EXOR 2.0

From Ferrari's Prestige to Philips' Turnaround: What Lies Ahead for This Family-Driven Industrial Holding in the Next Decade?

If you are unfamiliar with Exor, I did a writeup on the Italian Conglomerate this spring. While most shy away from the seemingly strange mix of companies, I believe the market may be underestimating this family-run company. Conversely, I am still struggling to wrap my head around this company, also the reason why I wanted to do an update on it. And, why I still to this date, do not own shares of it.

Currently, the market seems to value everything Exor owns—except for Ferrari and Philips—as if it's worth almost nothing. While narrowing this discount could be an attractive opportunity, it's a one-time event. I'm more interested in whether John Elkann and his team can consistently generate high returns from their industrial cash flows. Some might wonder why not simply invest in Ferrari. My reasoning is that the substantial cash Exor can reinvest from its industrial giants is too significant to ignore compared to its market value.

A Troubled Conglomerate Back in 2014

Exor was built on the foundation of the old FIAT group, which today includes Stellantis, CNH Industrial, and Iveco Group. Over the past 15 years, this group has undergone two major restructurings to improve upon the troubled conglomerate it once was. In 2016, the FIAT group split into CNH Industrial and Fiat Chrysler Automotive (FCA). FCA later merged with the PSA group in 2021 to form Stellantis. The significance of Stellantis and CNH Industrial within the Exor portfolio cannot be overstated. Ninety percent of Exor’s cash flow over the last twelve months comes from these giants. However, the market sees little value in these assets, pricing Stellantis at approximately 3x earnings and CNH at about 7x earnings. Furthermore, the market further discounts Exor for owning these companies.

The three strong (CNHI, FCA & Ferrari) global companies that emerged as a result of FIAT SpA’s transformation from a troubled Italian conglomerate, thanks to the unique talent of Sergio Marchionne. The result of this transformation is clear in the combined value of these companies which multiplied nearly seven times between March 1st 2009, when EXOR was created, and December 31st 2016. (Elkann, Annual Report 2016)

From the above statement, it´s obvious the Exor group have been key in splitting up large, but troubled industrial groups, into more focused and well-run businesses. The further merging of FCA with the PSA group, which formed Stellantis in 2021, show impressive results so far. Nonetheless, the market seem to have little faith in the future success of Stellantis & CNH. Nonetheless, Stellantis track-record so far is quite impressive, looking at it´s financials.

From 2016→2020, The FCA group posted EBIT margins between 4→6% and ROIC of 0→6%. Stellantis, on the other hand, have delivered EBIT margins ranging from 10-12% and ROIC of 10-16% since 2021. Ultimately, turning a value-destructive company into one which creates value. And this value, have payed well for Exor management. They have received dividends of €2.2 Billion from Stellantis and CNH, since 2021.

Dividends funding Exor´s new Portfolio

Nonetheless, it seems like CEO John Elkann & Co is trying to diversify away from their cyclical industrial roots. Management highlights three segments they intend to focus on: Luxury, Healthcare & Technology. With Ferrari, standing as the crown jewel of their portfolio as of today. Phillips was a notable acquisition, showing their intention of having a foot within the medical equipment industry. While Phillips have traditionally been a diversified company, similar to the old FIAT group, they have streamlined their portfolio, now focusing 100% on Healthcare. It will be interesting to see how Phillips will develop. If the company could get back to paying a strong dividend, it would certainly be attractive for Exor management, diversifying their cyclical cashflows coming from Stellantis & CNH Industrial.

Before we dive into what the future may look like for Exor - let´s first take a quick glance at how their portfolio has evolved since the Financial Crisis.

Portfolio Changes

Most investors start with a clean slate, but John Elkann didn't have that luxury. Instead, he inherited the family-run conglomerate IFIL, a diverse portfolio of companies spanning various industries with little synergy, much like a miniatyre of the broader economy. The portfolio included a mix of assets, from the pride of Turin's Juventus and the luxury of Ferrari to Case tractors, Iveco trucks, and the paper producer Sequana. It also featured a bunch of well-known auto brands and the newspaper La Stampa. While many of these remain in the portfolio, a few new additions have since joined & some have left, most notably, PartnerRe.

2009 - After the Financial Crisis: 1/10 of Exor Today

Net Asset Value: €3.6B // Shares: 240.87m // NAV per share: €15

From the midst of the financial crisis to today, the Exor group have compounded NAV per share at 17%. While this is calculated from a favourable starting point, it has still massively outperformed their benchmark, MSCI World Index. While the FIAT group had to restructure and cut their dividend during the financial crisis, Exor actually received relatively strong dividends of €177M, €255M and €122M from 2006 to 2009. With the following recovery, Exor stock spiked 93% in 2009, compared to MSCI World index at 38%.

This year, John Elkann also laid out his priorities for allocating capital going forward. Nothing complicated, but sound principles which should stand the test of time.

People. We like outstanding individuals, who have a record of success and who think and act like owners

Financial Results. Strong cash & earnings generation & sound financially

Competetive position. Sustainable competetive advantage over the long term.

Governance. We seek to be directly represented on the Boards of Directors.

Also, I would add one las and indespensable condition: The price must be right.

As with most family-run companies, you will find timely principles which follows their journey, generation after generation. The founder, Senatore Giovanni Agnelli, also left them a timeless vision to execute on, from back in 1899.

Above all we must always look to the future, foresee the future of new inventions, be unafraid of the new, and delete from our vocabulary the word ‘impossible.

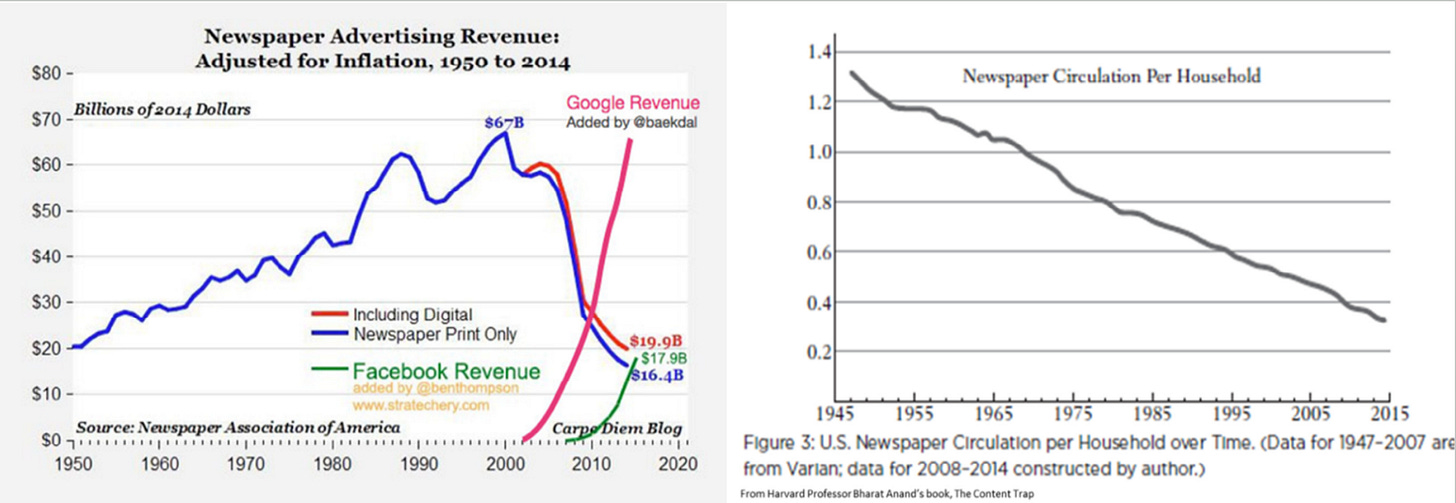

With this principle in mind, may competetive threats within their industrial sector be a reason for the markets discounting their portfolio? Are they behind the curve in innovation? Remember, with a century old conglomerate, it´s no surprise several Exor companies have gotten their business model disrupted before. A prime example coming to mind is La Stampa, the newspaper business which got their revenue model eaten up with the digital transformation, from the likes of Google and Meta.

Nonetheless, La Stampa survived the disruption, and is still within the Exor Portfolio to this day, under the name of GEDI Gruppo Editoriale. However, new clouds may be looming on the horizon, but now for the heart of Exor´s portfolio.

Disrupting the Industrial Giants

The first transition of challenge for the splitted up FIAT group, is the shift from molecules → electrons. This put incredible pressure on traditional manufacturers, both to embrace new technology, but also keep up with newer players entering the field. Also, the traditional business model of selling cars at low margin and selling high-margin service parts, may not be as lucrative in the BEV field (fewer moving parts). To add on top of this, Chinese manufacturers may have established a cost-advantage in battery supply.

Adding these pieces together, there seems to be minimal financial upside for traditional automakers, but plenty of risk. It doesn´t make it easier that some manufacturers use pricing pressure (some even with negative gross margins), to flood the market with their brands.

Looking at recent published data on maintenance costs for vehicle brands, also suggest Stellantis is not exactly in the leading position. I would also note I rarely see Stellantis BEV brands on the roads here in Norway. Time will tell whether Stellantis brands will keep their market share & unit economics (much profits from service parts). My guestimate so far, they got a lot of catching up to do.

Secondly, and potentially a harder transition to play catch-up on, is the merging of software & hardware → Automation. Looking at the some major competitors for the industrial giants within the Exor portfolio, namely John Deere & Tesla, these seem to have gone all in for autonomy, for many years already.

In an attempt to reclaim ground within technology, acquisitions have been a key driver for CNH in particular. Most notable was their acquisition of Raven Industries for $2.1B in 2021, in what Exor management viewed as a bold decision in trying to combine CNH´s manufacturing prowess with agtech and autonomy capabilities.

Nonetheless, if it turns out that the right strategy for solving autonomy involves plentiful training data & AI training capacity - the players who have already invested (cameras + neural nets in cars + training capacity) should have a headstart hard to capture. On the other hand, Stellantis management would know much better than me or any other investor for that sake, how to deal with this. My guess is, they are working heads down on this right now. There is also the potential that manufacturers can lease these solutions if this market proves to be a winner-takes-all market. An interesting observation in the below video of Raven Technology, is the John Deere equipment within the video. I am not sure whether John Deere depends on Raven for their new automation solutions, but could be worth a further look.

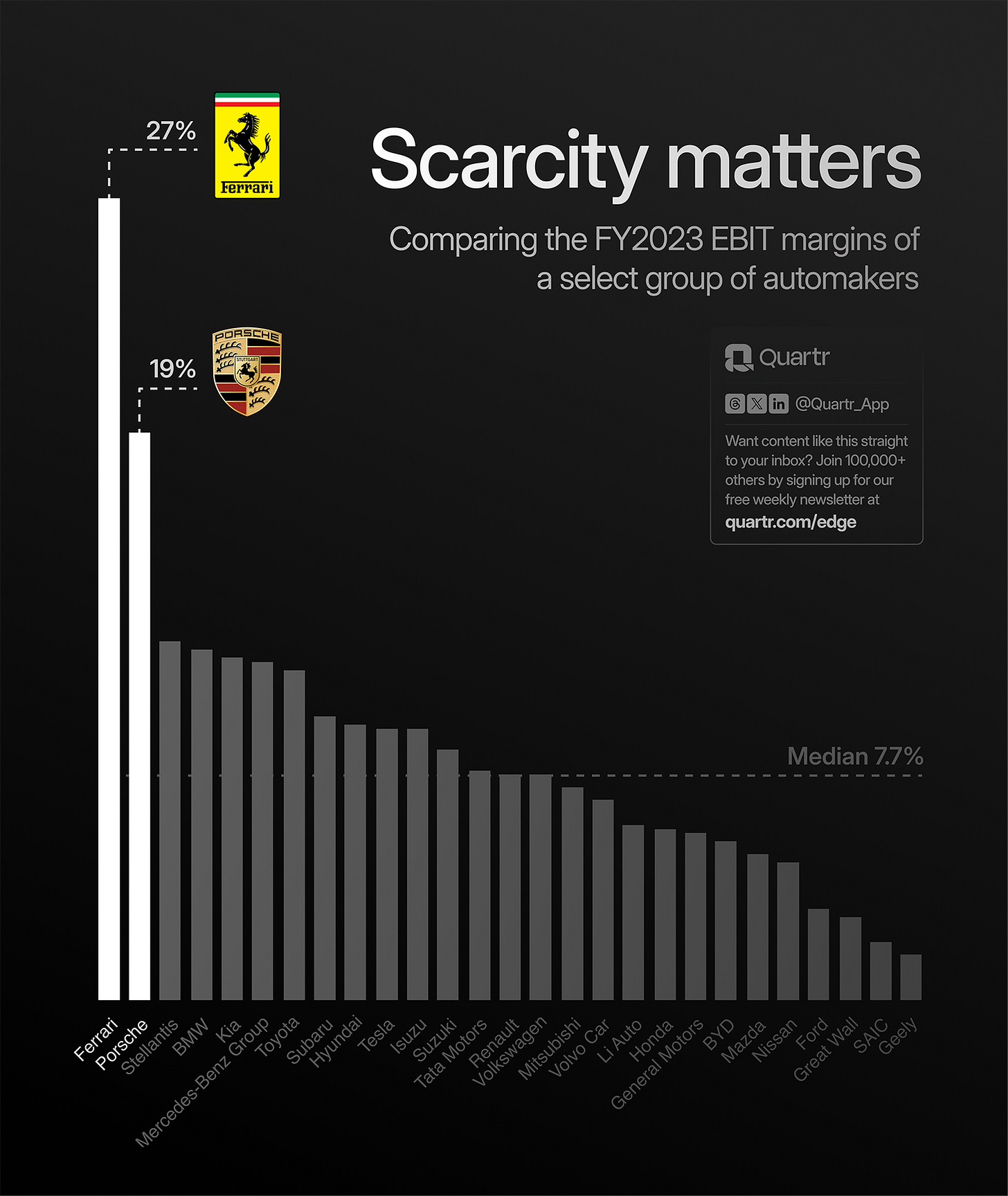

Another noteworthy point for CNH is that John Deere consistently generates 10-15% higher operating margins. In contrast, Stellantis performs better, more on par with Mercedes and Toyota in terms of financial performance. However, the market appears less confident in the industrial giants within Exor's portfolio, as they don't seem to receive the same "premium" valuation that others do.

With all these industrial risks in mind, I think we got a good starting point to understand some of the risks the market prices in. Now, let´s zoom back in to today & take a look at what Exor does with their industrial cashflow. It is certainly not being reinvested into the industrial sector.

2024: Exor Portfolio Today

Exor's two recent acquisitions are Clarivate and Philips. While many praise Exor’s impressive returns from their Philips investment so far, NAV per share is likely ~flat since 2023, due to Stellantis value falling sharply. It's also concerning to see the both the value of the old FIAT group and Juventus fall since 2020 (except Iveco). Despite this, Exor's NAV per share has grown by 12.5% per year since 2020, thanks to diversifying into new areas, the value appreciation of Ferrari and share buybacks.

Currently, the discount to NAV stands at 46%, which is higher than the combined value of their ownership in Stellantis, CNH, Iveco, Juventus, and several other companies combined. Among these other companies, Exor holds part-ownership in notable businesses such as Christian Louboutin, The Economist, Welltec, and Institut Merieux. Essentially, an investor in Exor today could almost view the purchase of Ferrari and Phillips on a standalone basis, and get the rest for free.

Additionally, the industrial side of the portfolio provides Exor management with close to €800M in cashflow. In comparison, Ferrari and Philips alone, have provided Elkann & Co only $75 million in dividends over the last twelve months. Not much to create a dual engine of growth - A powerful driver behind the best holding companies.

Imagining Exor´s Future

Given the market’s uncertainty regarding the future of Stellantis and CNH, we can consider a hypothetical scenario where these companies' net income declines by 30% per year. Conversely, sectors targeted by Exor, such as healthcare (Philips) and luxury automobiles (Ferrari), could grow at 5% and 12% respectively. Assuming an average 40% payout ratio, we can estimate future dividend payments to Exor.

As you can see above, even if the industrial companies' performance declines, the overall portfolio could still generate close to €1 billion per year in dividends. Especially if Elkann & Co can find a couple additional dividend-paying companies to acquire. With regards to Phillips, I was surprised to see the positive estimates for the company in 2024 and 2025. With a target payout ratio of 40-50% of net profit, Philips could yield substantial cash flows for Exor, as outlined above. These calculations do not account for cash flow from private businesses under Exor’s control.

Even with these relatively pessimistic scenarios, the cash flow from the industrials should provide Elkann & Co with the capital needed to reimagine the portfolio. While it is unlikely that the family-run conglomerate would entirely abandon its long-standing industrial roots, their current statements suggest a focus on luxury, healthcare, and technology. With regards to technology, they could also mean they want to help their industrial companies succeed in the technological shifts, such as the potential of automation. Akin to how Exor-owned La Stampa had to reinvent itself to the internet economy.

FERRARI - The Crown Jewel

With Exor’s stock closing at €90 at the time of this writing, the Ferrari stake now represents 87% of Exor's market cap, up from 56% in 2022 and 69% in 2023. While the luxury automaker benefits from the power of scarcity, as highlighted by Quartr, its valuation multiple of 50x earnings makes it somewhat vulnerable to multiple contractions. Nevertheless, with Exor trading at a nearly 50% discount to its NAV, even a 30% stock correction for RACE 0.00%↑ would only reduce the discount back to ~35%.

This suggests that the market isn’t discounting Exor simply because Ferrari looks expensive. Instead, the discount likely stems from Exor’s complex portfolio or skepticism about its industrial holdings.

One could argue it doesn’t make much sense to first discount the individual companies and then further discount the holding company for owning these. The market might also be discounting Exor due to a lack of faith in John Elkann & Co.'s ability to successfully steer the company into new ventures. Ultimately, it has been their Ferrari ownership stake that has driven their NAV growth in recent years.

Despite the market's discounting, Exor’s management seem to do the right things, and are also aggressively buying back shares. With a market cap of approximately €18 billion and yearly dividends received close to €1 billion, management can easily repurchase 4% of shares annually, in addition to funding their ~1% dividend yield. This provides shareholders with an attractive direct yield. Additionally, as Ferrari's weighting in Exor’s portfolio potentially continues to grow—both due to a lack of growth from other parts of the portfolio and the buybacks —it seems unlikely that the discount to NAV will continue to widen.

Ultimately, if you believe Ferrari will perform well, investing in Exor provides exposure to Ferrari, with the added benefit of getting the rest of the portfolio almost for free. Of the €88 price tag on an Exor share today, €77 is equivalent to the value of their Ferrari ownership stake. Below, you will see a graph to illustrate this. Depending on the time you write this, these values may have changed from this writeup.

Conclusion

After revisiting Exor, it appears to be a reasonably attractive opportunity. It seems unlikely that the discount to NAV will widen further, thanks to the strong dividends the conglomerate receives, and the value of Ferrari. As illustrated in the graph above, the blue line (NAV) and red columns (Ferrari) indicate potential support for further widening of the discount, especially the Ferrari value. However, management needs to create a portfolio that investors want to own. Currently, Exor's reliance on dividends from their industrial holdings to fund their expansion into sectors like healthcare and potentially technology makes it challenging to understand.

Exor’s transition to reporting as an investment entity in 2024, could make it easier for investors to understand their underlying earnings, potentially helping to reduce the discount.

In my opinion, the ideal situation would be to see Exor management able to put CNH & Stellantis up against the technology leaders within their industry. If these can continue to provide Exor with cashflow, instead of falling behind (as the multiples suggest), they could continue to drive shareholder value for several decades.

With regards to this comes the first major risk I find with Exor: Stellantis and CNH needing to cut their dividends in order to reinvest in itself (battery + autonomy). And secondly, a potential multiple contraction or missteps by Ferrari, would also remove the argument of (almost) buying Ferrari & getting the rest for free.

Nevertheless, the continued increase in NAV per share should lead to higher cash flows for Exor - and should be a leading indicator for the shareprice, even if the discounts stay the same. If they can allocate capital wisely, as they have demonstrated in some instances, today’s price point seems quite attractive.

For my own investment journey, I am placing Exor in the "too hard" pile for now. I already own another conglomerate, in Investor AB. With the Swedish conglomerate being my main position by a large margin. I see two key advantages in Investor AB’s portfolio. First, they receive dividends from a wider span of companies, most with leading market positions. As most of these are also not that cyclical, it is relatively straight forward to value the company, based on the underlying earnings power of all the companies. While this can be timeconsuming, you can see several posts of this on my X profile.

Second, Exor´s portfolio seems much less settled. While Investor also targets key sectors to invest in, namely healthcare, technology and industry, they don´t diversify away from their core (industry), like Exor does. The industrial sector is in the core of Investors portfolio, with giants like Atlas Copco, ABB, Epiroc & Saab.

While both portfolios contain “market laggards” (eg. Juventus, Electrolux, Husqvarna), these have ultimately shrinked to low percentages of the portfolio. As a result, investors may do wise just do exclude these from their calculations, and focus on what truly drives NAV & earnings power of the conglomerate. I would actually applaud management of these family-run conglomerates for staying the course with their laggards within the portfolio. Not all management teams of today, are this long-term focused in their ownerships (and a bit stubborn to). You could argue this trait makes them a “preferred buyer”, as it provides a company with a stable owner, willing to stay the course.

Thirdly, I find it hard to understand Exor´s return on incremental invested capital. Investor is much simpler. Much of their cashflow is reinvested organically into the Patricia Industries field (wholly-owned), with seemingly exceptional performance. It seems like Exor´s ROIIC, is more dependent on succesful one-off investments, similar to that with Phillips. With the track-record of Exor having done so succesfully, providing market-beating NAV / share growth - they may continue to do so succesfully.

For me to consider Exor further, I would need a clearer understanding of the types of companies they aim to own and what returns they are able to achieve with their industrial cashflows. How will the portfolio look in the future, and how will Stellantis and CNH cope with competitors embracing software-defined vehicles & heavy machinery?

While I applaud the purchase of Philips (so far), investing in turnaround plays may also be a difficult strategy to replicate consistently with high returns on capital. Ultimately, the discount looks tempting for any investor seeking value. Also, John Elkann seems like a great man at the helm. After listening to many quarterly calls, there seems to be a bunch of great people there. I can also recommend Nicolai Tangen´s interview with John Elkann. Lastly, I would never bet against the crown jewel itself, Ferrari. A company worthy of it´s own writeup, one which will likely continue to drive up the Asset Value of this conglomerate, potentially all by itself.

verry interesting read!