Asseco Poland

Layer upon layer of Holding Structures - enabling autonomy and aligned incentives in operations and in capital allocation.

Earlier this year, a well-known Listed subsidiary of Constellation Software, Topicus (writeup linked below), took a stake in a Polish Holding company, called Asseco Poland. Following this move, many international investors opened their eyes for this Polish Holding Company — as the Constellation Software universe has one of the better capital allocation track-records out there.

Asseco’s stock is currently at 194 PLN, up 128% since Topicus acquired their stake.

We’ve already written a detailed writeup of Topicus, but this time it’s time we look closer at their recent bold move — a 24.8% stake into this Polish software-giant, with many layers to dissect. You can see the topics we’ll cover below.

1. Branching out — Decentralized structure

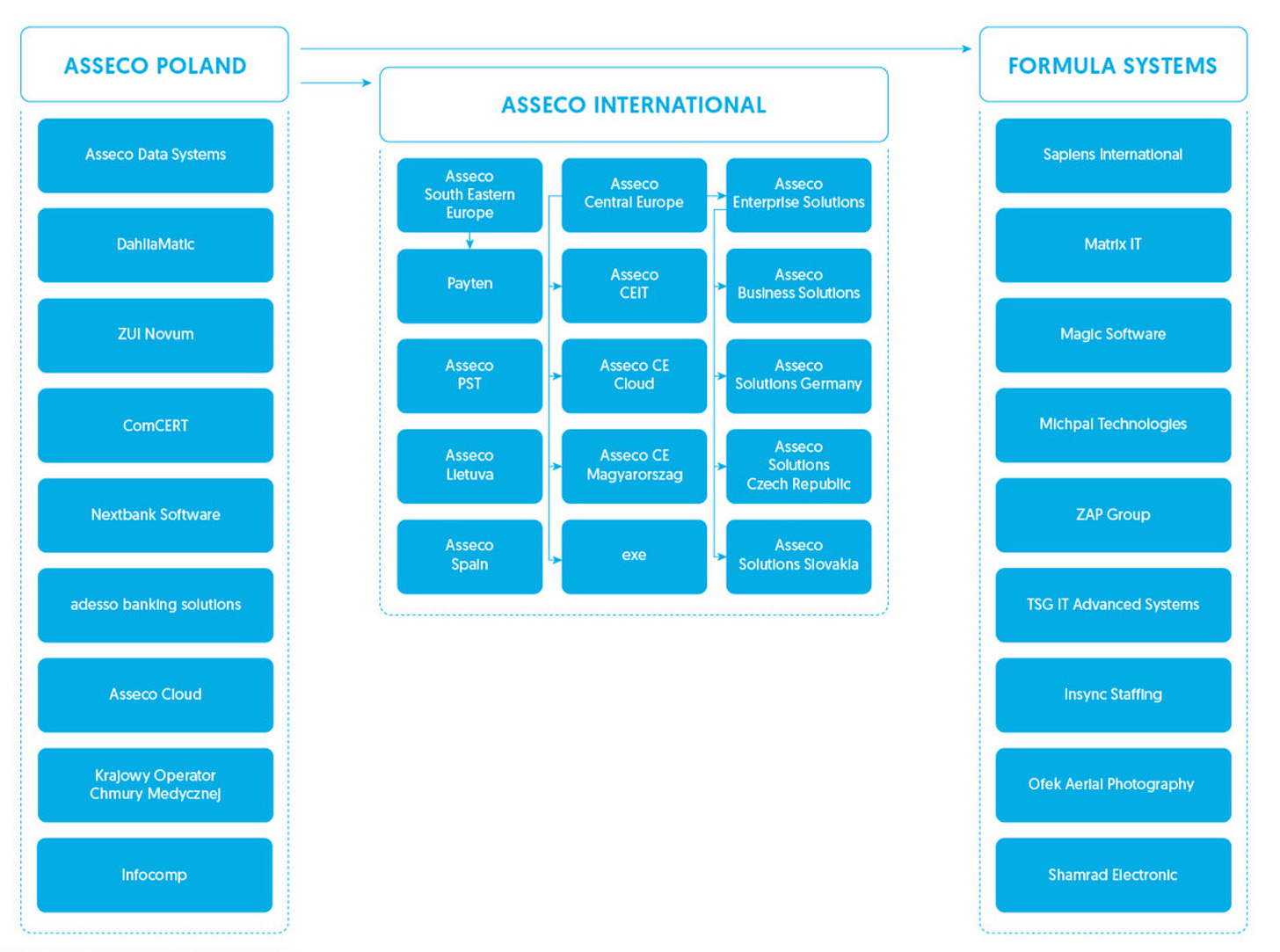

Asseco Poland is now part of an impressive decentralized structure, shown in Exhibit I, with all ties leading up to the “mothership” Constellation Software. Asseco Poland is a separately listed decentralized entity, with ownership across many companies, both listed and private. Note that there are hundreds of individual companies behind many of the entities you see below — a remarkable example of Decentralized Capital Allocation.

While Exhibit I show many of the Listed Entities surrounding Asseco Poland and Topicus, this is not how Asseco Poland chooses to report it’s segments. Instead, the also listed Asseco South Eastern Europe and Business Solutions, are classified under Asseco International — A large group consisting of many subsidiaries itself. The 3rd group, beside Asseco Poland and International, is Formula Systems, which makes sense, given the different geographical exposure in the different groups.

And for this writeup, we’ll exclusively focus on Asseco Poland (incl. International and Formula), but also consider Topicus’ role in shaping Asseco’s future — where we already have some insight from their stake in another listed Polish company, called Sygnity.

2. How to read the numbers

First, when valuing complex holding companies, one method consistently stands above the rest in our opinion: look-through earnings. Also why we’ve detailed every ownership stake in Exhibit I.

Many of Asseco Poland’s subsidiaries are fully consolidated even though they are not 100% owned, simply because Asseco have control, similar to how Constellation have control over Topicus. To understand the true economic profitability of the group, we need to strip out the portion of earnings that belongs to other owners.

The easiest anchor point is the Net income attributable to shareholders line, where non-controlling interests are already removed. This gives a clean view of what actually accrues to Asseco Poland’s shareholders. But elsewhere in the statements, the picture becomes noisier. If you believe certain expenses meaningfully distort underlying cash generation, such as the amortization of acquired intangibles, a dynamic we know well from CSU and Topicus, the reported net income may understate true economics. Similarly, the advantageous cash-conversion profile of VMS businesses (often benefiting from negative working capital) appears more clearly in cashflows than in the P&L.

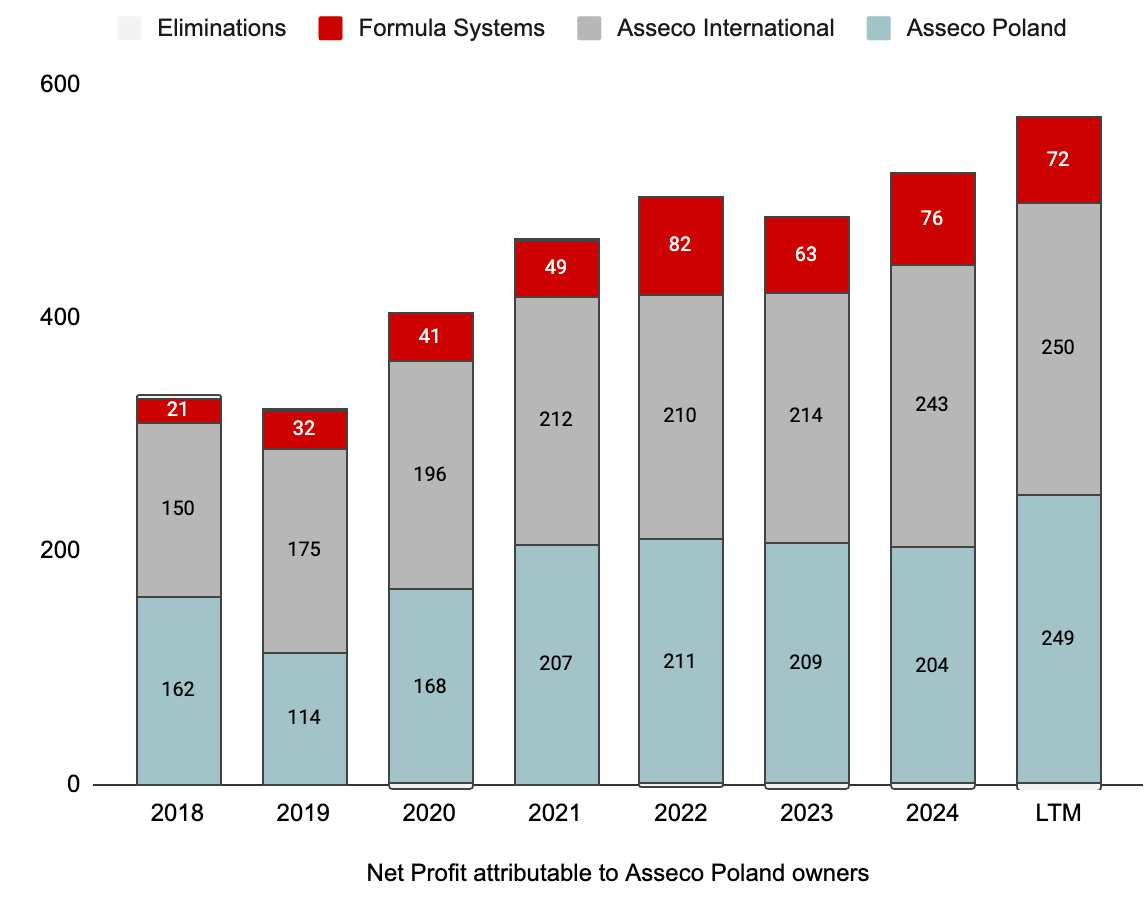

Before calculating look-through earnings, it’s worth examining Asseco Poland’s track record — and understanding where its profit contribution truly comes from.

3. Track-record & Business Model

Asseco has grown to become the 6th largest software vendor in Europe. Own solutions are 80% of sales, with their speciality being production and development of software. More specifically, some of Asseco’s key assets includes critical software infrastructure for the banking, insurance and public administration sector (source).

Other sectors are utilities, telecommunications, healthcare, local admin, agriculture, uniformed services as well as supporting large organizations like NATO and EU. Asseco is a well-diversified group.

And, with more than 140 acquisitions completed, there is no doubt Asseco Poland can be called a serial acquirer.

Business Model and Value Creation

Asseco Poland operates through decentralized Business Units, a structure shared with other successful serial acquirers such as Constellation, Lifco, and Ametek. Exhibit I shows that this structure continuously expands, enabling the company to scale without losing local expertise or agility. Central to this model is a perpetual-owner mindset, which prioritizes long-term performance over short-term gains.

Unlike acquirers that depend on high leverage or aggressive cost cutting, Asseco generates attractive returns primarily by buying companies at compelling valuations. While post-acquisition synergies exist, they are intentionally modest because each business unit retains substantial autonomy.

Decentralization and Local Autonomy

Each Business Unit is empowered to pursue localized product strategies tailored to its sector and region. This brings several advantages:

Aligned incentives: Local management is motivated to maximize performance.

Operational agility: Units can quickly respond to market and customer needs.

Systematic knowledge sharing: Best practices can be shared across the group.

The decentralized model also mitigates the law of large numbers: Asseco can continue expanding without central bottlenecks limiting growth.

Cash-on-cash returns

To illustrate Asseco’s value creation, we’ve modelled Asseco Poland vs Topicus since 2018, by looking at the incremental operating cashflow vs total investments. While such models ain’t perfect, they give a rough estimate on the returns vs the reinvestments. You can see our napkin math model in Exhibit III below.

Asseco Poland’s 26% cash-on-cash returns are some of the strongest we’ve seen. Also close to Topicus’ 28%. For Industrial acquirers, we would also consider working capital as an investment, as purchasing inventory is a continous struggle in order to sell more physical goods (for most — not Costco for example).

However, Asseco had a much lower reinvestment rate than Topicus. Also explained by their significant dividend payout, but interesting to see, is the larger proportion of organic investments within Asseco.

Constellation and Topicus have long preferred inorganic investments, due to the higher and more consistent return they’ve been able to earn here. An important sidenote here is that both companies have not built their cash position over time, which means there is not a buildup of leftover cash, operating cashflow has been deployed, but also to other places not shown here (dividends, equity investments and more).

Another interesting observation from the (imperfect) Cash-on-cash return calculation, is the divergence from compounding rate (return x reinvestments) vs CAGR in cashflows. OCF compounded faster, by 15% at Asseco and 25% at Topicus, versus model-based compounding rates of 10% and 18%.

Our conclusion is that Asseco Poland is creating value and it will be interesting to see whether their acquisition spend increases following Topicus stake (through a subsidiary called TSS). Importantly, Asseco are positioned in an economy growing much faster than most of Western Europe, having just overtaken Switzerland as the World’s 20th largest Economy.

Nevertheless, while Poland sounds like the key market of Asseco Poland, their geographical footprint is far broader. In banking software alone, the company operates in more than 40 countries, making it a truly global player. What portion of Asseco’s value actually occurs within Poland?

4. Geographical Footprint

So we already know Asseco Poland is a global group. But once looking at the segment breakdown for consolidated revenues, Exhibit III below, you would think there’s almost no Poland (which is wrong, we’ll come back to this soon), with the Israel-based Formula Systems representing most of their consolidated sales.

Looking at the chart on the right, we see that the Formula Group operates with the lowest EBITA margins, significantly below those of Asseco Poland. Since 2017, sales have compounded at: Formula Systems (14%), Asseco International (9%), and Asseco Poland (7%).

However, there are two key considerations when analyzing Asseco by segment.

First, as we just noted, Asseco Poland generates a disproportionately high share of consolidated profits relative to its share of sales, due to structurally higher margins.

Second, Asseco Poland’s ownership stake differs materially across the three segments, which has a major impact on how much of each segment’s profit ultimately belongs to Asseco’s shareholders.

5. Profits Attributable to Asseco Poland Shareholders

Once we break down the net profit attributable to Asseco Poland shareholders, the picture becomes clearer: Asseco Poland and Asseco International contribute in roughly equal measure, while Formula Systems contributes meaningfully less on a look-through basis.

This means that, in economic terms, Asseco Poland shareholders are exposed to a ~40% / ~40% mix between Poland and the rest of Europe, with the remaining ~20% tied to Formula Systems’ exposure in Israel and other markets.

To summarize, these graphs highlight a remarkably stable and consistently profitable group, with value creation occurring across multiple fronts. This is one of the central insights about Asseco Poland—just as with Topicus or CSU. Despite their size, these organizations are structured in a way that pushes back the law of large numbers, enabling continued growth. Their deeply decentralized models allow each unit to scale independently, creating an architecture where the whole can keep expanding long after most companies would have hit structural limits.

And despite completing more than 140 acquisitions to date, Asseco Poland still sits at only about a $3.5 billion market cap — a size some investors may classify as a small-cap.

Let’s go over the signs we have for their strategy going forward.

6. Topicus’ Strategy with Asseco?

Signs from Topicus majority stake in Sygnity 2022?

Before looking at what the leaders of Topicus’ and Asseco had to say on this, let’s take a look at what happened after Topicus acquired a ~72% stake in Sygnity during Q2 2022, another Polish listed company — shown in Exhibit V below.

The key observations from the above graphs are:

1) Sygnity experienced rapid revenue and margin expansion following Topicus’ stake.

2) Acquisition spend drastically picked up 1,5 years later.

As a result, Sygnity is now a 10-bagger for Topicus in just 3 years. It seems like having Topicus as a controlling owner resulted in a classical win-win.

Asseco & Topicus CEO’s comments on the deal

Asseco’s founder and long-time CEO, Adam Góral, described the shareholder agreement with Total Specific Solutions (TSS, a Topicus subsidiary) as both a strategic and cultural fit:

“The shareholder agreement we signed significantly increases the likelihood of further value growth for all Asseco shareholders while providing broad development opportunities for employees and management… TSS’ commitment to supporting operational independence while ensuring that the values my teams uphold remain a shared priority for both myself and my partners.”

This is the same sentiment many small entrepreneurs express when selling to TSS: autonomy is preserved, teams are protected, and long-term customer relationships take priority. Sellers often accept a lower price because they view Topicus/TSS as the preferred home for their business.

Góral also highlighted the scale advantages:

“TSS is one of the leading software groups in Western Europe, while Asseco is the leader in Central and Eastern Europe… Companies within both groups will have the opportunity to expand their product offerings and gain access to new markets.”

TSS CEO Ramon Zanders underscored the cultural alignment:

“We will build a partnership of two strong European software groups based on perpetual ownership, decentralized governance, and client centricity.”

Our View: Why Topicus + Asseco Makes Sense

Constellation Software spun out Topicus to build a European hub capable of scaling the Constellation playbook across a continent fragmented by language, regulation, and local norms.

Seen through that lens, acquiring a stake in Asseco is almost a perfect fit:

It gives Topicus immediate depth across Central and Eastern Europe, and access to Asseco’s distribution across these geographies.

It partners them with a group that has decades of embedded customer relationships and regional trust.

Asseco gains expertise from one of the more experienced acquirers out there, with close ties to Constellation Software, the controlling owner of Topicus.

It aligns them with an organization that already shares their core philosophy: perpetual ownership, decentralized governance, and local autonomy.

In Europe, where borders matter commercially, culturally, and legally — these traits would be very hard to replicate organically for either groups.

And consistent with Constellation’s value-investing DNA, the timing of Topicus stake — during a period of depressed valuations for Asseco Poland — is unsurprising. And so far, early numbers for Asseco are showing positive signs.

While many may expect Asseco to increase acquisition spend drastically, similar to Sygnity, we would like to emphasize what stood in the Shareholder Agreement, about preserving Asseco’s identity as a dividend-paying company. The bull case for Asseco is an increased M&A spend + margin expansion similar to Sygnity. However, in our opinion — Asseco Poland is a higher quality business than Sygnity was back then.

7. AI Risks

Market concerns around Constellation Software and Topicus recently, have revolved around two topics in particular: 1) Law of large numbers with acquisitions and 2) Artificial Intelligence disrupting legacy software companies.

Our view currently on the AI risk summarized:

AI could strengthen incumbents more than it threatens them.

Topicus, Constellation, and Asseco already have customers, domain expertise, and entrenched platforms — three difficult assets to replicate for newcomers.Decentralization reduces systemic risk.

These organizations are not single headquarters making top-down decisions. They are networks of thousands of small, specialized software units.

For AI to “disrupt” them broadly, it would need to materially impair dozens of independent niche markets simultaneously.Localized experimentation is a major advantage.

Each business unit can test, deploy, and iterate on AI features independently, then share successful approaches across the broader group.Advantage of a high hurdle rate

Constellation and Topicus are highly disciplined with high hurdle rates, particularly for small deals. Paying a low price means the investment doesn’t rely on a high terminal value to deliver strong returns.

New deals take over Value generation over time

Because these companies continually redeploy much of profits into new acquisitions, current cash flow gradually becomes a smaller part of total value. Even if existing businesses decline or run off due to for example inability to compete with AI startups, their cash flow may last long enough to fund replacement acquisitions, allowing the platform to sustain over time.

That said, Asseco seem somewhat more vulnerable than Topicus due to its larger presence in broad verticals like banking and insurance — areas where AI-driven disruption (perhaps) is likely to appear sooner. Niche VMS markets (libraries, bowling alleys, municipal platforms, etc.) remain far less attractive targets for AI-first disruptors, simply due to the nature of being vertical (small adressable market).

But enough speculation from our side, if Constellation Software management calls out they are unsure how this will develop, that probably warrant some caution for ourselves in having any success predicting this.

However, there were some light on this topic from the take-private of Formula Systems Sapiens division.

Sapiens taken private by Advent for $2,5 billion

Sapiens, a specialist in intelligent software-as-a-service solutions for Insurance, with customers like global insurer Chubb to Norwegian-giant Gjensidige (and 600+ more).

Sapiens is very clear that AI redefines the Insurance Industry, from calculating risks more accurately, marketing more efficiently to taking in more data, like those of satellite images of a particular home roof for example. Paid members will be aware of a company we’ve been invested in for 3 years now addressing these topics.

This also seem to be part of the reason for Advent, a Private Equity firm, to acquire Formula System’ owned Sapiens for $2,5 billion. While Formula will retain a minority stake, the 64% premium to Sapiens closing stock price, will be a significant cash inflow to Formula System. CEO of Formula, Guy Bernstein, had this to say on the deal:

Formula will continue to retain ownership in Sapiens and is excited to partner with Advent to accelerate the transition to AI and SaaS, delivering the next generation of insurance solutions for our customers. This partnership builds on Formula’s longstanding commitment to innovation while bringing in Advent’s global expertise and resources. Customers can be assured that the trusted relationships, service quality, and industry leadership they have relied upon will remain, strengthened by a shared vision for driving the future of insurance technology

The family-tree we shared earlier continues to branch out. Sapiens will now be a privately owned company, but Formula retains a minority stake in the company. Thus, the lookthrough earnings will still be there, but in a lesser extent.

8. Valuation

Lastly, we wanted to touch on Valuation, and here we used Price to Earnings and EV / EBITA multiples.

Topicus acquired their 25% into Asseco Poland for 85 PLN per share, or 8x EV / EBITA for LTM figures as of Q2 2025. Given the business quality we’ve observed from the key figures above, this serves as a reminder of the exceptional capital allocation skills for Topicus (and also Constellation Software). Today, Asseco Poland shares trade around 20x EV / EBITA or 23x Price / Earnings.

Q3 2025 results were postponed by 4 days to December 1st 2025. By H1 2025, results have been outstanding for Asseco Poland. If we annualize the improvement seen in H1 2025 for the fully year, the stock is today priced closer to 21x PE and 18.5x EV / EBITA. Given we’re close to 2026 now, and with Asseco’s track-record of steady growth, it’s likely Asseco trade closer to 19x PE or 17x EV / EBITA for FY 2026 figures.

That price seem very fair given Asseco’s business quality and growth runway.

And if we add in the insights Tresor Capital shared recently, highlighting Asseco as “the architect of the next Polish growth era”, it’s clear Asseco is positioned perfectly in an area experiencing multiple tailwinds, with an underlying need for investments into software. Asseco is for example the second cloud infrastructure player in fast-growing economy Poland. Tresor Capital concluded their writeup perfectly:

“We view Asseco as a company that is in the right place at the right time.”

And with Constellation Software (through Topicus) now as a key partner, we would not be surprised seeing more capital being put to use into more value-accretive acquisitions — just like we’ve seen with Sygnity. Still, it’s clear from the Shareholder Agreement that Asseco will retain their identity, also as a dividend-paying company.

And for Topicus and Constellation Software, their strategy of continuing to branch out capital allocation, seem to lengthen their runway to continue deploying capital into value-accretive deals. Despite this, investors should be very careful extrapolating high reinvestment rates indefinitely at today’s returns, as we’ve both seen capital deployment can be lumpy, but returns also tend to decrease with size. Still, we see little signs that the collective group is about to slow down any time yet.

Asseco Poland reports Q3 numbers next week, 1st of December.

If you enjoyed this writeup, you’ll find many more on Outsiders Corner. Consider subscribing if you want more of these in your inbox. While you won’t see us weekly in your inbox, it’s a lot of effort behind those few that pops in. Thanks to all subscribers, and especially those who’ve opted to become paid members.

Thank you, super interesting. Regarding the valuation, why do you use net profit and not cash generated (proportional recognition)?