*Disclosure at bottom.

Background

This year offers a tempting opportunity to celebrate portfolio winners and showcase stellar returns. However, pausing and evaluating whether the current strategy and holdings are positioned to deliver solid returns while maintaining a prudent level of risk going forward, sounds like a better idea.

Success in investing often feels simple during favorable market conditions. While some returns may reflect the genuine outperformance of a company, others could merely be the result of rising tides lifting all boats. It's critical to distinguish between these scenarios. If a stock's price rises beyond what its fundamentals justify, the risk of holding that stock increases—the market is now paying a premium for the same underlying reality.

On the other hand, some companies rightfully see their share prices climb as their fundamentals improve. Yet even then, a stock growing 50% in a year while its fundamentals grow 10% is not a trajectory that can endure indefinitely. In these cases, you can end up with a compounding business and sleeping stock for many years.

Ultimately, investors focusing on stock prices rather than fundamentals, are likely to be the odds favourite to swim naked when the tides turn.

For the intelligent investor, rising multiples has two implications:

Increased Risk: Elevated multiples signal market optimism, assuming the future will exceed expectations—a gamble that doesn't always pay off.

Lower Future Returns: As more of the anticipated growth is priced in, the potential for future gains diminishes.

By staying grounded in fundamentals and carefully evaluating the balance of risk and reward, investors can position themselves to navigate both rising tides and turbulent waters with confidence. While I am not the biggest fan of surface-level price metrics for a large bunch of companies, I think the PE ratio of the Nasdaq100 speaks for itself.

The accompanying graph also underscores a key advantages of being an individual stock picker. If rising valuations become uncomfortable, you have the flexibility to step away from index-driven strategies and focus on uncovering opportunities independently or build cash. For most readers here, that’s likely the ultimate goal: to take ownership of your investments and craft a portfolio aligned with your convictions.

Biggest Learnings this Year

Success Drives Arrogance, Arrogance Drives Failure

Compounding Business, Sleeping Stock

Return on Capital x Reinvestment Rate

Wonderful Companies at Fair Prices

Drawback of Sharing Investment Ideas

1) Success drives Arrogance

Lessions from the Titans, details how even some of the most impressive businesses can falter, with examples like General Electric and Boeing. The seeds of failure are often sown during the best of times.

Success often drives arrogance or complacency. The severities of most crisis is underestimated. Crisis management is best done in advance (Lessons f.t Titans)

For investors, this insight translates to avoiding overconfidence driven by portfolio returns. It's no coincidence that sports psychologists stress the importance of focusing on the process rather than the results—a principle equally applicable to investing.

2) Compounding Business, Sleeping Stock

While I previously discussed the increased risk when a stock outpaces its underlying business, I didn’t highlight the asymmetry that often emerges when the opposite occurs. The best example this year is my writeup of Bouvet, which has had a sleeping stock for several years, despite consistent growth in low double digits.

These situations are particularly appealing, as excitement has dissipated with a falling stock, allowing the fundamentals to catch up. It's not difficult to see the value in owning a business that delivers a 4% dividend yield while growing at double digits. A company earning 50%+ returns on capital and trading at above 5% free cashflow yield can be an excellent investment, since minimal capital is required to fuel growth.

3) Return on capital x Reinvestment Rate

The primary limitation of Bouvet’s business model is its inability to reinvest substantial capital at exceptional returns year after year. Growth is constrained by the challenge of finding and integrating great employees rather than by access to capital.

In contrast, businesses that combine high reinvestment rates with high returns on capital are rare but can become exceptional compounders. My writeup on Serial Acquirers specifically aimed to highlight one such category of businesses.

REQ Capital articulated well why these models are so compelling: they offer strong returns while maintaining relatively low risk. This stems from their ability to compound effectively with minimal leverage, thanks to consistently attractive returns on capital. Two standout examples from another Writeup, Scandinavian Industrial Compounder writeup, Lifco and Bufab, illustrate this principle—showing how a business with higher returns on capital requires less capital to fuel growth. Conversely, one could also say that Bufab is a great example of a proven capital allocator using leverage cleverly, to generate attractive returns for it´s shareholders.

4) Wonderful Business at Fair Prices

While there is no doubt Lifco is a wonderful business, the EV / EBIT of >30x today, may prove to be a tough headwind for future returns. A halving of this multiple in 5 years time, would lead to 15% growth per year being nulled out. Despite this, it can still be an attractive investment, especially over longer time periods, simply due to management continuing to find clever ways to allocate capital going forward. Maybe in 5 years time, the market believes Lifco can continue reinvesting capital like they have historically, and the multiple will stay at these levels. Time will tell.

For the individual stock picker, it may be hard to find a similar quality business like Lifco offered at bargain prices. However, finding these high-quality names at fair prices is simpler.

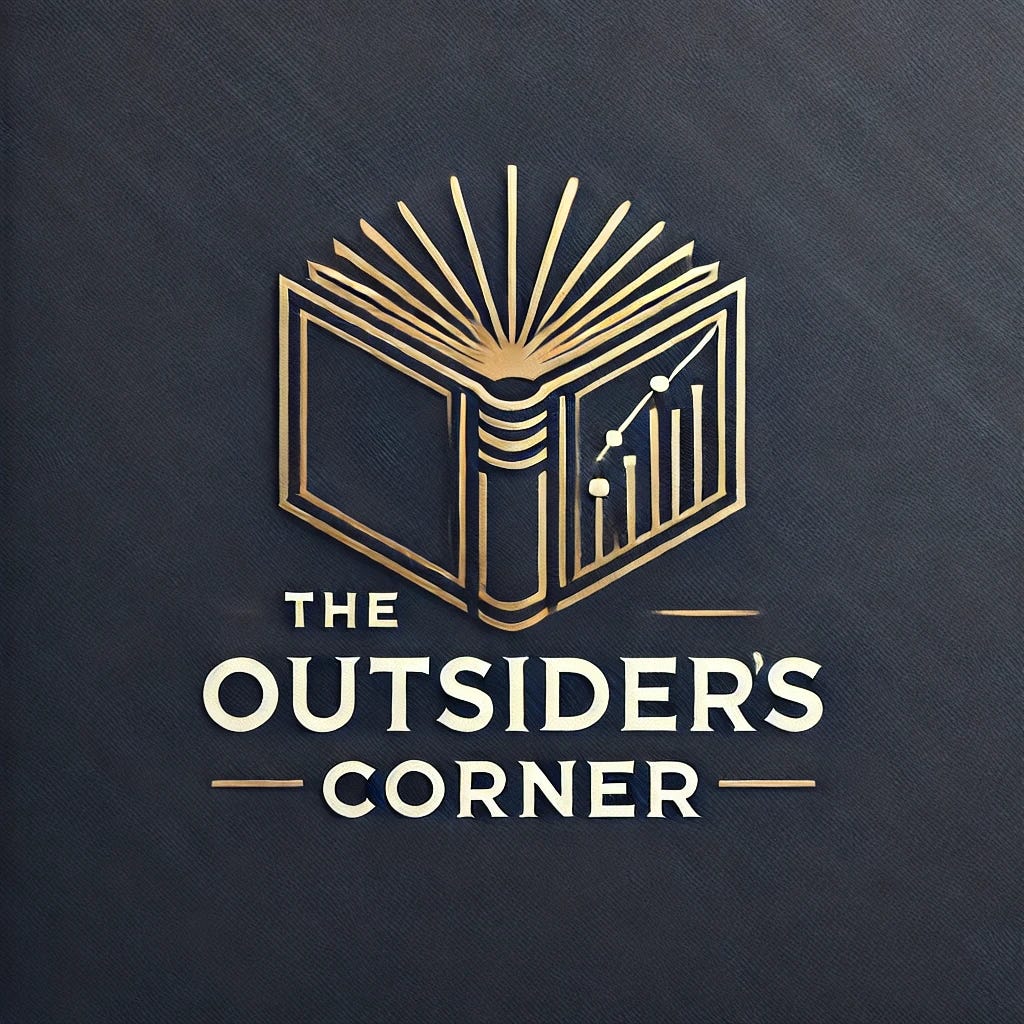

Medistim, a Norwegian supplier of devices and consumables for surgeries, may (finally) trade at fair prices. Similar to Bouvet, the stock has moved downwards for many years after trading at elevated prices (40 - 70x PE). With what I deem as short-term headwinds for the business recently, the stock has finally come down enough in price (~25x PE), that I find the risk reward attractive enough to own this wonderful company. Another positive, is that their recent Capital Markets Day highlighted innovations for their product´s software, which should make it harder for competitors to replicate their product offering - increasing their competetive advantage.

This investment idea offers a 3% dividend yield, 11% annual per-share growth over the past decade, consistently strong margins (~80% gross and 25% operating), a net cash position, and exceptional earnings-to-free-cash-flow conversion. It's far from an average company.

5) Drawback of Sharing Investing Ideas

The most significant lesson I learned this year came after sharing an idea I had been following for two years. The company, which I’d classify as an "Ugly Duck"—highly shorted, screening poorly, and with a poor stock performance—had an underlying business that was progressing well. Management appeared trustworthy, consistently delivering on their promises, and profitability was on the horizon. Moreover, the company was priced for failure, with a negative Enterprise Value.

However, sharing this idea was a brief experience. After less than a day of research exposure, my inbox was flooded—not with constructive feedback, but with messages that were far from helpful. I was taken aback by the response, which seems to be a common outcome for people sharing unpopular ideas. As a result, I decided to delete my research and refrain from sharing "Ugly Duck" ideas in the future.

Sharing insights on quality companies at fair prices seems to foster a much more respectful environment, one I am more inclined to engage with. I have no room in my life for disrespectful interactions. That said, I still highly value constructive feedback and have learned much from those who have corrected my mistakes along the way.

Portfolio Structure

If you´ve come this far you may have catched the two different type of investments I make: Quality Companies & Ugly Ducks.

While they sound like opposite sides of the spectrum, they both inhibit characteristics making them interesting for me as an individual investor.

Quality Companies, by being great for long periods of time, enabling me as a patient investor to earn parts of the returns from underlying business. The problem, these rarely trade for a discount, so most times you must take on the risk for short-term multiple compression, in favour of owning a piece of a wonderful business.

Ugly Ducks, since they are priced for failure, leaving much room for upside if they can can become anywhere close to Quality over time.

These are two different bets, the first, betting that the past winners will continue to win. The other is to find those left in the garbage with actual potential. Consequently, the chances of being wrong tends to be larger among the ugly ducks, meaning these represent a smaller part of my portfolio. Today, the portfolio looks something like this:

Quality Companies: 60%

Ugly Ducks: 20%

Cash: 20%

However, most of my returns in the last couple years have come from Ugly Ducks, with both early picks (2021-2022) becoming multibaggers by now (3x and 9x). Unfortunately, this also removed part of the assymetry or margin of safety if you like, with the stocks improving more than the underlying businesses. Meaning, the execution and valuation risk has definitely increased now.

An outsider observing only the business development would be equally surprised by how pessimistic market sentiment became for some stocks became in 2022 and, conversely, by how much love these companies have garnered in 2024. I still struggle to understand the extent of the volatility in stock prices, especially given their relatively stable business performance and minimal balance sheet risk.

While this volatility has been hard to grasp, I remain drawn to similar setups if I come across them in the future. And, the increased prices of today may not reflect the similar assymetric opportunity when I first found these ideas.

Heads I win, Tails I don´t lose that much

Nonetheless, there are problems with ugly ducks.

First, these opportunities are in my opinion rare. More often than not, the market pricing something for failure, is correct. Doing your own due diligence for these are critical, as they rarely work out immediately, if at all.

Secondly, we will all be wrong from time to time. Going all in on an idea that works out 90% of times, does not help if it gets your capital taken out once. These ideas should be position-sized accordingly.

Lastly, there is something about these ideas which may be questionable to advocate beginner investors to try at. While own due diligence should be required for any investment, these ideas are more attractive for more get-rich-quick types or beginners at investing. It still baffles my mind that the companies most Norwegians own, are those with negative, unstable margins and negative shareholder returns over the last decade.

Ultimately, there is no way around knowing what you own and why you own it, when it comes to investing.

Selling Winners

As a general rule, I avoid selling ideas completely, because there is great learnings by sticking with investment ideas and seeing them develop. I have found trimming them down to a comfortable level, and being open to add if the price falls enough to be a comfortable strategy. While the continoussly rising share-prices has proved me wrong for trimming so far, I am inclined to belive that this has reduced the risk of permanent loss of capital in the portfolio.

Two ideas I have added to recently, MBB and Evolution, fit well into the Ugly Duck category right now. German Industrials and Evolution are probably among the most disliked parts of the market now, making the price, in my opinion, moving to far to the pessimistic side, compared to their business fundamentals. Whether these investments will work out, time will tell.

Conclusion

During times like today, when people threat making money in the markets as easy, I get cautious. Subsequently, I have trimmed those growing much faster than their underlying business, some even capturing a decade worth of it´s business growth in one year. This capital has gone partly to build cash and some new ideas, such as Medistim, MBB, Evolution and adding to my position in Topicus, a standout in the Serial Acquirer sector writeup. I will continue to prioritize good sleep over returns.

When it comes to the Outsiders Corner newsletter, I continue to be a strong advocate of skin in the game, meaning I also own most of the ideas I share. To date, the only writeups I have no investment in is Exor and Nekkar. The rationale for these exclusions was outlined at the end of their respective analyses. Still, both remain on my watchlist, and I tune into their quarterly updates.

The focus of the newsletter will continue to be on Quality Companies at Fair Prices, as these ideas seem to be some of the most consistent generators of wealth in the markets. I will refrain from sharing the ugliest ideas I find, for several reasons outlined. I believe these ideas require a tremendous amount of own research to work out, especially to stay calm during short-term headwinds and not worry to much of volatile stock movements. Simpler said, I will not do writeups of ideas I would not be willing to recommend to my closest family.

As the year comes to a close, I want to express my gratitude to all the readers of this newsletter. While I write as a hobby and share my research for free, it’s the engagement from this community that keeps me motivated to continue.

A special thanks to those who also have pledged a future subscription. While I’m not yet comfortable charging for a service I wouldn’t personally pay for, I’m considering creating something that may offer additional value to those seeking more in the future.

Constructive Feedback is always appreciated. Happy Holidays.

I’m new to investing, and simply trying to navigate this clustered landscape of opinions and analytics, small investors with “great knowledge” who may or may not have a hidden agenda behind their publications. It’s not easy to do all the research yourself and not only get to know and find the right companies, but also to understand what you are reading and if it’s good or bad. Not to mention how much time it consumes. Your work Ole has made me understand a lot more about the fundamentals of stocks and trading, and also given some sort of a strategy that i will build my entire investing portfolio on during the coming years.

I guess all I’m trying to say is keep up the good work! I love reading your insight as I feel the approach you have to this is something I can relate to.

I do not understand why somebody would respond nastily to an analysis with which they disagree. To debate rationally adds value; to insult adds only bad feelings on both sides. My suggestion is that you write whatever interests you and helps you to clarify your own thoughts. If some of your audience responds rudely, is there a way to block them?