Paradox Interactive

This deep dive is a collaboration between Learning To Grow & The Outsiders' Corner. A former Swedish wonder-child now trades at a 5-year low of 139 SEK (-39% YTD). We hope this writeup will help dissect whether the stock response is warranted and whether the company may be attractively priced for potential long-term owners.

Content:

Introduction

The Opportunity

The Gaming Market

Business Model

Endless Games

Launching new games

Different approach to developing games going forward

The Strategic Failures of 2018–2021

Financials

Valuation

Wrapping things up

Introduction: Taking a step back

In the highly competitive field of investing, we believe retail investors hold one key advantage over professionals: a long time horizon.

We don’t face the threat of being fired for underperforming benchmarks, nor do we need to justify our holdings to clients, colleagues, or partners when negative news surfaces. We can remain patient and weather the storm, allowing us to capitalize on opportunities that arise from short-term market fluctuations driven by greed and fear. Negative news often triggers continuous selling pressure, potentially presenting a rare chance to acquire shares in a great company at a favorable price. Currently, Paradox Interactive, a Swedish game publisher, is experiencing its steepest drawdown in its listed history, which is why we are considering it at this moment.

The Risk: Missed deadlines, issued profit warnings, reported significant impairments on new titles like "Life by You," and poor customer feedback on highly anticipated sequels such as "Cities Skylines 2." These issues indicate deteriorating fundamentals, suggesting that the company's impressive historical financial performance may not be sustainable.

Despite the stream of bad news, we believe there's a compelling case for considering Paradox Interactive. Many of our readers are contrarian, long-term thinkers, so we aim to provide a balanced view of the company, highlighting both the risks and the potential opportunities.

The Opportunity: Currently trading at ~10x operating cash flow (~20x FCF), the risks seem priced in. If management can address some of these issues, today's valuation could be attractive for a net cash business with historically high growth rates, market-leading ROIC, and core titles with monopolistic market positions.

This writeup will uncover Paradox Interactive as an investment opportunity, a company where CEO & Founder Fredrik Wester has a 33% ownership stake, the investment firm Spiltan 17%, and Tencent Holdings another 10%. But first, let us take a look at the market they operate in.

The Gaming Market

A quick screen among owners of some of the most popular gaming franchises shows that Paradox holds a rather unique position, scoring well on all criteria here (except for stock returns). The polish CD project, Chinese 37 Interactive and the owner behind legendary console game FIFA, Electronic Arts, are the only ones close. Importantly, gaming is a truly global market, with previous distribution advantages being reduced by the popularity of platforms like Steam or mobile platforms like App Store, giving players the freedom to choose among a variety of games. As this enables more competition, it may be one of the reasons for the abysmal stock returns since pre-covid. However, one should also consider the fact that most of these have come down in valuation since 2019, which makes hurdle rates for future returns lower.

Despite the horrendous 5-year average return of 1% among the companies above, the gaming market is expected to grow 10% per year until 2029. Whether this growth will translate into shareholder value for all these companies remains uncertain.

Before diving deeper into Paradox Interactive, it's important to understand the asymmetric risk-reward dynamics of game development. Developing a game is both costly and risky, with no guarantee of success at launch. Customer preferences for graphics, playability, and multiplayer options vary widely across different gaming niches. To appreciate the inherent risk in developing a game, I find Jeff Bezos quote after failing Amazon´s attempt to launch the Firephone particularly relevant:

We are working on much bigger failures right now

While it's easy to focus on recent failures like Life by You and Lamplighters League, we must also remember the inherent positive asymmetry in game development. Take Cities: Skylines 1, for example. Developed by a team of around a dozen people at game studio Colossal Order, it has sold millions of copies and generated recurring revenue through DLCs to Paradox for a decade. Despite the poor release of Cities: Skylines 2, recent improvements suggest that these issues are fixable. CEO Fredrik Wester commented on the recent developments in the Q2 report, saying:

We’re also happy that Cities: Skylines II has picked up momentum, with the latest updates bringing sweeping changes to systems and many additions that players have enjoyed. It’s far too early to claim victory, but these are several steps in the right direction.

Also, owning a game franchise with a loyal player base enables the game developer to launch additional sequels (e.g., Fifa by EA) or sell downloadable content (DLC) at low marginal cost compared to developing a brand new game. With Paradox being well known for their DLC monetization strategy and their loyal player base, we must also recognize the potential negative effects of this. Players may feel exploited by being overly monetized for a game they love. However, as it is voluntarily purchased, it should be a sustainable strategy as long as they add more value than they charge.

To sum , the field is ultra-competitive, with well-capitalized competitors dominating the market. Despite this, platforms like Steam have made selling games a truly global endeavor, providing opportunities for smaller developers to reach a wide audience. While Paradox is a small player in a global market, we believe they hold monopoly-type market positions with their core game titles. We will now uncover it´s business model and the valuation of this Swedish game publisher.

Paradox: Business Model

As a publisher, Paradox owns and operates studios that develop the games they sell. They currently have seven studios (soon to be six as they’re closing down Paradox Tectonic after the failed Life By You game) in six different countries, with their headquarters located in Stockholm. They own a portfolio of titles within 23 game brands.

Paradox has been active in the industry since they published their first game in 1997. A brief overview of landmark game launches can be seen below:

Paradox Interactive games are known for their immense depth and are famous time sinks for people who love to spend thousands of hours mastering the games. Despite an extensive game catalogue, Paradox Interactives has eight games that drive most of their revenue, which the company has named core game titles. These are central to their profitability and cash flows. The core portfolio is Europa Universalis IV, Victoria 3, Crusader Kings III, Cities Skylines (1&2), Stellaris, Age of Wonders 4, Hearts of Iron IV, and Prison Architect.

They mainly develop games within the genres of Grand Strategy Games (GSG), 4X (Explore, Expand, Exploit, and Exterminate), sandbox simulations and management, and some role-playing games (usually referred to as RPGs). A common trait among all their games is replayability and unique saves where the player creates the story.

Grand strategy games are the biggest genre for Paradox. Within this niche, Paradox is head and shoulders above their competitors. The traits of GSG are high levels of detail, and you usually play as the leader of a nation/geographical unit and manage your units via a map. The hallmark of paradox games is that you can play them for an absurd amount of time, with games spanning from days to weeks of hours. Speaking of time sinks, in 2018, the then VP of Business Development at Paradox, Shams Jorjani, said:

If a game can’t be played for 500 hours, we shouldn’t be publishing it.

In GSGs, the player gets to control practically everything, and the amount of stuff you can control is a lot. This creates games that let the player immerse themselves in the games at a deep level. The only downside is that it can be quite hard to get into the games. Gameplay is centered around warfare, diplomacy, resource management, and more. Notable GSG titles for Paradox are Europa Universalis, Crusader Kings, and Heart of Iron.

4X games are a genre of games where the objective of the game is to explore, expand, exploit, and exterminate. This genre differs from GSG by the exploration, usually with a map that is limited by fog of war (basically greyed out; you know the boundaries of the map but not the “content” of it). There are usually many of the same elements in grand strategy games, and the level of detail is usually quite substantial. Gameplay is centered around warfare, resource management, and relationships with other players or AIs. Paradox games within this niche are Stellaris (which should be seen as a GSG/4x hybrid) and Millenia (released earlier this year).

Sandbox simulations and management games are among the most popular in Paradox Interactive’s portfolio. This genre is all about managing, building, and creating within the context provided by the game. The blockbuster game(s) of Cities Skylines are great examples of this, where the player manages and builds cities from the ground up, having to take care of logistics, environment, and other necessities to run and make a city thrive. Other examples of this genre within Paradox’s games are Foundry (a factory management game) and Prison Architect (building and managing a prison and its inmates). As with the strategy games Paradox makes, all the simulation games that Paradox has made are famous for their attention to detail and how much freedom they give their players in realising their vision of a city, prison, or factory.

Want to know more about Paradox’s GSG? Here’s a great video running you through the many different games in this genre.

Strategy and business model

Paradox Interactive makes money from niche games. They have very long-lasting relationships with their players, and games that have been around for decades are recognized as the gold standard within their genres. They have five factors that they want to base all their games on:

Agency: Their players need to be able to affect the worlds they are playing in.

Living Worlds: The game worlds need to be vibrant and feel like living universes.

Inviting: Games should be interesting, provide ways to learn mechanics and engage.

Cerebral: Paradox games will make you think and make you start using your mental capacity to find unique solutions to the challenges you face in the game.

Endless experiences: You should be able to play these games again and again and again.

Paradox’s Interactive slogan is “we make the games, you create the stories”. This is the foundation for every game within the company’s portfolio. Where a lot of other games are leading their players through and telling the story of their games, with more or less agency within the frames of that story, Paradox wants to provide their players with a canvas where they can create their stories.

Their game engine, Clausewitz, creates several interdependent systems operating at the same time, and decisions taken within the various systems ripple out into other systems. I.e., diplomacy decisions affect the resource systems, and so on. Alongside the players, there will be many AI players responding and acting within these same interdependent systems, making their own decisions that create new situations. This mix makes Paradox’s games unique in every playthrough and creates what Paradox describes as a logical soup.

This means that Paradox Interactive games don’t present fully-fledged stories that you get to experience by playing through the game from start to finish. Players and their decisions shape the development of the game world, and each game is unique. These unique stories emerge from the kettle of the logical soup. This enables players of Paradox’s games to keep on playing, game after game, and experience new things every time.

For a company, this is quite a powerful value proposition. Paradox enables players to create, build, manage, and experience the stories they want to create. You get to tinker, flick a bit on some inputs, and spend a ton of time learning the games. This means that to master the games, you have to sink in hours, upon hours, upon hours. Players usually say that you need hundreds of hours before you understand the games properly. Traits that could resemble the high switching costs of the likes of Adobe.

Paradox’s main goal when developing new games is to create endless games. By this, they mean that they want their games to be played decades after their launch and that they can continue providing new content for these games throughout this period of time. One of Paradox’s core value propositions for their games is that they will continuously release downloadable content (DLC) for their games in the form of expansions that give players access to new factions, continents, etc., or smaller DLCs with new visuals, units, and so forth. These DLCs are something they often plan ahead of a game’s release schedule, and they strive to have a rich pipeline of content for their game titles at all times.

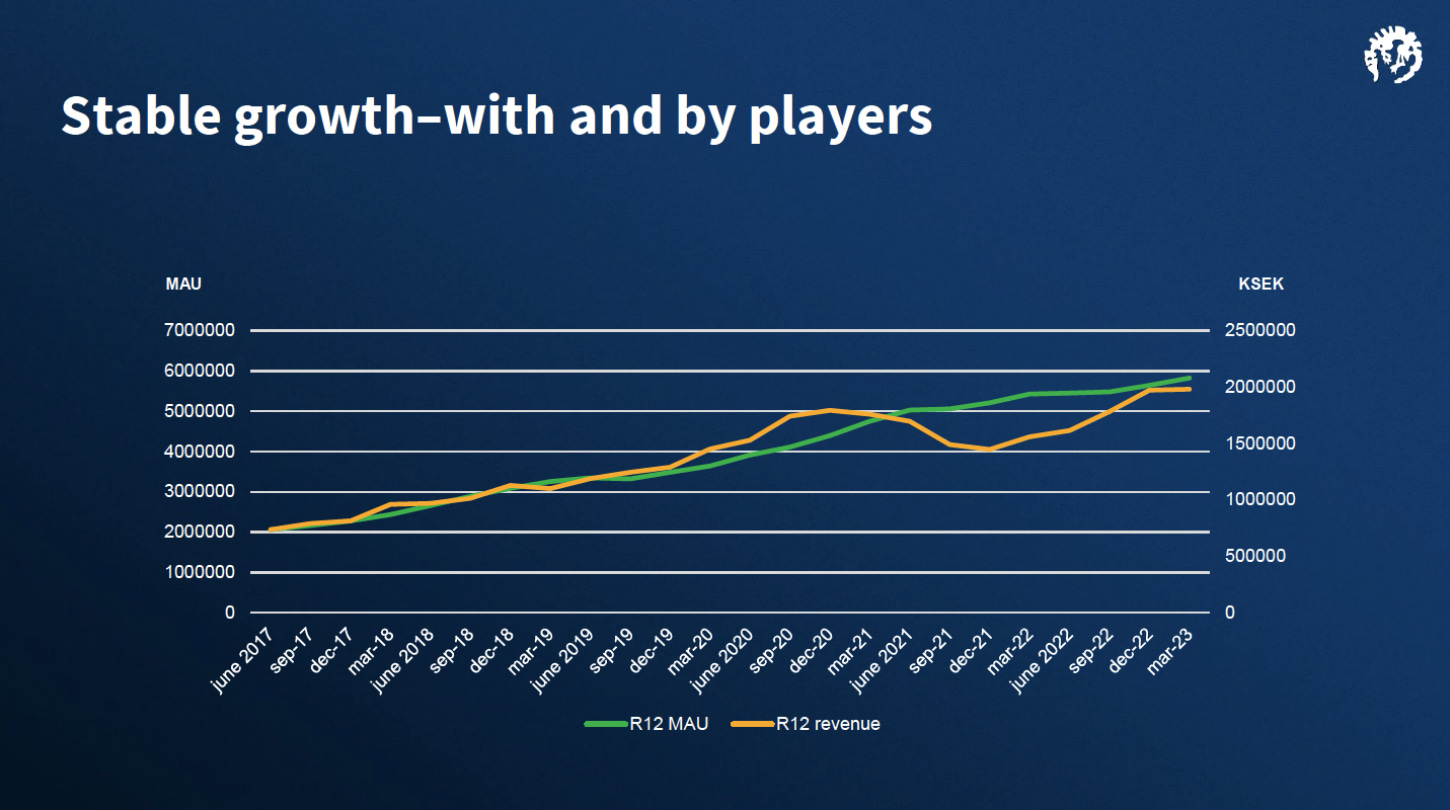

A key metric for the company is Monthly Active Users (MAU). Over time, this is the most telling metric for how paradoxical revenue growth will look. They are most of the time very open about the number of players and how the development is. The below slide shows the effect MAU has on revenue growth:

This graph from fund manager Thomas Nielsen, who manages First Veritas, which holds shares in Paradox, shows the development of MAU for Paradox games since 2019:

Endless games

The chart below shows the number of players on several of the important Paradox titles. As you can see, the most popular game currently is Hearts of Iron 4 (released in 2016), a GSG set in the World War II era, followed by Europa Universalis IV (2013), Crusader Kings 3 (2020), and Stellaris (2016).

As we can observe, most of the main titles of Paradox are games that have been on the market for quite some time. These Endless Games are powerful value-creators for the company. Cities Skylines 1 is still one of their most frequently played games, and as a true testament to the longevity of their games, there are still 2745 people playing Crusader Kings II today, 12 years after the game was originally released, and their most played game (HOI IV) is from 2013. The downside to this strategy is the relation their gamers have gotten to certain titles, and, well, frankly, Paradox is struggling to live up to their successful releases. As the company often say: “We are our own biggest competitor”. Nonetheless, the staying power of Paradox games is nothing but impressive. We’ve attached player count since launch until today of three of the most popular games in the company’s portfolio below.

What makes an endless game?

Every play through is unique.

The mechanics and game experience are hard to master and complex (the more you play the game, the more stuff you can do within the games wide boundaries)

The games aesthetics don’t age fast (you do not need ray-tracing to enjoy a Paradox map)

A steady stream of new content through DLC and mods keeps the game fresh and enables new experiences (more on mods and DLCs later).

We find the fact that a Paradox game from 12 years ago can be preferred over the shiny new toy to be very interesting. It goes to show that it is the mechanics, the possibilities and the experience of playing GSG that matter, not how nice they look or how modern they feel.

To illustrate this, here is how Crusader Kings looked in 2012 vs 2020:

Now, there are definitely improvements that have been made to the visuals of CK3 compared to CK2, but looking at it today, the difference between these games 8 years apart is surprisingly small.

You might be thinking, what does graphics have to do with investing in the company Paradox Interactive? Well, there’s a couple of things that make Paradox’s visual identity a strength to the company’s business:

Their games don’t get dated very fast. Graphics, visuals and realism in games have evolved at a stunning pace these last 10 years. The grand strategy genre is less dependent on having great graphics to be fun to play.

The less demanding graphics of Paradox games makes games easier and cheaper to develop.

So, for Paradox gamers, the content and the universe they can create inside the (wide) boundaries of Paradox Interactive’s games are what carry the most weight.

Building on endless games

Paradox games last. But even games with an endless amount of emerging storylines, such as Paradox, can grow stale. So to add to their players' experiences (and, let's be honest, make some more money), Paradox's business model is based on adding content to their games through DLCs.

These DLCs are powerful ways to create more value outside of simply selling their games at release. Most of their games have DLCs available to them as mentioned, and these vary in size. The effect on the bottom line is quite substantial, especially between big releases. The management often highlights how important DLCs are for their revenue, and it is one of the most important streams of profits for Paradox.

Personal experience from my time playing Cities Skylines 2015→2019

“I first bought the main game in 2015 for ~40 dollars. Following that, I bought a DLC for ~5-10$ every ~3 months or so, adding more complexity and variation to the game. In addition, I downloaded free mods and literally thousands of assets from the Steam platform to make my game look just how I wanted it to. This enabled me to play for 1000+ hours without getting tired of it, giving me plenty of value for the money paid.”

The DLC model is one of the main factors enabling endless games and creating a lasting relationship with their customers. There are, however, not only positives with DLCs. Gamers tend to feel exploited when content is paywalled behind a DLCs. This is very understandable, especially if there’s content that is necessary for the game to function or be interesting. Also, adding content through DLC channels can cause companies to prioritise profit over quality by releasing unfinished games that lack content with the goal of fixing the game and adding content through paywalled DLCs. This is, in our opinion, not a good way to create value both for Paradox and for its customers. We hope the company refrains from taking these steps, as it might drive loyal customers away and open space for competition.

There’s a lot of discussion and controversy in the gaming world regarding the DLC model. Paradox has talked about alternatives such as subscription services (paying a monthly fee) to gain access to either base games or DLCs across the Paradox universe.

For investors, it’s important to note the high return on investment from DLC´s compared to developing a full-base game. A great base game enables recurring revenue later on.

Pricing out their customers is a real and potential risk for Paradox, and they have to be able to create value at game launches as well. Competition in the gaming industry is fierce, and they can’t afford to rest on their laurels.

However, if they are able to execute and develop good games, they can create valuable platforms that last for decades. Expanding their game portfolio meaningfully builds and extends a long-lasting revenue base for Paradox.

Modding

Another meaningful part of playing Paradox Interactive games is the active and engaged community. Since the beginning of their games, modding (short for modification) has generated a lot of interest and engagement. Mods are basically content (stories, game modes, new factions, etc.), visuals, or entire new epochs that have been created by players for players.

Mods have been an integral part of the Paradox experience for as long as their games have existed, and they add longevity and new ways to play Paradox games.

Let’s not nerd out to much here, but we'd like to show some examples of mods that are available to add to Paradox Games:

Historical Project Mod for Victoria 2 is a mod designed to generally elevate an old game to the next and modern level and give it more historical accuracy.

Millennium Dawn is a mod for Hearts of Iron IV that takes the player to the modern age instead of being stuck in World War II, basically turning HoI IV into a new game within a new time period.

Better Barbershop and Community Flavor Pack for CK3 are both mods that add more and better visuals to your characters, elevating the role-playing dimension of the game in total.

Mods are an exciting value proposition for a gaming company, as they not only spread the burden of innovation out to your users but also create a deeper relationship with a part of your demographic.

Recently, Paradox has taken control of their mods and opened up their own modding platform. Earlier, they used to allow and encourage modding through platforms such as Steam and the Epic Store, but in a move to ensure that mods could be used by all their players across platforms such as different consoles and PCs, they opened up mods.paradox.com and have limited modding to this site.

There’s also been action taken to enable modders to monetize their content, creating ways for modders to earn money alongside Paradox. This seems like a great way to establish new revenues of income, both for modders and possibly also for Paradox themselves. Paradox also reaches out to creators of successful mods to co-develop new DLC content based on successful mods.

This allows Paradox not only to encourage the players themselves to find ways to improve Paradox’s IPs but also derisks the creation of new content for Paradox games by the fact that they can leverage players efforts to create content and onboard this content if they succeed.

Who are their players?

Paradox games are definitely niche games. They have nowhere near the number of blockbuster games like Counter Strike and Fortnite (both have peaks of around 1.5 million players a day) compared to their best-played game, Hearts of Iron IV, which has daily peaks of around 47 000 players.

So who are these people playing these excruciatingly detailed grand strategy games? According to the studio’s data & analytics team, the stereotypical player is:

These are people who have time and resources to play, and even though they have a more diverse player base than what is described as the "stereotype,” the primary shared attribute is that their players can sink in the hours. Which is quite obvious given the detail and time it takes to play grand strategy games.

They want to learn; this can be centred on historical periods, game mechanics and so on.

They want a challenge; players have heard about how hard or detailed a Paradox game is and want to test themselves on it.

They want to test out the “what if” scenarios of storytelling.

These three elements create a loyal player base that returns regularly. Paradox players stay with the company and purchase content regularly over time, creating a great foundation for growth.

There are a bunch of examples of crazy ambitions, like conquering the world as the native American tribe, the Iroquis. The dynamic nature of Paradox games even surprise the players themselves, such as this guy who couldn’t get himself to kill his daughters husband because “he’s just a swell fucking guy”, ultimately resulting in the downfall of his dynasty and ending the playthrough. These are just a couple of examples of how Paradox players experience the games and the potential of the logic soups they brew.

Launching new games

As mentioned at the beginning of this article, the share price has taken a tumble. This share price decline has been caused by the unsuccessful launches of several new games. Especially the launch of Cities Skylines 2 has created doubt in the markets.

As the market is pricing in continued failures, it is worth taking an extra look at the most recent released games.

We can see that their freshest blockbuster game, Cities Skylines 2, had an unsuccessful launch. When beginning the article (April 4, 2024), there were only 5300 people playing a highly anticipated game that was released last fall, and in early June, there were twice as many people playing the original and nine-year-old Cities: Skylines (first launched in 2015).

Age of Wonders 4 has been a success compared to expectations, and they got a good reception for the game at launch; however, it’s taken some time to ramp it up, and it’s not living up to the popularity of their bigger titles. Let’s take a look at the player count for some of their freshest releases:

And the worst there is:

As we can see, there not ’t a lot of players playing these newly released games, and Paradox has flopped all of their latest releases (after Age of Wonder 4) to various degrees. Lamplighters League was a big miss, and they decided to part ways with the studio that made the game and write down all expenses related to game development. Across the Obelisk is the only game that can be counted as a success and is a result of the Paradox Arc approach the company has taken to new game development.

This repeated itself as Paradox decided to cancel Life By You, a The Sims competitor, before it launched and parted ways with the studio that developed the game overnight. Drastic measures, but given the costs related to marketing and launching, it is probably the best decision to not fall prey to the sunk cost fallacy.

We can see that their bigger studio launches have largely produced missed hits over the last couple of years. Only Age of Wonder 4 has been successfully launched with a good reception. The biggest failure was the launch of Cities: Skylines 2, which faced a terrible public reception, despite OK reviews by critics.

The CS2 debacle should be the most concerning release for potential Paradox investors. The core games are the company’s main revenue driver, and sequel launches are integral to the growth of the company.

Thankfully, due to its endless nature, there is still room for the developers to improve on and build a CS2 that people want to play and that has fewer bugs and issues. The user count for the Cities: Skylines franchise is rather stable, if we look at both the original and the sequel, so the player base is still there. The company has taken steps to fix the game, and as we will show in just a second, it has managed to create growth in players for CS2.

So, as investors, we should not be too shortsighted. Paradox has a history of mostly successful launches. Yes, there have been several bad launches (if we can call the Life By You cancellation a launch) in the last year, but before the recent troubles, Paradox had an impressive 71% hit rate for their game launches.

After beginning the work on this article, the company has launched updates and added content to Cities Skylines 2 for free. It’s interesting to see player sentiment shift, exemplified by these two threads that are among the most upvoted on cities: Skylines 2 subreddit: Thread 1, Thread 2.

As we can see from the player count, Cities: Skylines II is picking up steam and has almost caught up with its 9-year-old senior sibling. It is probably safe to assume that players are spending time in both the original and the successor. However, it’s nice that the company has the possibility of turning things around in Paradox’s games despite fluked launches.

A more rigorous approach to growth

In their capital markets day in the fall of 2023, Paradox CEO Fredrik Wester said that the company is going to approach adding games to its portfolio in new ways. As we’ve just discussed, they have failed to broaden their product offering through large studios working on games outside their niche of strategy and simulation, and Paradox have been ruthless to the failing studios.

They base their new growth strategy on three pillars: Stock up (add more long-lived games to their portfolio), dig in (strengthen core games growth), and break out (make new experimental hits from passion-driven developers).

It is the “Break out” part of the strategy we will touch upon in this section of the article:

Going forward, they have plans to launch more new games via Paradox Arc. This is an approach where Paradox owns small studios with teams that consist of fewer developers, working on what they describe as passion projects.

The goal of this experimental and creative approach to game development is to leverage new-thinking and passion projects to create great games. Bigger studios are often tasked with creating a game that most people working on it don’t really care for. The Arc approach should enable studios to take more risks and create games that players want to play.

Paradox Arc got around 10–15 games under development and consideration and a yearly investment of 75–100 million SEK. They cancel 4 out of 5 games, leading to a kill rate of around 60–80%. They test new games on players, and only launch games they see has the potential to be played repeatedly.

This is a more cost-efficient way to launch games compared to adding large (and often expensive) studios to their portfolio that have historically not managed to produce hits. The annual investment into Paradox Arc is also a lot smaller than the costs related to these bigger projects that have been canceled lately.

Recent examples of write-downs show the costs of big game launches with larger studio productions. The Lamplighters League write-down was around 170 m SEK and Life By You write-down landed around 200 m. I.e., almost twice the total annual investments into Paradox Arc.

Another important factor is that large parts of the expenses related to new games happen close to and surrounding launch. That’s when the company invests into marketing, finishes development with larger teams and so on.

By approaching development of new games through the Arc-model, they should be able to spot potential losers earlier and cut losses before the big expenses ramp up. The slide below highlights how the costs grow closer to launch. Notice that if they launch a successful game, the break even comes rapidly, often around the first quarter of a live game.

Examples of games that have emerged from the Paradox Arc project are: Cities Skylines, Across the Obelisk and Magicka. All games that were commercial hits for Paradox, especially Cities Skylines,.

New games on the horizon

Paradox Interactive is currently (most likely) working on a successor to their highly successful Europa Universalis franchise. The project is nicknamed Project Caesar, and currently they are interacting with their playerbase through Paradox’s own forums.

They release frequent developer updates to their forums, where they explain and talk about decisions made in the development process of this new game and interact with users on the forum. This community interaction is nicknamed Tinto Talk, and the studio manager of the Barcelona-based Tinto studio, Johan Andersson, frequently interacts and posts. Andersson has a track record of working on successful games in the Paradox portfolio, such as Europa Universalis IV, Hearts of Iron III, and Crusader Kings II. Given that the Tinto studio has been responsible for former EU games and that Mr. . Andersson is known as Mr. . Europa Universalis, it’s the worst hidden secret in the Paradox universe that the company is working on a successor to the smash hit EU IV.

Another game on the horizon for Paradox Interactive is Prison Architect 2, a sequel to one of their core games, albeit one of the smallest core games. This looks to be mainly a step to take Prison Architect in a 3D direction and add more realism to the aesthetics of the game. The company recently announced that the game has been postponed without a release date as they want to ensure quality at launch. Indefinite postponements are, in our experience, never a good sign, and this might result in another big cost write-down.

Let’s end on a bad note on the topic of games on the horizon. Vampire: The Masquerade: Bloodlines 2 is a sequel to a cult-fan classic RPG that was originally launched by Activision studio Troika Games. The original has a great review score and a large fan base.

Unfortunately, the follow-up has been mired in uncertainty for a long period, and the teaser material that has been released has not been well received. Investors would be wise to temper their expectations, and we deem it very likely to be another game that might end up on the chopping block. Time will show, but we think it is prudent to remain pessimistic about Bloodlines 2.

The strategic failures of 2018–2021

As we have touched upon briefly during this write-up, Paradox Interactive have failed at launching new games. The latest news is that on August 2, 2024, Paradox announced that they will delay the launch of Prison Architect 2, originally set to launch in September this year. They did not provide a new release date for the game.

Many investors and profiles on social media have pointed fingers to the former management and CEO of Paradox, Ebba Ljungerud. Ebba Ljungerud was the CEO of Paradox between 2018 to September 2021. All of the expensive and failed projects were started under her tenure. The easy explanation is that this is “her” fault. We believe this to be a too simple explanation, and base this on a couple of points:

Founder, majority shareholder and long-time CEO, Fredrik Wester, remained at the company as head of the board as a full-time position.

Several long-time key personnel was (and remain) at the company at the time. A change of CEO doesn’t change everything, as most of the organisation remained intact.

We find it more likely that, given the growth sentiment surrounding the gaming industry, the company saw a need to expand into new segments and genres. This led to over-investing into new concepts outside of their core competencies.

Life by You was supposed to be a The Sims contender. They brought in the big brass of former key personnel in the development of The Sims games. The studio developing LBY, Paradox Tectonic, was a large and expensive studio that ended up yielding nothing but losses to investors on something that was outside Paradox’s core. The same can be said of Lamplighters League and Vampire the Masquerade. Even the sequel to Prison Architect seems to be an attempt to do something new and expand into new genres (3d models, role-playing elements, et cetera).)

Trying to broaden the product portfolio is a commendable effort. However, they seem to not only have overreached by adding several large projects outside their core but also neglected what was working (evidenced by the Cities Skylines 2 lapse).

We believe that such a failure is the result of the organisation, not an individual. It is not prudent to point the fingers at one person and forget to scrutinize current management. Given their long and thoughtful presentation during their last capital market day (held in fall 2023), it seems that the organisation has learned an expensive lesson. As discussed, going forward, resources will go towards strengthening core games and rigorous game development with strict hurdles. We believe this strategic shift and lesson learned will benefit investors of Paradox going forward.

Financials

Understanding Paradox's financial health requires a closer look at their Income Statement. First, timing of game releases significantly impact quarterly revenues. Therefore, investors should consider trailing twelve-month results instead of quarterly figures. However, we were positively surprised at how well Q2 2024 revenue held up (4th highest revenue ever), despite few game releases and no major base game release. This speaks well of the durability of current game franchises, either through additional copies or downloadable content.

Secondly, as game development is an exercise of trial and error, with one successful launch potentially paying for a dozen failed ones, it is all about having some big winners and avoid the big failures. Quite similar to investing, in general. The strong hit-rate of 71% combined with the durable game portfolio explains some of it´s market-leading 30%+ return on invested capital (ROIC). However, if they continue developing poorly received games and DLC´s, we may not see these high returns for much longer. Nonetheless, looking at the recent Q2 2024 quarter, with the 4th highest operating cash flow, despite few big releases, this hints to the market may have underestimated the strength of their current game franchises.

Thirdly, as a successful Paradox game franchise can last for many years, we believe management is very conservative in their practice of amortizing these on the balance sheet. Remember, Paradox spends heavily on game development upfront but receives cash post-launch. Prison Architect for example, has been fully amortized and is worth 0 SEK on the balance sheet, and with the upcoming sequel (hopefully) releasing soon, this provides the company with minimal risk.

To illustrate some of these dynamics, listen to what CFO Alexander Bricca had to say on this during the Q1 2024 earnings call:

So when we acquire IPs, studios or games, (…), we allocate the purchase price for the specific assets to be amortized over time. We have EUR 2million as goodwill. That´s all we have as goodwill. The rest has been either developed games or intellectual property in some way that we´ll mostly depreciate over 5 years.

And we think this is a prudent way to handle acquired assets. It pushes down the profit for us, but it also takes down the risk and builds for the future.

This shows that most old franchises, which still account for most of Paradox's revenue, are worth 0 SEK on the balance sheet. These have been expensed in the Cost of Goods Sold line, in addition to expenses such as royalties. However, as these are non-cash expenses, they doesn´t impact cashflows today. Subsequently, we consider operating cashflow as a key metric in determining Paradox´s development, due to the income statement containing more noise, at least in the short term.

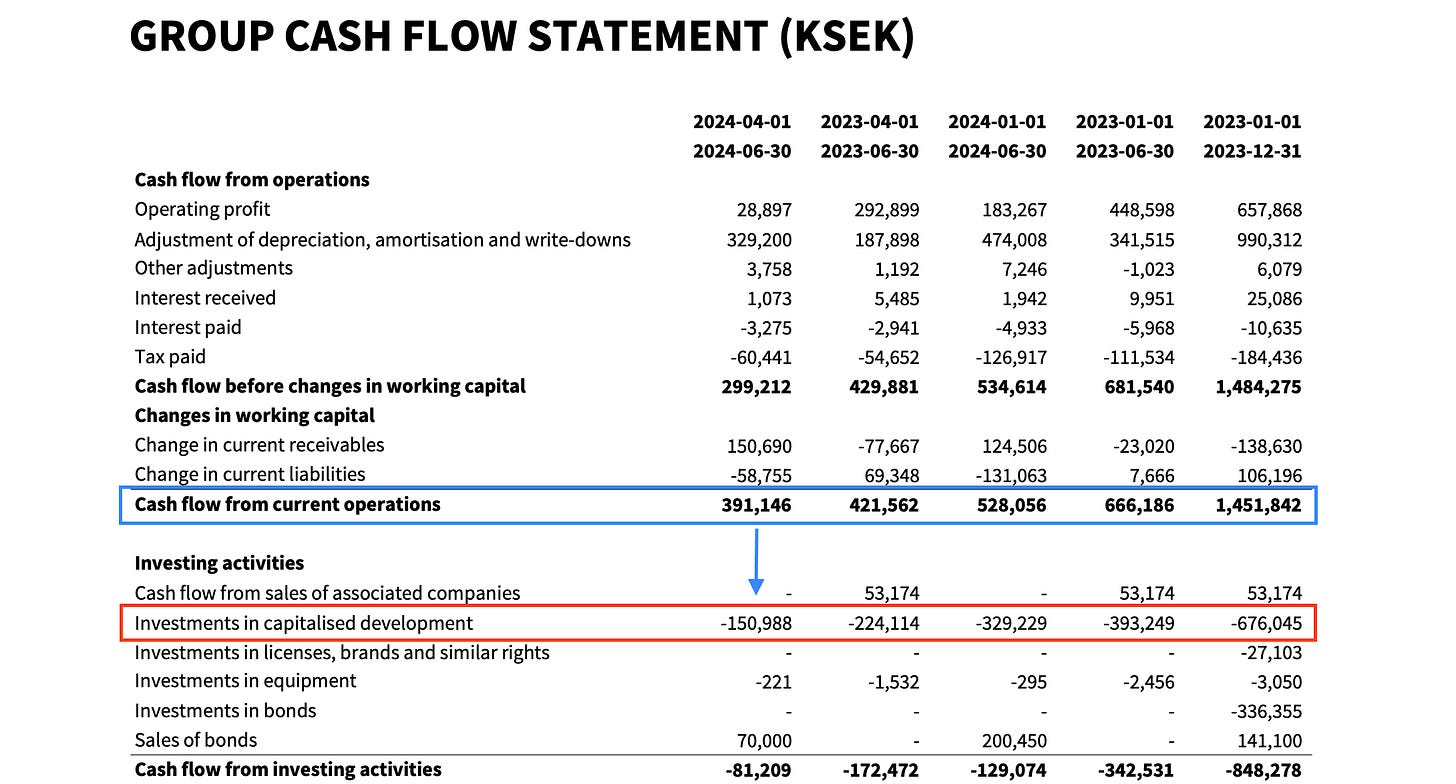

Nonetheless, operating cashflow is not the final destination. While the purchase of property and plants is insignificant for Paradox, they are still not a capital-light business (which some stock screeners may make you believe).

Developing these games is costly and perhaps a source of improvement (with the expensive failed launches recently). Within the cash flow statement, you find these expenses under the Investment in Capitalized Development.

In conclusion, when we soon value Paradox, we use operating cash flow, a Maintenance portion of the capitalized development costs, to arrive at Owners Earnings. To be conservative, we estimate 50% of these costs as maintenance. For the last twelve months, this equals OCF minus Capex (maintenance) = 1314 m minus 320 m = 994 m SEK. However, as working capital changes can vary drastically from quarter to quarter, it may be more appropriate to use an average cash-conversion from the last 5 years (86%), instead of today´s 96% (see figure below).

Similarly, we could also use Revenue * EBITDA margin * Cash-conversion (5y avg) to calculate Owners Earnings.

This gives us Owners Earnings LTM of: 2480 million * 42% * 85% = 895million SEK. Comparing this figure to the same in 2019, 460 million SEK, gives us a compounded annual growthrate in FCF of ~14%. We believe this portrays a much more accurate picture of Paradox development and growth than for example, Operating Income, which would suggest Paradox has stayed flat since then.

Nonetheless, we may be fools trying to adjust earnings like we did here. Truth be told, the stock market seem to disagree with us, showing a stock price with zero returns since 2019, similar to the Operating Income development. However, as we will look into now, Paradox is actually in a much stronger position now than 2019. They generate so much cash that we believe the dividend could be doubled or tripled.

As a sidenote, it is interesting to see that the Income Statement correlate better with the stockprice, while the cashflows flow correlates better with the growing player base.

Capital Allocation: Dividends Incoming?

Market Cap: SEK 15.3B; Net Cash position: SEK 1.1B; Enterprise Value: 13.8B

Looking at the cash production of Paradox, we can see they have generated roughly 55% Operating cash flow margin over the last 5 years. Of these, 67% have been used for reinvesting, 20% to strengthen balance sheet and only 13% to pay dividends.

Looking at the last twelve months, less is reinvested as a percentage of OCF (perhaps as a result of the discussions earlier on Paradox Arc). Also, as much as 30% have gone to strengthen the balance sheet. With a net cash position of 1.1B (8% of M.Cap), one could argue the balance sheet is strong enough. However, seeing owner-operators accumulate cash is nothing new. We argue that while a net cash position is positive, it comes with the caveat of lower return on equity, especially if interest rates gets lower. In Q2, the company acted upon lowering interests on bonds and sold short-term bonds to move 70 million SEK to a bank account with better terms.

As a result, we would not be opposed seeing Paradox return more capital through dividends (as their listing on the smaller exchange First Nordic doesn’t allow them to buy back shares).

Hence, with a dividend yield of 2% today, one could argue they could afford a 5% dividend yield (from 30% to balance sheet) without hurting reinvestment needs.

Assumptions

With the aforementioned adjustment to Owners Earnings, we have a good starting point for valuing the company. There were 3 main assumptions we made:

50/50 of capitalized development costs are used for growth and maintenance.

Cash-conversion is now 10% higher than the 5-year average; we would rather use historic average.

EBITDA margin is now 3% lower than the 5-year average, which we don´t adjust for.

With these assumptions, we came to the final value of Revenues of 2480 million SEK * EBITDA margin of 42% * Cash-conversion of 86% = Owners Earnings 895 million SEK

With an Enterprise Value of 14.2B, Paradox trades at ~16x EV/Owners Earnings. Perhaps as confirmation bias to our own conclusion, Thomas Nielsen came to a similar one with his adjusted PE of 17x.

Due to the cyclicality of their cash flows, we believe using OCF - Capex overestimates free cash flows, as it does not take capitalized development costs into account. On the other hand, we are unsure what percentage of these costs are for maintaining current operations and what is made for growth capital. In addition, we need to make assumptions for the long run.

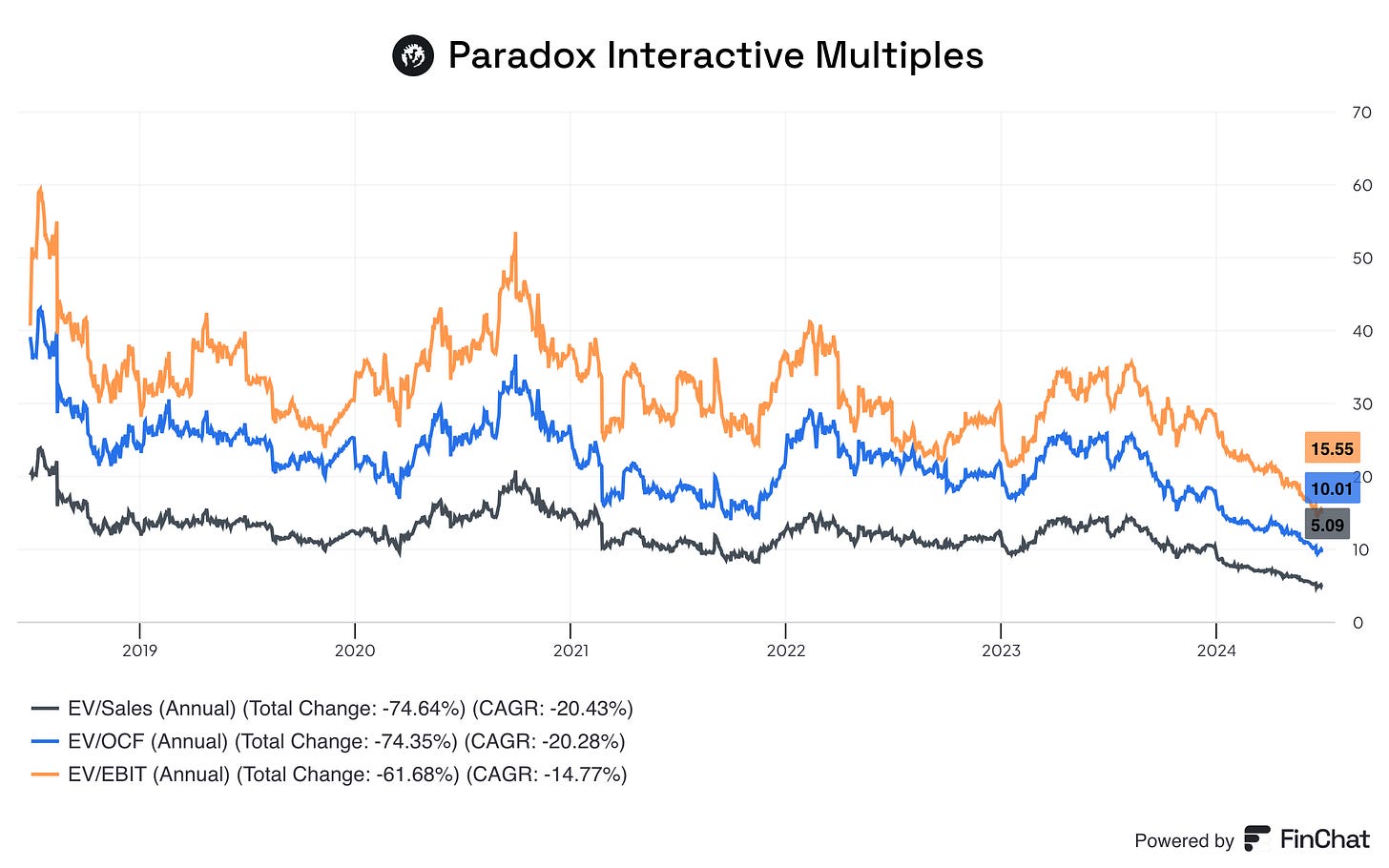

However, looking at the graph below, there is no doubt Paradox is historically cheap. This is illustrated by shareholders achieving 0% return, despite EPS having grown from 3.5 → 5.1 (9% CAGR) & operating cash flow per share has grown from 6.9 → 12.7 (15% CAGR).

Checking in with the market

Looking forward and assuming future cash flows is always harder than simply checking in with Mr. Market to see what growth is expected at the current share price. Running a reverse DCF based on the assumptions made above yields the following results:

The above calculation is based on the following assumptions:

Growth capex of 50% of Paradox Arc costs. 50% is high, but this decision is based on former Arc projects contributing to the bottom line of the company (ex. Cities Skylines, as most CS revenue is from larger-scale development costs).

Discount rate of 12% accounts for the cyclical nature of the gaming market and tough competition. However, if no substantial competition arrives and the company better manages its cyclical earnings (i.e., fewer big failures), a discount of 10% could be justified. Our discount rate should therefore be viewed as cautious and conservative.

An adjusted last-month FCF (we look through the fingers on the write-downs) of 890 million SEK.

This basically means that the market priced in a growth rate that is substantially lower than that of the gaming industry going forward. The current owner's earnings yield is also attractive. Let’s remember that the growth from core games without sequels has been 15% annually. Adding in sequels to core games, Paradox has shown a 21% CAGR throughout its history. The discrepancy of historical growth and expected growth at current share price makes for an attractive investment, in our opinion.

If we want to be optimistic and look at Paradox possibly starting to grow in line with the market (let’s remember that the company has outpaced market growth since inception) and that we account for a less cyclical discount rate of 10%, we achieve this result:

The above forward-looking DCF is based on the same assumptions as the reverse DCF model; however, we’ve increased expected growth in year 1–10 to 12% and 8% to be aligned with expected market growth. This shows a potential discount to free cash flow of 57%.

Multiple plotting

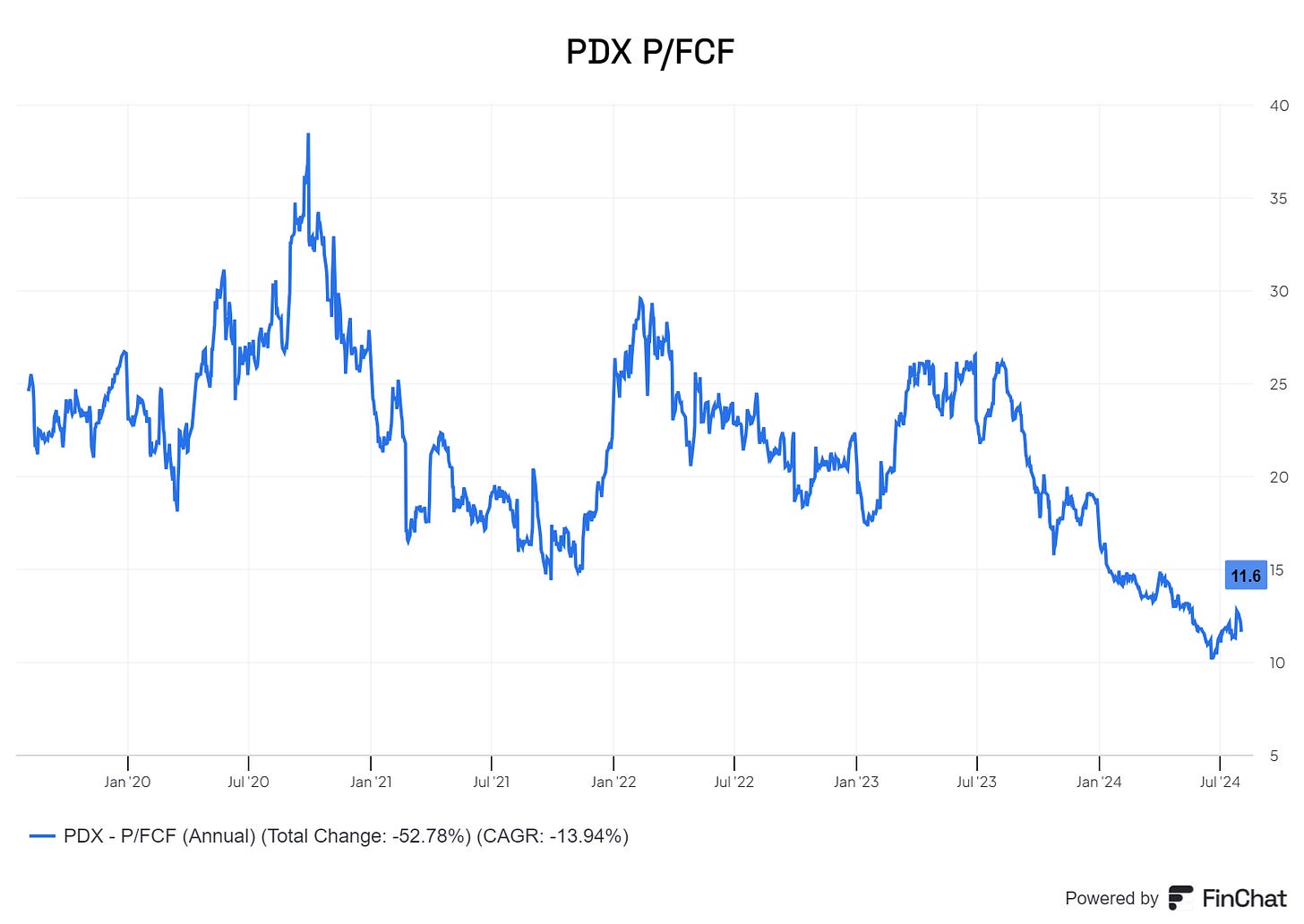

In an attempt to understand possible returns, we’ve plotted out possible FCF growth scenarios going forward. Before showing the plot, it is important to remember the historical averages of Paradox Interactive in relation to FCF growth and P/FCF:

Historical average FCF growth

5 years FCF CAGR: 20%

9 (data only available for ‘14 -’23) years FCF CAGR: 61,3%

Historical average (P/FCF)

5 years average P/FCF: 21,8

10 years average P/FCF: 21,9

As we can observe from the above numbers, free cash flow has slowed quite a bit the last few years. This is mostly due to explosive growth in the early phase of the listed Paradox Interactive (in '14, the free cash flow was 64,3 million SEK, compared to 1.4 million SEK for FY ‘23). However, the average multiple have remained remarkably steady over the last nine years (looking at the graph, however, reveals large fluctuations in pricing). Remember, the P/FCF of stock screeners is more similar to operating cashflow than actual Owners earnings due to a lack . of capital development costs.

Now that we are familiar with historical averages to more easily navigate potential multiple outcomes, let us have at it!

As a bearish base assumption, we take the market’s pricing at face value. With an expected 8% annual FCF growth in the near future, these are the possible exit values at a stable multiple of 17x P/FCF:

This would lead to subpar returns on investment, at a CAGR of 7,64%. Adding in a dividend return of around 2%, we could expect a below-index results with a 10% annual return. Not good enough to beat the hurdle rate of 12%.

Let us then look at several scenarios pitted against each other:

As we can see from the potential outcomes above, only a multiple contraction and a 10% CAGR scenario yield unattractive returns compared to a hurdle rate of 12%. None of the above scenarios is based on a multiple expansion, and all are either above or in line with recent historical average free cash flow growth. We do not expect Paradox to grow in line with historical FCF CAGR (the bigger you grow, the slower you grow, especially in the gaming industry).

But there is enough potential for attractive returns ahead that Paradox is an interesting investment for a prudent and conservative investor going forward. The above calculation does not account for dividends (as it is hard to predict), only the share price matching free cash flow produced by the company.

An attractive optionality is the favourable comparables coming up. If the company succeeds at not wasting it’s money on large game titles outside their core competency in the coming years, there will be headlines shouting that Paradox has grown it’s net earnings by three digits and so on. This will however, normalize over the years, and the lumpiness of being invested in Paradox is likely to continue.

Wrapping things up

In trying to wrap things up, we find it timely to quote Howard Marks:

Most great investments begin in discomfort.

The last few years have surely been uncomfortable for Paradox Interactive. The management has made key mistakes and, in our opinion, overreached. There are positive things to be said about the management of Paradox Interactive, though. During the pandemic, gaming publishers and studio owners leveraged their assets up to the heavens and above, often paying far too much to achieve un-profitable growth.

At the same time, Paradox set their minds on expanding their product offering, overreaching beyond their niche as a grand strategy developer, and failed to impose prudent quality control on new product development. This led to many failed investments. However, Paradox did not leverage up their assets and remained debtless with a strong cash position. In the euphoric cycle of the gaming industry, with everyone sitting inside, playing video games like no tomorrow, the company navigated the cycle with the remaining focus of returning value to shareholders. We can only fault them for trying to hard to expand their portfolio.

After 2021, the management took important steps for Paradox. They’ve onboarded moderators and their content, reached out to their player base with their developer diaries, and postponed or cancelled bad products. These are all ways to address the issues they’ve struggled with. They have also stated that they have steered away from risky and expensive projects. CEO Fredrik Wester wrote about the topic in their second quarter report:

In 2021, we made major changes to how we invest in riskier projects, which means that we have not started new projects with the same combination of high risk and high costs as Life by You… Recently, much of our focus is on achieving the right quality and taking the right risk in all types of projects. But more needs to be done. No change for the better can be too small or too big, even if it is work that will take time.

Their new strategy of stocking up, digging in, and breaking out bears the promise of a fresh trajectory for what has been one of the highest quality companies in the gaming industry.

Currently, the sentiment towards the gaming industry is bleak. As market leader Nintendo reported earnings of 02.08, showing a 55% drop in profits, investors reaffirmed the bleak look at what is still a rather young industry.

Paradox Interactive has had several misses these last few years. It is reasonable to believe that seasoned (and invested) management has learned many uncomfortable lessons these years. As we are in between large launches of core games, with Mr. Market looking too much on failed projects that are in the past for a company with extremely healthy financials, this seems like a good time to invest.

Given the current market pessimism towards Paradox Interactive, both authors hold positions in the company, albeit with different weightings. Learning to Grow has made Paradox his fourth largest holding, with a portfolio weight of ~10% as of August 3, 2024, while Ole holds a smaller 5% position.

Notably, Ole previously owned shares but sold them immediately after the launch of Cities: Skylines 2, as he found the execution by Paradox and its partner, Colossal Order, to be potentially thesis-breaking and worthy of looking through. While Paradox seems to improve on this, it should serve as a reminder that they really disappointed one of their largest pools of loyal players. Nonetheless, seeing Paradox management admit their mistakes and actually execute on improving them (Steam reviews, active players), we believe the stock price has given investors a good opportunity to acquire one of the highest quality businesses in the Nordics at a reasonable price.

That´s all for now. Thanks for reading through. If you have questions or disagreements, please get in touch. You can reach us in the comment section below or via X: @olensrud and @ikkenospes.

None of this is financial advice.