The Outsiders - Owner Operators

Thinking like an owner operator with 3 examples from our portfolio.

The stock market is a remarkable place. With a single click, you can partner with some of the world’s most exceptional operators

The Rare Breed: Why Owner-Operators Matter

The stock market is a remarkable place. With just a click, you can partner with some of the world’s most exceptional business builders — individuals who not only run great companies, but often own them too. Their incentives are aligned. Their timelines are long. And their playbook? Fundamentally different.

I’ve highlighted several of these owner-operators — some well-known, others less so. Below, you’ll find a deeper dive into why they matter, how they allocate capital, and why I believe they represent one of the most attractive corners of the market.

I. The Owner-Operator Advantage

Across companies like Adyen, Airbnb, Investor AB, Norbit, Paradox Interactive, and Shift4, there’s a common thread: founder leadership. These businesses are still run by those who built them — or, in Investor AB’s case, by the family that has stewarded capital for generations.

This deep alignment of ownership and control creates something rare: a mindset built around decades, not quarters. These leaders aren’t chasing EPS beats. They’re building enduring platforms. They are, at least compared to most leaders, Outsiders.

When you extend your time horizon, your relationship with risk transforms. Rather than maximizing short-term gain, these operators seek resilience, adaptability — and optionality.

II. Optionality: A Superpower for Founders

Optionality — the ability to evolve, expand, and adapt a business — is one of the most underrated advantages in investing. It’s not just about having a vision. It’s about having the freedom and flexibility to pursue that vision when the opportunity arises.

Look at Amazon and Nvidia. Jeff Bezos and Jensen Huang didn’t stop at retail or graphics cards — they bet boldly on cloud computing and AI. Entire industries were born as a result.

That same spirit lives in the companies I follow. When founder-operators play the long game, they don’t just ride trends — they often create entirely new runways for growth. And with the benefit of hindsight, it's clear that some companies might not have survived without this mindset. Take Atlas Copco: at two points in time, the company was forced to pivot its entire business model. Other firms might’ve crumbled. But partly thanks to the foresight and adaptability of long-term stewards like the Wallenbergs (Investor), Atlas Copco didn’t just survive — it evolved. Further, in a time where they were desperate for cash, the Wallenberg’s stepped in.

For a company like AirBnb they have so far not been very succesful with their expansion into experiences. However, they have hinted to working on a new product which will be launched next year. While the outcome remain highly uncertain, this is a typical trait from owner-operated businesses - they seem more willing to take risks.

At least with their business, we will later go into how their balance sheet often resembles the opposite - risk averse. If you have a risky balance sheet, you can take less risk operationally.

III. The Proof Is in the Compounding

Let’s take a simple thought experiment. If you had equally invested in six of the companies mentioned above five years ago, your capital would’ve compounded at above 18% annually.

Here’s the breakdown (CAGR):

Norbit: +57%

Investor AB: +21%

Shift4: +19%

Adyen: +13%

Paradox: 0%

Airbnb: -5%

Not every founder-led company is a home run — setbacks are part of the game. But when you zoom out, the collective performance speaks for itself. I’m not suggesting that founders always outperform, but when you combine high-quality assets with aligned, long-term owner-operators, the odds tilt slightly in your favor. It’s not magic — it’s incentives, focus, and skin in the game.

IV. Cash: A Capital Allocation Dilemma

What should these founder-led firms do with surplus cash?

Companies like Airbnb, Adyen, and Paradox choose to hoard it. All maintain fortress balance sheets. Airbnb’s net cash is nearly four times its operating profit. Paradox has double. For some, this seems overly conservative. But in volatile industries, cash is strategic. It buys time, flexibility — survival.

Still, there’s a trade-off. Excess cash can weigh down returns and breed complacency. Shareholders eventually ask: what’s next?

In contrast, private equity playbooks emphasize leverage. That works in steady, cash-generative businesses — think Domino’s Pizza franchise model. But for hit-driven models like Paradox, debt erodes optionality.

There’s a fine line between prudence and stagnation. And the best capital allocators know exactly when to cross it.

V. The Real Meaning of Free Cash Flow

Understanding a business’s real earnings power means thinking like an owner. What’s left after running and growing the business?

Accounting definitions of Free Cash Flow often miss the mark — especially in tech.

Take stock-based compensation (SBC). It’s treated as non-cash, but for firms like Airbnb, it’s a necessary cost of retaining talent. Same with capitalized software or game development — critical growth investments that don’t show up in capex.

This creates distortions:

Firms like Constellation Software that pay in cash look “less efficient.”

Companies that acquire growth (e.g., Shift4) get favorable treatment versus those who build it organically (e.g., Toast).

True owner earnings = operating profits before growth investments, minus real reinvestment outflows. It’s not about GAAP. It’s about cash in, cash out — and what’s left.

VI. The Allocators Who Get It Right

Some founder-CEOs (or just CEO’s) have mastered both sides of the equation — building great businesses and allocating capital well. That’s where the real compounding happens.

And how to measure them?

I would suggest following what Compounding Tortoise does - carving out capital clearly destined for growth from the operating profit number, and valuing the company based on a steady-state metric, like NOPAT. Some businesses, like the small-cap Borregaard from Norway, breaks both this number and their business’ return on capital numbers for you.

I would argue if the business you read about is capital intensive, but does not report their return on those precious dollars deployed - that’s a red flag.

Case Studies from the Outsider Corner Portfolio

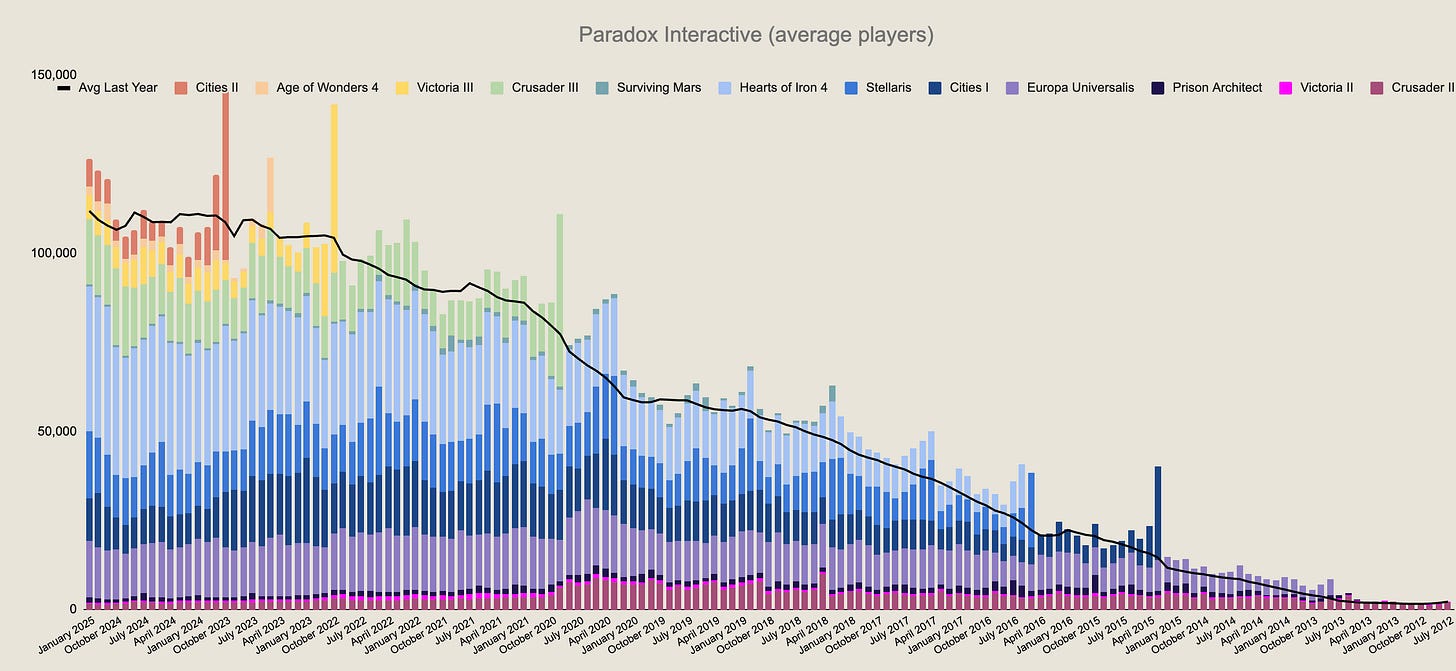

- Paradox Interactive

Paradox, the Swedish strategy game developer, is a classic owner-operator story. Under Fredrik Wester, the company built enduring franchises — Crusader Kings, Europa Universalis, Cities: Skylines. These IPs continue to generate cash years after release, thanks to loyal fanbases and high-margin content updates.

But innovation has slowed. Recent titles have underwhelmed, and most of the company’s value still comes from older franchises. Capital deployed into new IP has seen mixed success — a reminder that even elite operators face limits.

Still, Paradox boasts 30%+ ROIC and 40% operating margins — proof that reinvesting into proven IP can be extremely lucrative, even when innovation falters.

- Constellation Software

Mark Leonard’s playbook is legendary: acquire vertical software businesses at low multiples, while empowering decentralized teams to operate with clever incentives.

But the real genius? He’s gathered an ecosystem of allocators — many now leading spin-offs like Topicus, which continue the model with stunning consistency. Together, the “Constellation Universe” deploys capital at 20%+ returns, with low-single-digit organic growth layered on top.

How long can it last? That’s the billion-dollar question. But for now, it remains one of the market’s finest examples of scalable capital allocation. If you want to learn more, check out my Serial Acquirer writeup, which ranked Topicus and Constellation 1 & 2.

- Norbit

Norbit might be one of the most underrated gems in the Nordics.

While impressive that their contract manufacturing segment (PIR) delivers higher EBIT margins than market darlings like Tomra’s core business, the real story lies in segments like Ocean and Connectivity, where EBIT margins reach 30%. Capital allocation has been equally sharp, delivering the rare combination of high reinvestment rate and high return on capital, illustrated by cash deployed last 5 years:

41% to capital expenditures

54% to acquisitions

24% to working capital

19% to dividends

Total reinvestment? >100% of cash flow — powered by modest leverage.

And the results? 27–29% ROCE over the past two years, with attractive forward multiples despite a soaring share price. If you’d like to learn more, check out

’s writeup of Norbit, still relevant to this date.It’s worth noting that not every company in the Outsider Corner portfolio reinvests capital like Norbit. Some exhibit the opposite profile: exceptionally high returns on capital employed, but limited opportunities to redeploy those earnings at scale. As a result, they tend to distribute a significant portion of profits to shareholders, while growing at a more modest pace.

Previously covered names that fit this mold include Medistim, Bouvet, and Nordnet, which you can find more information of following the links below.

Final Thoughts

The best businesses aren’t just led by visionaries — they’re stewarded by capital allocators who know how to turn profits into compounding machines.

If you're looking for resilience, long-term optionality, and strategic capital allocation, this is where to look. It’s why a significant portion of my portfolio is allocated to these kinds of companies — businesses where incentives, intelligence, and discipline align.

Thanks for reading — I truly appreciate it. If you found this or any previous writeups valuable, consider sharing it with a friend. Word of mouth is one of the best ways to help this newsletter grow and reach more like-minded investors.

For those curious about my full portfolio, ongoing research, and behind-the-scenes insights, there’s also a paid tier. That’s where I’ll share more of my personal journey and other projects that don’t make it into the free version. Your support there helps me carve out more time for this project.

Wishing you a relaxing and joyful Easter! 🐣

Great piece as always Ole. Owner operators and founders is this wooly but important metric that is impossible to quantify. In the end, we need to act as qualitative detectives digging through quotes, managerial decisions and leadership signals such as phrasing and incentives.

One aspect I've come to enjoy is how straight-forward management is in their discussion of the business. If they can break it down and not add a bunch of tropes or managerial new-speech that always gets me curious. Outside the usual suspects, I'd say AQ Group, Norbit, Paradox (since Wester came back) and Momentum Groups managers stick out in this regard.