Shift4 - Investor Day Update

Key Insights from Investor Day, Global Blue Acquisition, and Founder leave for NASA

Since the first writeup on FOUR 0.00%↑ in Nov 2023, the stock is up ~100%. This development is underpinned by strengthened fundamentals and an unconventional capital allocation strategy that continues to build their track record of value creation.

Anyways, after showcasing their new expansion plans, including the recently announced acquisition of Global Blue for $2.5B, the stock has so far fell 25%. What has happened?

If we multiply the current shareprice of $95 with fully diluted shares outstanding (90,76), we have a market cap of ~$8.6B (note, most financial platforms use common shares out).

This post is not to repeat past writeups, but rather to highlight important new developments. While most eyes seem to be on Founder and CEO Jared Isaacman leaving the company to lead NASA, the Investor Day showed that this company is far from done. And the recently announced acquisition of Global Blue, may be the most interesting one so far.

The $9B payment company’s Playbook

If you are unfamiliar with payments or Shift4 in general, I recommend checking out my writeup on the Payment Sector or one of the writeups I have on Shift4.

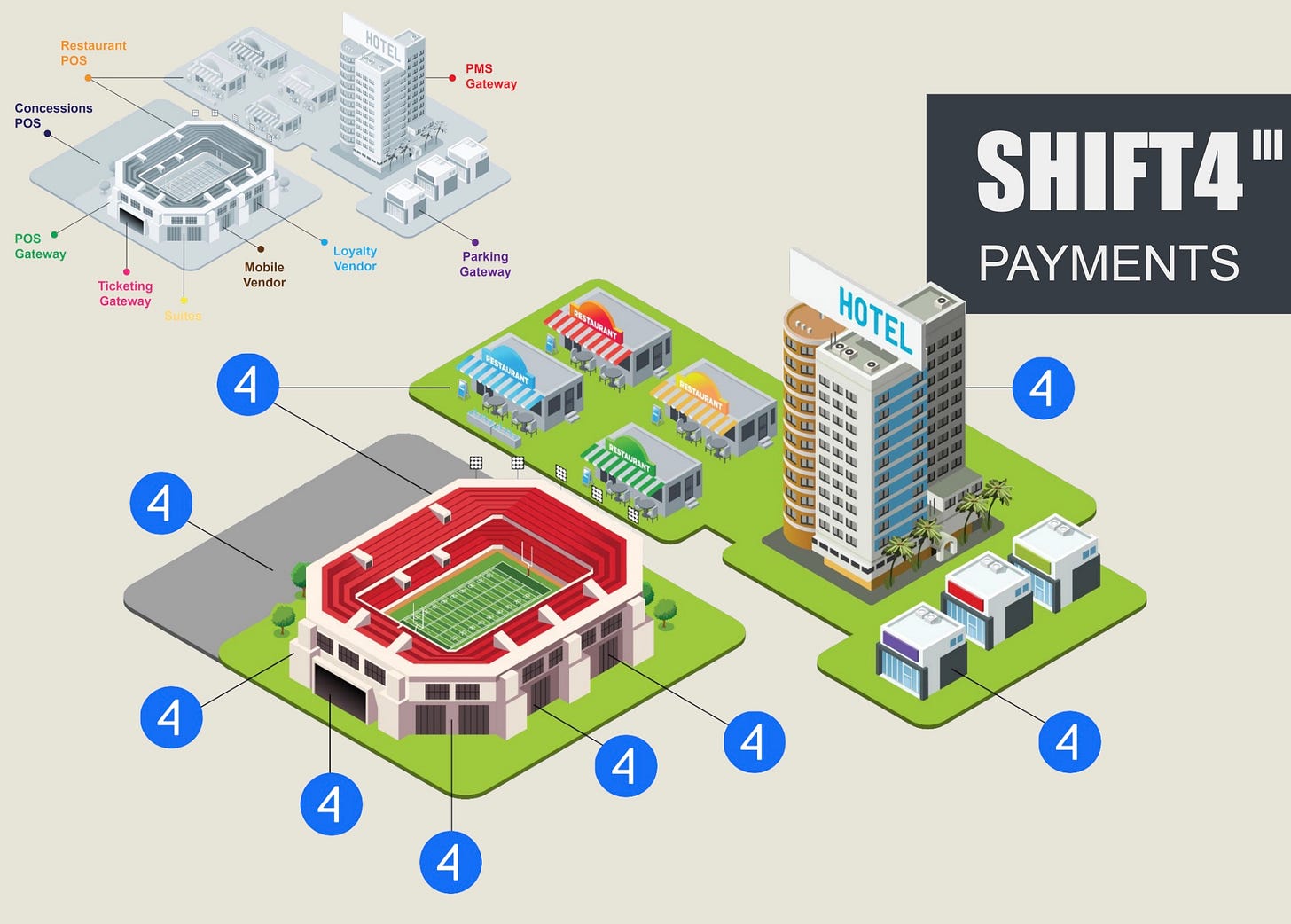

In short, Shift4’s opportunity is to take market share from legacy payment players who solve just one or two parts of a merchants problems. For your average grocery store on the corner, they may be happy with just a POS device which can accept payments from a credit card, watch and phone. But, for a world-class hotel, a packed sports stadium or in a golf resort, you don’t have to imagine for long the complexity and hassle commerce can be. And more so, if you are a global brand with hundreds of locations, and need intergrations to tens of different software unique for your vertical.

With these complex merchants in mind, Shift4 has found there place, with an untratiditional way to achieve lower customer acquisition costs than their competitors, a strategy Luke Thomas explained so brilliantly it would be a shame not to dive into it.

Investor Day Insights from Luke Thomas

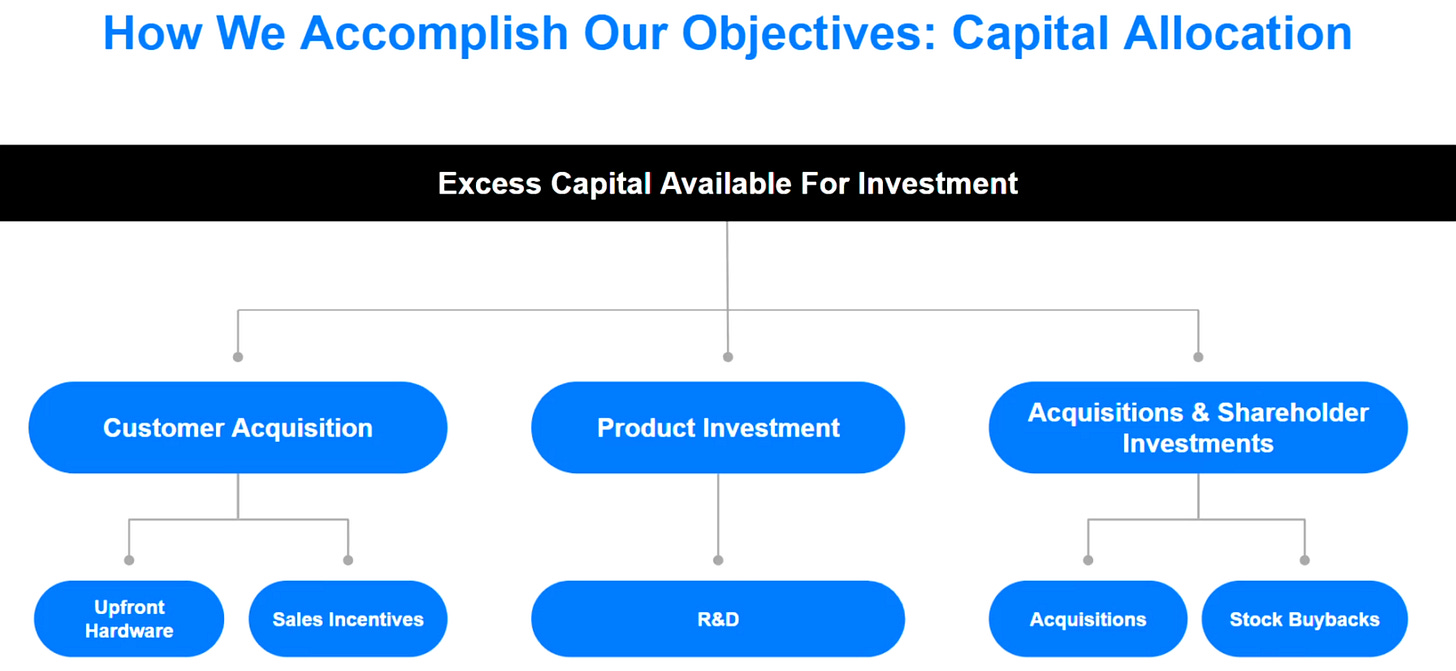

Luke Thomas, Chief Strategy Officer, shared a great overview of how Shift4 views capital allocation, his thoughts are highlighted in italic.

Customer Acquisition: The highest ROI bucket, with a low payback period from the relatively cheap $1-2k worth of hardware + sales incentives, compared to a takerate on future payments volume, a wonderful stream of future cashflows.

we will always allocate capital here first, due to how fenomenal returns are

The problem: Convincing a merchant to replace their payment infrastructure is no easy task—especially when they have countless other operational concerns. That’s why having established merchant relationships is a key advantage, allowing for more effective deployment of incentives.

We’ll revisit Point 3 to explore Shift4’s unconventional approach to achieving this, with significantly less total capital investments than its competitors.

Product Investment: Even with the best incentives in the world, complex merchants won’t change to your solution, if its inferior to what they have.

this one is incredibly important for building a long-term sustainable competetive advantage, by having the best product in the market. And the better the product, the easier to deploy a lot of capital in customer acquisiton. Also why we have 6x’d capitalized R&D over the last 4 years.

Acquisitions & Stock Buybacks:

the important piece to highlight is that a primary rational for doing acquisitions is to still feed that first bucket of Customer Acquisition.

In summary, R&D and acquisiton is all about feeding the high ROI opportunity of Customer Acquisition, at a low total cost. But, how do they approach this?

Acquisition-led growth strategy Explained by Luke Thomas

We don’t do acquisitions because it’s easier or we have to. It’s actually a much higher execution bar from a skillset and company culture perspective, but the results are so superior that it is worth it.

1) Advantaged CAC Model - GiveX acquisition example

We paid $130M of enterprise value for a ~130 000 merchant locations using GiveX giftcards. So a $1k per location upfront, then taking a reasonable assumption of free hardware and sales incentives of another $1-2k. So in total, a $2-3k in total customer acquisition dollars, including the price of the company.

For context, Toast spends around $17k for each new merchant in S&M alone.

How many percent of that merchant base they can cross-sell payments to, determines how much value they can create from that acquisition alone.

2) Enhanced Platform and Capabilities

While it’s true that the primary rational for buying GiveX was to cross-sell payments into their merchant base, we also picked up a best-in-class gift & loyalty platform which we can integrate into our overall platform and offer to all our merchants. This is a huge advantage of buying these features which should be part of a platform rather than standalone companies.

The million $ question here, is how durable is this growth playbook of acquiring under-monetized payment opportunities? For now, they continue to come up with new deals.

3) Delete the Parts

Results in operational efficiencies and costs savings, which in most cases is deleting parts of the acquired company. But sometimes it means deleting parts on Shift4’s side, as was the case with GiveX. We had an older homegrown giftcard solution which paled in comparison to GiveX. Therefore, we made their solution the default and deleted our own, resulting in cost savings.

4) Accelerated Time to Market

We were already organically expanding to Canada, but this (GiveX) massively expanded our pace. Giving us a huge base of merchants that are now more interested in our more complete offering (not only giftcards), with a bunch of sales talent, relationships and the local product expertise to understand their clients.

The fact that GiveX already was a profitable company, is the cherry on top.

So given this unique acquisition strategy where our acquisitions fills up our cross-sell funnel allowing us to deploy our next customer acquisition dollar, how do we measure the return on that capital?

You really have to look at the total capital deployed in all three buckets (capital acquisition, R&D, acquisition, buybacks) over a long enough time period and see how much incremental EBITDA or Free Cashflow this capital generated.

So how have we performed?

Over the last 5 years we have invested $2,7B of capital in those three buckets, and that has generated an incremental EBITDA of $590m and FCF of $424m. Which means that this capital was invested at a 6.4x FCF multiple or a 16% FCF yield.

This is what gives us confidence that we will achieve market-beating returns on the capital we deploy.

With this acquisition strategy in mind, it’s an ideal time to take a deeper glance at the announced Global Blue acquisition which came on the same day.

Global Blue Acquisition ($2.5B)

CEO Taylor: We expect this to close in the second half of 2025, there is a regulatory review period, but I don’t want to scare anyone, this is not an 18 or 20 month review period, these are a handful of licenses in countries we already have begun processing on, and we expect to be concluded in about 6 months or so.

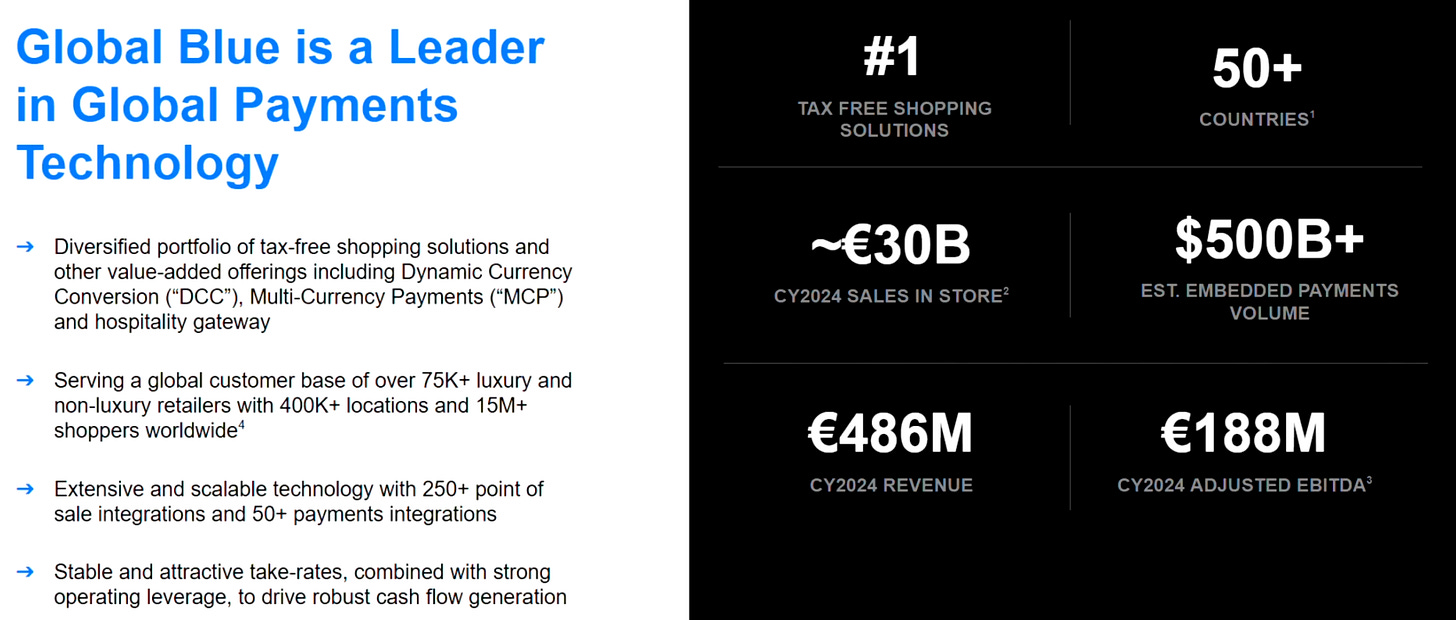

What Global Blue do:

Taylor: The number 1 provider (80% market share) of VAT tax refunds across an incredible base of merchants. They enable the best merchants in the world to deliver an incredible commerce experience for international travelers that are shopping abroad, who gets a discount as long as they can prove they can leave the country. If that sounds complicated to you, it should - and that’s what excites us about it.

This means you are plugged into in-store transactions, you are talking to tons of different data systems, you are maintaining things like passport information. And they enable this across 50+ countries around the world. They do it both at the country level (manage refund process for all merchants in a country), but also at the merchant level, where the merchant can create a great experience for their end customers.

They have about €30B of sales in store, these are the transactions they enable this functions for. But despite that, these businesses are selling lots of goods which not goes through this refund process, so there’s a huge payment pie available for us (!).

… And, this is a great business. This is a very profitable business growing fast. What we believe the market didn’t appreciate was that it was 90% owned by private equity sponsors, and their market share was so high that it was hard to imagine where they would go next.

And this is the punchline, these are some of the merchants (below) we are a critical vendor for when we close this transaction.

Another side of the Global Blue Acquisition

Besides the tax-return side of the business, Global Blue also have a payments business, doing dynamic currency conversions at the Point-of-Sale. Shift4 have never offered this, so here they also have a cross-sell opportunity into their merchants.

In summary, the cross-sell opportunity goes both ways - Shift4 can tap into Global Blue’s (impressive) merchant base and do their Customer Acquisition Playbook, while Global Blue can integrate their dynamic currency conversion & tax refund solutions onto many of Shift4’s merchants.

This is typical Shift4. They don’t do deals for the sake of doing deals. They find undermonetized payments opportunities & deploy their customer acquisition playbook to generate recurring cashflow streams, at attractive returns on capital.

Importantly, Shift4 is known for taking their extensive capabilities and giving away benefits to their merchants, such as dynamic currency conversion, sometimes for free. Over time, this looks likely to solidify Shift4’s low-cost competetive advantage, as vendors serving individual parts of the merchants’ value chain never could do this.

Anyways, Global Blue seems like more than just a normal deal. It could be a gamechanger for Shift’s global expansion plans. Management of Shift4 also highlighted under the Investor Day, that it’s the retail space which has the biggest untapped opportunity for Shift4, besides the global expansion (sidenote: see bottom for interesting new board member from a well-known giant). While there is no guarantee they will be able to cross-sell payments to the likes of Hermés, LVMH and IKEA - the odds of winning such merchants may have increased substantially.

Let’s dive deeper, to understand how Tax-Free shopping with Global Blue works

A shopper visiting a store is eligible for a VAT refund on their purchase. Their data is collected either via their mobile phone or at the merchant’s store. In the latter case, they simply scan their passport in-store, and the refund can be processed to their account within a few days.

For a leading luxury brand, it’s a reputational risk if high-value customers find the tax refund process frustrating. According to CEO Taylor, Global Blue has outperformed its main rival, Planet, particularly during and after the pandemic, by investing in digital solutions to streamline the customer experience. As a result, the company now commands an 80% market share in tax-free refunds.

Financials + 2025 Guidance

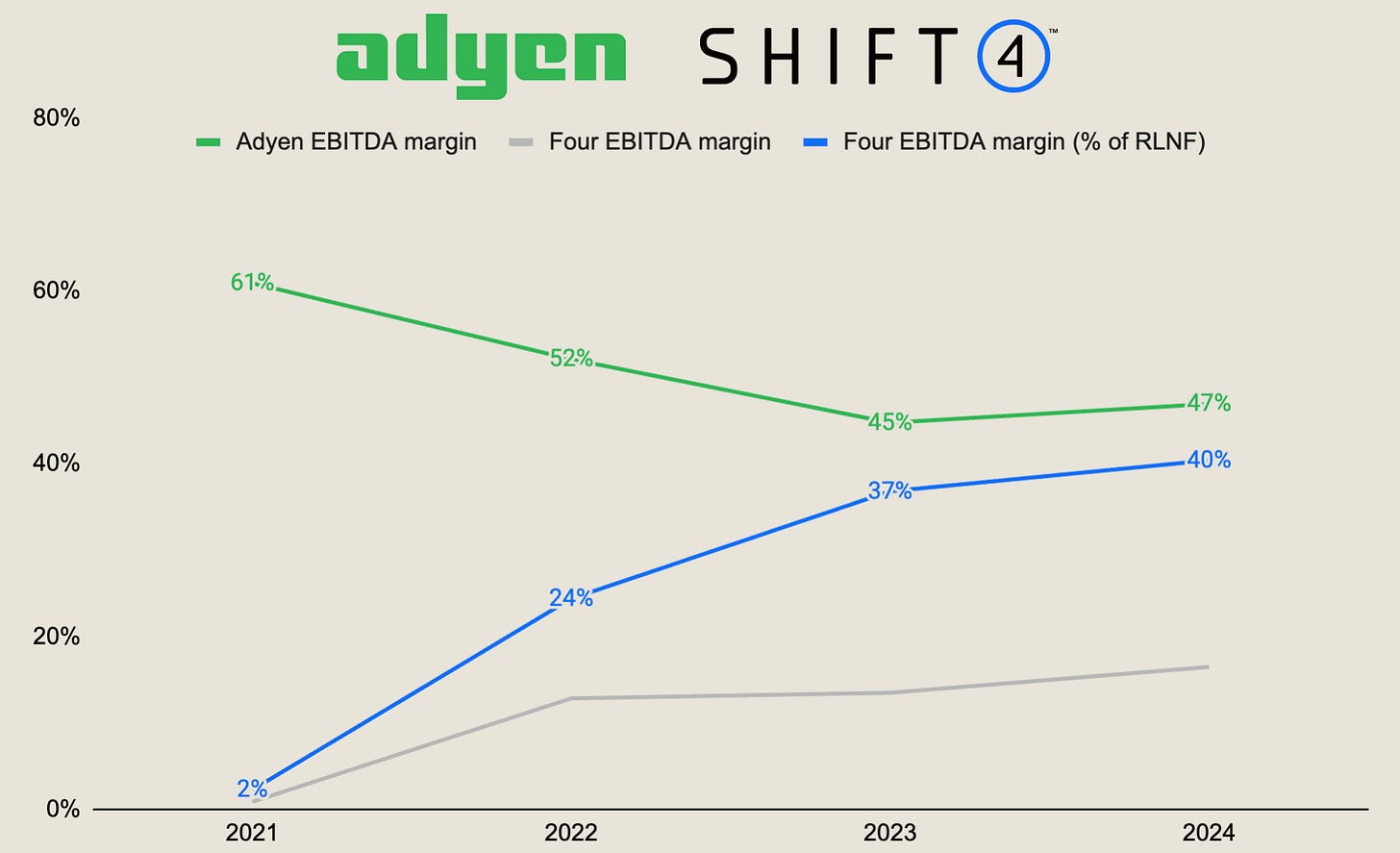

When evaluating Shift4’s recent performance, a few key points stand out. First, its reported revenue includes network fees—charges that ultimately pass through to Visa and Mastercard. In contrast, payment giant Adyen adjusted its reporting in 2023 to exclude these fees. You can see the difference this (grey vs blue line) would make if Shift4 did the same thing. The graph is not meant to take anything away from Adyen, a company with a different playbook to Shift4 (highlighted in this Payments writeup).

Second, if we annualize Shift4’s Q4 revenue excluding network fees ($405M), it already implies a 19% year-over-year growth compared to FY 2024 ($1,359M). While there are some seasonality in Shift4’s numbers (like soft margins Q1), this speaks volumes of not only looking at fast-growing companies through the rear-view mirror.

Factoring in additional cross-sells to its newly acquired merchant base (Vectron, Rebel, etc.), along with organic wins like Alterra Mountain Company, a 25% growth rate in 2025 seems reasonable—aligning with Shift4’s own guidance (excluding Global Blue).

However, if we include the Global Blue acquisition and some cross-sell into this merchant base or even higher success in cross-selling to their already overflowing merchant base, it’s not that hard to imagine another year of >30% growth.

With all these positive developments, why come the stock market reacted so negatively to the Investor Day? I believe their guide for 2025 may be part of it.

2025 Guide

Shift4’s guidance focuses on four key metrics: end-to-end payments volume, revenue less network fees, adjusted EBITDA, and FCF conversion. While I would prefer some type of per-share metric (given their acquisitive growth), management has repeatedly stated that they track this internally, given that many executives have a significant portion of their net worth invested in the company.

Nevertheless, for 2024, Shift4 projects 25% revenue growth, a 49% adjusted EBITDA margin, and FCF conversion above 50% at the midpoint.

The market may have reacted negatively to the revenue deceleration (from 50% to 25%) and lower FCF conversion (from 60% to 50%). However, I wouldn’t read to much into this years guidance. Increased effective tax-rate (from higher net margins) and increased interest expenses (some loans at 1% rate have reached maturity) are key drivers of the lower cash conversion. Management also provided a Medium Term Guidance (picture), which would bode well for shareholders, especially given their now more established track-record of beating these.

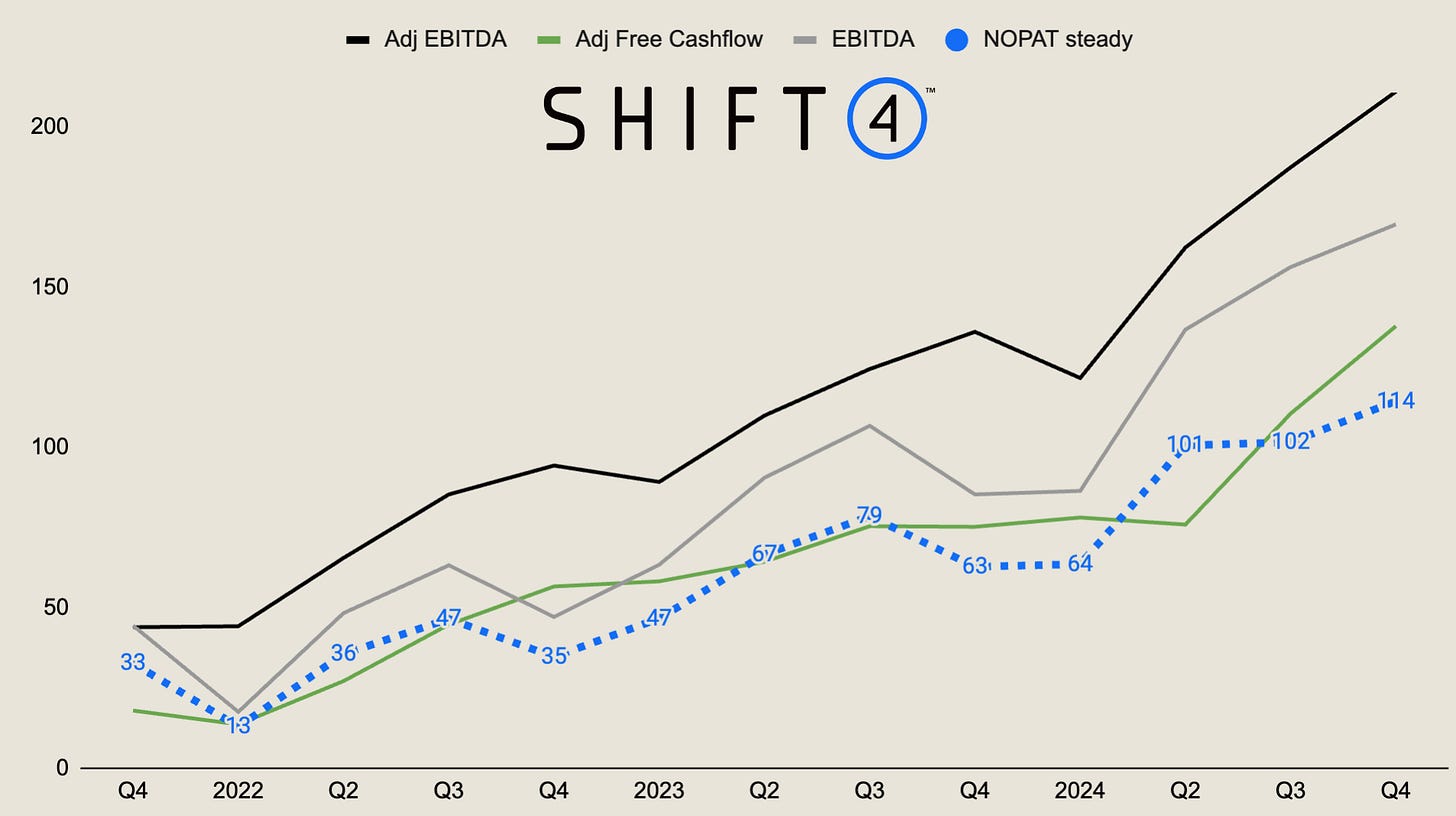

However, we need a further look into what the underlying profits actually are. While not perfect, one approach is to estimate a steady-state Net Operating Profit After Tax (NOPAT). This takes EBITDA (including SBC), subtracts an estimate of maintenance capex, and multiply this with 1- tax rate. Since this excludes interest expense—a meaningful cost for Shift4—valuation should be based on Enterprise Value (EV), which includes net debt, rather than Market Cap.

Additionally, one could factor in Global Blue’s impact on valuation. However, this also implies one accounting for the corresponding increase in Enterprise Value by $2.5B.

This ties back to Shift4’s capital allocation strategy. It’s not just about profit growth, but more so how much capital is required for that growth (return on capital).

NOPAT

Our own measure of steady NOPAT (blue line) correlates quite closely to Shift4’s own adjusted Free Cashflow. You can see this below.

On a last-twelve month basis, this results in NOPAT of $381m and Enterprise value of $9.7 (91.8m shares x $95 shareprice + ~1B net debt), which implies EV/NOPAT of 25x.

With no financial background ourselves, we calculate NOPAT as EBITDA - maintenance capex - tax. For the inputs, we arrived at maintenance capex of ~8% of revenue less network fees and tax-rate of 20%. Assumptions of maintenance vs growth is hard, but were based on subjective assumptions of the D&A line in the 10K.

As always, we aim at being directionally right rather than precisely wrong, and would appreciate feedback on this if you would have done this differently.

Risks

There are two obvious risks for Shift4 right now, leverage & succession. On the first, Shift4 has established some track-record of deleveraging, but still, some may have been more comfortable with the case if not for the sizeable Global Blue deal.

On succession, Jared plans to remain the largest shareholder after leaving to NASA. But more importantly, is how impressed we were of the team behind Jared during the Investor Day. Both CEO Taylor and CSO Luke have been highlighted here, but there were several other interesting presentations during the 4 hour long Investor Day.

Sidenote: Shift4 is in the process of enabling their merchants to accept payments through cryptocurrencies, with enabling their merchant deciding for themselves if they want immediate conversion to $ for example. May be relevant for those who are interested in this space. Shift4 does not view this as meaningful to 2025 numbers, or any time soon.

To finish off, I would like to highlight two things:

New board member, Seth Dallaire, chief growth officer of Walmart.

No need to speculate here, but still interesting given Shift4’s relatively small retail presence, which is also highlighted as the space they have most room to grow.

Take on the Adyen’s of the world?

Jared shed light on a recurring question: Can Shift4 compete with the likes of Adyen, especially among the largest global merchants and in retail?

For now, Shift4’s strength lies in complex, card-present merchants, where their deep integrations provide a clear advantage. However, if we take Jared’s words at face value, expanding from card-present to e-commerce is easier than the other way around. This suggests that Shift4 may have a natural path to scaling its capabilities in e-commerce over time. How this plays out remains to be seen.

Final Take

After three deep dives into Shift4, and given the positive outlook in this write-up, it should come as no surprise that Shift4 is a top-three holding of mine, alongside Investor AB and Topicus.

The reasoning is simple: ROIIC × Reinvestment Rate.

While it’s easy to find companies with either high returns on invested capital or aggressive reinvestment, finding a company that excels at both is rare.

Topicus exemplifies this by using its durable, steadily growing cash flows from vertical market software to acquire more businesses at high hurdle rates (low purchase prices relative to intrinsic value). Their strategy is straightforward and well understood, but still, it’s easy to underestimate the durability of their strategy, examplified by their new move of acquiring a stake in a listed holding as well.

Investor AB, my other top-three holding, reinvests most of their wholly-owned businesses, but pays out their sizeable dividends from their Listed Portfolio. However, they still benefits from reinvestments outside its own cash flow statement, much like Shift4 actually.

For example, Shift4 benefits when FC Barcelona increases sales or when Alterra’s Icon Pass expands into new resorts. Essentially, they profit not just from their own value creation but from the success of others as well.

With this underlying business model, paired with a proven capital allocation strategy, Shift4’s growth runway looks to endure for many more years. Even at a nearly $10B enterprise value, they remain just one of many players in the massive payments space—and crucially, they are taking market share (26% organic growth in 2024).

And the recent acquisition of Global Blue may give them many many more years to have an overflowing merchant base to deploy their customer acquisition strategy on.

I guess time will tell, thanks for coming so far!

If you are interested in watching the Investor Day, see Shift4 at X, or tune in on Quartr.

Nice write up, I got the same $381 adjust cash flow too using different method. https://open.substack.com/pub/patchtogether/p/shift4s-stock-has-dropped-20-since?r=os6rc&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true