Most businesses eventually reach a maturity phase where organic reinvestments no longer yield sufficient returns on incremental capital (ROIIC). At this stage, management faces a choice: return capital to shareholders through dividends or buybacks, or pursue mergers and acquisitions (M&A). The latter often carries a negative connotation, as many deals fail to deliver the expected value.

Common pitfalls include cultural misalignment, integration challenges, overestimation of synergies, loss of key talent or just overpaying. Nonetheless, some companies have M&A as their speciality, and the best ones, seem to never run out of opportunities to redeploy capital at high returns. REQ Capital describes it nicely:

Acquisition-driven compounders acquire small private niched businesses, frequently family-owned, with a solid financial record and organic growth, that often lack sufficient organic reinvestment opportunities to substantially absorb the cash flow they produce.

Upon entering a permanent capital home, these small niched business continue to produce strong cash flow and acquisition-driven compounders can reinvest this pool of capital, generating higher returns on capital than their cost of capital for an extended period (REQ, 2024).

In order to create this article I used Finchat.io to collect and analyze all the data I needed. If you want to try out the software or support my work, becoming a Finchat subscriber using my affiliate link definitely helps out: https://finchat.io/?via=olensrud

Holding Company vs Serial Acquirer

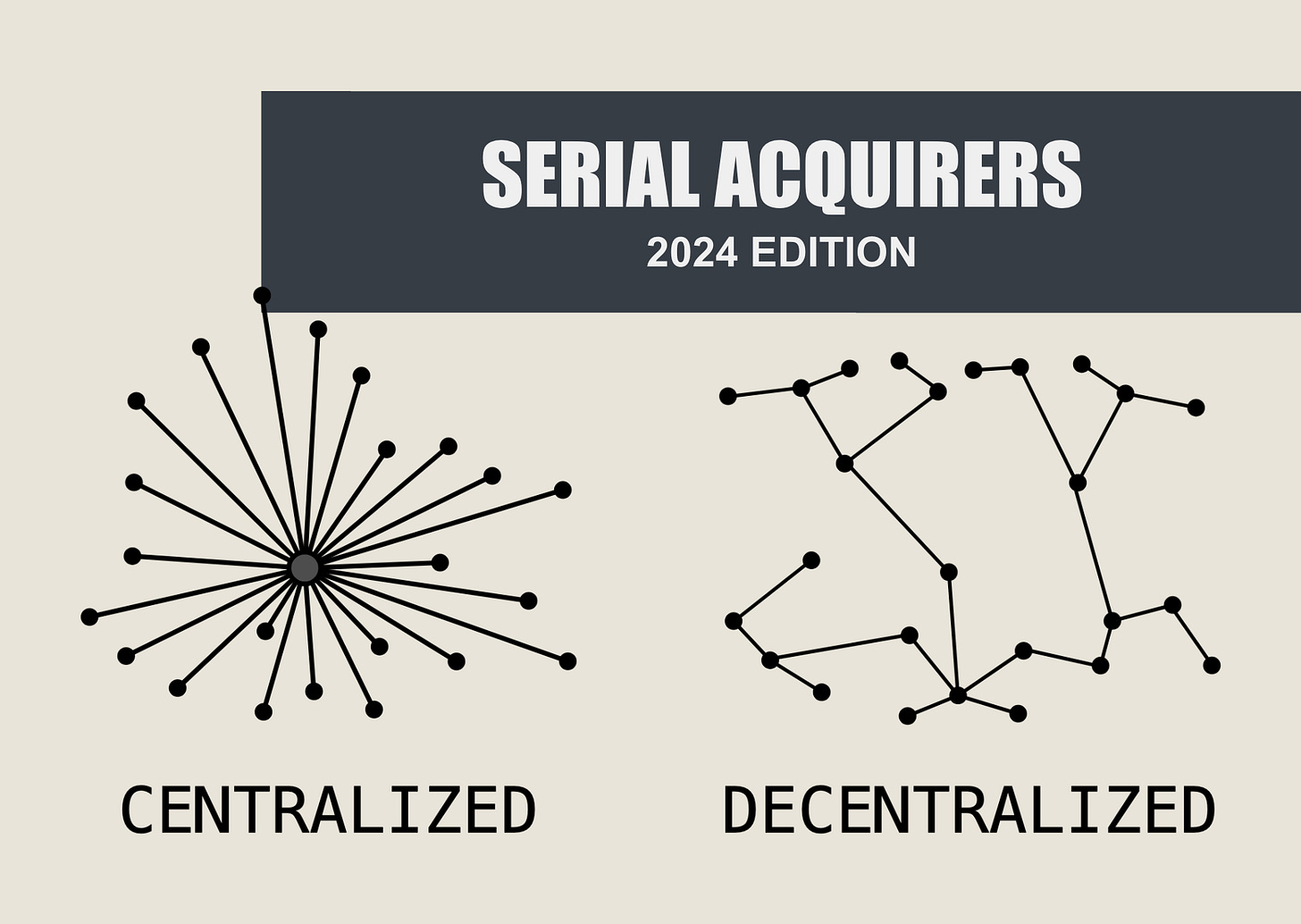

With regards to how these are structured, there are many ways to do so. Perhaps most famously is the Holding Company structure, with one or a few capital allocator(s) on top, reinvesting the cashflows received from their subsidiaries.

In many holding companies, such as MBB SE, Investor AB, or Exor (as discussed in previous writeups), management teams often take on board roles within their portfolio companies. This dual responsibility of capital allocation and direct oversight makes a holding structure particularly well-suited to a strategy focused on fewer but larger acquisitions. It also supports the idea that acquiring high-quality companies, rather than engaging in restructuring efforts, offers a more sustainable approach to value creation.

When management acquires quality businesses, they can leverage what I call a "dual reinvestment engine," benefiting from value creation beyond their direct efforts. For example, Exor continues to reap significant rewards from the ongoing value creation at Ferrari. Additionally, majority ownership by family or long-term-oriented shareholders allows the underlying businesses to adopt a long-term investment horizon, often spanning years or even generations, rather than focusing on quarterly results. This structure enables management to prioritize long-term growth over short-term profits, fostering a more sustainable approach to value creation.

However, slow-growing companies can also be attractive investments. If these companies generate strong cash flows but have limited reinvestment opportunities, the holding company can allocate the surplus cash elsewhere.

Ultimately, the key to value creation lies in the ability to generate durable cash flows streams and redeploy that cash at solid incremental returns (ROIIC), above the cost of capital. This principle applies equally to serial acquirers, who typically engage in more frequent, smaller deals compared to traditional holding companies.

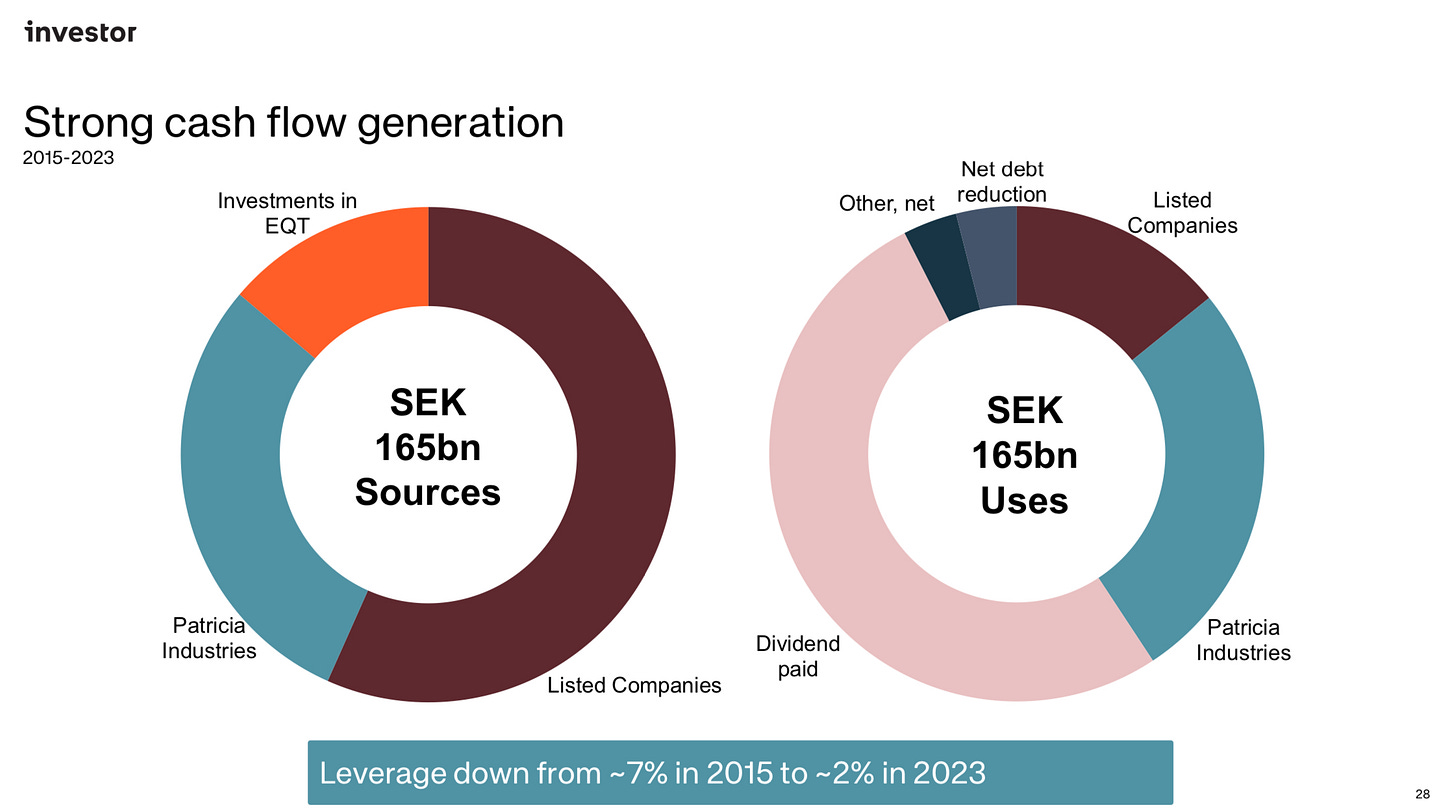

A noteworthy example is Investor AB, which operates Patricia Industries, a business unit focused on smaller, more frequent acquisitions than those pursued by the parent company. The substantial portion of cash allocated to Patricia has enabled it to consistently achieve exceptional growth rates. At the same time, the large dividends paid out to shareholders limit the conglomerate's potential for even faster growth.

This highlights the importance of a decentralised structure, where value creation happens several places, providing a long runway for growth. Investor still benefit tremendously from the value creation of subsidiaries like Atlas Copco and Mölnlycke. We will come back to the importance of this decentralized value creation, in enabling this long runway for growth.

Structure of Elite Serial Acquirers

Elite serial acquirers, such as Lifco, Ametek, and Constellation Software, stand apart from traditional holding companies in several key ways. Firstly, they focus on frequent, smaller deals rather than large-scale acquisitions. Additionally, their structures tend to be more decentralized, with individual business units sometimes conducting their own M&A activities and occasionally even spinning off into separate entities. This approach, when executed well, can potentially provide better reinvestment opportunities at scale than most holding companies. For example, Addtech shared their strategic thinking on growth, envisioning a structure where seven managers each oversee seven business units, with each unit managing seven businesses—a total of 343 businesses. This layered approach demonstrates how such companies can effectively manage a vast number of acquisitions while maintaining a decentralized model that encourages continuous improvement.

Companies like Addtech and Constellation Software have both spun out some of these Business Units as separate companies, with Addlife and Topicus as examples. It is quite remarkable how a company like Constellation Software can continue reinvesting capital at high returns, with over 800 companies under it´s umbrella. You can see a simplified illustration of their business unit structure below.

REQ Capital shared a couple hints to how such a wast organization can succeed.

Many successful acquisition-driven compounders operate with a decentralized organizational setup and retain customer relationships and daily business decisions at the subsidiary level, letting acquired companies preserve their entrepreneurial independence. Common for the best acquisition-driven compounders is that they have slim HQs, whose focus primarily is dedicated to capital allocation and close follow-up of financial performance.

REQ Capital also highlighted the key points in why programmatic acquirers are such an interesting field to invest in - combining Strong Returns with Low Risk.

Strong Returns:

High Reinvestment Rate

High Return on Capital

Dual Engines of Growth

Low Risk:

Diversified Cashflow Streams

Low Debt

High Insider Ownership

They also found some red flags worth noting. Notable examples were:

Heavy use of equity to fund deals → Share dilution

Weak incremental returns on capital → ROIIC

Expecting synergies, using M&A consultants or offering short-term guidance

Buying listed companies or turnarounds

Doing few, large deals

Purely institutionally owned.

Key Metrics for Comparing Serial Acquirers

With this information in mind, we can start extrapolating key performance indicators we can screen the field with. Some good ones could be.

Moderate Net Debt to EBITDA: Free cash flow to fund most acquisitions.

Low Share Dilution: Indicates minimal reliance on equity for funding acquisitions.

High Reinvestment Rate: Frequent acquisitions funded primarily by cash flows.

Strong Return on Invested Capital (ROIC): Efficiency of capital deployment.

Return on Incremental Invested Capital (ROIIC): Recent Capital Deployment.

High Cash Conversion: Reflects efficient working capital management & low maintenance capex.

Significant Insider Ownership: Alignment with shareholders.

In addition, I would add historic growth in EBITDA. Further, a metric for valuation is also needed. I prefer using EBITDA and multiplying this with the average historic cash-conversion of the business. This becomes a decent proxy for Free Cashflow. Notably, a company on EV / EBITDA of 20x can actually be more expensive than a company trading closer to 40x, due to difference in cash-conversion.

EBITDA CAGR

EV / Free Cashflow (cyclically adjusted using EBITDA & cash-conversion)

One notable example is Constellation Software. Thanks to their negative working capital—stemming from a favorable billing process and efficient working capital management—they can convert a larger portion of “accounting profits” into actual cash, which can be used for dividends or reinvestment. In contrast, a company with positive working capital must continually reinvest cash just to maintain its operations. Achieving negative working capital is especially challenging for businesses involved in producing or selling physical goods (some exceptions like Costco and Tesla). Nonetheless, improving working capital can help the reinvestment engine, on the other hand, there may be good reasons for why certain companies prefer holding larger inventories from time to time (supply chain disruptions, availability etc).

Another important metric to consider is organic growth. However, since many companies do not report this, we’ll focus on the metrics available.

Warning. When screening this many companies, I used operating cashflow - capex to calculate free cashflow (FCF). This may not account for all expenses and should considered carefully. Further, since I am no accountant, there will be stuff I miss here. I was warned by one investor of Vitec Software, and how they threat capitalized dev.costs, and adjusted for this. Further, looking below at CSI´s reporting of Free Cashflow available to Shareholders, suggest there are other expenses I could be missing, when using the “easy” way to calculate FCF. Either way, I think it will be an interesting exercise to screen for potential ideas to investigate further.

SCREENING FOR IDEAS

In order to screen all this data I used Finchat.io. If you want a discount on the software, use my affiliate link, which also support my work, as I receive 1/4 of the revenues from there. “https://finchat.io/?via=olensrud”

After chatting with other knowing more of this field, I noted down a total of 24 generalist serial acquirers I wanted to screen. Many of which were picked from REQ Capital´s own list of serial acquirers they follow. A happy surprise was seeing some of the companies mentioned in the Scandinavian Industrial Compounder writeup here.

I collected 10 years of data from Finchat. However, one problem I occured was differences in reporting. Vitec Software for example, reports capitalized development cost under cash flow from investing, something my screener did not report under capex. Including these expenses, made the company go from a ~80% cash-conversion to ~50%. Ultimately, the only thing I can guarantee in screening this many companies, is that important nuances will be missed.

I also included a couple notable performers without 10-year public track-record, such as Topicus. To limit the potential field, I also excluded specialists like Couche Tard, or companies with poor track-records or history.

SCREEN 1: Data Collection

Below, you can see the metrics I calculated. I did a couple adjustments, like deducting expenses to minority interest in average cash-conversion (biggest impact on KPG) and took out capitalized development cost for Vitec Software, not reported under capex. The only thing I can guarantee, is missing other nuances like this.

Cash-conversion is Free Cashflow / EBITDA, Reinvestment rate is calculated as (capex + acquisition) / Operating Cashflow, and margin stability uses standard deviation on EBITDA margins.

Interestingly, the average company is just $15B in market size and delivered annual shareprice increase of 28% for the last 5 years. A simple exercise comparing revenue growth of 16%, combined with relatively stable margins, suggest a multiple expansion also boosted returns for the group. Perhaps justified, with this performance.

SCREEN 2: Quality Score

Ranking the companies on quantitative metrics can be challenging, especially given the weighing you place on each metric. A company like Lagercrantz, which arguably should be rewarded by scoring consistently good on all scores, is punished for not being above average on any score. Remember, most of these have all been excellent compounders, so take comparisons here with a grain of salt.

Either way, I decided to place a hurdle of 0.9 in score to reach the next round. 6 companies was left out here: Halma, IMCD, Ametek, Indutrade, AQ Group and Beijer Alma. Some excellent companies in there for sure.

SCREEN 3: Risks

With 17 companies of the first 23 still in the game, I wanted to exclude those relying massively on equity or leverage to fund acquisitions, growing slowly or with cyclical margins. Of course, using leverage or your own equity can work perfectly fine, but I would like to narrow the list a bit further. You can decide for yourself whether you think this is a good approach or not.

11 companies passed the risk screen. A notable company missing out was Diploma, due to share dilution of 3.4% per year. Notably, very few companies here relied massively on leverage, a trait which highlights how different these programmatic acquirers are to private equity. One company even had a net cash position, OEM International - a company scoring extremely well on my previous writeup on Scandinavian Industrials. But here, it fell out due to low reinvestment rate giving lower growthrate, despite it´s large returns on capital scores.

Ultimately, the screening ended up with these winners, ranked by Quality Score:

Topicus Inc.

Constellation Software

Terravest Industries

Kelly Partners Group

Teqnion

Momentum Group

Atlas Copco

Addtech

Lagercrantz Group

Lifco

Heico

DISCUSSION: 2 Key Metrics

After analyzing the numbers across these companies, two key metrics stand out: high returns on capital and a high reinvestment rate.

When ranking the 11 top-performing companies by their reinvestment rates, a clear trend appears: companies with lower Return on Capital Employed (ROCE) tend to reinvest more than those with higher ROCE. This is understandable, as finding opportunities to deploy capital at returns above 20% is inherently challenging, and should be increasingly so at larger scale. However, as long as a company can allocate capital at returns that exceed its cost of capital, it may be worthy of an investment. It’s worth noting that Heico's reinvestment rate is significantly influenced by recent large deals (Q3 2023), representing nearly 10% of its market cap at the time.

Since all of these companies are growing relatively quickly, the recent pace of deals can heavily impact their reinvestment rates shown below. Best illustrated with Topicus, who experienced a small "acquisition drought" over the past twelve months, compared to its usual history. Although, reading much into these short-term ups and downs may not provide much signal, given the fluctuations in finding and landing deals. On Topicus, it looks like they are back on track already, given the recent filings.

UItimately, it all comes down to 2 questions:

How much and for how long can a company reinvest cash at high returns?

At what price does it make sense to own such a business?

Compounding Rate & Durability

If you multiply return on incremental capital with reinvestment rate, we get compounding rate. While the Compounding Rate is not a perfect predictor of future growth, it offers a useful comparison against valuation. On average, these 11 winners reinvest 96% of their cash flows at an approximate 21% ROICE. Together, this equals something close to a 20% compounding rate. With an average EV/FCF multiple of 36, these companies are not cheap, but the valuation hinges on how long they can continue reinvesting capital at favorable returns. Remember, most companies growth-rates tend to slow after some years. On the other hand, one could argue these companies have demonstrated their ability to compound over longer timeframes.

For example, if Addtech manages to compound its capital at a robust 30% annually over the next five years, the current valuation would indeed be justified, potentially leading to earnings more than triple in that time. However, such projections are highly optimistic and should be approached with caution.

A more pragmatic approach is to consider the company's own hurdle rates to. Teqnion, for instance, aims to double its Earnings Per Share every five years. While this goal might seem modest at first glance, the true power of compounding is often underestimated. Growth may appear slow initially, but with sufficient time and capital reinvestment, compounding does its thing. As Charlie Munger wisely observed: Given enough time, a stock’s performance typically mirrors the returns of the underlying business.

Conclusion

What strikes me as most impressive about these companies is that their success doesn’t seem to stem from being in the right place at the right time or benefiting from favorable market conditions. Companies like Heico, Constellation, and Terravest don’t operate in glamorous fast-growing industries. To illustrate, you may find them deal with aftermarket airplane parts, bowling operator software, and bulk fuel tanks—sectors that rarely make headlines.

Instead, these companies appear to share a common trait: exceptional capital allocation skills. To illustrate this point further, I’d like to share some insights REQ Capital (2023) highlighted of Mark Leonard, the architect behind successful compounders like Constellation Software and Topicus.

When it comes to great small businesses: Why not own a bunch of them through a holding company?

Our current policy is to invest all of our retained investor’s capital (and then some) when we think we can achieve our targeted hurdle rates. When we can’t find enough attractive investments, we plan to maintain our hurdle rates and build cash for as long as our shareholders and board will allow. We believe that long-term shareholders and boards should set those policies, which segues nicely into discussing shareholder democracy and the role of boards.

A very special case of value investing, is the example of a company that is growing quickly, that the market expects to stop growing within the next 5-7 years, but that actually keeps growing quickly for much longer. If you can spot one of those, it may appear expensive on a PE basis, but actually be an attractive longterm investment on a “value investing” basis. Spotting this kind of investment requires the ability to foretell the distant future… which is extremely difficult to do with consistency.

One of the issues that the CSI Board, in particular, worries about as CSI gets larger, is the complexity created by our continued growth. We totted up the numbers this quarter, and we had approximately 125 business units which were competing in approximately 50 verticals. We tend to add 10-15 business units and 3-5 verticals each year. The Board rightly asks how they (and CSI management) can expect to understand and manage an ever larger number of business units and verticals.

I’m not sure if there’s an optimal structure and size for an Operating Group. At the one extreme, I do worry about the Operating Group managers becoming overwhelmed because of constrained resources at the Group level. At the other extreme, I’m concerned that they may hire too many staff at the Group level and take on too much of the business units’ activities. This is one of those debates where there are likely no easy answers, but it helps to have a regular dialog and some crisp data.

If you want to support my writings, you can support me by using my affiliate code for Finchat.io: https://finchat.io/?via=olensrud. Excellent software for analyzing companies, which you receive a discount and I receive a share of your billings. I love using it to turn over rocks quickly, as it helps me to detect stuff I don´t like very fast. When I find something interesting, I have powerful tools at my disposal.

I will also leave a link to other potential writeups I either mentioned during this writeup or have similarities. If you have any feedback, I welcome you to reach out in the comment section or via message on X @olensrud.

Please note that the information provided is for informational purposes only and should not be construed as financial advice. The author may hold shares in companies discussed.

Sources: REQ Capital (2023). A Deep Dive into Shareholder Value Creation by Acquisition-Driven Compounders. Link: https://req.no/wp-content/uploads/2023/12/REQ-Deep-Dive-Acquisition-driven-Compounders-December-2023.pdf

Great write up! Missing one serial acquirer: ZIGExN. Here is my analysis: https://arnoldweenink.substack.com/p/zigexn-high-quality-against-a-crazy?r=3m3w7a

Amazing work,thank you