Payment Providers - 2024

Exploring Investment Opportunities in the Competitive Payments Landscape

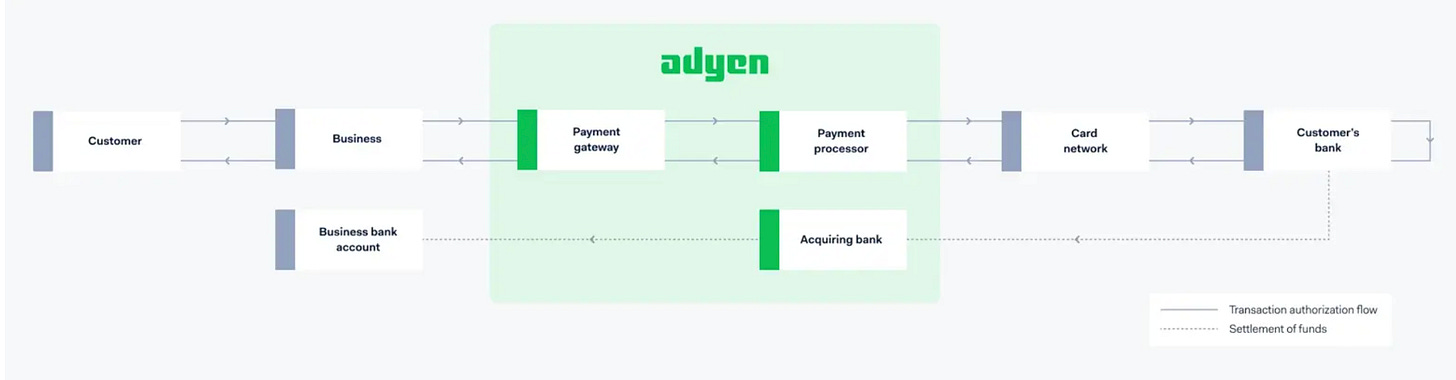

Understanding Payments. To quickly get up to speed on the world of payments, I would recommend Quartr´s Article on the Payment Value Chain. In summary, here is what happens before we see the accepted/decline message at a store (merchant).

Consumer Action: The consumer presents their card (or other payment method)

Payment Gateway: Standardize and sends information to the payment processor

Payment Processor: Routes this info to the appropriate card network (eg. Visa)

Card Network: Forwards details to the issuing bank (the consumer's bank)

Issuing Bank: Checks if the consumer has sufficient funds or credit

Response: Card Network relays this response back to the merchant acquirer

Acquiring Bank: The acquiring bank communicates the transaction status to the merchant and if approved, facilitates the transfer of funds to the merchant´s bank

Outcome: Consumer sees accepted or decline on payment device

Providers in the payments ecosystem, such as gateways, processors, and networks, typically charge fees per transaction or a percentage of the payment volume. Often combined with value-added services like software. The scope of services provided often determines the share of revenue they can capture. Adyen exemplifies this model effectively by linking customers, card networks, and merchant bank accounts—a comprehensive end-to-end payments platform. Adyen serve as both the gateway, payment processor and acquiring bank for many of it´s clients, such as Spotify.

However, as you may have guessed, generating a recurring revenue stream from other peoples value creation (with inflation flowing through) is quite attractive. Consequently, there's no shortage of competitors vying for a slice of this lucrative payments market—a characteristic likely to endure.

Anyways, within even the most competetive field there may be opportunities hiding. This writeup will aim to find potentially attractive niche segments or superior owner operators which could warrant a further look.

Finding great sources for this writeup was challenging, with most being written by the players/banks itself. If you know some great ones, especially for comparing players, please send me a DM or on X: @olensrud.

Market Size and Trends

The global payments revenue is expected to reach $2,2 trillion in 2027, indicating a 6% compounded growth rate. Nonetheless, echoing Warren Buffett's advice, long-term investors should prioritize companies with sustainable competitive advantages.

With the network effects of card networks like Visa and Mastercard, it is unsurprising that these continue to benefit tremendously from GDP growth and the transition from cash → electronic payments. Showcasing their competitive advantage, they consistently deliver return on capital employed (ROCE) of 25-30%, while most other payment players have single digit ROCE. Despite their multi-billion dollar scale, companies such as Fiserv, Global Payments, and FIS still struggle achieving attractive returns on capital, underscoring the fierce competition within the payments industry.

Further, as the tailwind of transitioning from cash → electronic payments starts slowing down, merely accepting electronic payments may not be sufficient. And, with plenty of options to choose from for the average business owner, customer acquisition costs may also rise. As you can see per the graph below, North America is now the slowest growing geography of the payment sector.

Moreover, with technology advancing and consumers demanding simpler and safer ways to pay, merchants face increased pressure to accept various payment options while avoiding fraudulent transactions.

The Merchant´s chokepoints

Most acute for merchants is of course, the ability to receive payments. With roughly 9% of subscribtion revenues lost to failed transactions, there is clearly room for improvement. To detect fraudulent activity while keeping a high authorization rate, your payment processor need up-to-date machine learning capabilities, to detect fraudulent patterns. A player handling this well is Adyen, doing so for large clients such as Spotify, Booking and McDonalds. Considering this, it makes little sense for a business to manage payments in-house, even for a billion dollar entity like Booking.

Other cited chokepoints being high transaction fees, expensive hardware costs, and binding lock-in contracts. These often incur with Independent Sales Organisations (ISOs), often major banks engaged in some type of vertical integration, with leasing out these solutions on behalf of others. It´s not straightforward understanding the value proposition here. Traditional entities like the ISOs are at risk of being disrupted by customer-centric, tech-focused companies.

With customers demanding QR-based payments, contactless payments, ordering at the table etc., the demands for the merchant increases. Despite the convenience that modern technology offers consumers, the behind-the-scenes complexity for a merchant handling all these can be astonishingly obscure, especially with different providers for every task. To illustrate this, I will share my experiences from helping out at my family’s restaurant this year.

The restaurant operates with two different point-of-sale terminals—one for outside (iZettle by PayPal) and one for inside (traditional cashier). Additionally, there are separate providers for the online ordering webpage (Shopify), along with different software vendors for table bookings, staff management, accounting, etc. All systems are paid for and serviced individually, resulting in a high total cost. If any system fails, navigating through 5-10 different service providers often becomes a daunting task. Most critically, these systems do not integrate well with each other.

Consolidation & potential for Switching Costs?

The most promising for the future is embedded finance, or integrating finance products into nonfinance ecosystems. Players that can monetize services and data are poised to capture a larger share of revenue pools (McKinsey)

In line with the above statement, the convergence between payments and software is an obvious opportunity. Offering the merchant all the tools it needs from a common platform makes sense. For the merchant, some benefits could include:

Cost Savings: By consolidating many services to one large provider

Additional services: Offer better loyalty apps / other solutions with payment data

Streamlined Support: Fewer service providers could mean less hassle

Enable business analytics: Improved communication between systems

Subsequently, one could argue that targeting the brick-and-mortar grocery store on the corner may not be the ideal customer to create a unique value proposition. Subsequently, I conclude that finding a niche to cater to and creating a unique value proposition, is necessary to offer great investment potential. While payments often come with limited switching costs, these should strengthen with the number of problems a provider can solve for their merchants.

Survival of the Fittest - Who is Winning?

Connecting the dots from the discussion above, it is evident that payment providers may be evolving into the Operating Systems for modern enterprises. This transformation is reflected in my earlier writeup of Shift4: The unlikely transition to an Operating System. Another example coming from their main competitor, Toast:

We serve as the restaurant operating system, connecting front of house and back of house operations across service models including dine-in, takeout, delivery, catering, and retail. Toast helps restaurants streamline operations, increase revenue, and deliver amazing guest experiences.

Comparing the key players within the payment processors and gateway industry highlights those that are effectively serving modern enterprises. Although more companies, such as Shopify, could have been included, the focus here is on four notable players capturing significant market share: Block, Adyen, Toast, and Shift4. It is important to approach the financials of some of these companies with caution, particularly those of Block, Toast, and Shopify. A significant portion of their revenue (over 6%) is allocated to stock-based compensation. While there may be strategic reasons for this, analyzing their free cash flow without accounting for these non-cash expenses can be misleading.

Other noteworthy performers include Corpay and PayPal, which will be discussed in more detail later.

Payment Processor & Gateway Comparisons

Segmenting the companies based on their respective fields clarifies their operational strategies. While most banks focus on issuing, Corpay, for instance, issues its own business cards. Acquiring typically involves maintaining the business accounts for merchants. You can find a detailed breakdown of the companies below.

Shifting Market Shares

Block, Adyen, Toast, and Shift4 are aggressively gaining market share, each catering to distinct niches. In contrast, the other seven companies grew by an average of 6%, lagging 2 percentage points behind the overall payments industry growth. These "laggards" have bolstered shareholder returns through aggressive share buybacks, reducing shares outstanding by 3-6% per year. While investors might benefit from owning these share cannibals that are slowly losing market share or hoping for turnarounds, the writing is on the wall: other players are eating their lunch.

End-to-End Platforms

Among the four fastest-growing companies in this analysis, only Adyen and Shift4 offer end-to-end platforms. Another notable end-to-end platform is Stripe, which is privately owned and thus not included in this list. Additionally, other known competitors like Clover, was first acquired by First Data in 2012, which later became part of Fiserv when they acquired First Data for record-breaking $22 billion. At the time of the acquisition, First Data was generating approximately $3B in EBITDA annually and growing at about 4% per year. While Clover primarily operated as a payment processor and gateway, Fiserv likely integrated its merchant acquiring services into Clover's customer base. This strategy is common in the industry: acquiring companies that provide one part of the value chain and then cross-sell additional parts of the value chain to it´s large customer base, and in some cases, add value added services like software.

Industry Consolidation

While the trend of consolidation is likely to persist, the strategies behind the fast growers are different. Adyen and Toast, focus on organic growth and more in-house development, which differs from those of Shift4, PayPal, and others, who often rely on acquisitions to expand their capabilities and market presence. Shift4, disliked by the market for this, explains how they achieve lower customer acquisition costs by doing so. Notably, while offering clients lower total cost of ownership than Toast (probably).

TOP 4

Let us take a quick glance on the four companies coming best out of the sector comparison, Adyen, Shift4, Corpay and Paypal. Importantly, when comparing the likes of Shift4 to Adyen, there are some accounting differences. Shift4 includes network fees within their cost of goods, while these are passed straight through the merchants of Adyen. This both overstates Shift4’s revenue, but also understates their profitability, in comparison to others. With this in mind, I rather use Gross Profit and EBITDA as measures to compare these. For those eager to dig deeper, Free Cash flow (-SBC) conversion to EBITDA, could be a good measure to consider as well.

ADYEN 🇳🇱

Processed Volume: $544B

Gross Profit: €1.0B

Gross Profit / EBITDA per employee: €0,27M / €0.17M

Noteworthy Customers: Spotify, Microsoft, Uber, H&M, Booking.com, Strava

Niche Leader: E-commerce, Platforms, Global commerce

Key Value Proposition: Global commerce, single integration, advanced fraud protection, high uptime, authorization rates & pace of innovation

Interesting Nugget: “Platforms want to work with us because we turn them into financial technology companies”. Platform customers served: 25k→70k Q1 to Q3 23.

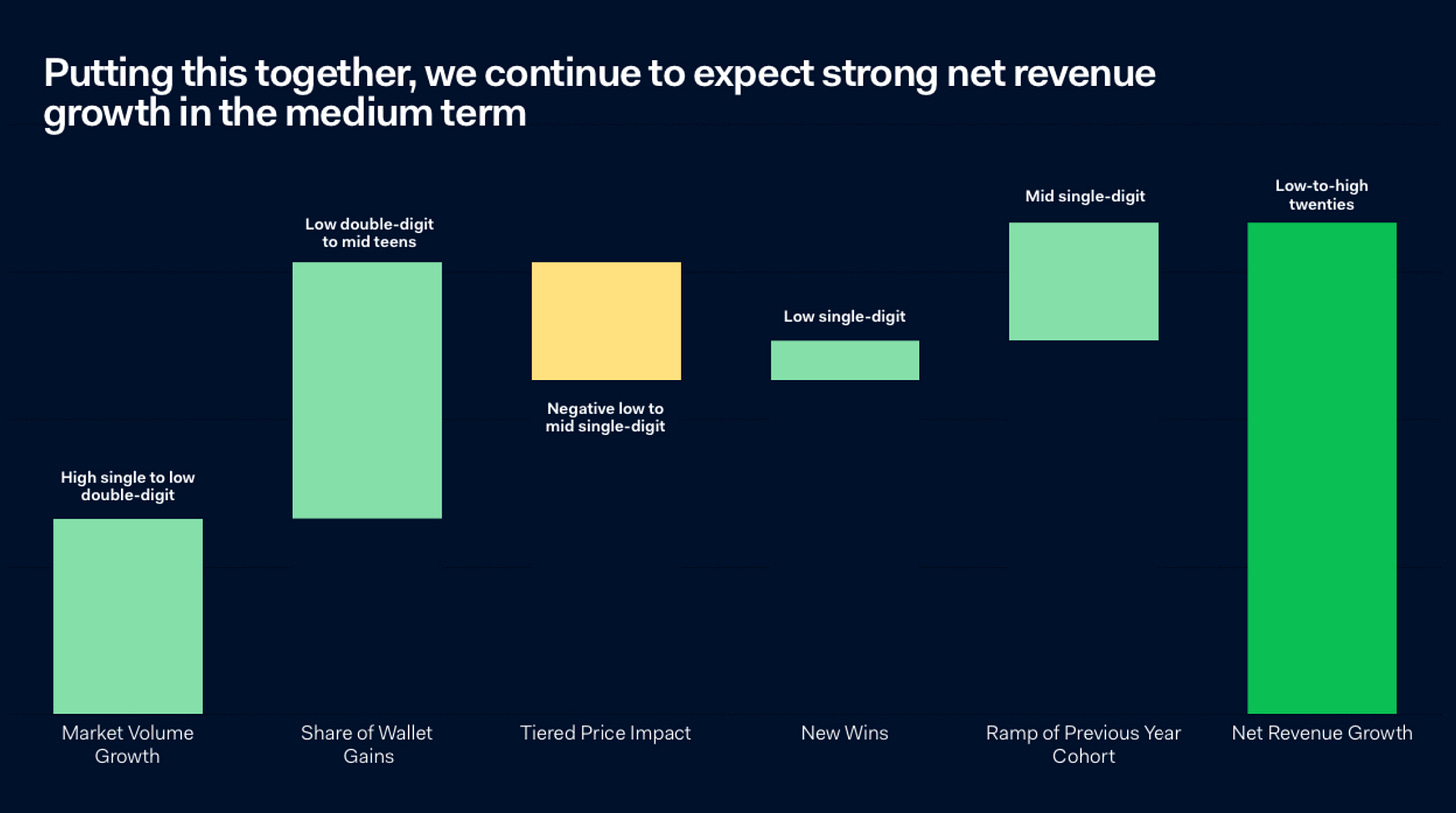

The superior quality company in this list, must be Adyen. Probably the only one which could be anywhere close to the likes of Visa or Mastercard. At Investor Day 2023, they even targeted >20% growth until at least 2026. If the payment market as a whole is expected to grow ~6% per year, this would be quite the feat. An impressive feat, given that they also reduce price (tiered price impact) as their merchants scale.

SHIFT4 🇺🇸

Processed Volume: $260B+

Gross Profit: $730M

Gross profit / EBITDA per employee: €0.26M / €0.12M

Noteworthy Customers: Starlink, Burger King, NFL stadiums, FC Barcelona, Wolt

Niche Leader: Complex Merchants - Casinos, Restaurants, Hotels, Stadiums, Resorts

Key Value Proposition: One vendor, specialized industry solutions, Business Intelligence tools, Skytab POS, loyalty/fan-solutions for complex merchants

Interesting Nugget: “By coupling Shift4’s card-present solutions with Finaro’s strengths in cross-border e-commerce, the combined organization offers a truly unified commerce experience that can compete with the biggest payments companies in the world”.

Why Are they Winning?

I believe there are 2 dynamics at play here:

1) Customer-centric business models increasingly reward customers at scale -akin to that of Amazon. Both Adyen, with low price tiers for customers scaling, and Shift4, with free hardware + software, use their scale to benefit customers. Shift4 started doing this only 5 years after the then 16-year old founder J.Isaacman started the company in 1999, by giving away point-of-sale devices for free back in 2004.

2) Relentless focus on both customer & importantly, the merchant experience. With increased demands from customers, continuously iterating to solve the needs for these and the problems of your merchants, is an attractive value proposition. Especially so, if this is within a niche, demanding more tailored solutions, like ordering at the table, self check-ins.

To stay competitive, banks and other traditional payments players must accelerate their move to cloud infrastructure and embrace modular, scalable payments platforms that can integrate into third-party software and systems. (BCG, 2023)

While tempting to also mention AI analytics here, simpler tools such as loyalty programs are potentially lower hanging fruits, with great potential. Allegiant Stadium, the host of SuperBowl 2024, chose Shift4 to create a cashless venue, but also to enhance the guest experience. Illustrating these capabilities, Allegiant Stadium is now ranked the best stadium in the world of NFL. These news travel fast, so expect more stadiums like Spotify Camp Nou to sign contracts with the likes of Shift4.

Two companies that are growing slightly slower but outperforming the industry are Corpay and PayPal. While Corpay may be less recognized compared to PayPal, both merit closer examination.

Corpay 🇺🇸

Processed Volume: >$145B (only corporate, 26% of revenue)

Gross Profit: $2.97B

Gross profit / EBITDA per employee: $0.29M / $0.19M

Noteworthy Customers: A variety of 21 000 customers across many industries

Niche Leader: Business accounts payable automation, cross-border payments, vehicle and lodging payments solutions (eg. fuel, toll, parking, insurance, drive-thru)

Key Value Proposition: Integrated solutions, modular operating platform and Issuing Corpay Mastercard - nr. 1 commercial Mastercard issuer in the US

Interesting Nugget: “Operated primarily in Brazil, we are the leading electronic toll payments provider to businesses and consumers in the form of radio frequency identification (RFID) tags affixed to vehicle windshields”. These are also used by commercial customers for fare auditing and routing controls, and at 6400 merchant locations to purchase parking, fuel, car washes & meals at drive-through restaurants.

PayPal 🇺🇸

Processed Volume: $1.53 Trillion

Gross Profit: $5.7B

Gross profit / EBITDA per employee: $0.41 / $0.21

Noteworthy Customers: 426 million active users, both consumers & merchants.

Niche Leader: Digital & mobile payments. P2P transactions & e-Commerce.

Key Value Proposition: Payment platform for online payments, PayPal Credit, Venmo - tailored both for merchants and consumers

Interesting Nugget: “60% of consumers trust PayPal more than their bank for storing payment credentials”.

Valuation

Adyen trades at a large valuation premium to Shift4. The market places Adyen at 5x the Enterprise Value of Shift4, with only 30% more Gross Profit and 2x the EBITDA. For 2024 forward earnings, EV/EBITDA of Adyen is 28x while Shift4 is 8x. Corpay and PayPal trades at Enterprise Values roughly 9-10x 2024 EBITDA, with 8-10% revenue growth in 2023.

I will not go into detail what prices I believe these could be attractive at. However, looking at their history, the risk/reward may rarely have been much better for all of these. All of them in massive drawdowns from 2020-2021, ranging between 15 to 80% below peak value. While some of those valuations where insane, it looks like the pendulum has swung back. Investors where overly excited about these companies back then, and they may be overly pessimistic now.

Artificial Intelligence

Artificial Intelligence is set to play a crucial role in the payments sector, yet it doesn't inherently favor any single player—at least not at present. Vertical integration or end-to-end players may confer advantages in its implementation, although this remains to be seen. What seems more probable is that organizations with a strong culture of innovation will leverage AI most effectively. Adyen for instance, looks like a promising contender to do so. Here's what the BCG analysis suggests:

Companies could potentially increase productivity by over 20% across various stages of the coding process alone, by implementing genAI. Looking ahead, organizations should consider scaling AI applications throughout their operations, with a focus on enhancing key customer interactions.

Wrapping Up

Let's circle back to the powerhouse behind all these businesses: the card networks. It's ironic that while fintech players innovate, consolidate, drive down costs or pioneer new technologies, most of them still rely on Visa and Mastercard's infrastructure to connect with banks.

These entities, with minimal reinvestment needs, continue to fuel their dividends and share buybacks with cash flowing in from around the globe. Having now explored the payment space, it's hard to envision them facing significant disruption in the near future. Interestingly, these businesses are trading at forward (2024) enterprise values of 20 to 23 times EBITDA. Perhaps, not an overly expensive price to pay for companies converting 70-80% of earnings into Free Cash Flow, while capturing their share of global value creation. Both still delivering low double-digit topline growth.

When it comes to payment processors, gateways or whatever other term we choose to use, it's clear that those capturing market share seem to tailor their solutions to niches (which may not be so small after all) and sustain a culture of innovation. For these organizations to thrive, scale is important to reach, but the pace of innovation may be even more crucial. Larger players seem to struggle matching the agility of smaller, more nimble competitors, potentially leading to continued new entrants in the space.

Ultimately, the sector remains crowded, but some manage to develop value propositions that should be hard to match. With a market size in the trillions, there's ample room for many players to flourish. We have yet to witness the same winner-takes-all dynamics in the gateway and payment processing realm.

Disclaimer: None of the information provided here should be considered financial advice, and I am not a financial advisor. I may hold shares in some of the mentioned companies. At the time of writing, this included Shift4.

You can also find me on X: @olensrud

Ole, you inspired me to research Shift4.

Interesting story.

My conclusions were slightly different from yours. If you are interested, you'll find my analysis here: https://rockandturner.substack.com/p/shift-4-payments-inc-remarkable-story

You may enjoy reading my analysis of Adyen https://rockandturner.substack.com/p/adyen