of sales), consists of selected surgery-equipment sold in Scandinavia.

II — The Problem

Cardiovascular disease, the leading cause of death globally, compounds by an ageing population and the rising prevalence of diabetes. India alone is approaching 60 million patients with diabetes — making it the Diabetes Capital of the World. As renowned surgeon John Puskas put it: “Numbers are rising with no end in sight.”

When arteries become blocked, treatment typically follows one of two paths: inserting a stent via catheter to reopen the vessel, or performing coronary artery bypass grafting (CABG), where surgeons reroute blood flow around the blockage.

Importantly for Medistim, who holds 80% market share in technology-assisted CABG surgeries (as seen in Exhibit I), 55% of global CABG surgeries still rely on finger palpation (feeling pulses by hand), to check for blockages or poor blood flow during surgery. This method is subjective and prone to error, and Medistim’s technology allows surgeons to measure (flow) and visualize (imaging) blood flow in real time.

These insights is well-documented to lead to surgical adjustments that reduce the risk of complications (REQUEST STUDY). Missing a poorly functioning artery, for example, can significantly increase a patient’s risk of stroke.

And perhaps just as important for Medistim, to borrow the words of John Puskas, a seismic shift is underway in how cardiovascular disease is treated.

Today, treatment decisions between PCI (stenting) and surgery vary enormously — sometimes by a factor of ten between cardiologists. This variation highlights how strongly personal preference and convenience, rather than evidence, can shape patient care (source).

This is possible as the same physician who performs the diagnostics can immediately proceed with stenting, without consulting a coronary surgeon. According to Puskas, this gatekeeper role is set to change dramatically over the next five years, moving decision-making toward a more evidence-based and patient-centered approach.

While Medistim’s machines are primarily used in more invasive procedures than stenting, the FREEDOM trial demonstrated that coronary bypass surgery significantly outperforms stenting in diabetic patients — with the benefits particularly increasing from two years after surgery.

III — Medistim’s Opportunity

We’ve already highlighted two major opportunities for Medistim:

Driving further technology adoption in CABG procedures.

Strengthen clinical evidence to guide more patients toward CABG over stenting, where outcomes are superior for some — particularly for diabetics and multi-vessel disease.

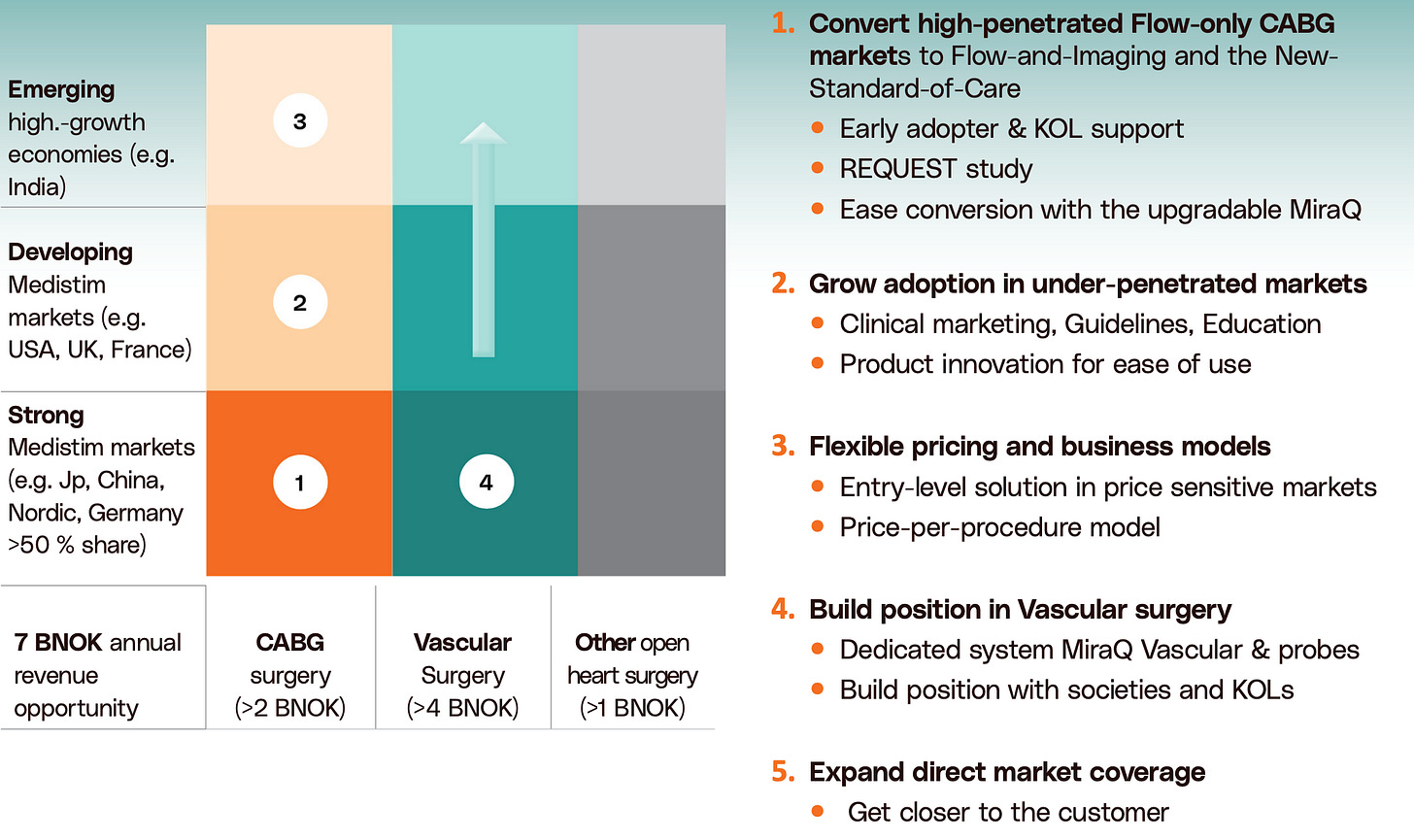

Still, as seen in Exhibit IV, the company has a multitude of growth opportunities. We will attempt to specify these in detail, as they’re critical to understanding growth.

First, Expanding Adoption in Under-Penetrated Markets

While we’ve already highlighted further technology penetration as a key opportunity, with 55% of procedures still unassisted, this opportunity is more concentrated in a few geographies — particularly the U.S., India, China, and Brazil.

The U.S. is Medistim’s largest market, representing nearly one-third of revenues, with 92% market share but (surprisingly) only ~40% technology penetration. Growth here hinges on clinical marketing, surgeon education, stronger guideline support, and importantly, securing reimbursement codes beyond bundled CABG coverage.

China, with ~60,000 annual CABG procedures, already sees ~70% adoption of Medistim’s TTFM technology, and a newly established direct salesforce strengthens its ability to scale. India, meanwhile, remains a massive untapped market with more than 100,000 procedures annually, where most surgeons still rely on finger palpation.

In short, the U.S. is the most important market now, but India may be in the future.

Secondly, Upgrading the Installed Base in Developed Markets

While underpenetrated markets are important, developed markets still hold opportunity. A large share of Medistim’s installed base consists of flow-only systems. The strategy is to make Flow + Imaging the new standard of care — a shift that transforms graft assessment from measuring blood flow to also visualizing where problems occur. For Medistim, this upgrade opportunity is twofold:

One-time sales: selling upgrade kits or new systems at higher price points.

Recurring revenue: surgeons using imaging will also require image probes (consumables), increasing the recurring probe sales per customer.

In other words, upgrading the installed base not only raises near-term revenues, but also expands the long-term consumable revenue stream. The REQUEST study was specifically tailored to document the effects of the flow + imaging device.

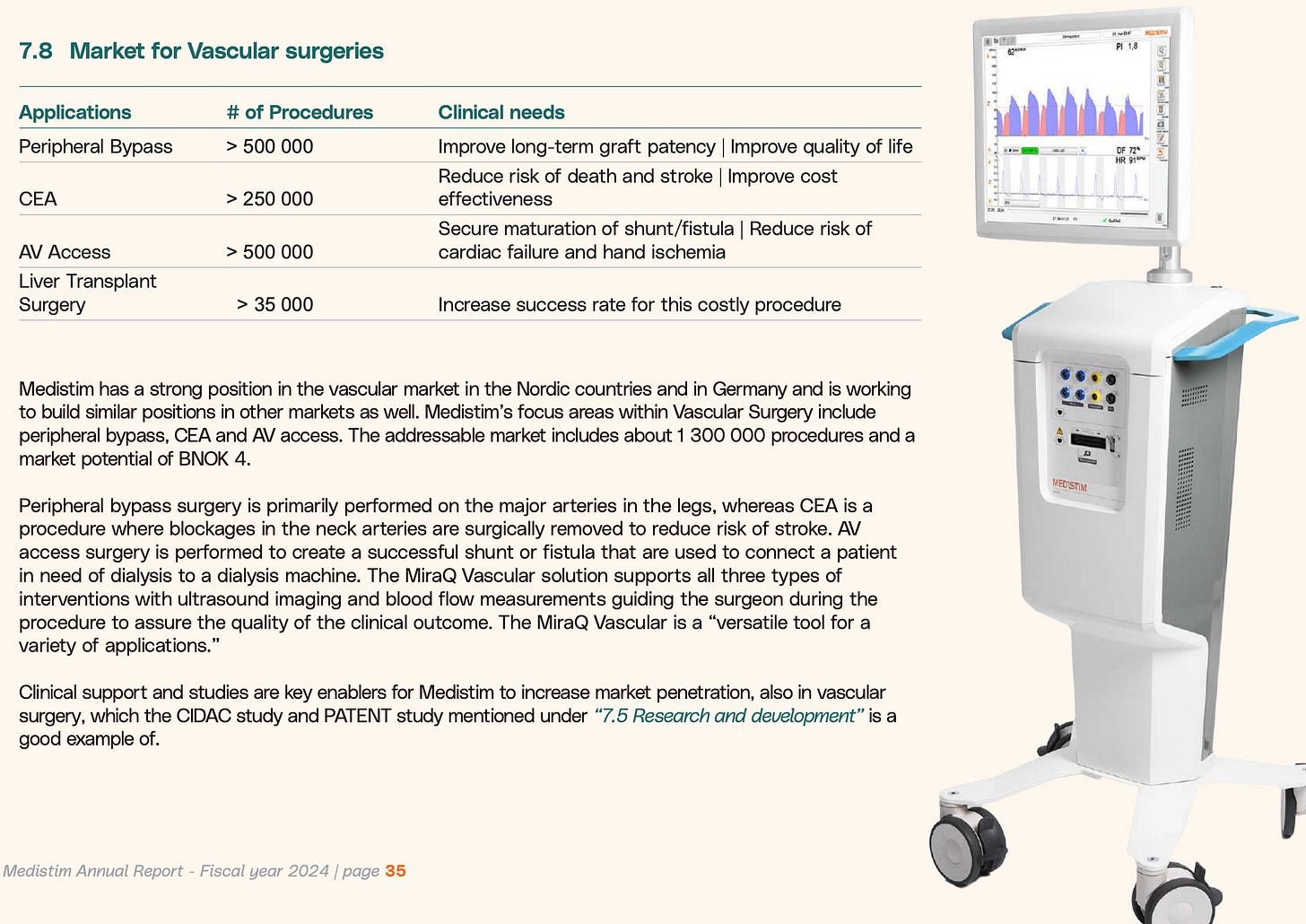

Third, Vascular as a Major Growth Opportunity

Vascular represents an even larger addressable market than Cardiac, and recent numbers underscore its potential. In H1 2025, Vascular sales grew 43% year-over-year, well ahead of the group’s 26% overall growth.

In vascular procedures, surgeons already use guidance tools like Doppler or angiography — but these provide estimates rather than precise, quantitative measurements. Medistim’s technology delivers hard data while avoiding the risks tied to x-rays or contrast media, making it both safer and more clinically compelling.

Importantly, the ongoing PATENT clinical trial is designed to validate this value proposition in peripheral bypass surgery. Patient enrollment is underway, and while the trial drives higher operating expenses today, it could unlock a much larger long-term growth engine if results are positive.

Fourth, Clinical Validation

Until late 2023, there were no peer-reviewed publications proving that TTFM technology in CABG surgeries could directly improve patient survival. That changed with the REQUEST Study, conducted on more than 1,000 patients using a previous generation of Medistim equipment.

The results were compelling: patients with LAD flow below 15 mL faced a 3.5x higher risk of death, stroke, or myocardial infarction post-surgery. Medistim’s devices enabled surgeons to detect this in real time, leading to adjustments in surgical strategy in 26% of cases and redo procedures in 3% of cases — interventions that could meaningfully change patient outcomes.

In short, documenting that Medistim’s devices saves lives in the surgery room.

Fifth, is improving the cost structure of Probe Manufacturing

The production of flow probes entails intricate tasks involving gluing and soldering of tiny components under microscope scrutiny. While our manual processes ensure precision, they also impose limitations on scalability and productivity.

By redesigning the probes and revamping and automating the manufacturing process, Medistim expects to yield substantial positive impacts on costs. Surprisingly, there may be room to expand gross margins above today’s 80%.

Sixth, Price Increases

When asked about U.S. price adjustments in light of the new 15% tariff on Norwegian imports, management made it clear this was already in motion. And more so, than what was required to offset the tariff impact of ~9%.

In other words, Medistim expects not only to fully absorb the tariff but also to strengthen pricing power in the U.S. Importantly, the effect of these increases has yet to be reflected in reported results, representing a potential upside for H2 2025.

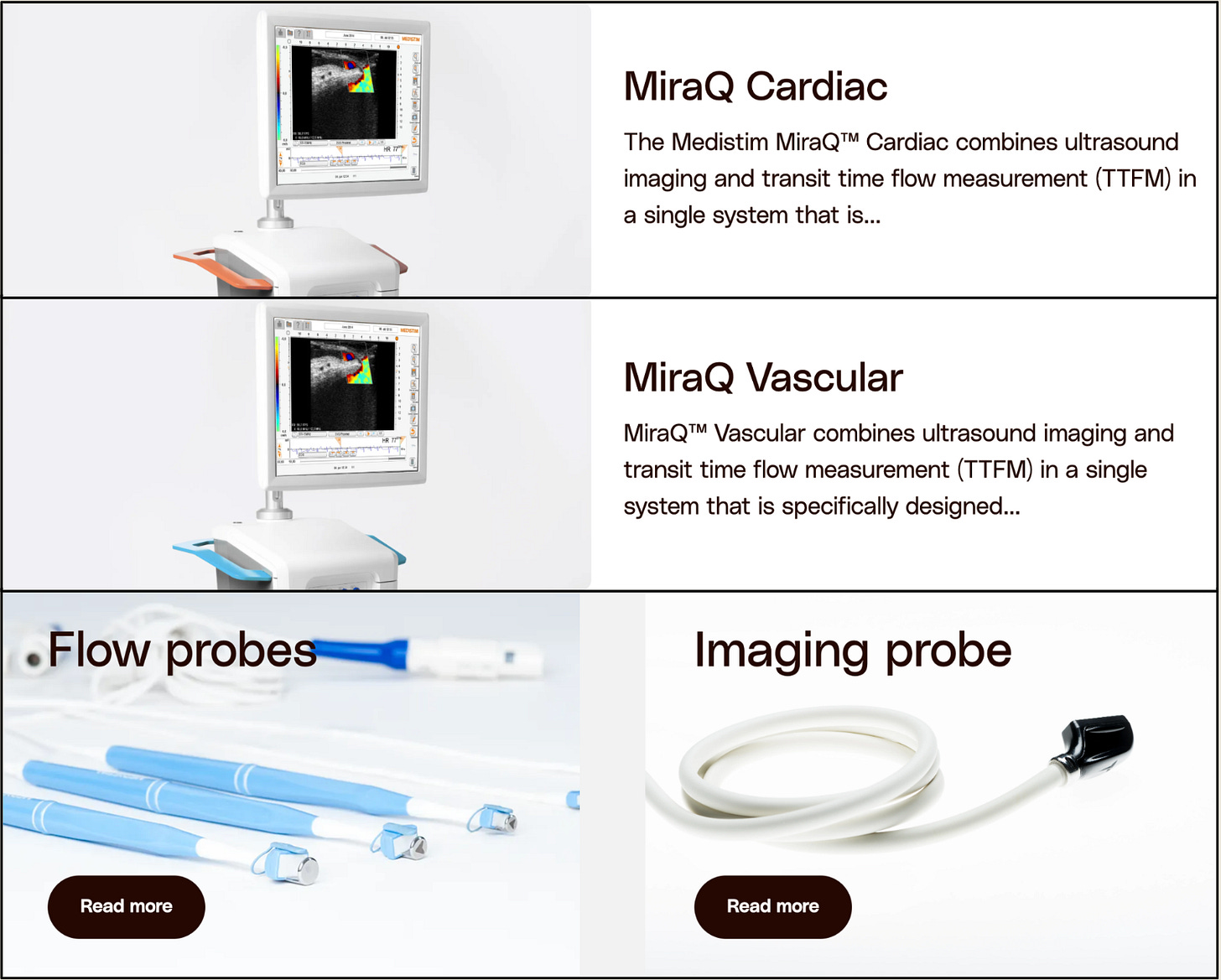

Lastly — Software and the Launch of MiraQ INTUI (Dec 2024)

After hearing expert surgeons describe INTUI software’s value at the operating table, it’s no surprise that CEO Kari pointed to higher pricing opportunities as hospitals upgrade machines with the new software.

INTUI fundamentally changes the surgical workflow. Junior surgeons gain instant feedback on graft quality through intuitive red–yellow–green flow indicators. Senior surgeons stepping in mid-procedure can immediately see what has been done and where to continue, eliminating uncertainty. Patients and families benefit as well, receiving clear, accurate reports of the surgery within seconds — replacing hand-drawn sketches with precise, software-generated documentation. In short, INTUI makes procedures easier, safer, and more transparent for everyone involved.

And, this Software is also a commercial opportunity: thousands of existing MiraQ machines in the field can be upgraded with Medistim’s service team. Additionally, CEO Kari confirmed that the newly launched INTUI software into MiraQ devices will come with price increases during the Capital Markets Day.

To conclude, Medistim’s track-record of innovation seem to be the answer to how they could sustain the excellent figures covered initially. Yet, even with these tailwinds, the question remains: what could derail Medistim’s continued success?

IV — Risks

Medistim itself highlights currency risk, macroeconomic uncertainty, and regulatory risks, such as loss of approval or changes in regulation. While currency fluctuations and macro factors are the most likely short-term risks, we do not see these threatening the company’s competitive advantage.

The single biggest risk for Medistim is falling behind on technology. The company’s success stems from its ability to respond to surgeon needs and improve patient outcomes through tailored hardware. With the launch of INTUI software, Medistim can now experiment with AI and continuously upgrade machines in the field. Expert surgeons’ feedback confirms that INTUI further strengthens the company’s moat. Continuous innovation is essential—no wonder Kari emphasizes expanding the R&D budget, as Medistim has historically underinvested relative to other medtech players.

Competitive pressure may increase with the expansion into the Vascular market. While Medistim’s position in Cardiac surgeries has been the perfect niche—technical enough to deter replication but small enough to avoid attracting large players—the larger Vascular opportunity may draw competitors with deeper pockets and broader distribution.

Other risks include the long-term implications of compounding drugs and the rise of surgical robotics. Medications from Novo Nordisk and Eli Lilly could reduce diabetes prevalence, potentially weakening a key structural tailwind. For surgical robotics, surgeons framed this as a potential tailwind at the Capital Markets Day, but we couldn’t fully understand why. We hope to explore this further in our next update, but could see this as a key risk to watch, given their reliance on the Installed Base.

V — Valuation

Medistim is currently trading at 245 NOK per share. With roughly 18 million shares, that translates to a 4,5 billion NOK Market share, or roughly $450 million USD.

The company currently trades at 23x EV / EBITDA or ~31x Owners Earnings. We’ve defined Owners Earnings for Medistim as Operating cashflow less tangible capital expenditures. We don’t include the intangible capex, as we think most of the capitalized R&D is related to growth investments. We don’t want to punish a historical 40% ROIC business for investing.

However, the steep price may be justified given fundamentals. Growth has picked up following a period of investment and macro-driven delays in machine orders. Higher revenue volume should also translate to some margin expansion, especially with parts of it being price increases, though margin expansion may be tempered by higher spend on R&D and clinical studies, to capture growth opportunities.

Additionally, management expressed that the 35 million working capital outflow we’ve seen over the last year, should reverse, as critical components are now secured:

We would expect also going into 2026 that inventory levels will decrease since we now have — don’t need to place purchase orders on the major components to our products (CFO T.Jakobsen, Q2 2025).

And on why they have to secure parts for critical components in advance?

When it comes to our inventory, I mean, we do have the regulatory issues that forces us to make sure we have all the components that we need because if we miss one component, we can’t sell our product, and that will be a catastrophe.

Taken together, we see the multiple likely moving toward 23–25x for FY 2025. And, given Medistim’s impressive track-record, shown in Exhibit X, combined with the competetive position still strengthening — we view this as a fair price for a company of this quality. To illustrate the high returns on capital achieved, Medistim managed to grow 10% during the last decade, despite paying out 80% of profits as dividends.