Exor: Discounting Excellent Track-record?

"Buying Exor shares today, is like getting Ferrari shares at a 40% discount, Stellantis for it´s market price of 8x FCF (3y avg) & the rest for free"

In this post, I will cover the family behind the Exor conglomerate, their core positions, a rather generous discount to asset value and their capital allocation priorities going forward. Let´s dive into it

Exor & the Agnelli family

Exor, a family-run conglomerate, best known for its significant ownership stake (22.9%) in the iconic car manufacturer, Ferrari. Led by the Agnelli family, with John Elkann currently serving as the main face, both as CEO of Exor and chairman of Ferrari. Their enduring commitment to the Fiat Group, which Ferrari joined in 1969, reflects a steadfast dedication to long-term ownership and excellence in the automotive industry. Following Ferrari's initial public offering in 2015, the Fiat conglomerate also underwent a transformation through a merger with the PSA group in 2021, forming Stellantis. Despite these changes, Exor still remains the majority owner of both Ferrari and Stellantis (14.2% ownership). Below, you will find financial KPI´s for the two in 2023. Two things to highlight: 1) Ferrari´s impressive pricing power, in a time of high interest rates: 2) Stellantis impressive margins & return on capital employed - much better than the average of the cyclical and competitive auto industry.

Ferrari: €6B revenue , 27% EBIT , 27% ROCE → Shipments +3%, revenue +17% & EPS +36% !!

Stellantis: €189B revenue , EBIT margin 12% (10% 5y) , ROCE 18% 5y

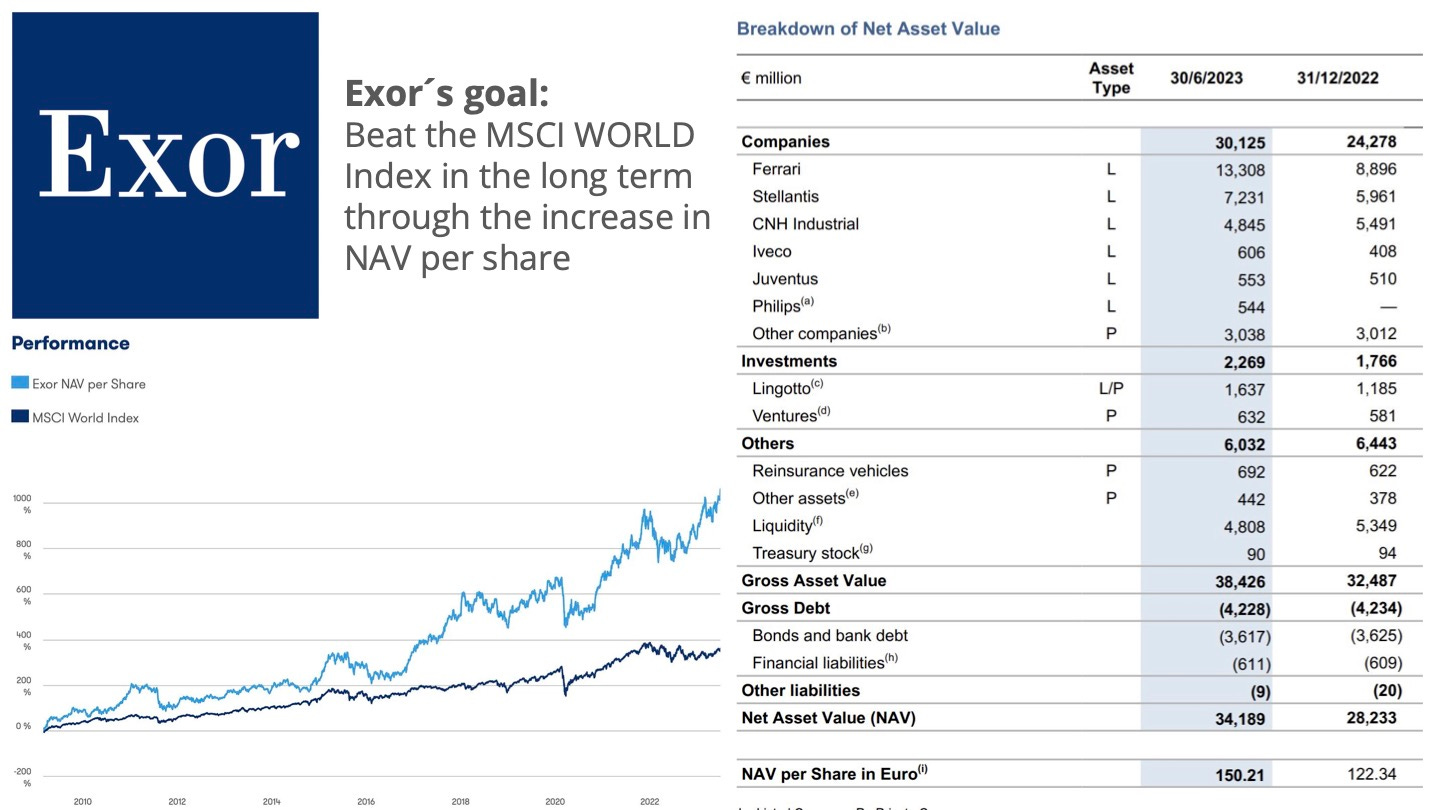

The combined ownership stake of Exor in Ferrari and Stellantis is valued today at €29.7B (€103 share-price), vs the market capitalisation of Exor at €22.9B. This offers investors a significant discount to net asset value (NAV), even when excluding all other companies under the Exor umbrella. More specifically, reported NAV was €150 per share in mid-2023 and has since spiked, driven by robust market performance by the two automotive giants over the last 9 months (Stellantis shares up 63%, Ferrari up 38%).

With Exor having compounded their NAV per share at ~18% per year for two decades, this raises the question: why is Mr. Market undervaluing a family conglomerate with such a stellar track record?

Could the discrepancy between the markets view on the different Exor companies, be the reason for the generous discount? Is owning a top of the food-chain luxury brand, an umbrella of auto brands potentially struggling in the EV transition (more on this later) & a soccer club, to much of a mixed bag? Are their hardware-businesses, such as Stellantis & CNH up for rough years ahead? Maybe they lack competency in software, against rivales more focused on automation technology, such as Tesla and John Deere?

Stellantis, previously referred to as a laggar in the EV transition. Although, they seem to have done a 180 degree turnaround - reaching profitable EV production, a hurdle which has proved enormous for most. CEO, C. Tavares had this to say on their EV strategy recently (Electrek, 20241):

Stellantis’ strategy is very different … from the other competitors from Detroit. We’re keeping full speed on electrification.

We are working very, very hard to bring the profit margins of electrified vehicles to the same level as ICEs. We are not there yet. But we are getting closer.

Even if some of the risks the market sees in Exor would be true - the market should price this risk into the individual stocks. I believe it makes little sense to add a further discount to the holding company because of reasons like this. Anyways, looking at the earnings multiples of Stellantis or CNH - they are not exactly priced for perfection (in contrast to Ferrari). The market seems to price in declining profits in the years ahead.

In total, buying Exor shares today, is like purchasing Ferrari shares at a 40% discount, Stellantis for it´s market price of 8x 3y FCF and getting the rest for free (Phillips, CNH Industrial, Iveco, Juventus FC, The Economist and more).

The path going forward?

As I´ve written about previously on Investor AB, - conglomerates have a unique advantage, something I called the dual reinvestment engine. Importantly, this only works if you own quality companies - those that can reinvest capital at high returns, while providing the conglomerate with a stable dividend income. In Exor´s case, I´d put Stellantis & CNH as “cash-cows”, while Ferrari is the reinvestment engine (27% ROCE, non-cyclical & pricing power). Remember, Exor´s cashflow is dependent on the success of their holdings, meaning, if Stellantis cut their dividend - most Exor cashflows are gone - removing “one of the two engines”. In 2022, Exor received 0.8B in dividends, similar to H1 2023 - meaningful cashflow for a 22B company.

Regarding Stellantis, CNH, and Phillips, the marked price them less optimistic to their counterparts like Tesla, Toyota, BYD, John Deere, Siemens, and J&J. As Ben Graham might have noted, when the market has already priced in a pessimistic scenario, there is substantial room for positive surprises. However, a potential threat lies in the advancement of software, which already augment the value of hardware. Companies like Tesla and John Deere are actively integrating software to enhance their products, potentially gaining self-reinforcing properties or even network effects at scale. Nevertheless, the future performance of Exor shares will likely hinge on three key factors:

How effectively can Elkann & Co allocate capital in the future?

How long can their cash-cows sustain them with dividends, allowing for the dual reinvestment engine.

Narrowing the discount, by improving the quality2 of the Exor portfolio.

Capital Allocation

After looking at their investment focus (picture above), one thing is clear - Exor want to increase the quality of their portfolio. Less cyclical & with structural tailwinds, somewhat contrasting to the industries which the Fiat group has operated in for a century. If succesful, this may help decrease the discount, which have been widening since 2020. Anyways, growing NAV per share, the only factor which can grow indefinitely, will be the key driver of long term performance.

Since selling PartnerRe for ~9B in 2021, Exor have had plenty of capital to allocate. These have gone into a mix of listed companies, ventures, buybacks and strengthening balance sheet. While the PartnerRe investment was a profitable endeavour (6.7B→9B+0.9B dividends in ~5y), the turnaround was quite impressive, buying the company when it was at a 102% combined ratio and selling it in the mid 80´s. With the proceeds from this sale, they have taken significant positions in two more “turnaround situations” in: Koninklijke Phillips (2023) & Clarivate (2024), both within the Healthcare vertical. Both companies with terrible share-price performance over the last 5 years (-40% & -10%). Interestingly, Exor management seem to have an appetite for going heavy in companies disliked by mr. Market. Perhaps not surprising for a long-term oriented steward of capital - with the advantage of not caring much of the short-term. Whether these investments will be succesful or not, time will tell. It seems as a recurring theme, that John Elkann looks more eager to invest outside the auto industry, than his maternal grandfather, Gianni Agnelli.

If I were to invest in Exor shares, which I may in the future, I would nail my investment thesis as simple as possible - potentially only including Ferrari & a couple of the listed companies. Due to the complexity, I would expect to get all the other stuff (including a stake in the famous soccer club Juventus) for free. Interestingly, if all investors thinks along these lines, the conglomerate discount of Exor may always persist. Anyways, buying stuff on sale is seldom a stupid endeavour, which seem to be the case today - making Exor a potential asymmetric investment opportunity. One which Exor management seem to take advantage of themself, by buying up their own shares.

That was it for now - thanks for reading! As always, none of this is financial advice.

Also, I have much more to share on Exor - after spending a year looking into it from time to time. This includes calculations of the underlying earnings power of Exor´s ownership stakes. Give a heads up, if this is of interest to you - you can always find me on X @olensrud. Ciao

https://electrek.co/2024/02/16/this-legacy-automaker-says-it-just-turned-a-profit-on-evs/

A quality company, in my view, embodies stable/expanding margins, a capacity to reinvest capital for high returns, minimal risk of failure, and a lengthy growth trajectory. Although cyclical companies can also be outstanding, their earnings may be more challenging to forecast and subject to greater variability.

I don't know enough about Exor to comment, but the problem with family run businesses such as these is that the family is already wealthy and they use the business as a trust fund to pay themselves an income to cover lavish living expenses. So payment of dividends comes before all other capital allocation, even if that means having to increase borrowing to pay those dividends (which is just plain foolish)

That means that the family's interests are not aligned with outside investors seeking to accumulate wealth in the first place.

European majority family owned businesses are a far cry from those in the US like Berkshire Hathaway.

I welcome your comments and thoughts.