The company you are about to read about, produces products you likely have touched, but rarely given much thought about. While you never interfered with the company directly, the company you bought the product from likely did.

But, compared to the price you paid for the product, this part of the supply chain contributed less than 1% of the pricetag of your product. However, the hassle to create it was definitely more than 1%. And, importantly, the hassle is increasing.

This means, that the sellers of the product you bought have little incentives to insource this process, enabling the opportunity for others to potentially earn decent returns on capital, in an otherwise crowded and commoditized sector.

Let me introduce you to Nilörngruppen, a niche player within the Apparel Industry. Before diving into it, let me first recap the conversation sparking this investment idea.

Conversation → Investment Idea

Curiosity takes you strange places. After meeting a chief logistic officer for a global apparell brand, I asked about their business, and learned about how increased traceability, could provide one part of their supply chain in particular, as a beneficiary.

The key driver? Regulations.

In the past, labels, or those small annoying pieces on your garments, primarily served to inform consumers about garment type, size, and care instructions. Today, end-consumers (read: regulators)—demand far more. They want transparency about materials, sourcing, environmental impact, and beyond. While the specifics of these requirements are still evolving, one thing is clear: the apparel industry is becoming increasingly complex.

For label manufacturers, these changes pose challenges—but even greater opportunities. These are already vital to e-commerce transitions, particularly through RFID systems, which enable precise inventory tracking. In online retail, where the customer interacts with a screen, not a salesperson, this accuracy is critical.

The Value Proposition

Nilörn operates close to the source of production—giant garment factories in Bangladesh, Vietnam, China, and beyond. While garment production has largely become commoditized, labels remain a high-value niche. By solving regulatory and logistical challenges that brands are unwilling or unable to tackle themselves, Nilörn secures its position in the value chain.

In a world of rising compliance demands and operational complexity, Nilörn isn’t just manufacturing labels; it’s creating solutions to solve more pain-points within the Apparell Industry. An enormous industry, with a variety of players involved.

APPARELS - A COMMODITIZED SUPPLY CHAIN

The apparel market is estimated around $1,8 trillion, and is expected to grow ~3% per year over the next 5 years. Despite this, most players, like the raw material producers, textile processors, garment manufacturers, retailers and most brands have become commoditized - meaning, competition have eroded most returns on capital down to levels not attractive for most long-term investors.

However, there are exceptions. For instance, some brands are able to charge a large premium for their products, best exemplified by well-known luxury giants like Hermés or smaller Nordic brands like Db and Amundsen. Typically, these companies may have 50%+ gross margins and 20%+ returns on invested capital. Compare this to most other parts of this supply chain, more likely at single digit returns on capital and lower gross margins. There is no doubt who captures most value.

However, some parts of the supply chain are also demonstrating consistent high returns on capital, such as label manufacturers like Avery Dennison and Nilórngruppen. How can that be?

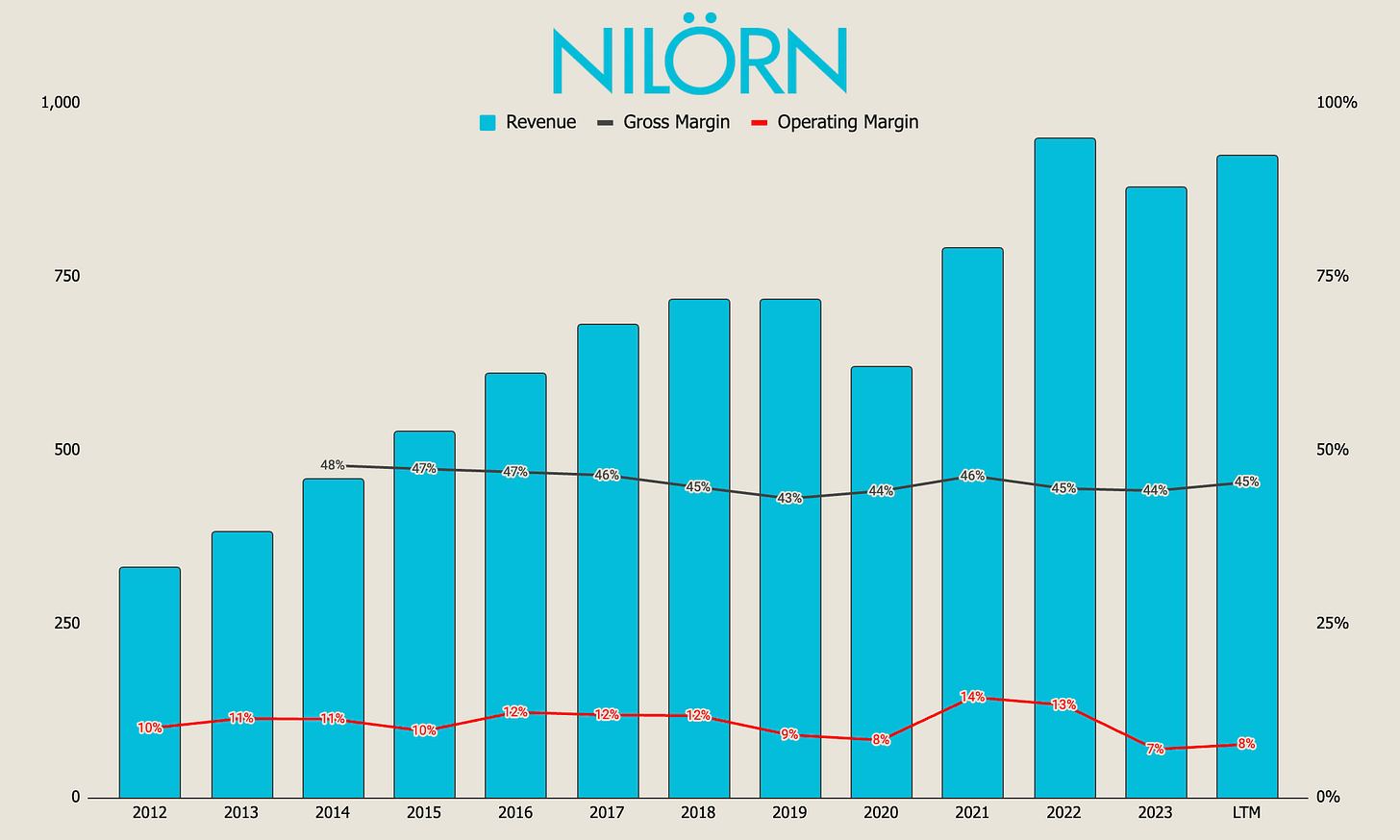

Nilörn, in particular, have delivered an average of 45% gross margins and 30% return on capital employed over the last 5 years.

To understand how this is possible, we must understand their role in the supply chain. What problems do they solve, and will these type of problems persist/increase in the future?

The Problem Solver

The Label Manufacturer is renowned for its seemingly simple yet essential role: attaching size and washing instruction labels to clothing. At first glance, you might wonder, why don’t brands handle this themselves?

Referring back to the introduction of this analysis, the answer becomes clear. Even for multi-billion-dollar brands, the incentive to focus on such a minor aspect of the pricetag is minimal. Moreover, with most brands outsourcing garment production to East Asian countries—such as Vietnam and Bangladesh—near textile and raw material sources, it’s only logical to include label addition in these regions as well. Label manufacturers bridge the gap between brands and garment manufacturers, often establishing facilities and relationships close to the massive factories that produce the majority of the world’s garments.

While the label manufacturer’s contribution to the value chain might be small in monetary terms, it addresses a critical pain point for brands and their end-customers.

Enhanced Customer Experience: In the highly competitive trillion-dollar apparel market, brands strive to create an exceptional customer experience. Elements like packaging, trim details, and the overall quality feel are integral to this effort. The label—often one of the first points of contact with the product—plays a subtle but important role in shaping customer perception.

Inventory Management: Retailers require efficient methods to track their products. The label manufacturer incorporates RFID technology—essentially a digital identity for each item—allowing retailers to manage inventory effectively. In the e-commerce age, where customers often shop online, precise inventory tracking is indispensable.

Sustainability and Compliance: Younger, environmentally conscious consumers and evolving regulations demand transparency regarding the environmental impact of products. Brand reputation poses a significant risk to consumer brands. Labels provide a direct touchpoint for sharing information about a product’s emissions and sustainability credentials. Although supply chain transparency remains a largely unsolved challenge, the label manufacturer is central to advancing this goal, ensuring customers can access the information they seek.

By addressing key pain points, the label manufacturer cements its role as a crucial partner in the apparel supply chain, delivering solutions that boost efficiency, foster consumer trust, and enhance the product experience.

In an increasingly crowded marketplace, branding is no longer just a differentiator—it’s a necessity, particularly for premium products. Brands must consistently demonstrate their value through trust, innovation, and alignment with consumer expectations. Falling short on traceability, accountability, and sustainability risks eroding that trust, especially as regulatory and customer demands intensify.

Industry Problems

The clothing sector faces mounting challenges. Overproduction remains opaque, with 89% of brands failing to disclose production volumes. Transparency on sustainability metrics, such as greenhouse gas emissions, decarbonization efforts, and energy sourcing, is limited. These gaps highlight the urgent need for change and the opportunity for innovative solutions. And the scores, ranks the brands on this topics.

The Opportunity for Nilörn

Labels are already an integral part of every product, making them a natural place to house critical information. By embedding traceability features, such as through QR codes, labels can provide a seamless gateway to a digital twin of each product. This approach not only addresses demands for transparency but also aligns brands with the growing consumer expectation for accountability and sustainable practices.

Expanding their offerings to include solutions like this allows Nilörn to position itself as a leader in enabling brands to meet the evolving standards of both customers and regulators, all while strengthening their competitive edge. This offering is called Nilörn CONNECT,

Execution Risk

While Nilörn is well-positioned to capitalize on industry shifts, execution risks remain.

Technology Risk: As a smaller player, Nilörn may face challenges investing sufficiently to meet the evolving demands of leading brands. A cyberattack in Q3 2024 highlighted the vulnerabilities smaller companies can face in safeguarding operations.

Changing Demands: There’s a possibility that brands, regulators, or consumers might opt for alternatives like QR codes printed directly onto garments, potentially reducing the need for physical labels. While this scenario seems unlikely, it underscores the importance of adaptability.

Nilörn’s Competitive Edge

Conversations with industry insiders suggest Nilörn has proven its adaptability, transforming from a traditional label manufacturer into a modern partner for navigating sustainability and evolving label requirements. One insider noted why their global brand chose Nilörn over larger competitors like Avery Dennison: size and focus. Nilörn’s smaller scale (with a market cap ~1/200th of Avery Dennison’s) aligns better with the ambitions and needs of mid-sized brands.

Avery Dennison Comparison

While Avery Dennison is a strong, diversified competitor (compounding at ~9% annually since 1990), Nilörn boasts superior metrics in several key areas:

Gross Margins: 45% vs. 29%

Return on Capital Employed (ROCE): 30% vs. 21%

10-Year Revenue Growth: 8% vs. 3%

Earnings Multiple LTM: 15x vs. 23x

Avery Dennison’s strengths lie in its stability, broader product portfolio, and higher operating margins, supported by consistent buybacks. The lower gross margin may come as a result of higher share of lower value offerings like packaging etc., which management of Nilörn also have highlighted comes with much lower margins.

Financials

Nonetheless, the financials of Nilörn does not scream competetive pressures. Consistently profitable growth, albeit some more cyclicality from 2020, and stabile gross margins, an important trait for quality companies, not exactly a price taker.

On the operating margins, these have fluctuated more, especially since 2020. One headwind from the demand side in recent years have been European customers in the Sports / Outdoor segment, with large finished goods inventory and consequently low order intake after covid (such as XXL). Some of this was offset, by strong performance in the luxury customers, with more stabile order intake during this period, also consisting of drastic rate increases.

Other important detractors to margins, was a cyberattack in August 2024 and political unrest in Bangladesh, leading to in total -4,4M SEK in one-time expenses and a 7-day production stoppage in one of their factories. Normalization within the Sport / Outdoor segment is expected to boost margins.

As you can see below, the operating income have fluctuated more than gross margins and revenues. Importantly, with a growing order book and some headwinds normalizing, 2025 looks to be a better year.

Cyclicality

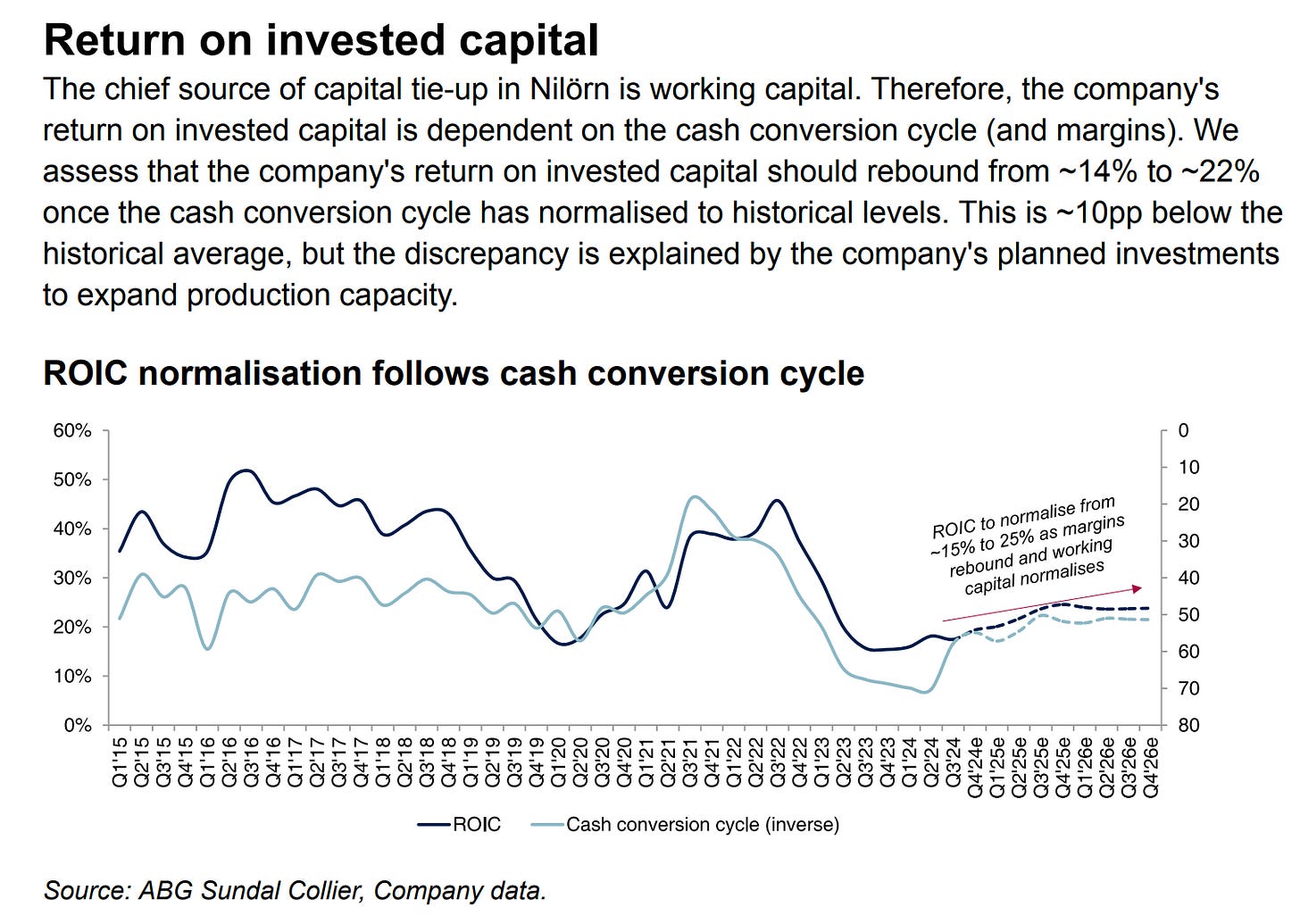

The pandemic introduced significant volatility to Nilörn’s business and working capital. For a business that usually ties 15% of sales into working capital and needs ~45 days to convert this into cash (cash conversion cycle), the pandemic changed this usual dynamics. First, demand was significant as Nilörn’s customers built up inventory levels to compensate for higher demand. Thus, cash conversion cycle went as low as ~20 days, improving Nilörn’s financials drastically (short-term).

Later, when inflation spiked, Nilörn’s clients halted investments, leading to a cash-conversion cycle over 70 days. Now, with their clients having been through a period of destocking, a headwind for demand. Importantly, with inventory normalisation ongoing, the cyclicality should hopefully stabilize more going forward.

ABG underscores why this is crucial for Nilörn, with most of their tied-up capital in working capital. Thus, an improved cash-conversion cycle (or normalization) leads to higher returns on invested capital.

Additionally, planned investments into increased capacity, puts pressure on free cashflow today, but should help the company generate more growth going forward, at hopefully, close to their historical returns on invested capital over time.

Capital Allocation

With the planned investments, the board decided to cut the usual high dividend payout ratio (~60-90%) from Nilörn in 2024, down to 20%. The rationale?

New production capacity both in Bangladesh and Portugal

Invest more in Nilörn Connect. Also by partnering with Worldfavor, on the path towards creating a digital product Passport.

As of Q3 2024, CEO Magnusson confirmed that land for the planned investments had not yet been purchased, underscoring two key points: capital expenditures are expected to rise, and management being conservative.

It is rare for a listed company with a net cash position to reduce its dividend in favor of reinvesting for future growth—a level of conservatism typically associated with family- or owner-led firms. While Nilörn’s largest shareholder is a private equity firm, the nature of that firm provides context: AB Traction, which owns 30% of Nilörn, is a family-run private equity entity with over 80% of its capital held by the Stillström family. This familial influence likely drives the focus on financial flexibility and long-term value creation.

Strong Owners

As mentioned, AB Traction is an important owner of Nilörn. Especially so, with CEO of Traction, Petter Stillström, operating as chairman for Nilörn. Another interesting owner is Fondsfinans Capital Management, who owns 6% of Nilörn shares for their clients.

First, AB Traction, a family owned private equity firm from Sweden, owns 26% of capital. Since 1998, AB Traction has delivered >12% CAGR, and many of these returns have come through their ownership stake in companies like Nilörn and OEM International (which they sold a bunch of shares to EQT recently). Actually, Traction took Nilörn private in 2009, and since, the company has improved drastically. Still, it is good to see the private equity specialist still believing in Nilörn, now representing a top 3 position for them, 15 years after taking it private (relisted in 2015).

Secondly, Fondsfinans, a larger investment firm, had an interesting take on Nilörn:

The company is relatively small by our standards, with a market value of just over 800 million Swedish kronor. Analyst coverage is limited, and liquidity is therefore low. Our holding period will thus be very long-term, as we are not looking to exit based on short-term movements

Fondsfinans highlights in detail, why this investment case is so interesting.

Since its stock market listing in 2015, Nilörn has delivered an annual return on equity of an impressive 34%. However, the company operates with limited capital, making it interesting to compare top- and bottom-line growth to understand how much of the return on capital translates into growth. With approximately 6% annual top-line growth, Nilörn has achieved roughly the same as the global market leader, Avery Dennison.

Avery Dennison, however, has scaled its business far more effectively, delivering over 10% annual EPS growth. While Avery Dennison also boasts very high returns on capital, this doesn’t appear to incentivize many new players to enter the market. We can perhaps conclude that the industry Nilörn operates in, is structurally strong, with profitability significantly exceeding the cost of capital.

Further, the competetive advantages they identified, were:

Long-term customer relationships, where Nilörn provides an essential yet very inexpensive product relative to the total cost.

Technological expertise that allows Nilörn to deliver tailored solutions to its customers, and

A diversified product portfolio, making the company a comprehensive supplier for its clients.

On top of this, they gave us clues on the valuation:

The advantage at the current valuation (April 2024, 800M SEK) is that no growth is priced into what we assume is normalized earnings. If we are correct, we essentially get all future growth for free. We are fairly confident that this growth will create value going forward and, in turn, benefit our shareholders.

Valuation

To the final question. At what price does it make sense to own this business? The pricetag today (770M SEK), is 5% lower than when Fondsfinans wrote the above.

First, to get an estimate of what earnings in 2025 would be, ABG Sundal Collier, published an equity research report on Nilörn 27th of Oct 2024. They mentioned that ~40% orders growth in Q3 2024 (30% adjusted for timing) provides visibility. Combing this with the recovery in the Sports / Outdoor segment, they revised the earnings estimates upwards. They now expect adj. EBIT of 108M SEK for 2025, +30% from 2024 numbers. This would place NTM EV/EBIT of 8x, ~15% below 10y average and ~40% below peers valuation. Similarly, they believe EPS will land at 6.83 SEK, compared to the 68 SEK shareprice of today. If this would come to fruition, the company trades at just 10x this years earnings.

This is what makes Nilörn an interesting investment idea for myself. It is priced for not growing, but has quite strong forces for further growth. Looking at the below graph, showing number of employees (red line) and shareholder equity (yellow), it does look like a company investing for future growth as well.

If the company goes back to their usual 60-90% payout ratio after the investments in 2025, this could mean that a >6% dividend yield from today’s purchase price is not impossible in 2026.

While I am not a big fan of crystal ball predictions, Nilörn’s product offering is valuable for their clients (48% gross margin last quarter), despite it’s minimal cost per product. And importantly, there are signs pointing to their offerings become increasingly important as more brands starts to take sustainability and transparency more seriously. The investment case can be summarized as follows:

Continued revenue growth of >6% over a market cycle

Normalized operating margins ~10% (back to 10y average, 8% today)

Normalized dividend yield of 5-7% from today’s price

If these were to happen, the IRR would already be very appealing, before any multiple expansion. One could argue, Nilörn deserves a multiple closer to 15x earnings at least, given it’s profitability, track-record (founded 1971), growth and returns on capital.

Remember, with high returns on capital and low growth, capital returns can become very significant. And in Scandinavia, investors seem to have a weak spot for dividends. It seem likely that if Nilörn can normalize the cash conversion cycle, thus becoming less cyclical and going back to their usual high payout ratio, investors will bid it up above 10x earnings. How much, I have no idea.

Conclusion

I am still wondering whether Nilörn is a fair company at a wonderful price. As Charlie Munger would have noted, it’s always preferable to go for a wonderful business at a fair price.

Yet, it feels like this business is more than fair. Yes, it’s been cyclical over the last years and no, it’s not the clear market leader within it’s industry. But, the Swedish Niche player seem better than the marked gives them credit for. Net cash, good growth over a cycle (despite high dividend payout →high ROC), strong cash-conversion and importantly, growing profits over time. Additionally, there seem to be further upside, if they are able to execute on their Nilörn Connect offering.

To round this off, I would like to share a quote I came across from studying Ametek’s success. Additionally, you can find some graphs from ABG on Nilörn’s financials.

Incurs a small fraction of the overall costs of a customers product, yet delivers significant value.

Disclosure: The content shared in this newsletter is for informational and educational purposes only. It reflects my personal views and experiences as an investor, and should not be construed as financial advice or a recommendation to buy or sell any securities. All investments carry risk, and past performance is not indicative of future results. The information presented here is based on my own analysis and is not intended to serve as professional advice tailored to any specific individual or situation. Please consult with a qualified financial advisor before making any investment decisions.

Sources:

Nilörn IR: https://www.nilorn.com/investors/

FINCHAT financial data: https://finchat.io/?via=olensrud (20% discount)

ABG Sundal Research Report: https://shorturl.at/uqvcD

Fondsfinans: https://www.fondsfinans.com/content/Markedsrapport-april-2024-1.pdf

Have just started my work on this one. Appreciate the work

Very interesting, thank you for sharing.