Holding Companies

Holding Companies are one of our favourite fishing ponds for long-term investments. However, we have learned to appreciate what we look out for:

Reporting must be transparent

We want to know the collective earnings power

Win-win dynamics

We like seeing Holding Companies who threat their acquisition targets in a way that benefit both parties.

Clear Understandable Strategy

The capital allocation strategy for creating value over time should be clear.

You will find 5 chapters below - one for each Holding Company. Further, our most popular piece to date is a good general introduction to the world of serial acquirers — where we take learnings from REQ Capital and apply them in practise.

Serial Acquirers - 2024

Most businesses eventually reach a maturity phase where organic reinvestments no longer yield sufficient returns on incremental capital (ROIIC). At this stage, management faces a choice: return capit…

1 — Investor AB (Swedish holding co.)

Deep Dive: Introductionary reading material

Investor: Well-Oiled Growth Engine

Mission Statement: We create value for people and society by building strong and sustainable businesses, through engaged ownership

Investor AB - Part II

Investor is not a company you can fully grasp through stock screeners or even through its own income statement. To understand how this giant continue to compound so well, you need to look deeper. For…

Business Update:

Investor AB - 2024 Update

Investor delivered another robust performance in 2024. Underlying profits increased by 12.5%, while the share price rose by an impressive 25%.

2 — TOPICUS (vertical market software)

Deep Dive: Introductionary reading material

3 — MBB (German holding co.)

Deep Dive: Introductionary reading material

MBB SE

Before diving into this analysis, I want to thank Michael Gielkens for inspiring this idea. While European industrials may not be the most glamorous sector right now, this could explain the significa…

Business Update:

4 — EXOR (Italian holding co.)

Deep Dive: Introductionary reading material

Exor: Discounting Excellent Track-record?

In this post, I will cover the family behind the Exor conglomerate, their core positions, a rather generous discount to asset value and their capital allocation priorities going forward. Let´s dive i…

Business Update:

EXOR 2.0

If you are unfamiliar with Exor, I did a writeup on the Italian Conglomerate this spring. While most shy away from the seemingly strange mix of companies, I believe the market may be underestimating …

5 — NEKKAR (Norwegian holding co.)

Deep Dive: Introductionary reading material

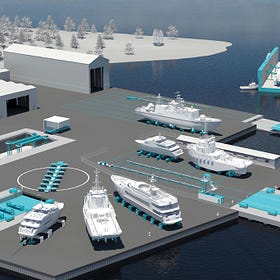

NEKKAR

Six months after the Scandinavian Industrial Compounder Comparison, it’s time to highlight a standout niche player from Norway’s marine industry: Nekkar ASA.

BONUS — SHIFT4 & NORBIT

Some businesses gradually take the shape of a holding company or serial acquirer over time. Businesses like Shift4 and Norbit, core positions of our Portfolio, seems to fit that camp. In theory, by having demonstrated their ability to succesfully acquire businesses and create value from them, this should lengthen the reinvestment runway of their business — the most crucial component of compounding, besides a high return on that reinvested capital.

Shift4 - Investor Day Update

Since the first writeup on in Nov 2023, the stock is up ~100%. This development is underpinned by strengthened fundamentals and an unconventional capital allocation strategy that continues to build …

While we have not done a specific writeup on Norbit, as we believe the likes of

& have done excellent work on this one, we covered it in both editions of our yearly Industrial Writeup.Nordic Industrials - 2025 Edition

Of the names highlighted last year, only Norbit remains a direct holding in our portfolio. Their execution has far exceeded expectations — and the stock is up over 200% since that write-up. It’s now our

Nordic Industrials - 2024

This writeup aims to do a top-down view on Industrial Compounders from the Nordics. While this approach miss important details about each company, it is a good exercise to reduce bias towards your po…