Our Top-Ranked Serial Acquirer for 2024

In our 2024 screen of Serial Acquirers, we ranked standout serial acquirers based on core performance metrics — from a multitude of criterias REQ highlighted as key. One name quietly claimed the top spot: Topicus, the European counterpart and spin-off of Constellation Software, both listed on the Canadian stock exchange.

Serial Acquirers - 2024 Edition

Most businesses eventually reach a maturity phase where organic reinvestments no longer yield sufficient returns on incremental capital (ROIIC). At this stage, management faces a choice: return capit…

Since then, Topicus has grown into a top 3 position in the Outsiders Corner Portfolio — and for good reason. Topicus is not only an elite operator of Vertical Market Software (VMS) companies, but a blueprint for long-term capital allocation.

As I dug deeper, I realized Topicus had far more depth than I first expected.

Table of Contents

Why Ranked #1: Consistency Across the Board

Best-in-Class Cash Conversion

Pricing Power and Terminal Multiple implications

Income Statement - taking out the growth capital

A) Durability of Cash Flows

B) Capital Deployment & Returns

Decentralization: The Hidden Engine

Topicus - The Holding Company Evolution

Financials & Valuation

Conclusion

Why Ranked #1: Consistency Across the Board

In our ranking framework, we scored acquirers on six metrics: growth, operating margins, cash conversion, ROCE, return on incremental capital employed and reinvestment rate.

Topicus didn’t just perform well — it was consistent across the board, with standout figures on cash conversion, similar to it’s bigger brother (and controlling owner) Constellation Software.

What makes these two software companies stand out? (one hint below)

Best-in-Class Cash conversion

Where VMS shines brightest is in cash flow. Topicus, like Constellation, benefits from two structural advantages:

Negative Working Capital: Their clients pay upfront or on fixed cycles, creating a float-like effect - management does not need to invest in upfront inventory.

Low Reinvestment Needs: Once software reaches functionality, maintenance is cheap. There's little need for constant R&D or capex. The below picture, of Justice System software from Constellation illustrates this well (Source). Note, we would not expect all software products within Topicus to look like early Windows.

On the other hand, Industrial acquirers such as Addtech or Lagercrantz focus on optimizing inventory turnover and working capital, by measuring profitability metrics such as EBITA to working capital. VMS is instead capital-light by design. That’s why comparing EBITA between these two is misleading. Cashflow is key.

To illustrate Topicus’ exceptional cash conversion, consider this: in 2024, the company reported consolidated EBITA of €331 million. Even after deducting €34 million in income taxes and €47 million in interest expense and lease obligations, Free Cash Flow still came in at €290 million. The prior year looked similar—€287 million in EBITA, €204 million in Free Cash Flow—despite a combined €68 million in taxes interest. These figures are presented before deducting non-controlling interests.

Put differently: over the past two years, €469 million of earnings before amortization (EBA) turned into €494 million in Free Cash Flow!

In summary, Free cash flow consistently exceeds accounting profits — a rare trait.

Pricing Power and Terminal Multiple implications

Despite the low reinvestments in organic initiatives, Topicus continues to deliver stable and solid organic growth, at mid single-digits.

This seem to stem from a similar characteristics we highlighted with Ametek, within the Industrial Compounder writeup. Mission-critical product (software) + low cost relative to other operational costs (think library; rent, payroll, inventory etc), often enable companies the ability to slowly raise prices each year.

While you can delay purchasing the newest Industrial machine, mission-critical software is high up the operating expense list, suggesting minimal cyclicality.

When we combine the high cash-conversion, structural pricing power and minimal cyclicality, we believe Topicus portfolio of VMS companies deserve a higher terminal EBITA multiple than most other Serial Acquirers.

Now, you might be wondering: Why are we ignoring amortization (A in EBITA)? And what’s up with non-controlling interest?

I had those exact questions the first time I dug into Topicus.

Income Statement: Stripping Out the Growth Capital

Depreciation and amortization are non-cash charges tied to past investments—depreciation for physical assets like buildings or servers, amortization for intangible ones like software, goodwill from acquisitions or customer relationships. While the investment is paid upfront, the cost is spread across years on the income statement.

So why do we measure many acquirers using EBITA?

Here’s the idea—highlighted in our deep dive on serial acquirers:

If a company reinvests at high returns, you want to isolate the profitability of the existing business—before layering on the effects of growth investments.

This approach makes comparisons more meaningful. It levels the playing field between a low-growth stalwart returning capital to shareholders and a high-velocity compounder plowing cash back into itself (or acquisitions). One might look cheap on a P/E basis, the other expensive—but remove the reinvestment layer, and the picture may flip, especially over long time (the power of compound interest - Einstein).

In our view, the depreciation line item for most acquirers represents maintenance capital—expenses necessary to keep the lights on—and should be treated as a real cost. But amortization, especially the portion tied to acquired intangibles and goodwill, is different. These are past investments into the subsidiaries that do generate not only steady, but also organically growing cashflows. With the estimated useful lives of 2-20 years and Topicus still growing organically, we believe this expense item overstates the investments Topicus would have to make to maintain current cash generation. Still, to keep things simple and as Topicus is not very cyclical, we prefer using cashflows when evaluating Topicus.

For a more fair comparison against Industrial serial acquirers, we would consider taking EBITA multiplied with it’s average cash-conversion over a cycle.

Luckily, Topicus breaks down Free cashflow available to shareholders (picture).

This is capital that Topicus could have distributed to shareholders via dividends. But let’s be honest — we’d much rather see them reinvest it, because few allocate capital better.

Take Sygnity, for example. Topicus acquired control (~73%) just three years ago at around 12 PLN per share. Today? The stock trades at 79 PLN — a 6.5x return. More recently, they acquired shares in Asseco Poland at 85 PLN. Three months later, those same shares are trading at 153 PLN — an 80% return in a quarter.

Unless you and I can find these deals ourselves, we may as well partner with the ones who can. And if you argue these are cherry-picked, just spend some minutes in the Constellation Software deal archive - the Groups track-record speaks for itself.

Durability of Cash Flows

We’ve already touched on the strong incumbent advantages within vertical market software (VMS). These businesses often serve mission-critical functions in niche markets—hospital scheduling, library management, cemetery logistics, you name it.

Even as AI accelerates the development of new software, building a better product is only one part of the puzzle. Convincing an entire cohort of librarians, school administrators, or water treatment operators to switch platforms—migrating data, retraining staff, risking downtime—is a massive hurdle. That’s why even aging systems with clunky User Interface continue to thrive. Also called Switching Costs.

While I wouldn’t claim deep operational expertise in niche software, the structural dynamics appear positive for incumbents—and by extension, for disciplined acquirers like Topicus. Especially as aging populations in Europe also create a structural tailwind for automation and software adoption in understaffed sectors. It seems likely that there will be more niche software companies in a decade than it is today.

The risk of technology obsolence seems less than most technology sectors.

Capital Deployment & Returns

This is where the risk of Topicus is more pronounced. Last year, Topicus paid out a substantial dividend, raising questions about the reinvestment runway. Unlike typical holding companies, which often trade at a discount to it’s parts, the market assigns a high multiple to both Constellation and Topicus—pricing in a long future of high-return capital deployment.

This can also be seen in the multiple arbitrage many of the best Serial Acquirers benefit from, where they acquire small companies at low multiples and consolidate their figures with an immediate double or more in market value (not comparable to Sygnity / Asseco deal as those were listed equites). Either way, the primary value driver comes from deploying capital at higher returns than their cost of capital.

But, the risk is obvious, how long can they sustain their reinvestment engine?

For now, M&A activity in 2025 suggests this concern has been postponed. But the premium valuation implies expectations for continued excellence. Any slowdown in reinvestment could change the narrative quickly.

It’s also worth highlighting the law of large numbers. Constellation is now a giant. Mark Leonard himself has acknowledged that the firm must reinvent itself to keep deploying larger pools of capital without sacrificing returns. Topicus, in theory at least, still has a long runway ahead before scale becomes a constraint.

That said, history shows that smart structures can stretch the limits of growth. Look no further than Investor AB: with the right degree of decentralization and capital discipline, holding companies can continue compounding well beyond what most would expect. Topicus seems to be walking that same path — with both the autonomy, incentives and a system designed to extend its reinvestment runway.

A great example is their recent stake in Asseco, with many layers of holding structures and niche software groups. And with a surprisingly large presence in Israel.

Decentralization: The Hidden Engine

Perhaps the Constellation Universe most underappreciated strength is this - their approach to decentralization.

Most succesful acquirers adopt a hybrid model: operations are decentralized, capital allocation remains centralized. Mark Leonard (Constellation Founder) broke this mold. Not only did he figure out VMS was the perfect domain for roll-up economics, but he also architected a system where capital allocation itself is gradually decentralized—handed down to increasingly autonomous operating groups. Even spun out to become individually listed companies (Topicus & Lumine).

This design scales beautifully. As Constellation grew, so did the number of business units—each with local accountability, entrepreneurial ownership and it’s own niches within VMS.

Topicus – The Holding Company Evolution

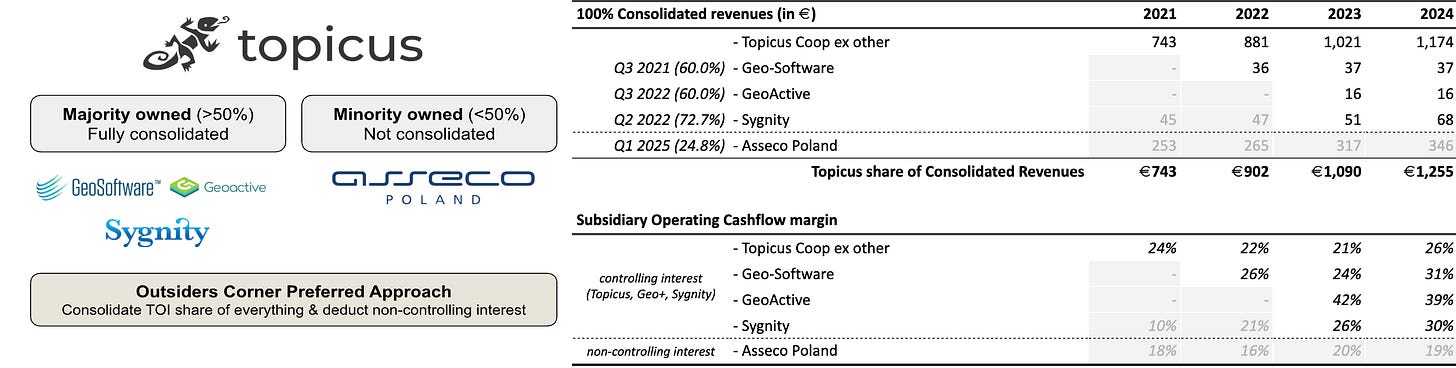

In our view, the recent acquisition of a 24.83% minority stake in Asseco Poland marks a subtle but significant shift in Topicus’s trajectory—from a pure-play acquirer to a more complex holding company - with capital allocation decentralized.

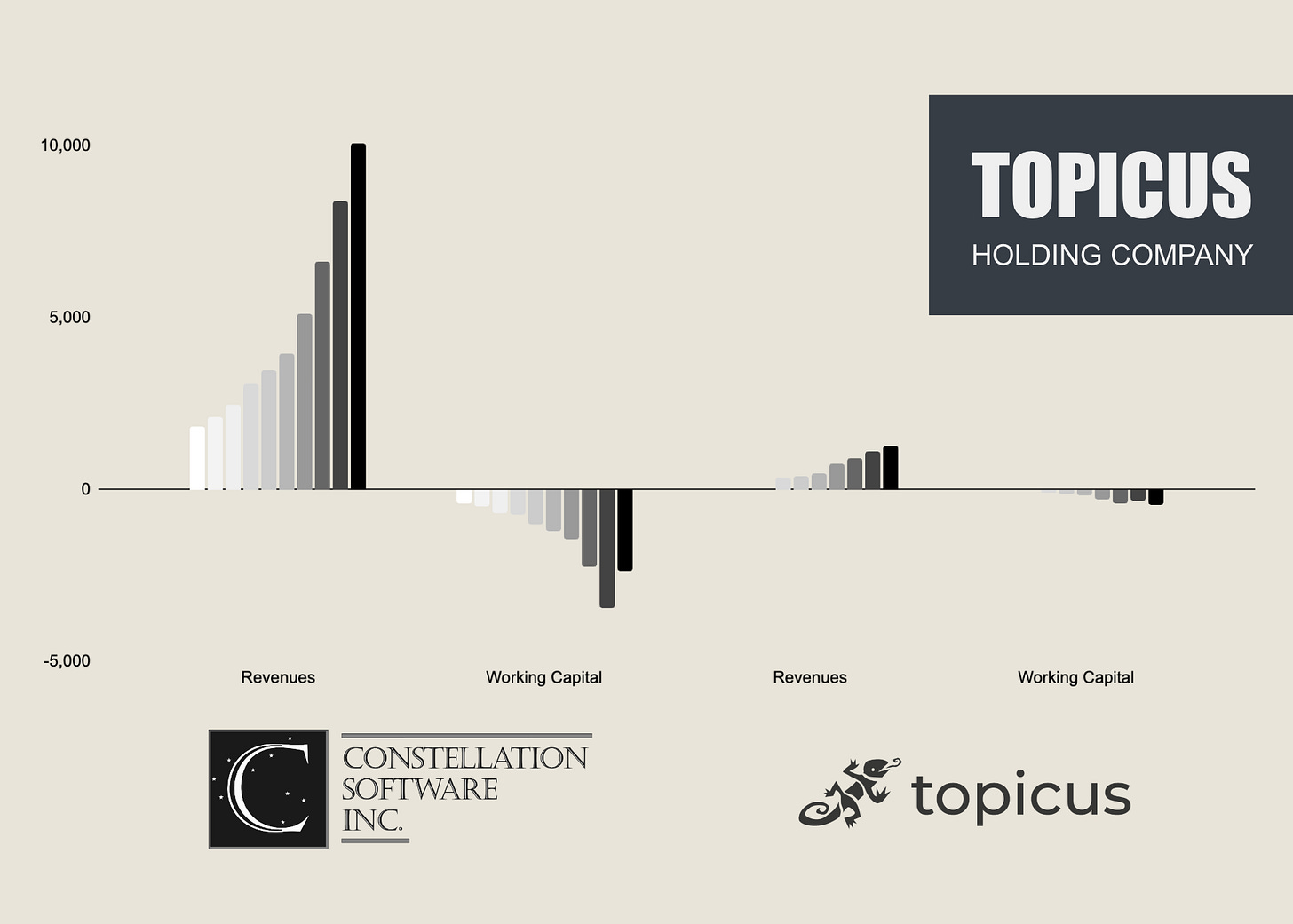

Unlike its earlier majority owned investments—Sygnity (72%), GeoSoftware (60%), and GeoActive (60%), the recent move signals openness to minority ownership as a path for growth. The implications of that distinction is more than just accounting technicalities—they speak to Topicus’s evolving capital allocation playbook.

Why Majority vs. Minority Stakes Matter

In majority-owned subsidiaries, Topicus (under IFRS) is required to consolidate 100% of the company’s revenue, costs, and earnings into its own financials—even if it owns only 60%. The slice that doesn’t belong to Topicus gets carved out at the bottom of the income statement as Non-Controlling Interest (NCI).

Minority stakes like Asseco, by contrast, are not consolidated. They’re often reported using the equity method—a single-line item that reflects Topicus’s proportional share of earnings, with little operational control and no inclusion in top-line growth metrics. It’s cleaner, but also less transparent.

That said, as we’ve explored in our coverage of Investor AB, value creation should be evaluated holistically — whether the asset is consolidated or not. If capital is deployed with discipline, a minority stake outside the reporting perimeter can be just as accretive as one fully under the umbrella.

However, our analysis of Exor’s more cyclical portfolio reminds us that this becomes more difficult when cyclicality enters the equation.

With Vertical Market Software, the picture is clearer. The stability and predictability of these businesses — much like Investor’s portfolio of compounders — make us more comfortable treating minority stakes like Asseco as core contributors to long-term value. We’ll be keeping an eye out for the developments within Asseco closely — and not merely through the lens of their proportional net income reported within Topicus financials.

It’s worth taking a closer look at the various non-controlling interests within Topicus.

Two Layers of Non-Controlling Interest

Topicus’s NCI structure has two distinct layers:

(A) At the parent level, public shareholders only own 63.98% of Topicus itself. The rest belongs to its original founders and Constellation Software. This means nearly 36% of all consolidated earnings are attributable to parties outside the public float. Note that Constellation has 1 Super Voting share, controlling Topicus.

(B) At the subsidiary level, many of Topicus’s holdings—like Sygnity, GeoSoftware, and GeoActive—still have outside shareholders. So even if Sygnity’s financials are consolidated into Topicus, a chunk of those profits ultimately belongs to other parties.

In short: the earnings you see on Topicus’s income statement are not all yours. Investors must adjust for both layers of NCI to understand what flows to the equity they actually own.

To further complicate stuff, Topicus reports their figures in Euro (€), while their Canadian listed stock trades in Canadian Dollars. It can be a good idea to keep track of all this within a spreadsheet.

We believe Constellation’s chaotic structure is not a weakness, but one of the keys to sustaining their exceptional reinvestment rates — a sharp contrast to many former exceptional acquirers, like Halma, who have gradually lowered their hurdle rates (higher multiples paid) as they have become larger. This should ultimately happen to Constellation as well, the question is just when.

For the minority-stake within Asseco, I’ll leave a link for the document here. ChatGPT summarized how Topicus is likely to report Asseco’s figures well.

The document also highlights well the multi-layered structure of the buyer, Topicus, where Constellation Software ultimately controls Topicus.

Financials & Valuation

Following the Asseco Poland deal, the accounting treatment for Topicus is likely to report its share of profits within the Income Statement and dividend income within Operating Cash Flow, as it is a minority stake. However, when evaluating holding companies, we find a different framework more informative.

Our focus is on measuring the collective cash generation and reinvestment activities, and ideally, forming a rough estimate of the returns on incremental investments. While Asseco Poland has not had similar reinvestment rates like Topicus in recent years, we do not rule out the potential that this may increase going forward, and something we will watch closelyu.

Key Financial Figures for Asseco Poland can be found here.

Starting Point Analysis

Working capital is a structural advantage within VMS. Thus, we view Operating Cash Flow as the best starting point for analysis, as this takes this into account. In contrast, we would assess industrial acquirers pre-working capital, and view this as an investment.

For Topicus specifically, we approach the business similarly to how we evaluate Investor AB: by breaking down the ownership pieces individually and assessing how the underlying profit pie develops over time.

Topicus: Consolidated Revenues & Operating Cashflow

Key figures for Revenues and Operating Cashflow margin is highlighted below. Numbers here are presented as if Topicus owned 100% of each subsdiary, and consolidated figures does not include Asseco figures, as this happened in Q1 2025. Even if Asseco Poland is a minority stake, we prefer to keep track of it due to it’s proportion to the group’s figures (~7% of revenues if consolidated in 2024). You will later see why revenues & operating cashflow understate Asseco’s real earnings power.

However, some of this operating cashflow is also required to keep the lights going - we can call this maintenance expense. Luckily, management of both Topicus and Constellation does an excellent job of breaking these down for us within Free Cashflow available to Shareholders.

Below, you can see the Free Cashflow figure, with no contribution from Asseco yet.

Important to notice here, is the low capital expenditure figure (2% of OCF) and the two layers of non-controlling interest we have discussed. To summarize, first there are non-controlling owners within Sygnity, GeoSoftware & GeoActive. Secondly, ~37% of fully diluted Topicus shares belongs to Joday Group & Ijssel. Note that these Exchangeable units are on top of the basic shares outstanding. The second is deducted at the line item above Underlying Free Cashflow to shareholders.

For 2025, we would expect a significant contribution from acquisition. Some of the deal activity just in Q1 2025 can be seen below:

~403m to acquire ~25% of Asseco Poland (in two parts, ~10% and 14.8%).

Worth approximately €730m today (part of the deal included dividends received back as well)

Other acquisitions totalling €255m, with one large contributor

Cipal Shaubroeck from Belgium with 590 employees and €110m in revenues.

If Cipal has ~10% EBITA margins, combined with it’s low double-digit organic growth, it is likely to be worth north of €200m when consolidated within Topicus. Thus, we believe Topicus got this deal to at an attractive price given the €255m (ex Asseco) including several other deals.

Valuation

With the Underlying Free Cashflow available to shareholders, current price of Topicus shares (159 CAD) suggest a ~35x FCF multiple for 2025 figures. There is no doubt the market expects Topicus to continue finding great investment opportunities. Something we believe is justified, especially considering deal news so far in 2025.

As Topicus has grown to become a significant position within our portfolio, you are likely to see more reports on Topicus in particular. Q1 figures come out in a couple days (written 30th of April 2025), which hopefully gives a green light for the acquisition of Cipal in particular. We should also get updated figures on the deal flow.

Unjustice to their Employees & Customers

Within a diversified holding structure like Topicus, encompassing hundreds of companies, generalizations can be misleading.

While discussing switching costs using an example like the Seattle Justice System software is illustrative, it's vital to clarify that this does not represent evidence of employee or customer exploitation across the broader organization. In fact, Topicus stands out as a company that impresses the deeper one looks.

Look no further than one acquisition done by Topicus this April (Source) of DearHealth, and the positive contributions they have to hospitals and patients.

demonstrable reduction in the number of outpatient visits, a reduction in the number of hospitalization days, a decrease in the use of medical specialists, a reduction in the number of laboratory tests and time savings in general.

Further, it seems that Topicus also have interesting organic initiatives as well. @Arenamancapital said X this: “Once you have acquired a large percentage of players in a space, you can start to integrate. CAC goes down, you can drive organic growth by cross selling. Likely churn goes down as tentacles go deeper into an org.”

Conclusion

Topicus, alongside its controlling owner, Constellation Software, embodies a rare and powerful combination: exceptional high returns on capital, paired with a high reinvestment rate. It is the essence of long-term wealth creation — and Constellation’s 35% compound annual growth over two decades stands as a testament to this model.

Superficially, Constellation has often appeared expensive. But history tells a different story. Through the correct lens — one focused on capital allocation and profits before reinvested dollars, rather than backward-looking valuation multiples — it has consistently been remarkably cheap. Not because of revolutionary products or viral consumer successes, but due to relentless discipline: acquiring great niche software companies at reasonable prices, empowering them to operate autonomously, and reinvesting capital wisely. No big news. Just rinse, repeat — and compound.

This inevitably leads to the question: why not stick with Constellation?

Mark Leonard has addressed this over the years, noting that as Constellation Software grows, it must continually reimagine itself. The law of large numbers demands ever more, and ever larger, acquisitions to sustain its compounding engine.

Thus far, it has been difficult — if not impossible — to pinpoint when this dynamic will meaningfully compress returns. But as the chart below illustrates, the smaller size of Topicus (comparable to Constellation’s scale around 2013) suggests — at least in theory — a longer reinvestment runway. Topicus, by virtue of its size, does not yet need to source as many high-quality deals to move the needle.

Of course, this theory is not without flaws. The substantial dividend distribution last year raises legitimate questions about reinvestment opportunities. Yet, given Topicus’ developments this year — also increasingly resembling a pure holding company — we remain inclined to lean toward the optimistic case.

Terminal Multiple Implications

The final point worth reflecting on is the question of the terminal multiple.

Both Topicus and Constellation Software continue to appear expensive on trailing figures — just as they always have. Confidence in their ability to reinvest capital effectively, and in their capacity to sustain relatively high terminal multiples, remains central to the investment case.

A standard discounted cash flow model often assumes that, beyond year ten, growth reverts to a baseline — typically GDP growth. Yet this entirely misses the essence of why the best holding companies and serial acquirers are so enduringly attractive: they continue to find intelligent ways to deploy incremental capital at high rates of return.

There are few better demonstrations of this principle than Investor AB — and perhaps even more impressively, its crown jewel, Atlas Copco. Both have compounded shareholder capital steadily for well over a century. The essential ingredients are clear: a thoughtful holding structure, strategic diversification, and a disciplined, decentralized approach to capital allocation — enabling both resilient organic growth and consistent value-accretive acquisitions.

Viewed through this lens, the investment models behind Topicus and Constellation appear not only sustainable, but uniquely positioned for enduring compounding — extending far beyond what conventional frameworks typically assume.

Moreover, unlike Atlas Copco and Investor AB, Topicus and Constellation convert a greater proportion of their accounting profits into true free cash flow — and crucially, they reinvest a larger share of that cash flow back into high-return opportunities.

With their continued success, it's only a matter of time before market forces attempt to compete on price. Yet so far, Constellation remains close to a preferred buyer for sellers of VMS businesses—a position difficult to replicate from scratch.

In my view, such companies deserve a premium valuation. As for when the day may come that reinvestment opportunities dry up — it remains a question only time can answer. Until then,

Cheers

For Paid Subcribers: I am in the process of making an extensive database for Topicus, but also for the 2 other Holding Companies occupying the next 2 top spots of my personal portfolio. This data, along with personal investment letters, will be exclusive for paid members.

Finchat Discount: From April 28th until May 1st, you will get 25% off (normally 15%) of your Finchat Subscribtion following my affiliate link. This tool is exceptional and a must-have for those wanting to have a time-efficient way of screening and analyzing companies. Finchat has definitely increased my productivity around investing, and made it much easier to keep track of many companies and grasp financials quickly.

Follow this link for Finchat 25% discount: https://finchat.io/?via=olensrud

If, in a long-term buy and hold portfolio, you were only able to invest in ONE company: Constellation, Topicus or Lumine, which would you choose and why?

Fantastic article! One stupid question, how do you get about 35 times 2025 FCF? Looking their 2024 financial statements FCF is 339,3m euros so 499,8m CAD. To compare apples to apples (for minority interest and currency) EV is 14,15b CAD so EV/FCF is little over 28 times with 2024 numbers?