Note from Ole: The ideas and analysis in this writeup are my own (not AI). Still, an AI tool was used to help make the text more precise and readable. Disclaimer can be found in the bottom.

June 2025 – A Reflection on Ownership

When I first wrote about Nordnet on April 1st, 2024, the thesis was clear: this was a high-quality business—profitable, innovative, and taking market share—trading at modest multiple of earnings (~15x), despite delivering what SEB rightly so called “skyscraper growth at basement valuation”.

I saw a dominant digital brokerage with prudent capital allocation and cost discipline, exposed to a long-term secular trend—the rise of self-directed, tech-enabled savings. Today, with the stock up ~50% including dividends, the investment has worked out well. But more importantly, so has the fundamentals.

Market share in the Nordic Savings Market has grown from 6% → 8%, with gains across all major areas outside of deposits (flat 1% market share):

Brokerage share: 15% → 21%

Fund capital share: 4% → 6%

Pension capital share: 2% → 4%

And to this date, I have still not sold a single share. Here's why.

In this Writeup

A Competitive Field: Everyone Wants Your Savings

The brokerage industry is extremely competitive. Traditional banks, insurance giants, fintech startups, and global players all compete for the same thing: your savings capital. Whether it’s equity trades, fund investments, or pension accounts—each krone deposited becomes monetizable, typically at low marginal cost.

In such a setting, size alone isn’t enough. The true differentiator—what creates resilience—is the capacity to innovate and operate with discipline and trust.

Nordnet’s Moat: Innovation & Cost Discipline

1. Pace of Innovation

In just the past few weeks, Nordnet opened access to six new European markets for their Nordic customers. Additionally, they implemented analyst price targets, opened for US pre-market trading and customers can now see the amount of people holding a stock on Nordnet over time. Small touches, but over time, these consistent small improvements compound into something hard to copy. A culture of improvement.

I’ve tested the brokerage platforms of several other Nordic banks, and I haven’t been impressed. Improvements that may take Nordnet a month to implement, seems to take a year elsewhere. It’s clear that many banks don’t prioritize their trading platforms — something digital-native players like Nordnet can take advantage of.

2. Operating Discipline That Actually Delivers

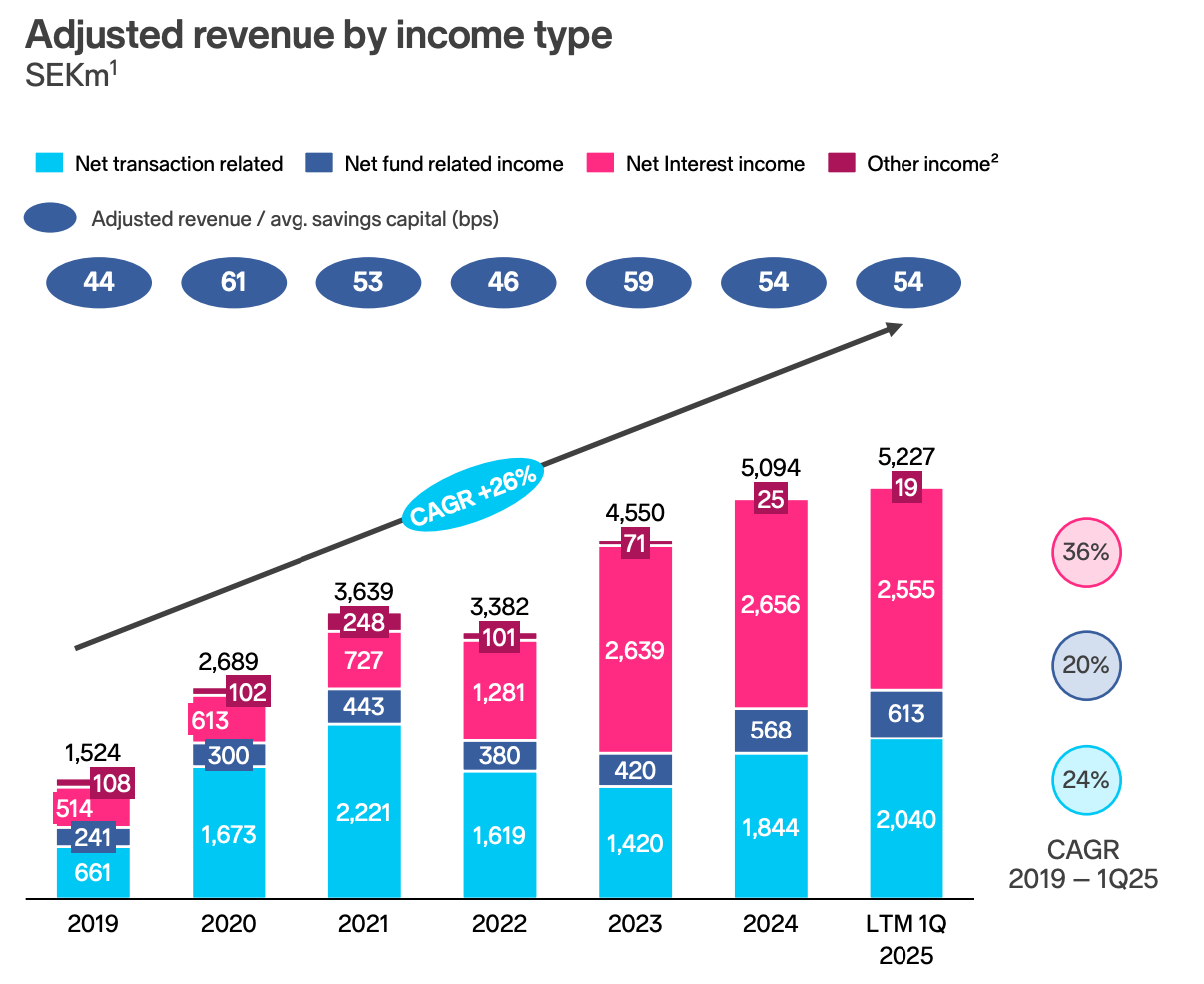

Since its 2019 re-listing, following a significant rebuilding of its platform, Nordnet has shown operating leverage. Revenue has compounded at 26% annually. More importantly, pre-tax profits have compounded at 54%! This isn’t common. (Sidenote, favourable upswing in interest rates have also helped).

Even tech-giants like Airbnb and Booking—often expected to demonstrate similar scalability—have struggled to keep expenses in check as they've grown in recent years. Nordnet stands out by doing more with less. Pre-tax margins are now ~60%!

Nordnet has a rare mix of several factors which could contribute to growth:

Growing market (GDP growth + higher participation, especially for females)

Young customer demographic on their platform getting wealthier.

Take market share (Pace of Innovation, Scale Advantages, aggressive Marketing)

Optionality of entering new markets (Germany)

Cost discipline (sales grow faster than costs)

Combine these together, and I would not be surprised seeing Nordnet continue compounding profits at double-digit rates for a long time - even for what looks like an established Stalwart from the outside.

Nordnet arguably has another edge to, explaining some of their market share gains.

Counter-Position - The underappreciated edge

Counter-positioning is often overlooked in investing. It occurs when a challenger adopts a business model that incumbents can't easily copy—because doing so would harm their existing economics. And despite Nordnet already having established somewhat of a lead in the Nordic savings market, they still operate like a challenger.

This applies especially to Nordnet’s push into the pension savings market. For instance, traditional players in Norway like Storebrand, DNB, and Gjensidige still rely heavily on high-fee, actively managed pension products. These generate strong margins, often through legacy pricing structures and distribution via corporate agreements or advisors.

Nordnet, by contrast, offers transparent, low-cost pension solutions—typically index-based and self-managed. They market broad market exposure at minimal cost (typically index), appealing to those wanting to take their savings in their own hands.

The key: incumbents are structurally disincentivized from matching this model. If they offered comparable low-fee products at scale, they would cannibalize their existing business and undermine advisor-driven distribution and their lucrative fees.

This is the essence of counter-positioning: Nordnet can move into the incumbents’ territory, but for them to respond back they would have to hurt their own pockets.

With rising fee awareness, long-term data favoring index funds, and growing digital adoption, this edge may be compounding. Of course, this is an advantage which applies to all newcomers, like Montrose from Carnegie, who wants to apply a similar pressure to the likes of Nordnet and Avanza. Competition will likely never stop, but the question remains - How will you overtake a scaled rival who innovates quickly?

Problems

1. Near-term earnings risk

Nordnet may be near peak earnings. Results are currently boosted by a mix of high interest rates—benefiting from idle cash and margin lending at great takerates—and still decent trading activity. If rates fall and trading slows at the same time, earnings could take a hit.

However, Nordnet’s revenue is more balanced than it may seem. It earns money from three main sources:

Trading commissions

Interest income from customer cash and margin loans

Asset-based fees on funds and pensions

These often offset each other. When trading slows, interest income may rise. When rates fall, markets usually improve, helping fund values and customer activity. So while earnings can swing quarter-to-quarter, the business model is quite resilient (and extremely profitable).

2. The bigger risk: trust

The more serious issue is customer trust. In early 2024, Nordnet suffered a major security breach. Some users were briefly shown the wrong account after logging in—and in rare cases, could even interact with someone else’s portfolio. The issue was quickly fixed, but it was a critical failure for a platform that depends on safety and reliability.

Regulators are now investigating, and a fine is likely. But the bigger damage may be reputational. Trust takes years to earn and seconds to lose. Just a couple more slips could seriously hurt Nordnet’s brand.

3. User friction

Many long-term users are already frustrated by Nordnet’s relatively high fees on international trades and currency conversion. These fees compare poorly to other low-cost alternatives. While they make up a meaningful share of Nordnet’s revenue, they also leave the company exposed to future price pressure—or customer churn if better alternatives keep gaining ground.

Trust is built up over decades—and can be lost in 10 minutes.

With the user friction and potential for peak earnings in mind, Takerate is definitely a topic worth examining.

Takerate & potential Commoditization

If brokerage platforms were truly commoditized, the logic would be that customers are presented with so many indistinguishable options that the lowest-cost provider inevitably dominates. I find that argument unconvincing—especially in the Nordic context.

First, Nordic banks enjoy several structural advantages. Small markets, language, regulation, and trust all act as barriers to entry. These are relatively small markets compared to, say, the U.S. or continental Europe, and the regulatory frameworks are fragmented across countries. Combine that with the high level of trust required to safeguard the long-term savings of Scandinavian households, and you have a landscape that is relatively unattractive for foreign challengers. In practice, competition is largely confined to local players.

Second, as discussed in the first writeup, the business model employed by platforms like Robinhood—relying on payment for order flow—is either banned or heavily restricted in the geographies Nordnet operates. This removes a key monetization lever that enables commission-free trading in the U.S., limiting the viability of zero-cost brokerage models in this region. Here, the customer cannot be the product. Whether Robinhood’s launch of Tokenization of stocks in the last week may become a challenge, remains to be seen. For myself, I prefer to own businesses directly.

Third, and finally, the cost of placing a $1,000 trade on Nordnet today typically ranges from $2 to $10. Compared to a decade ago, the price of accessing the market has dropped to a level that is insignificant for most long-term investors. The exception might be high-frequency traders, but they have access to tailored pricing structures that address their specific needs (lower cost per trade). Tailored pricing structures makes the platform a decent place for both the regular saver, the do-it-yourself type and the more active traders.

Now, let’s see how they plan on continue grabbing market share.

Their Marketing Strategy for Continued Growth

A key aspect of Nordnet’s success is its ability to deploy capital efficiently while maintaining strong shareholder returns. Despite distributing around 70% of net income as dividends, the company has consistently grown customer count by double-digit rates.

There are 2 reasons for their high growth, despite a seemingly low reinvestment rate.

First, sales & marketing, the most direct growth spend for Nordnet, is expensed immediately through the income statement. This has important implications when valuing the company. When Nordnet increases their marketing budget, like they have this year, this puts downward pressure on EPS and thus, upward pressure on PE. Something to keep in mind when comparing valuations to pre-growth investment metrics for Serial Acquirers for example. It also makes their reinvesment rate look lower than a company investing more in items expensed under capital expenditure.

Second, Nordnet has shown exceptional capital efficiency. Return on equity is the simplest measure here, as the asset and liability side of the balance sheet contains a bunch of noise with their customers moving capital (impacts cashflows as well). If we consider the return on equity from the relisting in 2019 following their transformational technology investments, return on equity has consistently been above 30%. And more impressive, pre-tax profit margins above 60%!

Valuation - Our Assumptions

To value Nordnet, we focused on three key drivers: growth in savings capital, the takerate on that capital, and the pace of expense growth relative to revenue. Given the uncertainty around each of these variables, we applied scenario analysis to understand the range of potential returns under different assumptions.

Below, you can see the change in the revenue lines + takerate on savings capital - key figures to understand before valuing the company.

Scenario Hypothesis

We believe Nordnet will continue taking market share in the Nordics, but still unsure whether they will succeed in Germany. Takerate may also go down in the future - Let’s test what type of profit growth these different scenario’s lead to.

We believe a CAGR of 13–16% in savings capital is achievable over the next five years. This expectation is underpinned by three key drivers:

Continue attracting savings customers by offering a great user experience in a market-leading app, aggressive marketing, and capitalizing on scale—particularly by spreading technology investments across a large and growing user base.

Demographic tailwinds, as Nordnet’s relatively young customer base continues to age and accumulate wealth + higher female participation within investing.

Increased adoption of pension solutions, where users increasingly take control of their own retirement savings through Nordnet’s low-cost pension offerings.

On the other hand, we’re less optimistic about the take rate. Interest income has been unusually high in the last couple years, but with rates already falling, this may come down. Historically, trading activity has improved when people have more to invest after paying less on their mortgage—but we’re skeptical this will outweigh the reduced interest income. We assume take rate between 2022 and 2024 levels.

In other words, revenues may grow slower than savings capital for the next 5 years.

Lastly, we need to consider the operating leverage Nordnet has demonstrated historically. Despite aiming for 13-15% customer growth, they only expect to grow operating expenses by 8%. This has probably been the most underappreciated strength of Nordnet’s business, one which we would like to consider the effects of.

Operating Expense growth of 9→7% would yield a 10-15% profit growth given a 10-13% revenue CAGR. Marketing expenses have also been very high in 2025, so these numbers may have been calculated from an artifically high base, but this remains to be seen. The expansion efforts in Germany will definitely come with it’s cost and weigh on profitabilty for the coming years (management expects breakeven in 2029).

In summary, we believe Nordnet can continue compounding profits at a low to mid-teens rate over the next five years. While we remain cautious about factoring in success in Germany, it’s clear that a strong foothold there would materially extend the growth runway and support a higher terminal multiple—particularly if returns on capital prove comparable to existing markets. That said, even in a successful case, Germany is likely to be a drag on profitability over the next 3 years at least. For now, we view it as optional upside and will continue to monitor developments.

At a forward P/E of ~22 (trailing ~23) and a ~3% dividend yield, we continue to view Nordnet as an attractive investment. The current multiple is well supported by steady market share gains, a disciplined cost base, and strong returns on capital—reflected in the company’s ability to distribute 70% of earnings while still growing at a healthy rate. Moreover, since much of Nordnet’s growth investment flows through the income statement, we believe the true steady-state multiple is materially lower than it appears—offering a yield profile (before growth is factored in) above what’s available in risk-free alternatives.

A key risk we continue to monitor is customer trust, particularly in the event of further security breaches. In addition, while our assumptions already account for it, we expect takerates to gradually decline from last year’s 0.54% to potentially below 0.50% over time—driven by lower interest income and the possibility of pressure on cross-border fees, which remain elevated compared to peers.

That said, we remain confident in Nordnet’s long-term trajectory. The company is led by owner-operators with a proven track record of disciplined growth and operational excellence—consistently outpacing competitors in both innovation and profit growth.

With a ~3% dividend yield, limited risk of multiple contraction—supported by several years of strong customer growth ahead—and the potential for 10–15% annual profit growth, Nordnet’s return profile remains attractive. At current valuation levels, we’re comfortable remaining long-term holders, as we have been for 2 years already.

A Final Observation

We’ve found our best performers to keep finding clever ways to surprise us on the upside, and Nordnet has been one of these so far.

We’re cautiously optimistic about their prospects in Germany, but more confident in their ability to grow market share—especially in the pension segment.

We don’t have all the numbers, but it’s clear many Norwegians’ pension capital has grown far less than the markets over time. High fees, low equity exposure from a young age, and underperforming active funds are likely the main reasons.

Helping people take control of their own savings, without taking on excessive risk, makes sense, and Nordnet enables this through a neat, steadily improving app on your smartphone.

As long as Nordnet continues to enhance its app, improve customer trust and educate its users, we remain optimistic that earnings will follow, despite all the worries around commoditization & competition risk.

Great look at an interesting Nordic player.

Thanks for the detailed write-up, Ole!