Paradox Interactive - Interesting again?

Paradox is selling off again. How has the investment thesis evolved since our August 2024 write-up?

In August 2024, Mathias - LTG and I highlighted Paradox Interactive as an interesting investment idea. The setup was: Niche strategy game leader with durable game portfolio, but with bad results for recent game releases, weighing on investor sentiment. We argued Paradox stock at 140 SEK offered little downside, given the attractiveness of their existing game portfolio.

Since then, Paradox stock climbed quickly back up to 210 SEK, before now diving down back down to 170 SEK today. What’s happened since August 2024?

Active Players by Game

In Exhibit I, we highlight Paradox’ average Players per game over time. Perhaps the most important KPI for Paradox, as active players means their products are relevant. Note that this metric ain’t the same as Monthly Active Users Paradox reports, which is around 6 million currently. Our metric is the data we could retrieve from Steam for average player per day.

We think there are two key lessions from this graph:

1) Paradox games are unusually durable. These games can last decades.

2) Paradox are slowly adding more legs to their revenue base over time.

Key Franchises

In Exhibit II below, the individual game Franchises are merged, like Cities Skylines and it’s successor Cities II. 6 franchises accounts for >90% of Paradox’ player base, and likely, >100% of Operating Profit (as failed games are a cash furnace).

And their major launch of Europa Universalis V this November, looks to have received excellent reviews on Steam, with 88% of the 47 thousand (!) reviews being positive. That potentially means those green bars above can expand, and more importantly, it’s sales and cashflow should inflect drasticallu upwards this Q4 2025.

Revenue Model

Paradox’s business model is straightforward: sell games and then expand those games over time through downloadable content (DLC). While the company has experimented with subscription offerings, the dominant model remains full game purchases supplemented by optional DLC that lets players customize their game.

Two dynamics are essential to understand game development:

New game development is high-risk. Creating a successful title is difficult, unpredictable, and carries a high failure rate. This can be seen by the numerous poor game releases of Paradox in recent years (similar to most competitors).

DLC is the opposite. Expanding an existing game for an established player base generates exceptionally high ROI, since the core development costs are already paid. It’s a rare combination of low risk and high incremental returns.

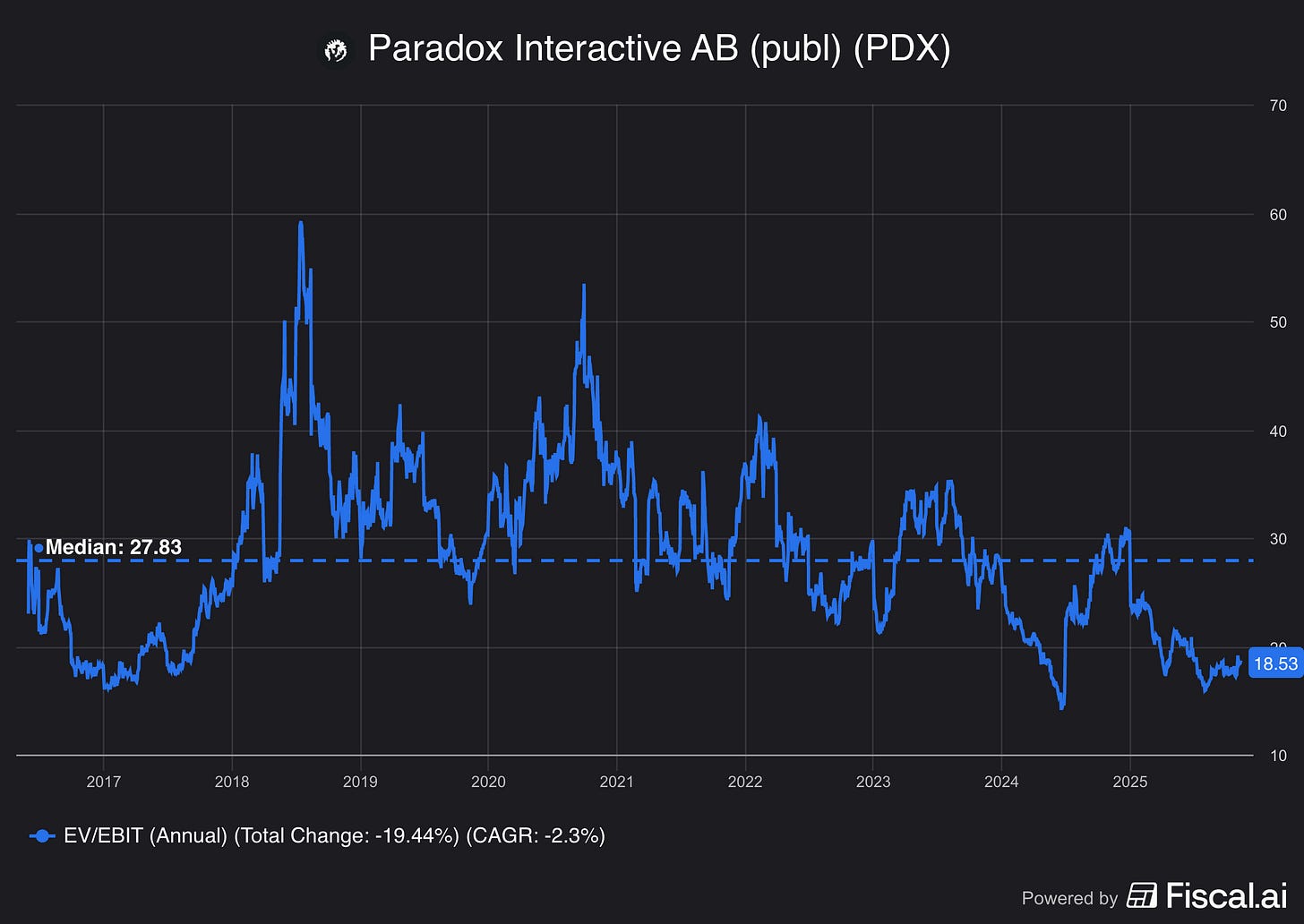

Paradox has through most of its time as a listed company had a massive premium valuation to the market average. Since 2015, the average EV / EBIT has hovered around 28x, with the peak in 2018 at 60x! Today, we’re 35% below average, at 18x, on what we believe are a lower than usual comparison base for the rolling 12 months.

The lower than usual comparison base, comes from the few releases we’ve seen in the last year. Although Paradox have recurring revenues from DLC sales and players still purchasing old games, game releases have a drastic impact on sales and profits. (Slightly less on profits actually, as the game is quickly amortized).

Conservative Accounting

An important aspect to highlight, is that Paradox is quite conservative in their accounting. After releasing a game, they amortize the capitalized development cost very rapidly, over 1,5 years. This is also part of the reason why the historical ROIC is so high for Paradox (10y average 34%), because many items worth 0 on their balance sheet still contributes significant profits, since they have been depreciated fully.

And since amortisation and depreciation happens above the EBIT line in the P&L, it can distort current cash generation when releasing games. The way we can see that is in the cash flow statement.

Cash Flow

In Exhibit V below, you can see the years where Operating Cashflow (orange columns) are well above Operating Income (blue line). These are the years with the significant releases, as they receive larger inflows in cash from game sales, but incur a lot of amortisation rapidly post game release.

What Exhibit V also show, is what happens to Operating Cashflow.

First, Paradox spend minimal on tangible capital expenditure, basically a rounding error. Instead, Paradox invests in game development, which is reported as purchase of Intangible Assets. Additionally, they have done a few acquisitions (in red), the most recent of Haemimont games this year. Then, the reminder cash is distributed as a dividend (yellow columns), close to 500 million SEK in the last twelve months.

Let’s do a quick Napkin math over incremental cash-on-cash returns.

We believe most investments from 2024 have not contributed to cash generation yet (but much from next big release quarter, Q4 ). Thus, if we sum up the capital invested in intangible assets and acquistions from 2015 - 2023, we end up with roughly 4 billion SEK in Invested cash, vs the 900 million of incremental operating cashflow. That’s a roughly calculated 20%+ incremental cash-on-cash return.

Recent Developments

For the 9 months ended Q3 2025, Paradox reported sales of 1317 million, down 12% from last year. Operating profit of 391 million, a 20% increase. That divergence is mostly explained by the significant 200 million writedown in Q2 2024. Cashflow, which similar to revenues highlights customer activity better, have declined.

Q3 2025 comments by CEO and owner-operator (33% stake) Fredrik Wester:

The third quarter has been characterised by a high pace in preparing for what will likely be the most intense period in Paradox’s history. In the fourth quarter we will launch two new titles and one remaster, as well as content to most of our core games: a testament to both our breadth and our development capacity.

He also notes that the few releases, the strengthening Swedish Krona and intense marketing campaigns in 2025, have put a pressure on their numbers so far this year.

Like previous years, the number of releases has been fewer in the third quarter, which together with a stronger Swedish krona has had a dampening effect on revenues. Simultaneously the period has been marketing intense with campaigns for our coming releases. In total it affects the quarter’s results but strengthens our position for the important period that now awaits.

Importantly, when we buy a company we buy it’s future cashflows.

Finally some success in new Game Releases?

Where the remaster of a core Paradox game, Europa Universal V, seems to be off to a great start in Q4, the two new titles, Vampire Bloodlines 2 and Surviving March Relaunced, seems less so.

Vampire Bloodlines 2

57% of 5000 reviews are positive, giving a Mixed Steam rating. Averaging around 2,000 active players at peak per day, 1 month after launch, means it could add 1% to the graph we highlighted first. And normally, the number of players flattens somewhat over time. From our point of view, looks like another rounding error in the long-run. Although, sales this quarter likely improved.

Surviving March Relaunched

44% of the 750 reviews are positive, giving another Mixed rating. This is a game in collaboration with the newly acquired Haemimont games. Since it’s just been out for 5 days, it’s little data on the number of players yet, but 3,000 players are currently playing. Vampire Bloodlines had 1,000, as of mid-day Sunday Nov 15th.

For comparison, Cities II and Hearts of Iron IV, key titles for Paradox, have more than 15,000 and 50,000 active players at the time of writing this. Europa Universalis, on the other hand, currently have more than 50,000 players now!

It’s no doubt the remake of Europa Universalis is the one which should contribute most to bottom line going forward. For comparison, it’s predecessor EUV IV, had 15,000 peak players at launch in 2013 and 5,000 average players, but player activity grown since then and remained incredibly stable around 12 - 18,000 since. While EUV V definitely will cannibalize some of the EUV IV player base, it seems like EUV V is up to a good start, and hopefully for Paradox, can expand the player base to.

In summary, Exhibit VII highlights the mixed success of launches within last years.

While assymetric risk / reward is a structural feature of Game Development, we have our own view of how to think about a Paradox investor’s risk profile adjust accordingly.

Investment Idea

Paradox’s share price has again fallen to around SEK 170 per share, corresponding to a market cap of roughly SEK 17.5 billion. We believe the company can comfortably support a SEK 600 million dividend in 2026 alongside necessary growth investments, implying a dividend yield of ~3.5% at today’s price. The net cash position is also likely to climb back above SEK 1 billion after the launch-heavy Q4.

At an EV/EBIT multiple of ~18x, Paradox is not cheap. However, we continue to argue that the durability of the company’s core franchises supports this valuation — assuming that durability persists. For context, the historical trough multiple was ~14x (during our 2024 update), while the 2018 peak reached 60x EV/EBIT.

We do not expect multiple expansion from current levels. But for long-term investors (including us), further multiple compression appears less likely to remain a material headwind — unlike the period since 2018. Investors who paid 60x EV/EBIT back then likely expected far higher growth than the ~10% top-line performance delivered, leaving them with seven years of flat returns and sharp volatility.

Sentiment today is weak, understandably, after several quarters of negative growth and increasing competition in gaming. However, we now have confirmation that one of this year’s major releases performed well, and — as our header image suggests — Paradox’s core titles remain highly relevant.

Assumptions

Paradox’s long-term growth rate is uncertain in our opinion.

But, if the company can continue generating roughly a 20% cash-on-cash return on reinvested capital, then with a 40–50% reinvestment rate, a high-single to low-double-digit growth profile appears reasonable.

A common bear thesis is that competitive pressure will intensify. This overlooks a defining characteristic of Paradox: it dominates narrow, defensible strategy-gaming niches. Some argue that AI-driven reductions in development cost will flood the market with new games. But the gaming market is already oversaturated — thousands of titles launch annually. It’s not obvious that consumers want (or could even process) 10x more.

On the other hand, continued semiconductor progress will enable more realistic gaming experiences. Yet, as noted in our previous update, Paradox’s successes are not driven by cutting-edge graphics, but by depth, storytelling, and strategic complexity. It feels unlikely that Hearts of Iron players would migrate solely for better graphics — though this definitely cannot be ruled out for all games. Further, other game developers may be able to creep into some niches Paradox dominates with a better game. City building for example is still dominated by Paradox, but who knows what will be launched in the future, and how players will respond.

A more material risk, in our view, is game development discipline. Paradox has taken steps to terminate weak projects earlier, which is important given that releasing an unsuccessful game is vastly more expensive than cancelling it mid-development. Still, if Paradox fails to expand its player base through new titles, upside potential becomes limited. It should also be noted that a lot of players seem frustrated with how Paradox charge their players. Our opinion, is that games in general are a really low cost entertainment per hour played. Prices of games, in contrast to everything else in society, have not risen much since last time I touched a Paradox game myself, back in 2017-2018 with Cities Skylines I.

Franchise Expansion Is the Engine for Upside

Paradox’s long-term success has depended on steadily adding new franchises. This dynamic explains the rich valuation in 2018: Investors believed new hit titles would continue to appear at the same pace.

Growth of Core Franchises

Pre-2015: 2 Core Titles (Europa Universalis, Crusader Kings)

2015: 3 Core Titles (+ Cities: Skylines)

2016: 5 Core Titles (+ Hearts of Iron, Stellaris)

2022: 6 Core Titles (+ Victoria 3)

Perhaps Prison Architect 2 becomes the next major franchise — perhaps not. Historically, Paradox has added a successful new franchise roughly every three years. No wonder investors are losing patience with Paradox stock with only one new title becoming large in the last 9!

Still, the current franchises continues to be cash-cows and larger audiences, with the multiple remakes and DLC’s released per year to monetize this. While they may not alone contribute to double-digit growth, they can potentially serve as protecting the downside for current investors — with the ability to deliver mid-single digit growth.

Summary

In summary, we think the potential for a 3.5% dividend yield next year, limited downside to multiple’s (in our view) and a mid-single digit growth from current franchises supports an investment case for 8-10% annual returns for shareholders.

We like these type of investments, because we don’t pay much up for potential upside from succesful launches. It’s also worth noting that management is seeing more opportunities within M&A now. While that could add another succesful franchise leg, it’s unlikely to come with a similar 20% cash-on-cash return like organic investments.