NEKKAR

The (good) Leftovers of an Industrial Giant

Six months after the Scandinavian Industrial Compounder Comparison, it’s time to highlight a standout niche player from Norway’s marine industry: Nekkar ASA.

Nekkar excelled in the rankings, with a compelling quantitative profile, driven by high returns on capital, double-digit growth, and a single-digit EV/EBIT multiple.

Anyways, before diving deeper, let’s first revisit a niche dominance playbook I called out in the Industrial Compounder writeup, from an Industrial American giant - Ametek.

Ametek's portfolio of niche businesses benefits from exceptional and resilient unit economics, largely due to their leadership positions—ranked first or second—in highly specialized markets. This dominance is bolstered by unique technological know-how and expertise that serve essential functions for their clients. Since Ametek’s products are highly technical and often crucial to the end product, yet low in cost relative to it, they enjoy pricing power and lasting customer relationships.

Additionally, due to the niche focus of their markets, they operate with less risk of larger competitors entering the field. Norbit, another Norwegian company excelling in the previous rankings, has underscored this several times, noting that better capitalized players (such as Huawei) are unlikely to allocate resources to their specialized markets, simply because they are to niche. You can find a great writeup on Norbit, from

, following this link.With Ametek´s playbook and the attractive nature of the niche industrial field in the back-of-our mind, let’s turn back to Nekkar’s own journey.

History of Nekkar - The Leftovers

Nekkar is more or less the reminders of what was previously called TTS group, a company founded back in 1966. From TTS´s early innings, their purpose was clear:

Enable heavier lifts, faster turnaround in ports and safer and more efficient operations for anyone involved in running the intricate systems of seaborne trade, travel and industry. (2015 Annual Report)

TTS started out as a small crane manufacturer in 1966. From here, they gradually expanded through strategic partnerships and acquisitions. Quickly summarized, they spent decades to become a global industrial giant, serving multiple marine segments. Part of this “broadening of the offering” strategy came from acquisitions, also enabling them to build out a global service network to support its extensive installed equipment base across many verticals.

With the massive expansion of the maritime market, boosted by offshore industries and global trade - TTS Group captured their share of this growing pie. However, as with so many growing empires before it, results does not always improve with scale. To illustrate the poor performance, revenues decreased by 14% from 2011 → 2015 and EBIT margins were 1,3% on average. The results further declined until 2017, when the board, some of which still serves, decided to restructure the group.

To my best understanding, it looks like what initially was industries with attractive unit economics and massive growth potential, attracted so many new entrants, that competetive pressures diluted the margin profiles for all involved, especially so during down-cycles. I may be unaware of other factors playing their role here.

This underscores the importance of targeting sectors where competitive advantages can be developed or sustained. Exemplified by Atlas Copco in 1948, when they abandoned diesel engine production to concentrate on specialized technical niches, a decision central to its long-term success.

Given these details, you may not be surprised to see the poor shareprice performance of Nekkar (TTS Group) since the listing on the Oslo Stock Exchange in the 1990´s.

Though I’d typically avoid companies with this track record, I think what remains here deserves a closer look.

First, this graph would look much better if dividends were included, as the major divestitures have been substiantial to investors returns. An interesting sidenote here, is that these dividends have been non-recurring. This makes Nekkar somewhat un-Scandinavian, with management prioritizing normal capital returns through buybacks rather than dividends. I know several Norwegian Investors who would shy Nekkar, due to this factor alone.

Secondly, Nekkar of today looks nothing like it did back then. More specifically, more or less all of the company´s revenue sources in 2014 is not within the company today. The only remaining division of TTS Group´s 6 division, is the Shipyard Solution, better known under the Syncrolift name today. Additionally, a good chunk of this division was also acquired from Rolls Royce in 2015 - making the Nekkar of today nothing like it was back then. The great quantitative score Nekkar received in the Industrial sector writeup confirms this, with the leftovers scoring similar as the best industrials.

On the other hand, a devils advocate could argue that the favourable developments may also just reflect favourable times, and that margins could revert back down. Anyways, let´s dive deeper to see what the leftovers of this industrial giant consist of.

The Restructuring - From TTS → Nekkar

In summary, 3 events stand out as integral to forming the Nekkar we know today.

2015: Acquisition of Syncrolift from Rolls Royce - source

2018: Selling all its assets, excluding Syncrolift, to MacGregor - source

2019: Renaming to Nekkar, with Syncrolift at the core

The Shipyard solutions primarily serves the purpose of enabling safe and efficient moving of ships from water to land. A very technical and potentially risky process when dealing with objects weighing up to and above 30 000 tons! But more importantly, a (relatively) niche (and technical) market with few players.

I have never seen a business divest so much of it´s core before. Likely controversial at the time, but the results since (below) speak for themselves. Nothing below screams poor quality as the financials of TTS back in 2015. Strong (and improving) margins, growing sales and good visibility in terms of the order book.

While this is not the only part of Nekkar, it is definitely the most important.

The Shipyard Offering

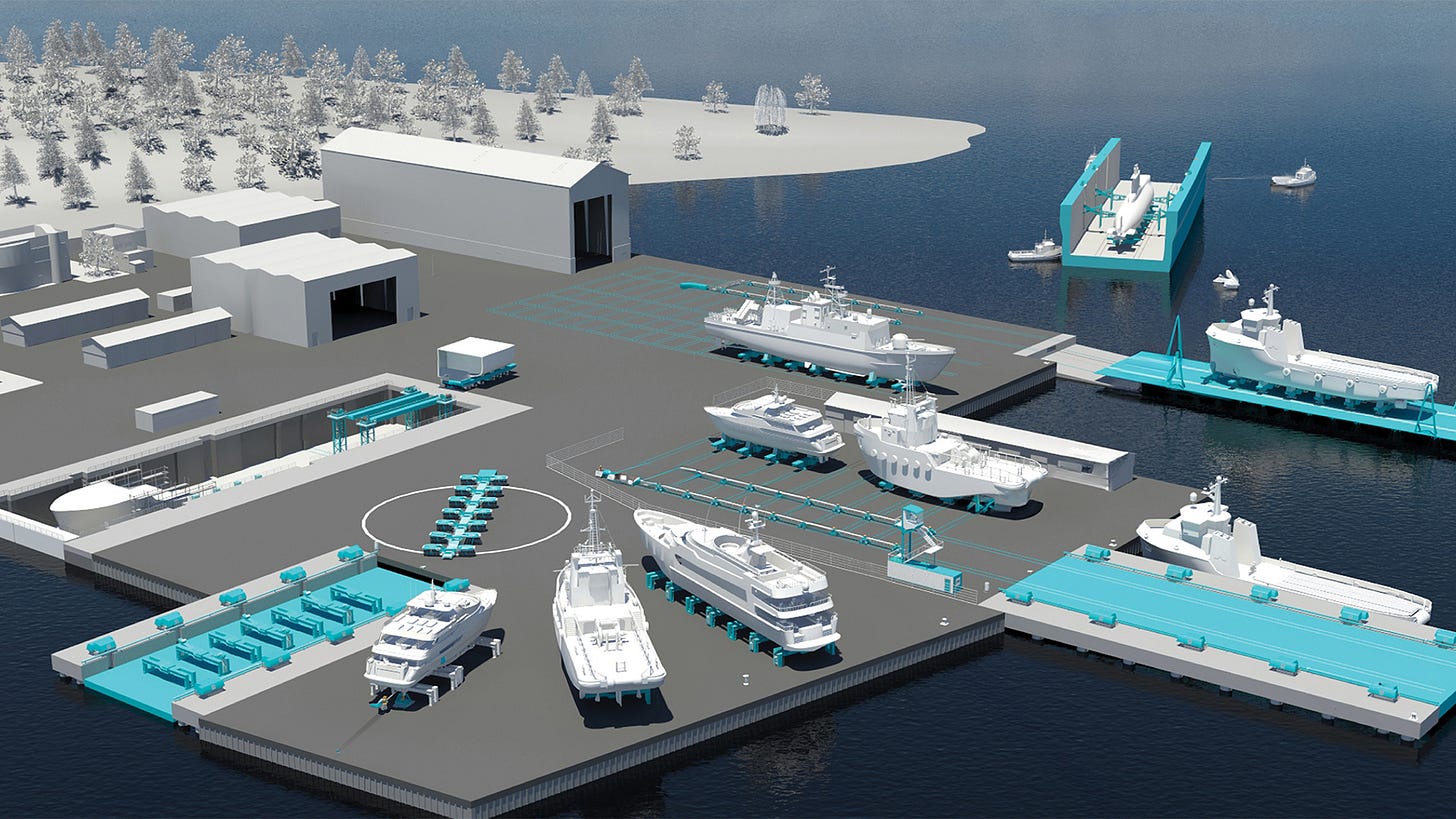

Modern dry docks known as "ship lifts" also known as syncrolift system are equipped with platforms that can raise and lower a vessel straight up and down.

Looking at the picture above, Syncrolift´s product portfolio comprises multiple components for moving these ships around. Their products serve over 280 shipyards worldwide - enabling flexible, efficient and safe lifting and launching of ships.

Although most revenue comes during installation, they are increasing the share of service and upgrade revenues. A great sign, given their large and growing installed base. While I would not put money that this business could become something like the elevator giants like Kone or Otis, I think the Finchat highlight below, should intrigue many: Net cash, low teens earnings multiple, decent margins and high returns on capital. Additionally, revenue per share has compounded by 13% since 2015.

As previously mentioned, Nekkar extends beyond Syncrolift. Though, Syncrolift currently drives 89% of sales and the majority of profits. With this in mind, I rather assess Syncrolift on a standalone basis and view any future contributions from Nekkar's other ventures as potential upside. For now, these additional segments detract from the group’s EBITDA margin and they need more time to prove themselves. An update on these other businesses may be warranted in a year or two.

Syncrolift - The Market Leader

Having delivered 19 of the 20 highest capacity operational shiplifts worldwide, Syncrolift definitely holds a leading market position. Redeye highlighted in their July 2024 Report that Syncrolift likely commands a 60% market share in shiplifts and 70% in transfer systems over the last decade.

However, one competitor not appearing on this list definitely stands out - Pearlson Shiplift Corporation.

At first glance, one may assume Pearlson’s focus seems limited to smaller-capacity shipyards, reflected by the relatively few installations shown in the report’s charts. However, with Pearlson recently having secured 12 large orders, including four in the superyacht repair sector and two large shiplifts for the U.S. Navy, is there another tail to this story?

The Pearlson Family´s Revenge?

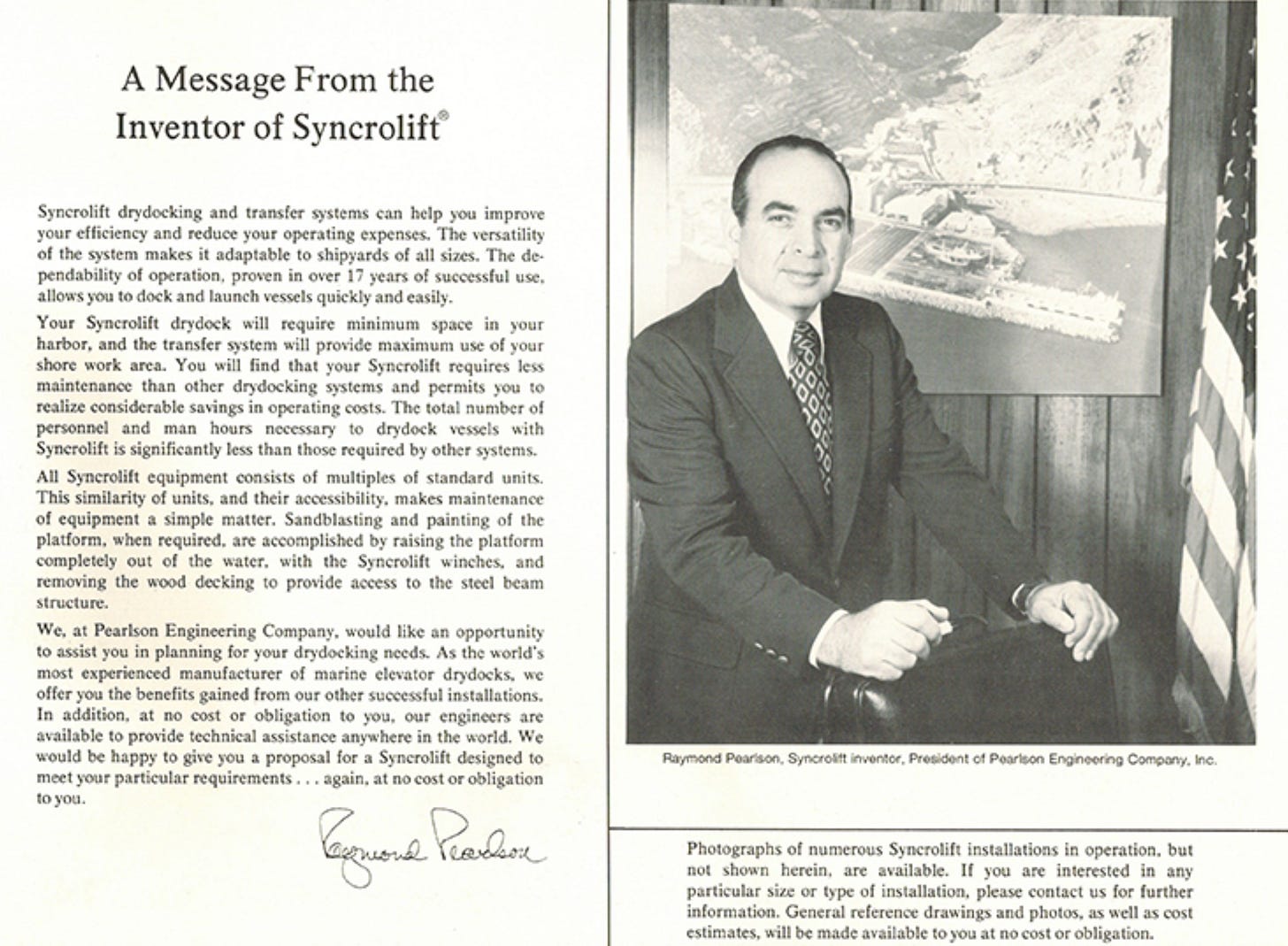

Most of the shiplifts you saw above (notice year column) has actually been installed by the family name behind the Shiplift itself - the Pearlson´s. To comprehend the competetive dynamics going on within the Shiplift business, we need a closer look into the family which started it all.

Remember that Nekkar (TTS then) bought the Syncrolift business from Rolls Royce back in 2015? Guess who invented the Syncrolift brand and technology originally?

Raymond Pearlson, the same man who started Pearlson Engineering Company (PECO). However, he sold the family business to NEI in 1979, which later got acquired by Rolls Royce in 1989. Some of the same patent and market position enabling Syncrolift to deliver the profits they do today. However, there is another tail to this story as well.

After Rolls Royce acquired Syncrolift in 1989, the grandson of Raymond, Douglas Pearlson, who served as the President of PECO, went another way. He co-founded Pearlson & Pearlson Inc., a shipyard consultancy specializing in dry-docking and transfer systems. But what he was about to do 2 decades later, would prove much more vital, trying to re-capture the family´s legacy in the Shiplift business.

In 2008, after Rolls Royce closed the Miami Shiplift Headquarters, Douglas saw his opportunity and recruited the engineers left there and established Pearlson Shiplift Corporation. His daughter, Kelly Pearlson, also joined and is now VP and has overseen most of the new shiplift builds, among these several projects delivered to the US Navy. And her grandfather, the original architect of the Syncrolift technology, Raymond, still lives to this day, now 98 years of age.

The Family Legacy has definitely been Re-Born.

Never bet against Family Operators

A July 2023 Instagram update on Pearlson´s order backlog, gave us hints to an order backlog of above $200M. Compare this to Syncrolift´s $80M at the same time, and potential cracks to their market dominance start to appear. Especially, when Pearlson also having secured contracts for the 4 largest shiplifts in the world since. With Redeye estimating market share split at roughly 60% for Syncrolift and 30% for Pearlson, tides may be shifting within this tightly contested duopolistic industry.

While unit economics within Duopoly industries often remain favourable for both parties and may do se here, the dynamics gets more challenging to asess if the leader gradually lose market share to the other player. While it´s hard to conclude whether this will continue, partly due to Pearlson being private, recent years tender wins, should suggest it is definitely a major risk to watch.

Let’s flip the coin and examine the other side - Syncrolift´s advantage.

Syncrolift´s Advantage

Time is a valuable resource, especially in busy ports or those serving purposes for the military. Another important trait is safety and accuracy.

Syncrolift is highly or mostly admired because of their remarkable accuracy and adaptability, which provide the exact positioning and high-precision maintenance of ships (Alobudi, 2023, p. 45.)

Azagala Capital, a shareholder of Nekkar for multiple years, have presented more on Syncrolift´s competetive advantage. They, similar to management (video), highlights the Rigid Platform enabling safer shiplifts, compared to an Articulated one, since they can withstand multiple wire ropes breaking. Azagala also stated that Pearlson does not have similar technology.

However, as with any competetive advantage, especially when it is a patented solution - I would highlight some wise words from a well-known innovator.

“The only true competetive advantage is pace of innovation”

With the Pearlson family definitely having plentiful experience in this sector, arguably much more than the employees at Syncrolift today (remember, many of the 19 largest shiplifts Syncrolift delivered, happened under the Pearlson family´s leadership). And with them able to re-capture market share as of recent years, with an arguably much stronger backlog today - Time will tell whether Syncrolift´s Moat will endure.

Additionally, an interesting observation from my point of view, is that Nekkar´s focus seems to primarily be diversifying their group, rather than protecting or improving their main business. Maybe my gut instinct is wrong, and Rolf Atle Thomassen, Manager of Syncrolift, & Co has everything under control.

Comprehensive Solutions & Service

Another potential competetive advantage, is that Syncrolift can offer most of the needs a shipyard needs to move boats. An aggressive innovation approach and tuck-in acquisitions, like one from Rolls Royce back in 2015, means they now have a product portfolio hard to replicate. Among these, are Propeller Pullers, Thruster Handlers, Side Bilge, Tail Support Arms, Flex Pads, automated Vessel Inhaul & Positioning Systems and Auto Block Guiding Systems*. Innovations and products aimed to reduce man-hours, improve safety and docking times.

Global Service Support may be another competetive advantage, with service offices in Norway, Dubai, Miami, Singapore, Mumbai and Perth. At least a barrier to entry for new entrants, since Pearlson also serves docks around the globe.

Another potential advantage, could be switching costs for current shipyards considering upgrades, given that most of the docking employees are likely to already have been trained within the in-house Syncrolift Academy.

Overall, there is no doubt than Syncrolift has a strong competetive position.

Financials Overview

Syncrolift generates revenue through maintenance services, upgrades, and modernization of drive and control units. With an order backlog slightly exceeding the last twelve months of revenue, the company enjoys strong visibility. Historically, orders for new builds have been cyclical, but factors such as increased NATO defense spending provide long-term tailwinds. Additionally, the proportion of service revenue from its installed base has grown steadily, now reaching NOK 90 million, or 18% of total revenue.

Profit after tax from 2021 to 2023 was NOK 119 million, NOK 62 million, and NOK 109 million, respectively, reflecting the cyclical nature of project deliveries. As of Q3 2024, revenue has declined by 9% year-over-year, mirroring a similar decline in the order backlog. The other parts of Nekkar contributes to revenues, but less so to the profits.

Order Backlog & Tender Pipeline (Q3 2023 vs. Q3 2024)

The tender pipeline for Syncrolift has grown to NOK 4.5 billion, up from NOK 3.7 billion in the same quarter last year. Syncrolift holds an impressive ~60-70% market share, though its ability to maintain this for the upcoming tenders, remains to be seen. However, increased naval investments should drive demand, especially given Syncrolift’s dominant 90% market share in submarine shiplifts and its status as the sole provider of systems for nuclear submarines. Another positive, is their broad product portfolio - enabling them to take on any type of project, if they can win it.

Return on Capital

Syncrolift, which constitutes the majority of Nekkar’s operations, delivers robust returns on invested capital (ROIC). For the Nekkar group as a whole, this averages 24% over the past five years, which likely would be much higher if excluding the others. However, sustaining high returns depends on opportunities to reinvest capital effectively. Management clearly views Syncrolift as a mature business, prioritizing new ventures for capital deployment, such as the recent acquisition of Globetech.

Globetech Integration

Globetech specializes in IT systems for ships, providing hardware, custom networks, satellite connectivity, and cybersecurity solutions. It boasts EBITDA margins above 20%, making it one of Nekkar’s most profitable ventures. With expected EBITDA of NOK 15 million in 2024 (up from NOK 11 million in 2023), Globetech will contribute 10-15% to the group’s EBITDA, based on Nekkar’s 67% ownership today.

Globetech’s revenues are less cyclical (50% repeat) than Syncrolift’s, enhancing Nekkar’s overall stability and quality. Whether significant synergies emerge remains to be seen, but Globetech’s client base of approximately 170 vessels presents potential opportunities. The transaction is two-staged, meaning that from 2027, Nekkar ASA will own 100%. The implied EV/EBITDA for the first stage stands at 7,7x EBITDA (64M cash + 15M treasury shares), with over a decade of profitable growth.

Valuation

Previous readers will be aware that I do like holding companies. However, this is only true if the total portfolio is attractive to own. The best example is Investor, who have the ideal combination of stabile and diversified profit streams, combined with attractive opportunities to redeploy capital at high returns, in sectors they already have market leadership in. In contrast, this was the main struggle highlighted in my writeups of the Italian conglomerate, Exor. My favourite approach in those cases, would be to value what seems high quality and “get the rest for free”. In Exor´s case that would be Ferrari, and for Nekkar, that would be Syncrolift.

The quality in Nekkar´s portfolio is definitely Syncrolift, and perhaps Globetech now. The 39% ownership stake in Fiizk may be interesting. For Intellilift and (especially) Techano Oceanlift, I would like to see a longer track-record of execution before considering these.

My favourite approach for valuation is to see what the market implies. Let´s see how much profits the main parts of Nekkar contains, and what the market values these at.

As of 29.nov 2024:

Market Cap: 991M NOK

Net Cash (debt): 143M NOK

Syncrolift:

Revenue LTM: ~500M NOK

Avg EBITDA margin 3y: ~22%

Profit after tax 2023: 109M NOK

Globetech:

Revenue LTM: ~75M NOK

Avg EBITDA margin: ~20%

Nekkar stake:: 67% = 10M NOK

With only these two in mind, excluding the holding expenses and less profitable ventures, these pieces should generate >100M of EBITDA. With an enterprise value of ~850M, the multiple to EBITDA does not seem very high.

Redeye has estimates the total group lands at 86M EBITDA in 2024, 122M in 2025 and 167M in 2026, and margins for the holding moving closer to those of Syncrolift. With these estimates in mind, it may not come as a surprise that Redeye has a price target of 16 NOK, up ~80% from todays price at 9,8 NOK. Especially with what could be a low single digit earnings multiple just a year out.

In summary, the company currently trades at approximately 9x EV/EBITDA for 2024, and closer to 11x Earnings. Free Cashflows are more cyclical, but looks to be quite much lower than Net Income historically, mostly due to investments in working capital and capex. Until now, Nekkar seem to prioritize organic reinvestments, acquisitions and buybacks, in that order. Their balance sheet is very strong, which should enable them to return capital to shareholders in the years to come, dependent on results, but also their reinvestment opportunities.

Conclusion

Nekkar's history reveals a fascinating narrative of niche industrial leadership. Companies in these specialized sectors often achieve superior unit economics and higher returns on capital compared to broader industrial segments, such as those once served by TTS Group. While Nekkar appears potentially undervalued, two concerns stand out for myself:

Strategic Direction:

"Broadening our revenue base" is a strategy that gives me pause. Especially so, with the poor track-record of doing so pre 2018. Syncrolift is clearly the cash cow, but the company’s focus on new ventures makes it difficult to evaluate the return on incrementally invested capital (ROIIC). The limited financial data on these new ventures adds to the uncertainty. I am also unsure to what extent management is excellent capital allocators. Maybe in a year or two, it will be easier to assess the capital allocation skills of management.

Market Leadership and Growth Projections:

Redeye projects a doubling of EBITDA in two years, but I’m less confident. This stems from a differing perspective on Syncrolift’s market leadership. While Redeye suggests that Pearlson is less innovative and technologically advanced—highlighting Syncrolift’s safer, more advanced articulated platform and superior control systems.

On the technological side, the key difference is that Pearlson uses an articulated platform which is a less safe alternative than the technology currently used by Syncrolift. Moreover, we see that Pearlson is less forward-leaning when it comes to technology and innovations. This includes its offering for transfer systems as well as control and safety systems.

Redeye may be completely right here, but I struggle to arrive at the same conclusion. Partly, because Pearlson is privately held, making it difficult to assess its performance and capabilities. Non-existent expertise in shiplifts (for myself) doesn´t help either.

Further, Pearlson’s recent success in securing significant contracts suggests its technology may not be as inferior as portrayed. My positive bias toward family-owned businesses, such as Pearlson, adds another layer of doubt, given their legacy and family operators behind the wheel - clearly wanting to recapture the family legacy.

Final Thoughts

For now, Nekkar falls into the “too hard” pile for my own investment journey. Despite its (potentially) attractive valuation and strong track record since the divestitures, the uncertainties surrounding its strategy and competitive positioning keep me from fully committing. However, I’ll be watching closely.

If the company continues to execute well, particularly in balancing new ventures with Syncrolift’s cash generation and securing future orders at similar margins, it could be a compelling opportunity. Syncrolift definitely contains many of the traits Ametek desires, highlighting what niche quality can look like.

As always, none of this is financial advice - due your own due diligence.