Nordic Industrials - 2025 Edition

Fourteen months ago, we explored top opportunities within the Nordic Industrial Compounder space. Since then, we've learned a few lessons, and now return with an updated list.

Of the names highlighted last year, only Norbit remains a direct holding in our portfolio. Their execution has far exceeded expectations — and the stock is up over 200% since that write-up. It’s now our third-largest position, behind Topicus and Investor AB (which notably owns Atlas Copco, Epiroc, and indirectly OEM International, all featured both this and last year).

Many of last years 22 companies featured have dropped off this year, many due to cyclicality. Cyclicality is tough, especially when operating leverage often works in reverse (a 10% decline in sales can lead to a much steeper drop in profits). NCAB group is one example of this. Margins are reverting back to long-term average.

Growth also seem to have slowed for most, as shown in today’s earnings release from the usually wonderful Lifco, which reported just 0.5% organic growth, and decline in EBITA. Still, the long-term thesis is likely still in play, but a 33x forward EV / EBIT after today’s drop (22x 10y average), means even wonderful stocks like Lifco may need time for their business to catch up from time to time.

Today, with higher interest rates and slower growth, it's also a tougher environment for many industrials, amplified by slow-growing economies in Europe.

Anyways, we still see Scandinavian Industrials as a great fishing pond for long-term investments. The purpose of this Sector Writeup isn’t necessarily to find brand new ideas, but to map out the landscape and highlight companies that may be worth a closer look. A similar exercise in 2023 led us to find and invest in Norbit. To illustrate the appeal at the time, the niche Industrial was priced at single-digit EV/EBIT multiples, despite growing double-digit and posting above 20% ROCE.

These writeups help keep us sharp. They push us to look beyond our current holdings and study peers with different models — some with better fundamentals or more attractive valuations. Sometimes, they even make us revisit our own positions and ask: Is this still worth holding?

I hope this overview proves both valuable and enjoyable for you. It was definitely a pleasure to put together.

Disclaimer at the bottom.

The Strength of the Nordic Industrial Playbook

Many of the Nordic Industrials here enjoy durable local moats and (some) are demonstrating their ability to scale and compete globally. Foreign competition may sometimes avoid the Scandinavian market, likely due to it’s little size, language barriers & local preferences. But for investors seeking durable compounders, local dominance here isn’t enough. They must win abroad too.

Take Medistim: a small Norwegian Industrial Technology firm that quietly leads in heart surgery rooms worldwide. With most sales coming from outside Norway and a razor-and-blade model, it’s a textbook example of a niche global compounder. We covered this idea in the 2024 Letter.

Norbit is another. A key growth driver today is its expanding leadership in niche segments of underwater mapping, also boosted as the industry transitions from manned to unmanned operations. Where a single crewed vessel once conducted seabed surveys, (several) autonomous drones now handle the task—each requiring its own suite of advanced sonar and sensor systems. This structural shift significantly increases demand for Norbit’s compact, high-performance sonar technology, especially in defense, offshore wind, and marine research applications.

Similarly, in its Intelligent Traffic Systems (ITS) segment, Norbit is capitalizing on the accelerating rollout of European Electronic Toll Services (EETS). The company is increasing its R&D investments to further develop hybrid tolling solutions that integrate GNSS (satellite-based) and DSRC (sensor-based) technologies. These efforts position Norbit to meet growing demand for interoperable toll systems, which helps logistic companies deal with less invoices and friction crossing borders, and strengthens long-term partnerships with leading providers such as Toll4Europe.

Similar, or completely different dynamics underpin many industrial success stories. Behind nearly every efficiency gain, automation trend, or technological leap, there’s often mission-critical components quietly enabling the outcome, many of which also with recurring sales. The best industrials—like Atlas Copco—repeatedly identify such niches and build dominant positions within them, or acquire their way into them.

The illustration below shows how industrials like Atlas & ABB is even part of the backbone enabling the advance of the Cloud & Artifical Intelligence.

A further benefit with this fishing pond (unlike most other technology), is the absence of extreme equity-based compensation, daily news coverage, fancy presentations & poor reinvestments of capital (in many instances).

While many see Industrials as boring, we see them as a goldmine—especially Industrial Technology. For us, these type of ideas are easy to sleep well with at night.

Let’s take a look at how last years list has done, and more so, update it!

2024 List → +19% return in 1 year

Despite the solid return of the 22 companies within last years screen, returns would only average +1% if excluding 3 Norwegians — Norbit, Kongsberg Gruppen and Kitron. All of which benefiting from a ramp-up in European defence spending.

On average, multiple expansion drove the bulk of returns — with the average EV/EBIT rising from 19x to 25x. While we don’t believe there’s meaningful alpha in simply screening for surface-level financial metrics, tools like Fiscla.ai can serve as effective starting points for idea generation.

From last year’s list, two companies stood out for further research for our investment journey: AQ Group and OEM International. Both having delivered solid returns so far (27% and 16%, respectively), though we did not participate in those gains.

A similar screen in 2023 was what made us aware of Norbit in the first place, well before the broader market caught on. That same process also surfaced Lifco that year — a business that met all our quality filters: high returns on capital, disciplined reinvestment, aligned ownership, and a reasonable valuation (at that point in time).

We missed one of them. The lesson is clear — when a company combines quality with a fair price, it's usually worth taking the bet. Today, valuations may be less forgiving, but the framework remains the same.

UPDATED LIST

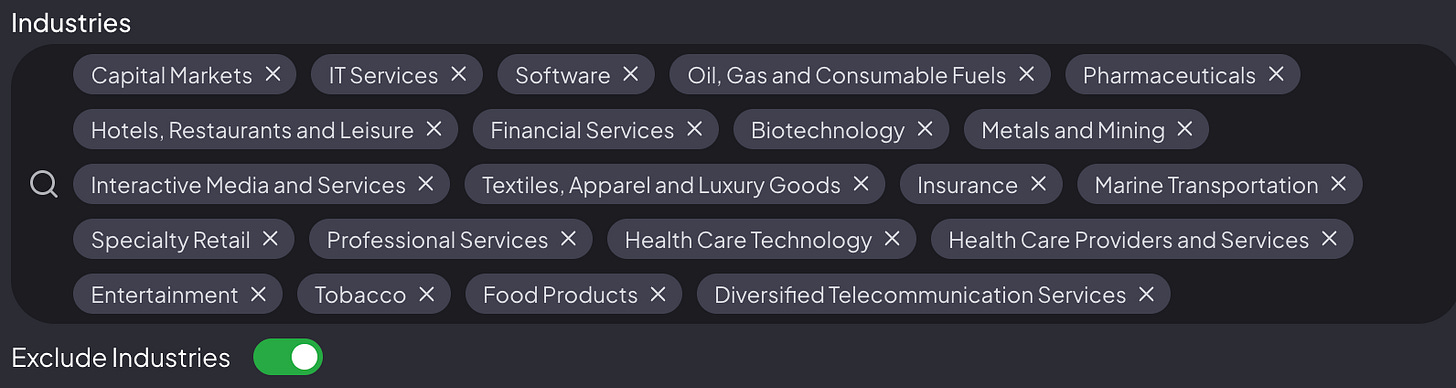

Now it's time to update the list. Like last year, we use Fiscal.ai to screen and narrow the universe down to 40 companies (more than last year). We excluded certain industries (image) and applied the following filters, based on five-year average figures:

Less than 3% yearly dilution

Return on capital employed (ROCE) above 12%

Operating margin above 10%

Revenue growth above 7%

Why these exclusion criteria’s you may ask? Because we want to avoid spending time on bad businesses. Betting on existing winners seems to be a better risk / reward.

You get a 15% discount off Fiscal.ai using this link: https://fiscal.ai/?via=olensrud

2025 Screen — Scandinavian Industrial Compounders

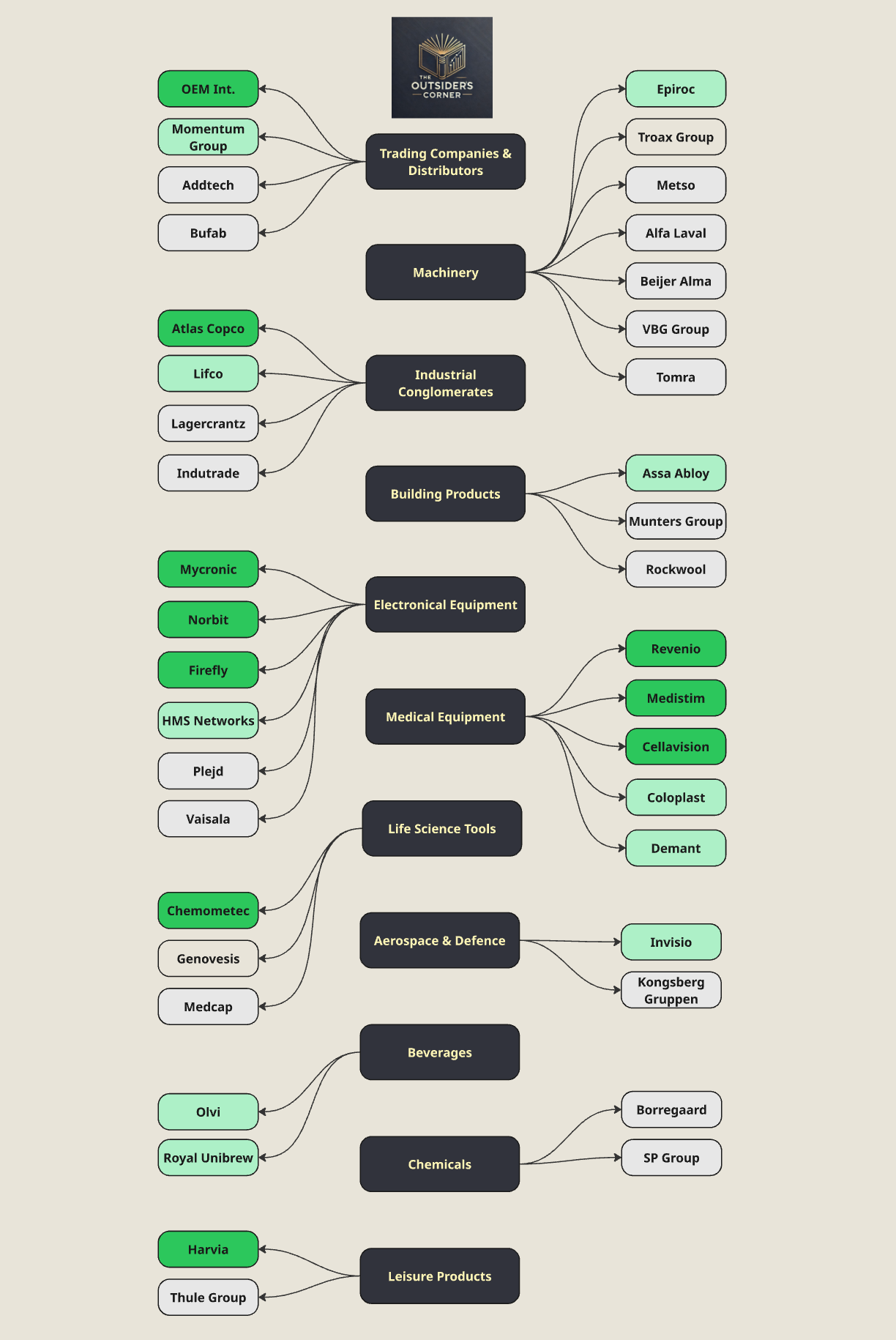

Our new list includes 40 companies: 24 from Sweden, 6 from Denmark, 5 from Finland, and 5 from Norway. You could argue that some of these aren’t technically Industrials, but I go with a simple rule: they mostly make and sell physical products. And the point of screening is not to be precise, but rather directionally right and narrow the universe.

Below, you can see the field categorized by Industries.

The colour coding you may ask? That’s who ranked the best on the critera’s measured. Dark green is top 10, light green is 10-20, and grey is nr. 20 - 40.

Important Caviat

The companies are grouped by industry, but metrics must be interpreted in context. Trading Companies & Distributors typically operate with lower gross margins (often below 40%), not because of weak performance, but due to their role as resellers of third-party products. This can make high-quality compounders like Addtech, Indutrade, and Bufab appear less impressive at first glance, thus receiving a lower score than others manufacturing more proprietary products.

These trading companies also tend to trade at higher EV/EBIT multiples, partly due to their track-record of succesful acquisitions and the resulting amortization of acquired intangibles. In smaller case studies, EBITA might be a more suitable metric—where depreciation acts as a proxy for maintenance needs, and amortization is more reflective of growth investments. When valuing companies reinvesting a lot of capital, we believe the ideal approach is to take out some of the growth expenditures, and look at them before growth capital expenditures, especially if confident in their ability to create value of it (incremental returns on capital well above cost of capital).

Keep in mind, EBIT still excludes real cash outflows like working capital needs, interest, taxes, and lease repayments. For most businesses here, this means the average EV/EBIT multiple of ~23x for the whole group may translate to something closer to 30x on actual free cash flow.

Additionally, I've ranked companies by cyclicality, measured by variation in EBIT margins. This means businesses like Lagercrantz or Norbit, which have steadily expanded margins over time, may be penalized under this framework. The intent here is simply to help narrow the field—there are likely many great investments beyond the top 10 or top 20.

A good example of margin expansion over time is Lagercrantz, which posted the second-strongest performance among the Trading Companies. Its focus on proprietary products has gradually helped improve margins over time.

Lagercrantz didn't make the top 10 this year, partly due to its elevated valuation—trading at a 33x multiple compared to the group average of 23x. While its ROCE remains consistently strong at around 20%, the current dividend payout ratio of nearly 45% significantly limits its reinvestment capacity—and thus, its compounding potential. Still, we believe Lagercrantz is a high-quality business and one we would expect continue delivering solid results in the years ahead.

However, we are increasingly cautious about investor expectations, especially for some of the acquisition machines. At some point, even outstanding acquisition machines may face pressure—whether through diminished returns (from paying higher prices or acquiring lower-quality businesses) or reduced reinvestment rates.

Ultimately, getting the business right will matter far more than getting the price exactly right over the long run. With that said—let’s dive into this year’s top 10!

Our Top 10 for 2025

On average, the top 10 companies have these key financial figures. Where appropriate, numbers are on 5y averages.

Market Cap: Median $1.1B (ranging from Firefly $120M → Atlas Copco $78B)

Revenue per share 5y CAGR: 13.5%

Margins: Gross 5y: 59% // EBIT 5y: 23% // EBIT Last year: 25%

Net Debt / EBITDA: -0.4x (net cash position)

Return on Capital: ROCE: 30% // ROE: 27%

Payout Ratio: 50% // Dividend Yield: 1,7%

Valuation EV / EBIT: LTM: 27x // forward: 23x

Let’s break down some interesting facts of the companies posting these exceptional figures.

Trading Companies (1)

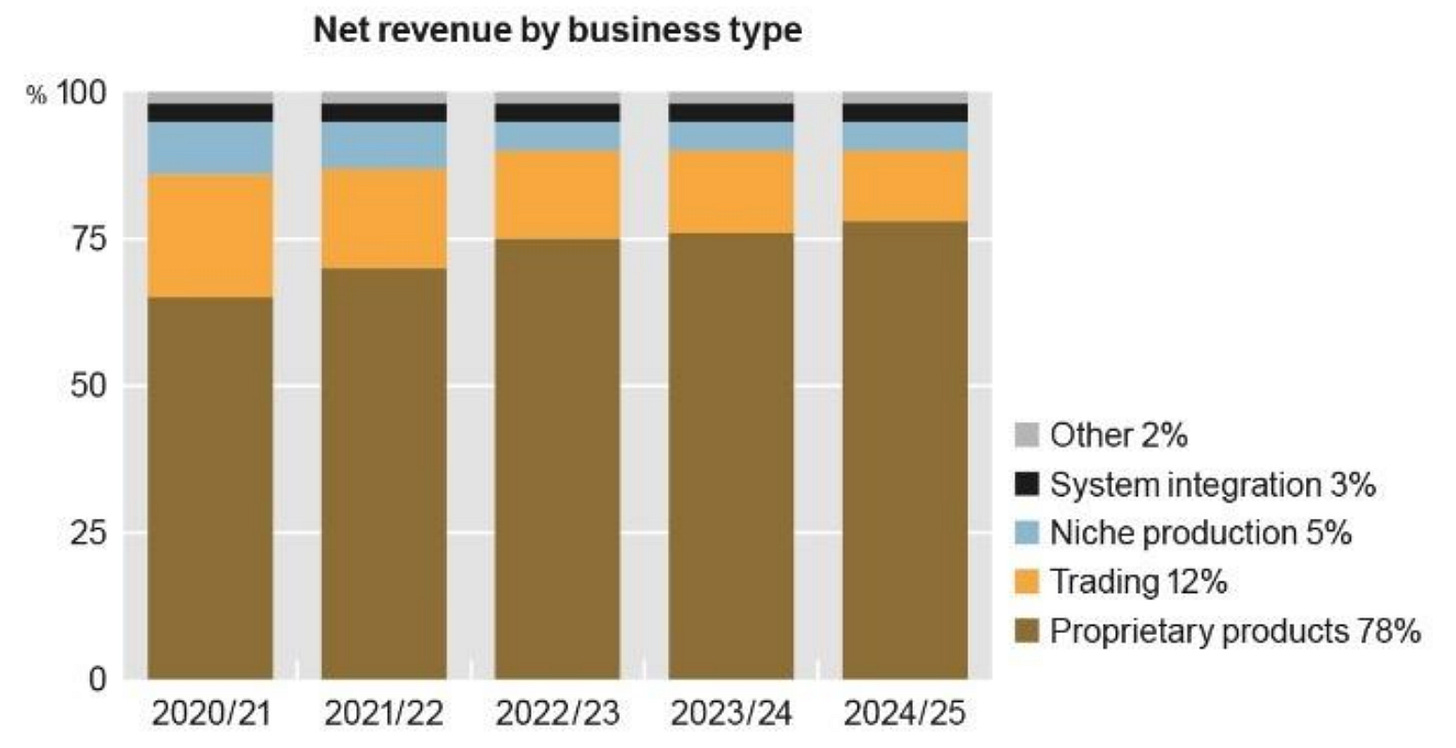

While all the Trading Companies mentioned earlier have been solid compounders, OEM International stands out with exceptional returns on capital employed close to 40%! What we believe sets OEM apart is its network effects. With a large customer base relying on OEM to source technical components and match them to specific needs, suppliers are compelled to partner with them to gain scale. This dynamic helps sustain OEM’s superior capital efficiency.

Unfortunately, they reinvest less capital than the likes of Lagercrantz, Addtech and more, who do more M&A. We remain very interested to see the changes Private Equity player EQT plans to do there - the business could perhaps benefit from a more aggressive reinvestment plan, which is what ultimately made the company not rank in the top 10 spots among our most popular writeup to date, on Serial Acquirers 2024.

Interestingly, we believe the lower EV / EBIT of 24x for OEM compared to the other Trading Companies gives headway for some lumpiness in succesful acquisitions, in contrast to those trading at closer to 40x EV / EBIT. If looking at EV / EBITA on Last 12 months, OEM lands at 25x while Lagercrantz and Addtech lands at 33x and 29x. A smaller difference than what we would expect only looking at EV / EBIT.

Here’s how OEM’s management explained the lack of acquisitions in 2024:

The reasons for the lack of deals vary, including the fact that businesses were not considered to fit well with OEM, were not scalable, or that the seller’s price ambitions were ultimately higher than the OEM considered reasonable

Let’s hope this reflects disciplined capital allocation rather than an unwillingness to accept slightly lower returns. After all, deals that may dilute OEM’s historic 40% ROCE could still be highly value-accretive in the long run.

Machinery & Industrial Conglomerates (1)

Atlas Copco have been covered here before, and will likely always be, as they always has. Perhaps most underappreciated by Atlas and it’s spinoff Epiroc (just outside top 10) is the recurring nature of many of their business lines. Epiroc in particular enjoys ~70% of sales from aftermarket services — not as cyclical as one may first imagine.

Electronical Equipment (3) companies Mycronic & Norbit have also gotten several mentions here in the last years. Mycronic was just until recently (one of few on this list) priced below their 10y average multiples for forward EV/EBIT. Both Mycronic and Norbit with impressive operating margins of close to 30% — higher than most pure Technology businesses you will find out there.

Moreover, one company not previously covered here is Firefly — a business we actually owned a few years ago. With over 50 years of operational history and more than 6,000 systems installed globally, this small-cap benefits from industry-leading technology, long-term service contracts, and ongoing demand for spare parts — creating a stream of recurring revenue beyond the initial system sale.

Despite a relatively high dividend payout ratio of 60%, Firefly has delivered solid growth over the cycle, compounding revenues at 14% annually over the past five years. This is supported by impressive capital efficiency, with returns on capital exceeding 30%. Their fire prevention systems are not only mission-critical in industrial production but can also help reduce insurance premiums — fires remain one of the most devastating risks in manufacturing, both in terms of human and financial risk.

Medical Equipment (3) was the most surprising sector here, with 3 in the Top 10.

Revenio has grown its EBIT per share by a staggering 20% CAGR over the last 10 years, mostly organically. Notably, this has been achieved with just one main product — the iCare tonometer.

Medistim, though much smaller, boasts one of the strongest moats on this list: surgeons using Medistim's flowmeters during bypass operations become long-term users — clinical habit is both hard to change, and surgeons / hospitals have little incentives to do so. Recurring probe revenues used during surgery are >60% of sales.

Cellavision, meanwhile, offers one of the most elegant examples of diagnostics automation. Its machines standardize manual blood cell analysis — but it’s the high-margin software and recurring consumables that drive long-term returns. Gross margins above 70% speak volumes.

Leisure Products (1) - Harvia, Harvia, known as the “LVMH of sauna,” has grown from its Finnish roots to become a global brand, now selling in Germany, the U.S., and beyond. What’s interesting is that more than half of its profits come from premium sauna brands and accessories — not just heaters. The people running the company are also great at using capital wisely, also hinted at with the Lous Vuitton reference. And with more people discovering the health benefits of saunas, Harvia is in a strong position to keep growing.

Life Sciences (1) - Chemometec rounds out the list with perhaps the most quietly dominant position here. Its cell counters are mission-critical for biotech and pharma companies — but what really stands out is the 90%+ gross margin and a track record of doubling EBIT every 2–3 years until recently. It’s Denmark’s answer to Thermo Fisher — just much smaller, and more profitable.

The List - For those enjoying Numbers

The numbers below was taken from 11th of July 2025. Remember that Forward EV/EBIT will not be acurate, but helps even out some of the justified elevated trailing price levels on trailing figures for companies like Kongsberg, Norbit and more, with order books growing rapidly.

To wrap up, we believe a screen like this will always uncover interesting ideas — but it’s the qualitative insights that often separate which ideas are comfortable to invest with or not. That’s exactly what we’ve done with our four selected picks from this batch, which we’re sharing exclusively with our paid members below.

Thinking about subscribing? You’ll find a link below. If not, no worries — you can still join our free list and get insights like this delivered straight to your inbox.

Enjoy your day,

Cheers, Ole